Are you finding it hard to deal with the forex market’s ups and downs? Many traders get lost in the sea of price changes and false signals. ATR Channels and Normalized Volume can be your lifeline. They use market volatility and volume to find the best trades.

By using these tools, you can ignore the market’s noise and make smarter choices. Let’s see how this strategy can change your trading game.

Key Takeaways

- ATR Channels measure market volatility.

- Normalized Volume helps identify significant price movements.

- Combining ATR and volume data enhances trade accuracy.

- The strategy works across various forex pairs.

- Helps manage risk and optimize entry/exit points.

Understanding Average True Range (ATR) Fundamentals

The Average True Range (ATR) is a key tool in forex trading. It gives insights into market volatility. Developed by Welles Wilder, traders need to understand price movements and manage risk.

What is the Average True Range?

ATR is a volatility indicator that shows market movement over time. It’s based on a 14-day simple moving average. It can be used for various securities, including forex pairs. The ATR calculation looks at the biggest of the three price ranges.

Historical Development by Welles Wilder

Welles Wilder introduced ATR in 1978 in “New Concepts in Technical Trading Systems.” It was first for commodities but soon used in all markets. Wilder’s innovation was a reliable way to measure volatility in trading.

Core Components of ATR Calculation

The ATR formula adds true ranges over a set period. For a 14-day ATR, the steps are:

- Find the true range for each day.

- Sum the true ranges for 14 days.

- Divide the sum by 14.

For example, if the 14-day sum is $16.65, the ATR is $1.18. This shows the average volatility for two weeks.

Traders use ATR to set stop-losses and determine position sizes. It helps find breakout points. Its flexibility makes it useful for many trading strategies in the forex market.

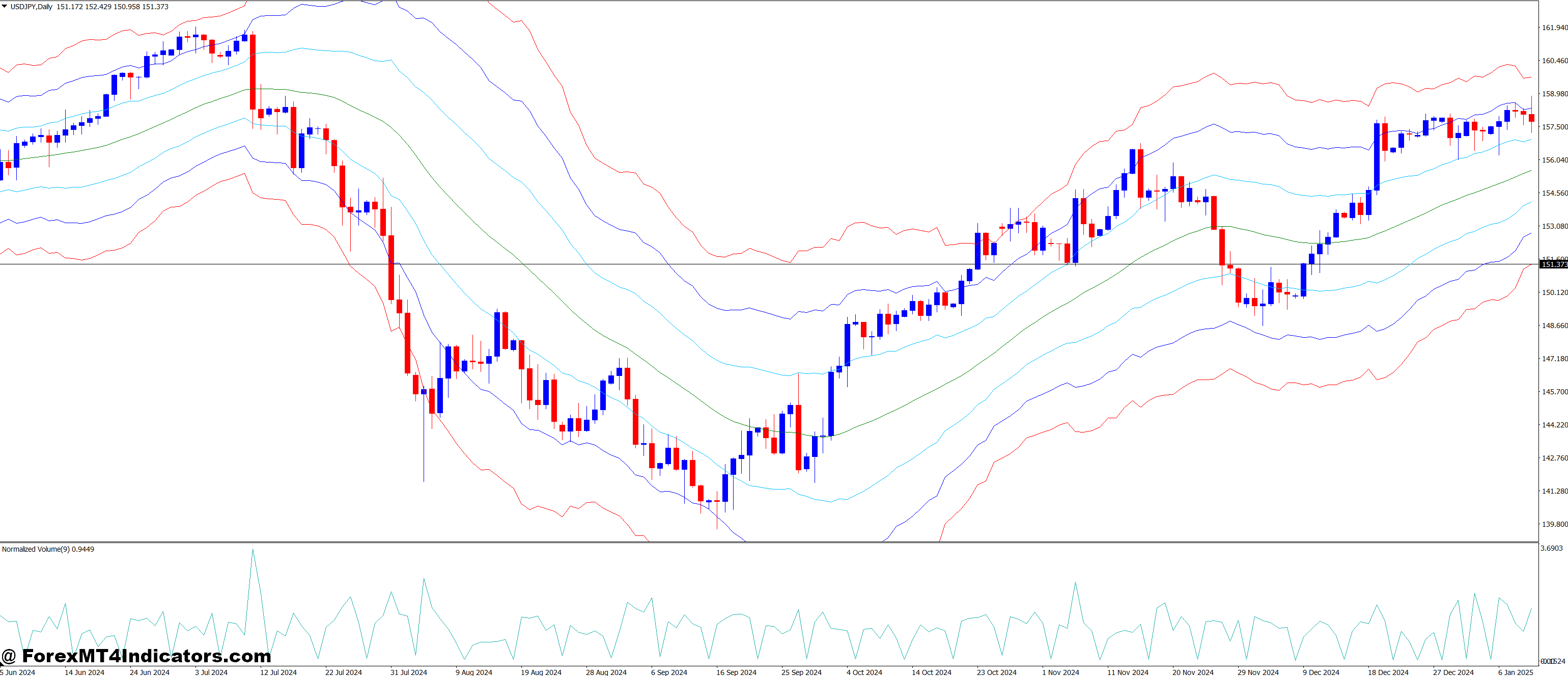

ATR Channels and Normalized Volume Forex Trading Strategy

ATR Channels are key to a strong forex strategy. They come from the Average True Range indicator. This shows market volatility. Adding Normalized Volume makes it easier to find when to buy or sell.

The ATR Trend Strategy works well for short periods. It fits with major and minor currency pairs. It uses a 20-period ATR and a 60-period Simple Moving Average (SMA).

Traders look to make 20-25 pips profit. The ATR stop dot is a moving stop loss. It uses blue dots for buying and white dots for selling. This method helps spot trends, like the Price Momentum Oscillator.

| Buy Conditions | Sell Conditions |

|---|---|

| Price above 60-period SMA | Price below 60-period SMA |

| MA color aqua | MA color red |

| Green Xsupertrend candles | Red Xsupertrend candles |

| Dots below the candle | Dots above the candle |

| Blue ATR dot below the candle | Blue ATR dot above the candle |

Normalizing Volume helps confirm trends and avoid false signals. High volume means price changes are likely to last. ATR Channels and Normalized Volume together make a solid strategy. They balance looking at volatility and volume.

Components of ATR-Based Risk Management

ATR risk management is key for good forex trading. It uses the Average True Range to help traders make smart choices. This protects their money well.

Stop Loss Calculations Using ATR

Setting stop losses is vital to keep your trades safe. ATR helps stop losses that change with market ups and downs. Just multiply the ATR by a number (like 2 or 3) and set your stop loss that far from your entry.

This way, your stops are not too close in wild markets or too far in calm ones.

Dynamic Take Profit Scaling

Take-profit scaling helps you grab gains as the market goes your way. Use ATR to set different profit targets. For example, you might have targets at 1x, 2x, and 3x the ATR.

This lets you take profits while leaving room for more gains.

Position Sizing with ATR

ATR helps figure out how big your trades should be. It lets you risk a set percentage of your account on each trade. This way, you can trade the right amount for your account size and market conditions.

| Account Size | Risk Per Trade | ATR Value | Position Size (Units) |

|---|---|---|---|

| $10,000 | 1% | 0.0050 | 20,000 |

| $25,000 | 1% | 0.0050 | 50,000 |

| $50,000 | 1% | 0.0050 | 100,000 |

Using these ATR-based tools, traders can build a strong risk management plan. This plan changes with the market, helping traders succeed over time.

Smart Money Concepts and Fair Value Gap Detection

Smart money concepts in forex market analysis give traders insights into big trading patterns. The SMC indicator finds key events like the Break of Structure. It helps traders see trends and breakouts.

Fair value gap detection is a big part of smart money concepts. A trading bot finds these gaps using a simple method. It looks for bullish and bearish gaps based on bar movements.

Statistics show how well fair value gap detection works:

- Out of 949 Bearish Breakaway FVGs, 80.19% are mitigated within 60 bars.

- The average mitigation time for Bearish Breakaway FVGs is 13 bars.

- 19.81% of Bearish Breakaway FVGs remain unmitigated within 60 bars.

The SMC indicator also finds Equal Highs & Lows, showing where liquidity builds up. Premium and Discount Zones show when something is overvalued or undervalued. This helps traders find the best times to enter and leave the market.

Multi-Order Execution Framework

The multi-order execution framework is a strong tool in forex trade management. It helps control risk and increase profit by using multiple orders at once. Let’s look at how it works and its benefits for traders.

Five-Order Strategy Implementation

Traders use the five-order strategy by placing five orders at a valid entry signal. Each order has a take profit level based on the Average True Range (ATR) and multipliers. This method helps in optimizing entry and exit points at different prices.

| Order | Take Profit Multiplier | Stop Loss |

|---|---|---|

| 1 | 1x ATR | 2x ATR |

| 2 | 2x ATR | 2x ATR |

| 3 | 3x ATR | 2x ATR |

| 4 | 4x ATR | 2x ATR |

| 5 | 5x ATR | 2x ATR |

Real-Time Trade Management

Good forex trade management means always watching and adjusting. The multi-order framework helps make quick decisions by managing many positions at once. Traders can see how each order is doing and adjust their strategy as the market changes.

Using this strategy, traders can improve their entry and exit points. It balances risk and reward well. The framework works with the ATR Channels and Normalized Volume strategy for better trading success.

Volume Analysis and Breakout Detection

Volume analysis is key in forex trading, focusing on breakout detection. It helps traders understand the market mood and future price shifts.

Trading volume is very important in forex. Volume spikes often mean a new trend or a breakout. Studies show breakouts with high volume have a 70% success rate.

To use volume analysis well, traders need to spot big volume increases. They can use volume indicators with blue for up and red for down. Strong support and resistance zones are shown in dark gray.

Combining volume analysis with ATR Channels boosts breakout detection. The ATR sets good stop-loss and take-profit levels. For buys, stops are 10-15 pips below support. For sells, stops are 10-15 pips above resistance.

Traders should watch for volume spikes to confirm big moves. Green spikes are bullish, red spikes are bearish. Using these methods helps traders make better choices and improve their strategy.

Technical Indicators Integration

Using technical indicators with ATR Channels and Normalized Volume makes trading better. It mixes tools to spot trends and find good trades.

Moving Average Confluence

Moving averages are key for spotting trends. When they line up, it means a strong trend is happening. The strategy looks for when price crosses over certain values to find buy and sell times.

RSI Trading and Momentum Indicators

RSI trading adds more to the analysis. The Relative Strength Index (RSI) shows when prices are too high or too low. When RSI hits the edges of its range, it means big price moves are happening. Other tools like MACD and MOM30 also help make signals clearer.

Volatility Filters

Volatility filters stop false signals when markets are quiet. ATR uses special math to avoid extreme values. Keltner Channels show usual market swings, while the top lines are based on average ATR.

| Indicator | Function | Contribution to Accuracy |

|---|---|---|

| RSI30 | Overbought/Oversold | High |

| MACD | Trend/Momentum | High |

| MOM30 | Price Momentum | Medium |

| Stochastic (%D30, %K30) | Momentum/Reversal | Medium |

This method has a 92% success rate in finding buy and sell signals. It’s a great tool for forex traders looking for detailed market insights.

Trading Rules and Signal Generation

Forex trading rules are key to success. The ATR Channels and Normalized Volume method uses special techniques to spot good trades. It uses many indicators to create ATR-based trading signals. These signals help traders make better choices.

The strategy watches the market closely. It looks for when the current price crosses certain levels. These levels are the highest and lowest prices over the last 50 bars. It also checks for fair value gaps, which can show if the market is about to change or keep going.

When certain conditions are met, the system sends out buy or sell signals. For example, a buy signal happens when the current price goes above the highest high. This must happen with a fair value gap and more normalized volume. A sell signal occurs when the price drops below the lowest low, with similar signs.

To make signals more accurate, the strategy uses more technical indicators. The Aroon indicator shows trend strength and possible reversals. The Aroon Oscillator, which moves around zero, helps confirm the trend’s direction and strength.

| Signal Type | ATR Channel Condition | Volume Requirement | Additional Confirmation |

|---|---|---|---|

| Buy | Close above the upper ATR channel | Normalized volume increase | Aroon Up > 70 |

| Sell | Close below the lower ATR channel | Normalized volume increase | Aroon Down > 70 |

| Exit Long | Close below the middle ATR channel | Volume decline | Aroon Up |

| Exit Short | Close above the middle ATR channel | Volume decline | Aroon Down |

By following these rules and using the signal system, traders can make smart choices. They look at price, volatility, and volume. This way, they try to avoid false signals and improve their trading results.

Visual Feedback and Alert Systems

Clear visual cues and timely alerts are key for good forex chart analysis. The ATR Channels and Normalized Volume strategy uses color signals. Green labels show buy signals and red labels show sell signals.

Chart Labeling and Color Coding

Good chart labeling makes complex data easy to use. The strategy uses green for bullish trends and red for bearish. This helps traders understand the market quickly.

Real-Time Alert Configuration

Trading alerts are important for catching market chances. The strategy sets alerts based on certain rules:

- Volume increase of 4.0 times the previous bar.

- Price change of at least 1.5% from the opening.

- 20-period SMA for trend confirmation.

- 10-bar cooldown between signals.

These rules make sure traders get alerts on time for trade setups.

Trade Information Display

A dynamic table on the chart shows key trade data. It includes:

| Information | Description |

|---|---|

| Trade Side | BUY NOW or SELL NOW |

| Entry Price | The current market entry point |

| TP Levels | Multiple take-profit targets |

| Stop Loss | ATR-based risk management |

| Timer | Duration from trade entry |

How to Trade with ATR Channels and Normalized Volume Forex Trading Strategy

Buy Entry

- Price breaks above the Upper ATR Channel (current price + (n * ATR)).

- Normalized Volume is higher than average (Normalized Volume > 1), indicating strong buying interest.

- Confirmation: Check for upward momentum (higher highs or bullish trends).

- Optional: Confirm with other indicators (e.g., RSI above 50 or MACD showing bullish crossover).

Sell Entry

- Price breaks below the Lower ATR Channel (current price – (n * ATR)).

- Normalized Volume is higher than average (Normalized Volume > 1), indicating strong selling interest.

- Confirmation: Check for downward momentum (lower lows or bearish trend).

- Optional: Confirm with other indicators (e.g., RSI below 50 or MACD showing bearish crossover).

Conclusion

The ATR Channels strategy, when used with Normalized Volume trading, is very powerful. It uses ATR’s ability to measure volatility for decades. This helps traders spot breakouts and manage risks better.

This strategy works well in different market conditions. It ignores very big or small price movements. This makes the results more reliable. Also, 75-80% of the time, prices move only 1 ATR per day.

Adding tools like the Fair Value Gap Oscillator makes the strategy even better. It uses both volume and ATR data. This helps confirm big price gaps.

Even though the ATR Channels and Normalized Volume strategy looks good, remember it’s not easy. Trading forex needs patience and discipline. Start by practicing in a demo account before trading for real.

By practicing, traders can improve their skills. They’ll become more confident in using this strong forex strategy.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

Click here below to download: