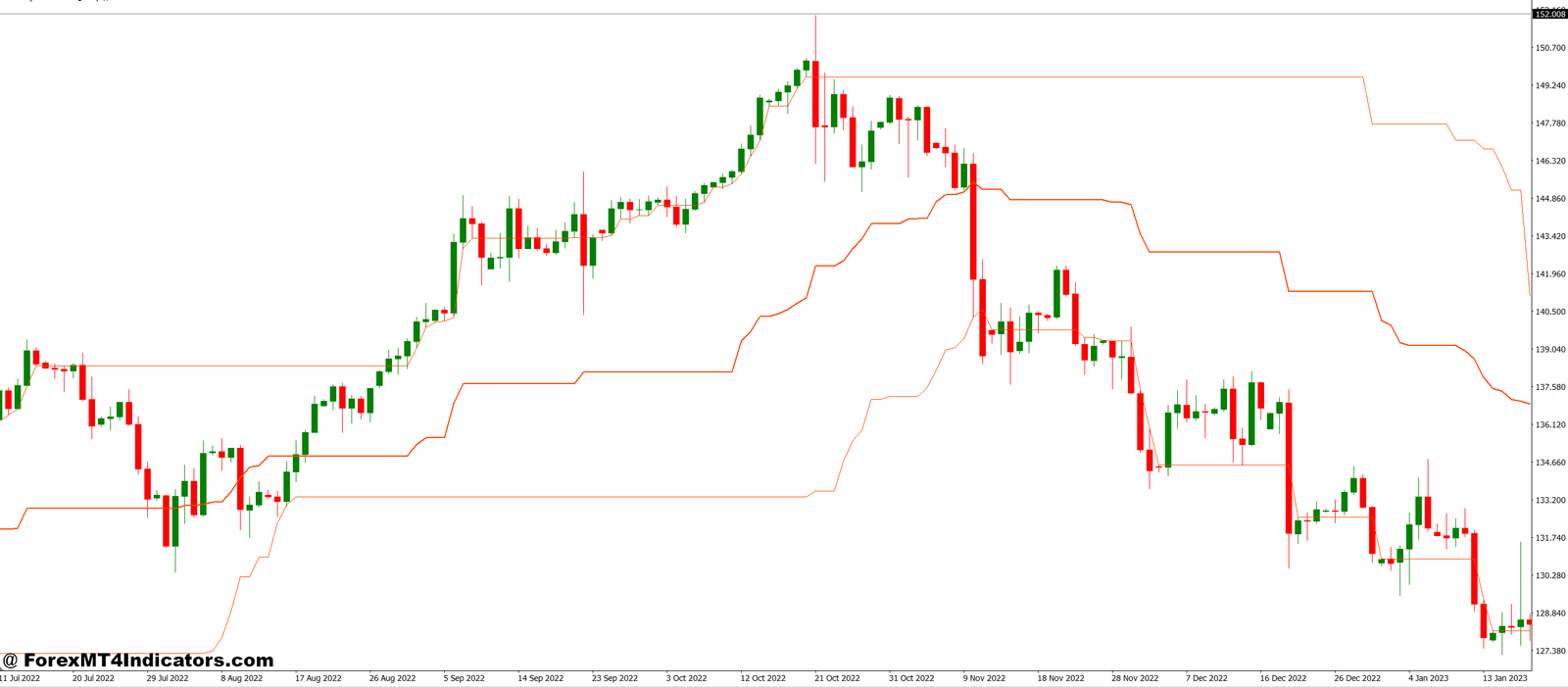

The LOC Kijun Sen Channel MT4 Indicator is designed to provide a visual representation of market direction. It builds a channel around price action, based on the Kijun Sen line from the Ichimoku trading system. This channel acts as a dynamic support and resistance zone, making it easier for traders to see where price might reverse or continue trending. By plotting both upper and lower boundaries, the indicator helps traders filter out market noise and focus only on high-probability setups.

Why Traders Use This Indicator

One of the biggest benefits of the LOC Kijun Sen Channel is its ability to adapt to different market conditions. Whether the market is trending or ranging, the channel gives traders a frame of reference for price movement. For example, when price stays within the channel, it signals stability, but when it breaks out, traders may prepare for strong momentum. This flexibility makes it suitable for scalpers, day traders, and swing traders alike.

How It Improves Trading Decisions

Many traders struggle with false signals, but this indicator reduces guesswork. By combining trend-following and channel analysis, it gives traders a better sense of when to buy, sell, or wait. For instance, if price touches the lower boundary of the channel during an uptrend, it may present a buying opportunity. On the other hand, touching the upper boundary in a downtrend can suggest a potential sell setup. These signals, when combined with other tools or confirmations, can help improve trade accuracy.

Practical Application in Trading

The LOC Kijun Sen Channel can be used across multiple timeframes and currency pairs, making it a versatile tool. Traders often use it alongside indicators like RSI or MACD to confirm signals and reduce risks. It also works well as a stand-alone system for those who prefer a cleaner chart. By visually guiding traders through market fluctuations, it builds discipline and reduces emotional decision-making, which is a major challenge for many.

How to Trade with LOC Kijun Sen Channel MT4 Indicator

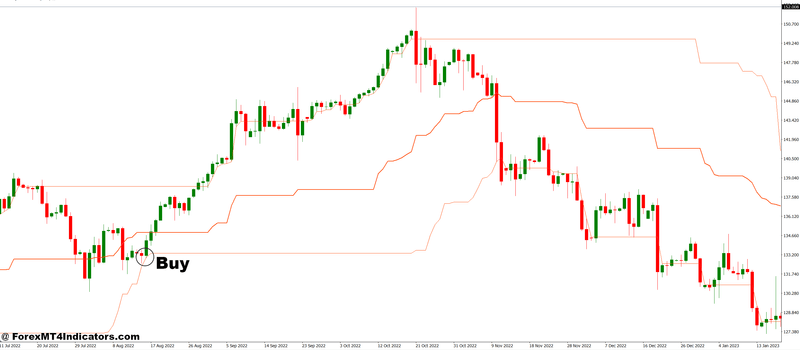

Buy Entry

- Wait for the price to move near or touch the lower boundary of the channel during an overall uptrend.

- Confirm that the channel is sloping upward, showing bullish momentum.

- Enter a buy trade when a bullish candle forms near the lower channel line.

- Place a stop-loss slightly below the channel’s lower boundary.

- Target the middle or upper channel line for taking profit.

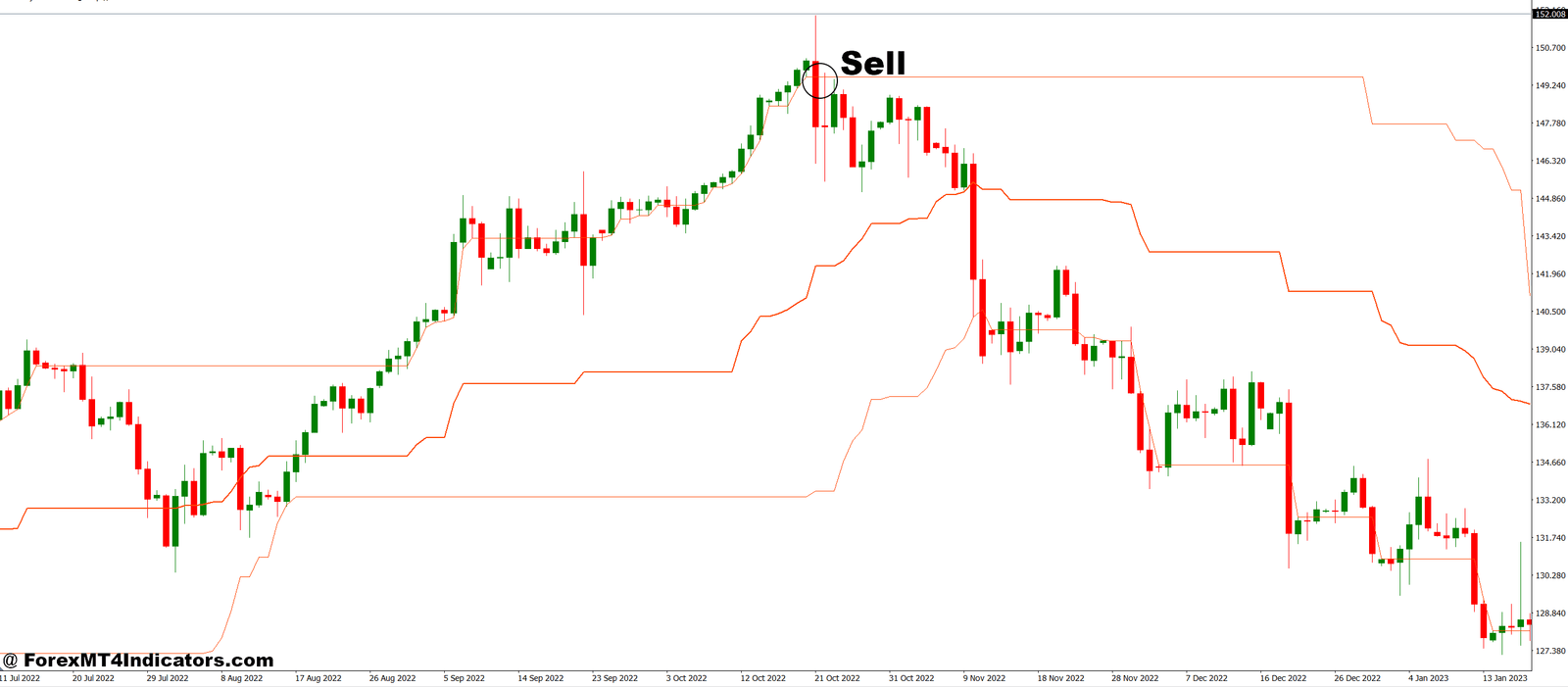

Sell Entry

- Wait for the price to move near or touch the upper boundary of the channel during a downtrend.

- Confirm that the channel is sloping downward, signaling bearish pressure.

- Enter a sell trade when a bearish candle forms near the upper channel line.

- Place a stop-loss slightly above the channel’s upper boundary.

- Target the middle or lower channel line for profit-taking.

Conclusion

The LOC Kijun Sen Channel MT4 Indicator is more than just a technical tool—it’s a guide for clearer trading decisions. By outlining dynamic channels around price, it highlights possible turning points and strengthens overall strategy. Traders who adopt this indicator can gain more confidence, avoid false moves, and improve their chances of success in the Forex market.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.