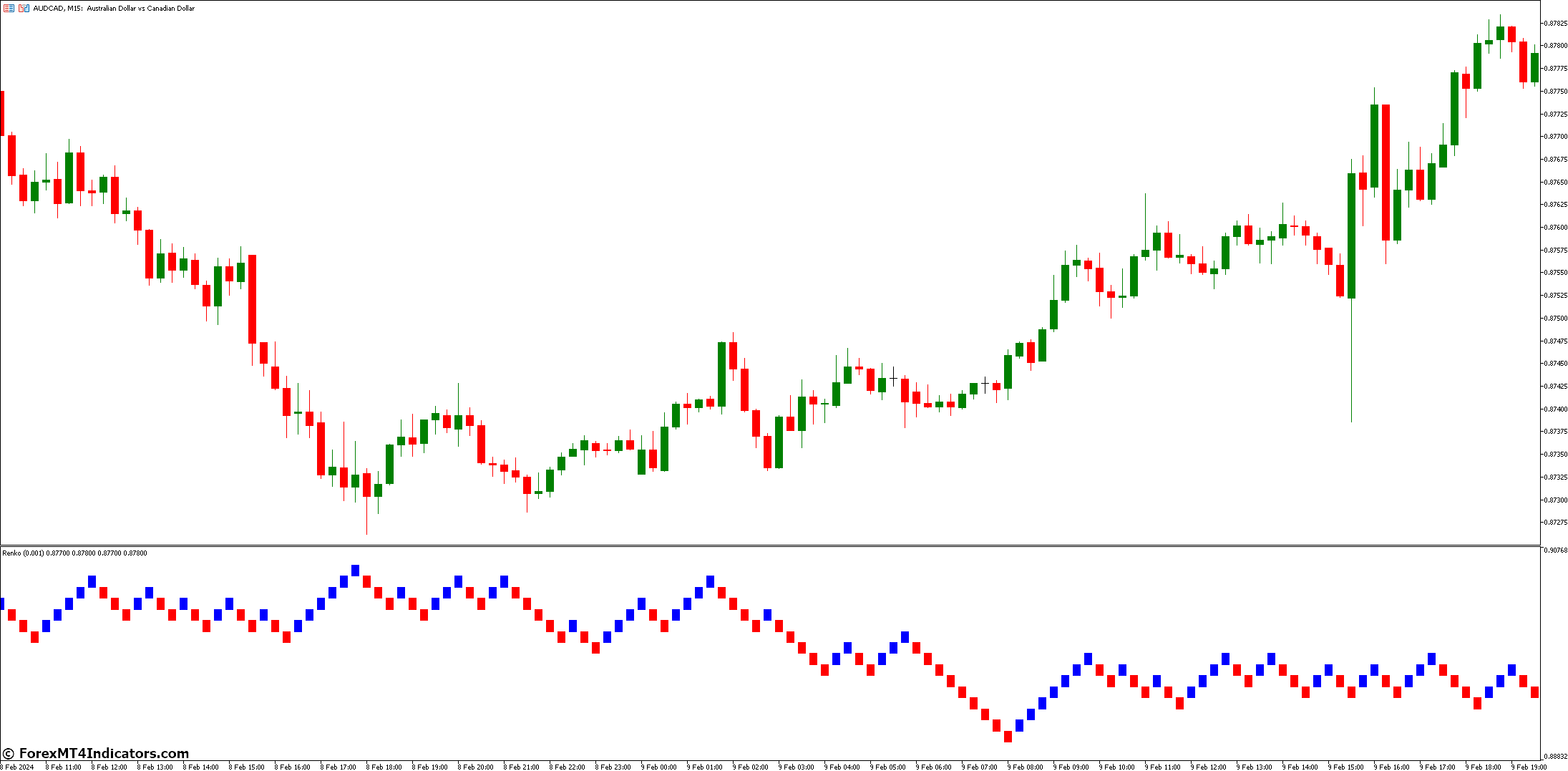

Renko Indicator is a unique charting technique that provides traders with a fresh perspective on price movements. Unlike traditional candlestick charts, Renko charts focus solely on price changes, filtering out noise and emphasizing trends. Whether you’re a seasoned trader or a curious beginner, understanding the Renko Indicator can enhance your technical analysis toolkit.

Advantages And Limitations

Before we dive into the nitty-gritty, let’s explore the pros and cons of Renko charts:

Advantages

- Noise Reduction: Renko charts eliminate minor price fluctuations, allowing traders to focus on significant trends.

- Clear Trends: The brick-based structure highlights trend direction, making it easier to spot bullish or bearish movements.

- Consistent Brick Size: Each brick represents a fixed price movement, ensuring uniformity across different time frames.

Limitations

- Lack of Time Information: Renko charts disregard time intervals, which may be a drawback for some traders.

- Whipsaw Effect: In choppy markets, Renko charts can produce false signals due to brick reversals.

Brick Size And Time Frames

Choosing the right brick size is crucial. Smaller bricks capture minor price fluctuations, while larger bricks emphasize significant moves. Traders can adjust the brick size based on their trading style and the asset being analyzed. Additionally, Renko charts work well across various time frames, from intraday to long-term.

Comparison With Candlestick Charts

Renko charts and candlestick charts serve different purposes. While candlesticks provide detailed information about price action, Renko charts simplify the picture. Consider using both types of charts to gain a comprehensive view of the market.

Asymmetric Reversals

Enabling asymmetric reversals enhances the accuracy of Renko signals. This feature allows bricks to reverse differently based on whether the price moves above or below the previous brick.

Identifying Trends

Renko charts excel at trend identification. Look for the following patterns:

- Upward Trend: Consistent upward bricks indicate a bullish trend.

- Downward Trend: Sequential downward bricks signal a bearish trend.

Combining With Other Indicators

Boost your trading strategies by integrating Renko charts with other technical indicators. Consider using the Relative Strength Index (RSI), Moving Averages, or Bollinger Bands alongside Renko patterns.

Practical Examples

Scalping Techniques

For short-term traders, Renko charts offer excellent scalping opportunities. Look for rapid brick changes and capitalize on quick price movements. Here’s how to approach scalping with Renko:

- Identify Volatile Assets: Choose currency pairs, stocks, or commodities with high volatility. Renko charts work best when price movements are pronounced.

- Brick Size Matters: Adjust the brick size to match your desired scalping time frame. Smaller bricks (e.g., 5 pips) suit ultra-short scalping, while larger bricks (e.g., 20 pips) allow for slightly longer trades.

- Spot Brick Reversals: When a series of bricks changes color rapidly, it signals potential reversals. Scalpers can enter trades as soon as the new trend establishes itself.

- Use Tight Stop-Loss Orders: Since Renko charts filter out noise, set tight stop-loss levels. Consider placing stops just beyond the last brick’s high or low.

Swing Trading Strategies

Swing traders can use Renko charts to identify medium-term trends. Combine Renko patterns with candlestick analysis for robust swing trading setups:

- Confirm Trends: Look for a consistent series of bricks in the same direction. This indicates a sustained trend.

- Wait for Pullbacks: After a strong trend, wait for a pullback (opposite-colored bricks). These retracements provide entry points.

- Candlestick Confirmation: Use traditional candlestick patterns (like engulfing candles or doji) to confirm potential reversals.

- Set Profit Targets: Identify key resistance or support levels on the Renko chart. Set profit targets near these levels.

How to Trade with Renko Indicator

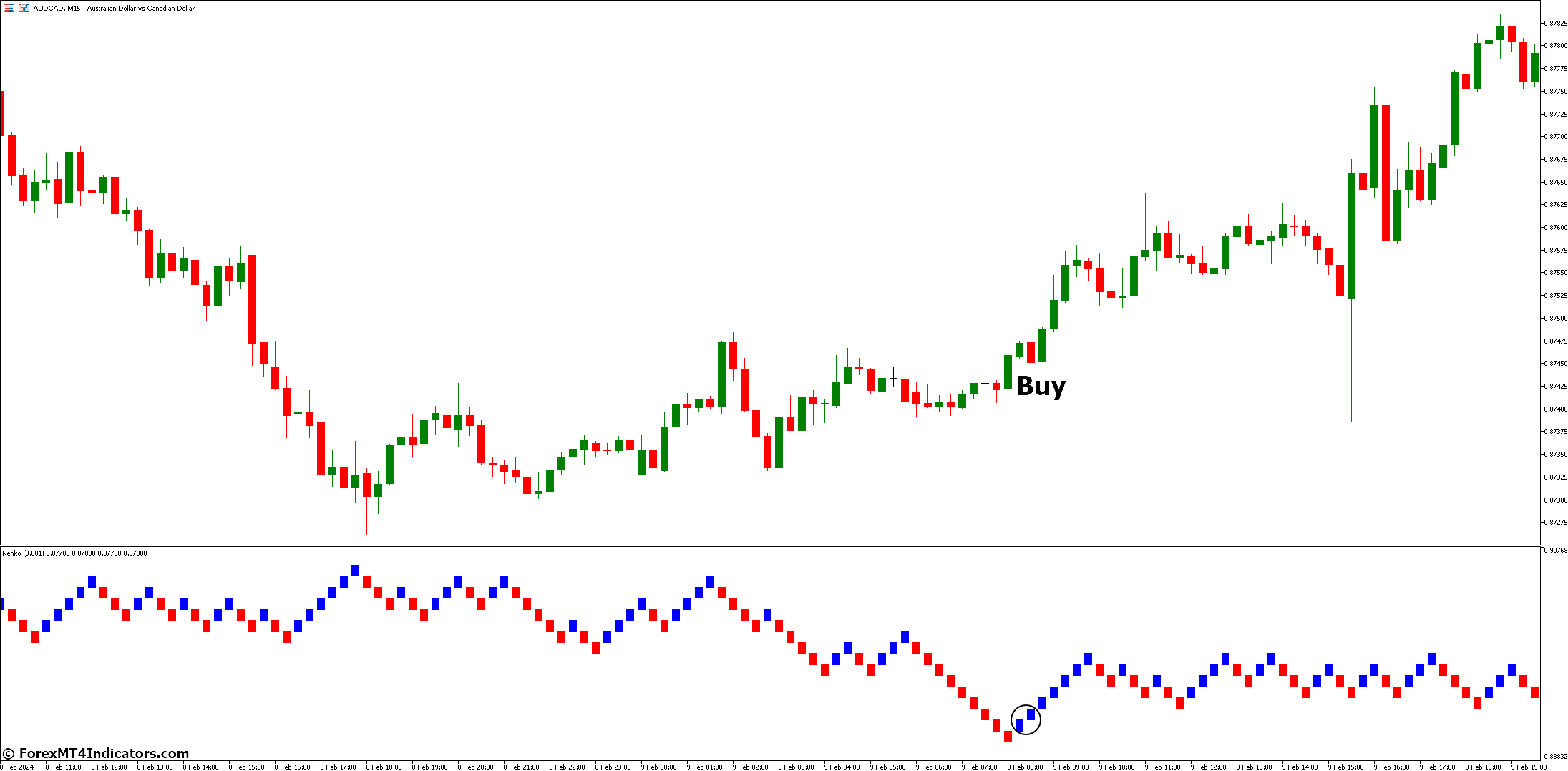

Buy Entry

- Renko shows a BULLISH trend (Blue bricks).

- Place a BUY trade at the current price or on a minor pullback.

- Set stop loss below the previous swing low.

- Target the opposite trading signal or use a favorable risk-reward ratio.

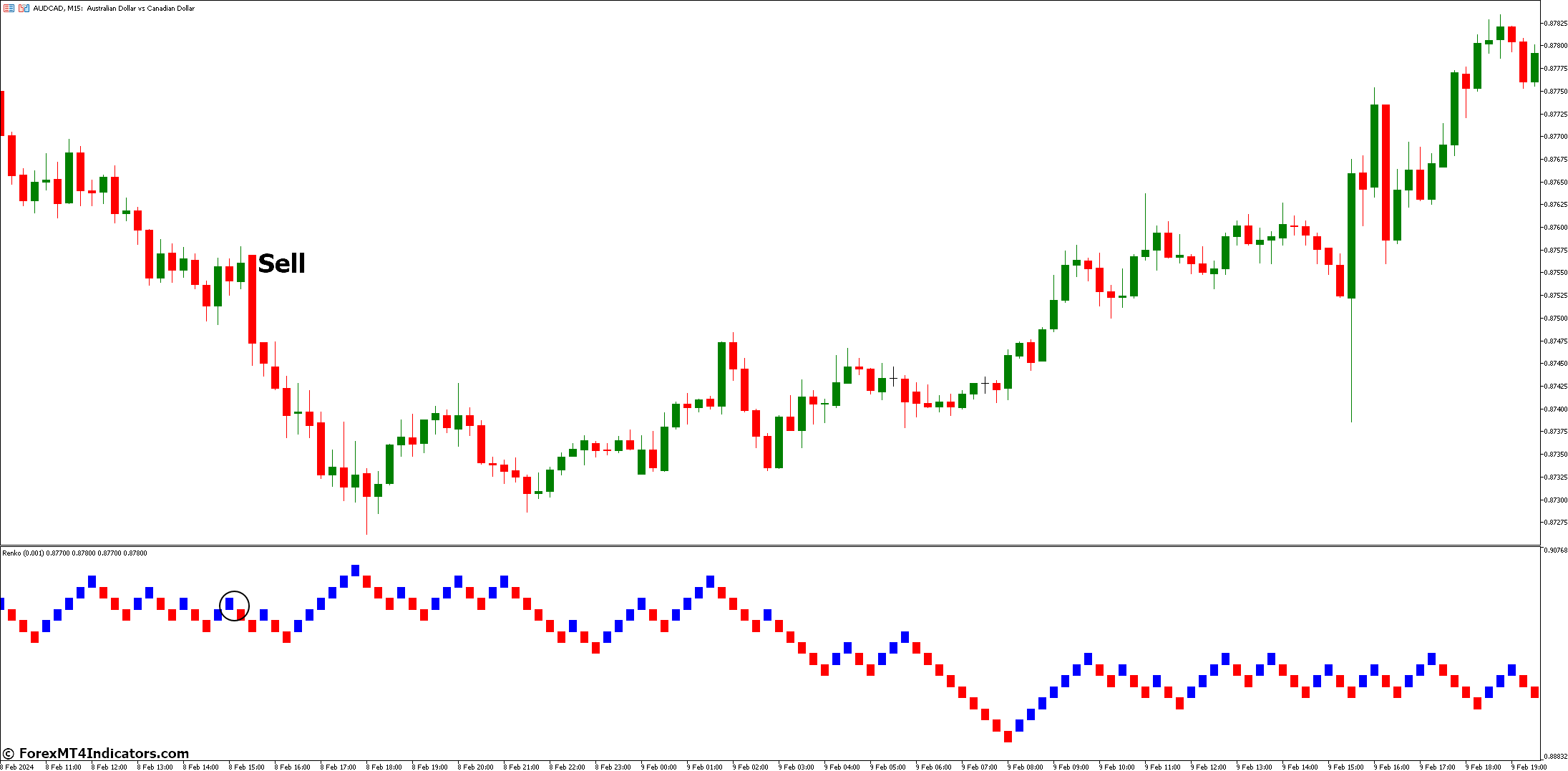

Sell Entry

- Renko shows a BEARISH trend (RED bricks).

- Place a SELL trade with stop loss above the previous swing high.

- Target the opposite trading signal or use a favorable risk-reward ratio.

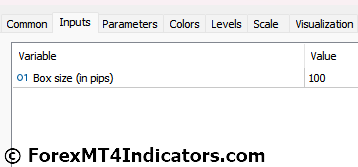

Renko Indicator Settings

Conclusion

The Renko Indicator has carved a niche for itself in the trading world. As technology advances, we may see further refinements and innovations in Renko charting tools. Keep an eye out for updates and enhancements.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download:

Olá!

Opero day trade no mercado futuro no Brasil e gostaria de saber se há alguma forma de ter gráficos renko no MT5. Caso seja possível, poderia informar como fazer configuração?