Introduction to the Constant Range Detector Indicator

Market volatility is one of the elements of technical trading which may provide traders some insight with regards to how the market is behaving and how it is about to move.

The Constant Range Detector Indicator is a volatility indicator which can be used in conjunction with other technical indicators to provide a meaningful indication of the market’s volatility.

What is the Constant Range Detector Indicator?

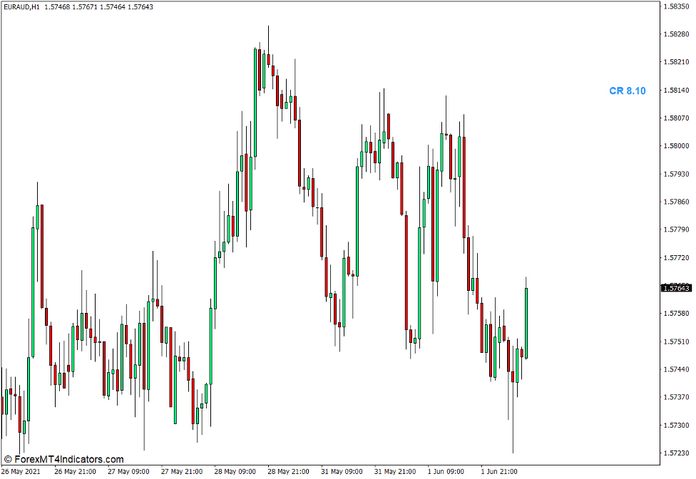

The Constant Range Detector Indicator or Custom Range Size Indicator is a custom technical indicator which displays the constant range of price.

This indicator displays a Constant Range (CR) value on the corner of the chart, next to its label “CR”. The figure that it displays is valued in pips.

How the Constant Range Detector Indicator Works?

The Constant Range Detector Indicator has a very simple algorithm which uses the price range of the last candle that has closed as a basis for the price range. It simply extrapolates the preceding candle and subtracts the low of price from the high of the candle. The resulting value is the price range of the previous candle with several decimal places. It then multiplies the value by 10,000 to convert the constant range value to pips. If the currency pair is a “JPY” pair, the indicator would multiple the difference by 100 to convert the value in pips.

How to use the Constant Range Detector Indicator for MT4

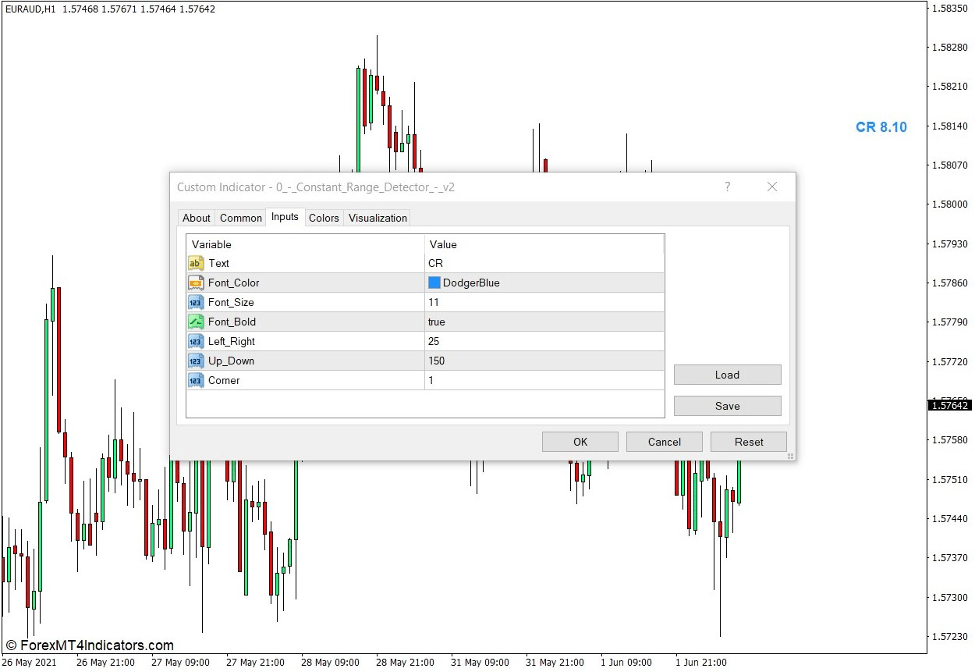

The Constant Range Detector Indicator has several options which can be modified under the Input tab within its settings.

“Text” allows users to modify the text label displayed beside the constant range size value.

“Font Color” allows users to select the color that they would want the label and the constant range size value to be displayed in.

“Font Size” allows users to modify the size of the text displayed.

“Font Bold” toggles the changing of the displayed to Bold fonts.

“Left Right” adjusts the distance of the displayed text from the corner of the chart on the x axis.

“Up Down” adjusts the distance of the displayed text from the corner of the chart on the y axis.

“Corner” allows users to select on which corner of the price chart the constant range size is displayed.

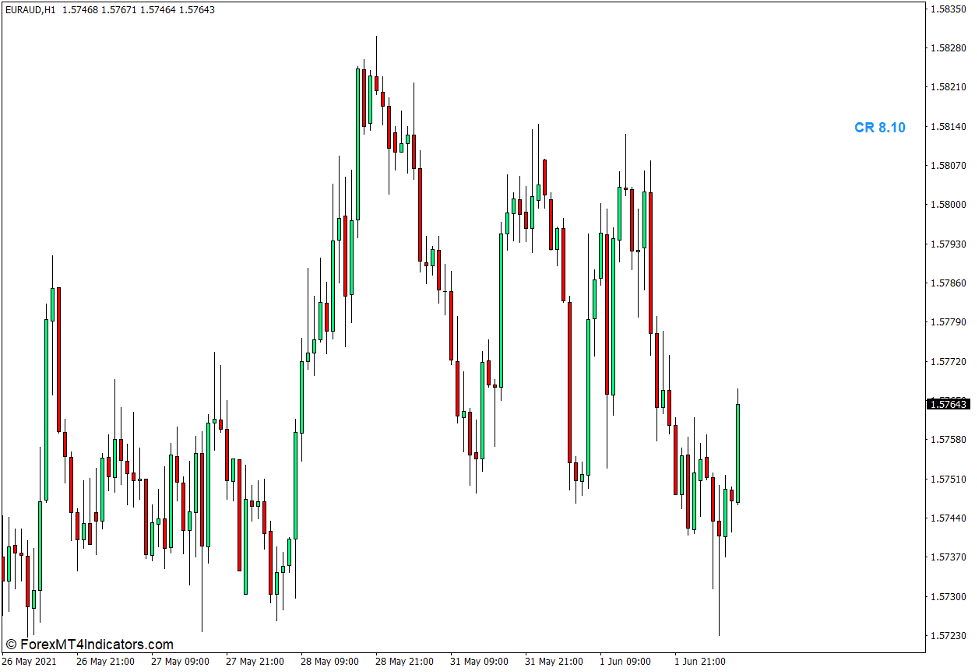

Constant Range Detector versus Average True Range

The Constant Range Detector can provide some useful information when compared with the Average True Range (ATR). It can tell us if the market is starting to contract if the Constant Range Detector value is consistently lower compared to the ATR. It can also indicate a momentum breakout or the start of a market contraction phase if the Constant Range Detector value has sudden increase and is significantly greater than the ATR.

Conclusion

At first glance, the Constant Range Detector Indicator may not seem like a very useful information for technical trading. However, when used in the proper context, this indicator can provide a valuable information for traders. Traders can use it in the context of observing market volatility, market expansions and contractions, as well as momentum breakouts. It is particularly useful when compared with other volatility indicators such as the Average True Range and volume.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: