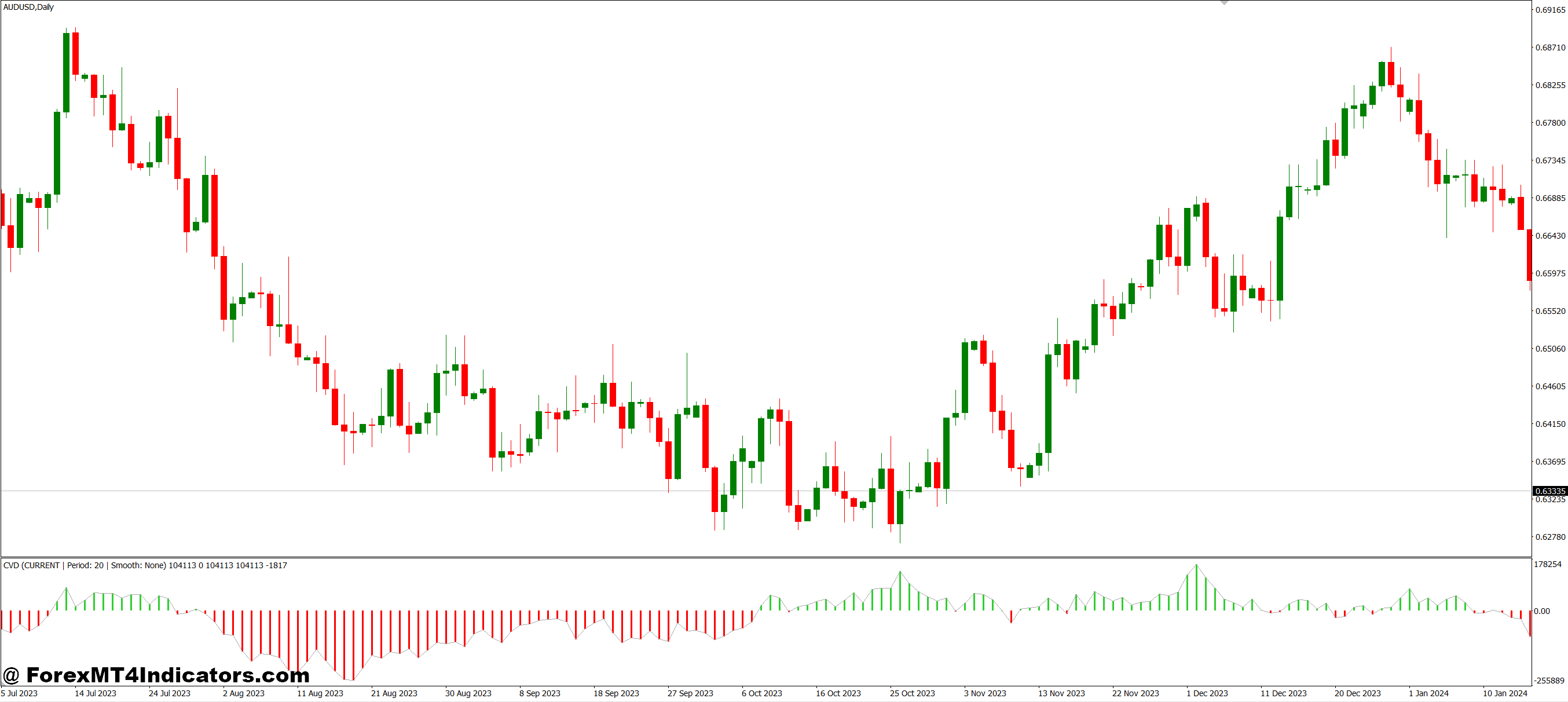

The CVD MT4 Indicator works by calculating the difference between buying volume and selling volume over time. Every time a trade happens at the ask price, it’s counted as buying volume. When a trade happens at the bid price, it’s selling volume. The indicator adds up these differences continuously, creating a running total that shows whether buyers or sellers have been more aggressive. When the CVD line goes up, buyers are in control. When it drops, sellers are taking over. This simple visual makes it way easier for traders to understand what’s really happening beneath the surface of price action.

Spotting Divergences for Better Trades

What makes this indicator so valuable is how it helps traders spot divergences. Sometimes the price keeps climbing higher, but the CVD starts falling. That’s a red flag. It means fewer buyers are supporting the move, and the rally might be running out of steam. The opposite works too—if the price drops but CVD rises, it suggests sellers are losing strength and a reversal could be coming. These divergences give traders an early warning system that price charts alone just can’t provide. It’s like having X-ray vision into market sentiment.

Easy Setup and Customization

Setting up the CVD indicator on MT4 is pretty straightforward. Traders download the indicator file, drop it into their indicators folder, and restart their platform. Once it’s loaded on a chart, they can customize the settings to match their trading style. Day traders might use shorter timeframes to catch quick moves, while swing traders stick with longer periods for the bigger picture. The indicator works on any currency pair, stock, or commodity that shows volume data. Many traders combine it with other tools like support and resistance levels or moving averages to create a complete trading system.

Combining CVD with Price Action

The real power comes from using CVD alongside price action. Let’s say a trader sees the price breaking above a key resistance level. They check the CVD indicator and notice it’s surging upward too. That confirms strong buying pressure, making the breakout more reliable. On the flip side, if the price breaks out but CVD stays flat or drops, that breakout is probably weak and might fail quickly. This confirmation process helps traders avoid fake-outs and focus on high-probability setups. It turns guesswork into a more calculated approach where the volume data backs up what the price is doing.

How to Trade with CVD MT4 Indicator

Buy Entry

- CVD line crosses above zero – When the indicator moves from negative to positive territory, it shows buyers are starting to take control of the market

- Bullish divergence appears – Price makes a lower low, but CVD makes a higher low, signaling that selling pressure is weakening and a reversal upward might be coming.

- CVD confirms an uptrend – The CVD line keeps making higher highs along with the price, confirming strong buying momentum that traders can ride.

- Sharp upward spike in CVD – A sudden jump in the CVD line indicates aggressive buying activity, often before a significant price move higher.

- CVD breaks above previous resistance – When the indicator pushes past its recent high point, it shows renewed buyer strength worth jumping on.

- Price pullback with rising CVD – When price dips slightly but CVD keeps climbing, it suggests buyers are accumulating, and the dip is a buying opportunity.

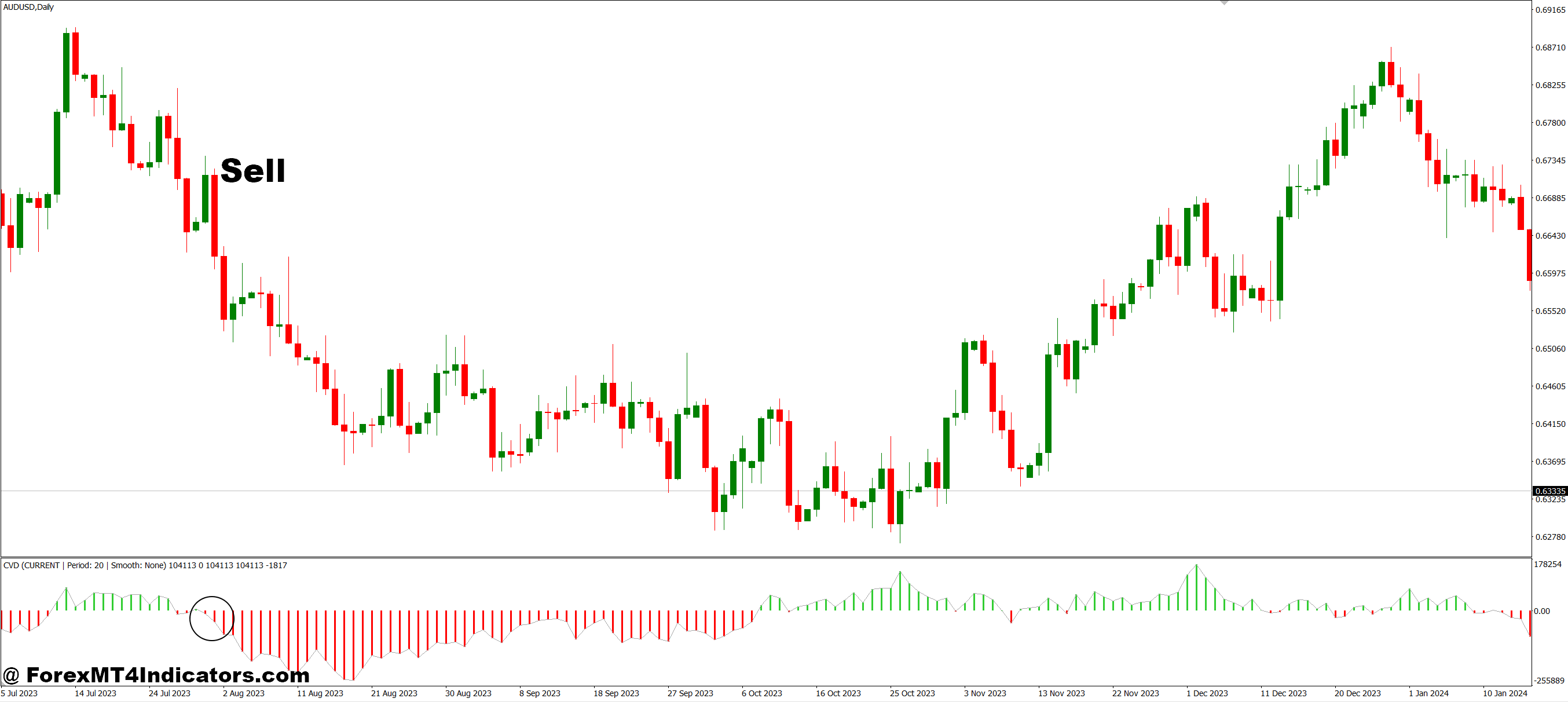

Sell Entry

- CVD line crosses below zero – When the indicator drops from positive to negative, it means sellers are gaining control and pushing the market down.

- Bearish divergence shows up – Price makes a higher high, but CVD makes a lower high, warning that the uptrend is losing steam and a reversal could happen soon.

- CVD confirms a downtrend – The CVD line keeps making lower lows alongside falling prices, proving strong selling pressure is in charge.

- Sharp downward drop in CVD – A quick plunge in the CVD line reveals aggressive selling activity, usually before a major price drop.

- CVD breaks below previous support – When the indicator falls past its recent low, it signals increased seller dominance and a good opportunity to go short.

- Price rally with falling CVD – When price moves up slightly but CVD keeps dropping, it suggests sellers are distributing, and the rally is a selling opportunity.

Conclusion

The CVD MT4 Indicator gives traders something they desperately need—clarity. Instead of guessing whether buyers or sellers are winning, they can see the evidence right on their charts. It helps them catch divergences before reversals happen, confirm breakouts before jumping in, and understand the real strength behind price movements. For anyone tired of getting caught on the wrong side of trades, this indicator offers a practical way to read market pressure and make more informed decisions. It’s not magic, but it’s definitely one of those tools that can level up someone’s trading game.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.