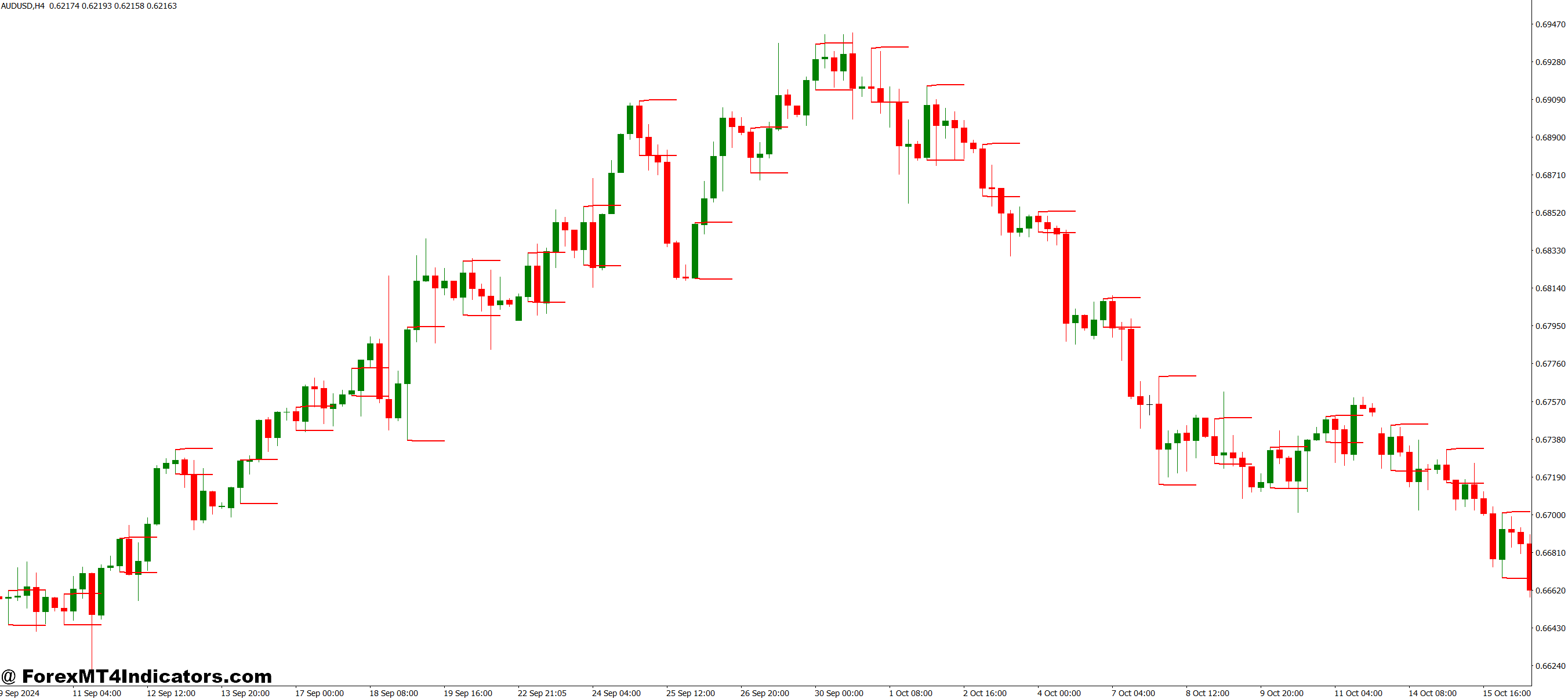

The Breakout Probability MT4 Indicator analyzes price compression and volatility to assign a percentage likelihood to potential breakouts. Unlike simple support and resistance indicators, this tool calculates the statistical probability of price breaking through a defined range based on current market conditions.

The indicator displays probability percentages above consolidation zones, typically ranging from 0% to 100%. A reading above 70% suggests favorable conditions for a breakout, while readings below 30% indicate the range may hold. But here’s the thing—these aren’t guarantees. They’re statistical edges based on pattern recognition.

Most versions show dual probabilities: one for upside breaks and another for downside. On EUR/USD during the London session, you might see 65% upside and 35% downside probability when the price tests resistance after a bullish trend.

How the Calculation Works

The indicator combines three primary inputs: Average True Range (ATR), price deviation from a moving average, and consolidation duration. The ATR component measures volatility—higher volatility increases breakout probability since explosive moves need fuel.

Price deviation looks at how far the current price sits from its mean. When price compresses tightly around a 20-period moving average, tension builds. The indicator recognizes this coiling action and raises probability scores.

Consolidation duration matters too. Breakouts from 3-hour ranges don’t carry the same weight as those from multi-day consolidations. The indicator typically weighs longer consolidations more heavily. A triangle pattern that’s been building for two weeks on the daily chart scores higher than a 15-minute range.

The formula isn’t publicly disclosed by most developers, but the logic follows this pattern: (ATR expansion + Price compression + Time factor) / Historical success rate = Probability score. Some versions incorporate Bollinger Band width or standard deviation bands for additional confirmation.

Real-World Trading Application

Testing this on USD/JPY during the Tokyo-London overlap produced interesting results. The pair formed a symmetrical triangle over eight trading sessions. The indicator showed 72% upside probability as the price approached the apex. When the break occurred, it ran 85 pips before the first pullback—a solid risk-to-reward setup.

But not every high-probability signal delivers. During choppy NFP (Non-Farm Payroll) sessions, the indicator flashed 68% probability on a EUR/USD range breakout. Price did break higher initially, but whipsawed back through the range within 20 minutes. The lesson? Probability isn’t certainty, especially during news events when algorithms dominate order flow.

For swing traders, the indicator works best on 4-hour and daily timeframes. Short-term noise affects probability calculations less when you zoom out. One trader reported using it on daily GBP/JPY charts, only taking setups above 75% probability. His hit rate improved from 51% to 64% over six months—statistically significant for breakout trading.

Scalpers can use it on 5-minute charts, but expect more false signals. The indicator needs sufficient data to calculate reliable probabilities. On a 1-minute chart during the Asian session, with low volatility, the readings become nearly meaningless.

Settings and Customization

The default settings typically include a 14-period ATR, 20-period moving average, and a consolidation lookback of 30 bars. These work decently on 1-hour charts for major pairs like EUR/USD or USD/CAD.

For volatile pairs like GBP/JPY or cryptocurrency crosses, traders often reduce the ATR period to 10. This makes the indicator more responsive to sudden volatility spikes. The tradeoff? More sensitivity means more false signals during ranging markets.

Conservative swing traders increase the consolidation lookback to 50 or 60 bars. This filters out short-term ranges and focuses on more established patterns. A trader specializing in daily timeframe breakouts might use: ATR 21, MA 50, and Lookback 60.

The probability threshold is adjustable, too. Some traders set alerts only when readings exceed 75%, while aggressive traders act on anything above 60%. There’s no magic number—it depends on your risk tolerance and win rate requirements.

Color-coding options help visual traders. Green zones indicate high upside probability, red shows high downside probability, and yellow signals uncertainty (roughly 50/50 odds). When both directions show low probability, the indicator’s basically saying “stay out—this range isn’t ready to break.”

Advantages and Honest Limitations

The primary advantage is objectivity. Instead of guessing whether a range will break, traders get a calculated probability. This removes some emotional decision-making from breakout entries. It also helps with position sizing—higher probability setups might warrant larger positions within your risk parameters.

The indicator excels at filtering out weak consolidations. Those tight 10-pip ranges that form during lunch hour on EUR/USD? The indicator usually shows low probability, saving traders from entering choppy, directionless price action.

But let’s address the limitations head-on. No indicator predicts black swan events. When the Swiss National Bank unpegged the franc in 2015, no probability calculation would’ve helped. The indicator also lags during fast-moving markets. By the time it calculates a high probability, the breakout may already be 20 pips gone.

False breakouts remain a risk, especially during low-liquidity periods. The indicator might show 70% probability, but if there’s thin order flow, market makers can easily trigger stops and reverse the price. This happens frequently during holiday weeks or overnight sessions in thin pairs.

Compared to the Donchian Channel breakout system, this indicator adds a probability layer rather than just signaling when price hits new highs or lows. Against the Average Directional Index (ADX), it’s more specific to breakout scenarios, while ADX measures overall trend strength. Traders often combine this indicator with ADX—a high ADX plus a high breakout probability creates a powerful confirmation.

How to Trade with Breakout Probability MT4 Indicator

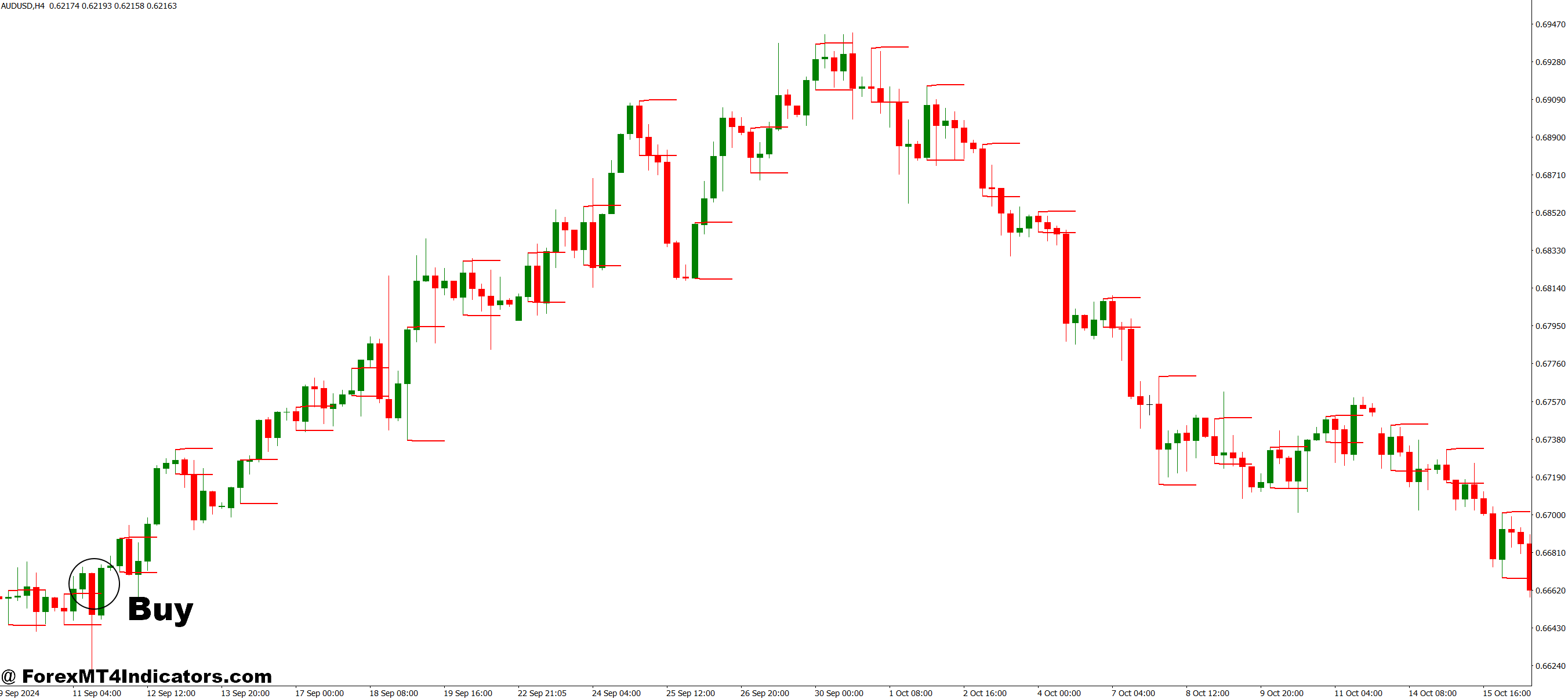

Buy Entry

- Wait for 70%+ upside probability – Only take long breakout trades when the indicator displays 70% or higher probability on the upside; anything below 65% on EUR/USD 4-hour charts typically results in false breaks.

- Confirm with price close above resistance – Enter buy positions only after a 4-hour or 1-hour candle closes at least 5-10 pips above the consolidation high; don’t chase wicks without body confirmation.

- Check ATR for volatility expansion – The 14-period ATR should be expanding when probability exceeds 75%; if ATR is contracting during a breakout signal, price lacks the momentum to sustain the move.

- Set stop-loss below consolidation low – Place stops 5-10 pips below the range’s lowest point, not just below entry; on GBP/USD, this typically means 30-50 pip stops depending on the consolidation size.

- Avoid during major news releases – Skip buy signals within 30 minutes before or after NFP, FOMC, or central bank decisions; probability calculations break down when algorithms dominate order flow.

- Target 1.5:1 minimum risk-reward – If your stop is 40 pips, aim for at least 60 pips profit; high-probability setups above 80% can justify targets of 2:1 or higher on daily timeframes.

- Scale in on pullbacks to breakout level – Add to winning positions if price retests the broken resistance (now support) with probability still above 65%; this improves average entry price on EUR/USD and GBP/USD swing trades.

- Exit if probability drops below 50% – Close partial or full position if the indicator recalculates and shows declining probability; this often signals weakening momentum before a reversal trap.

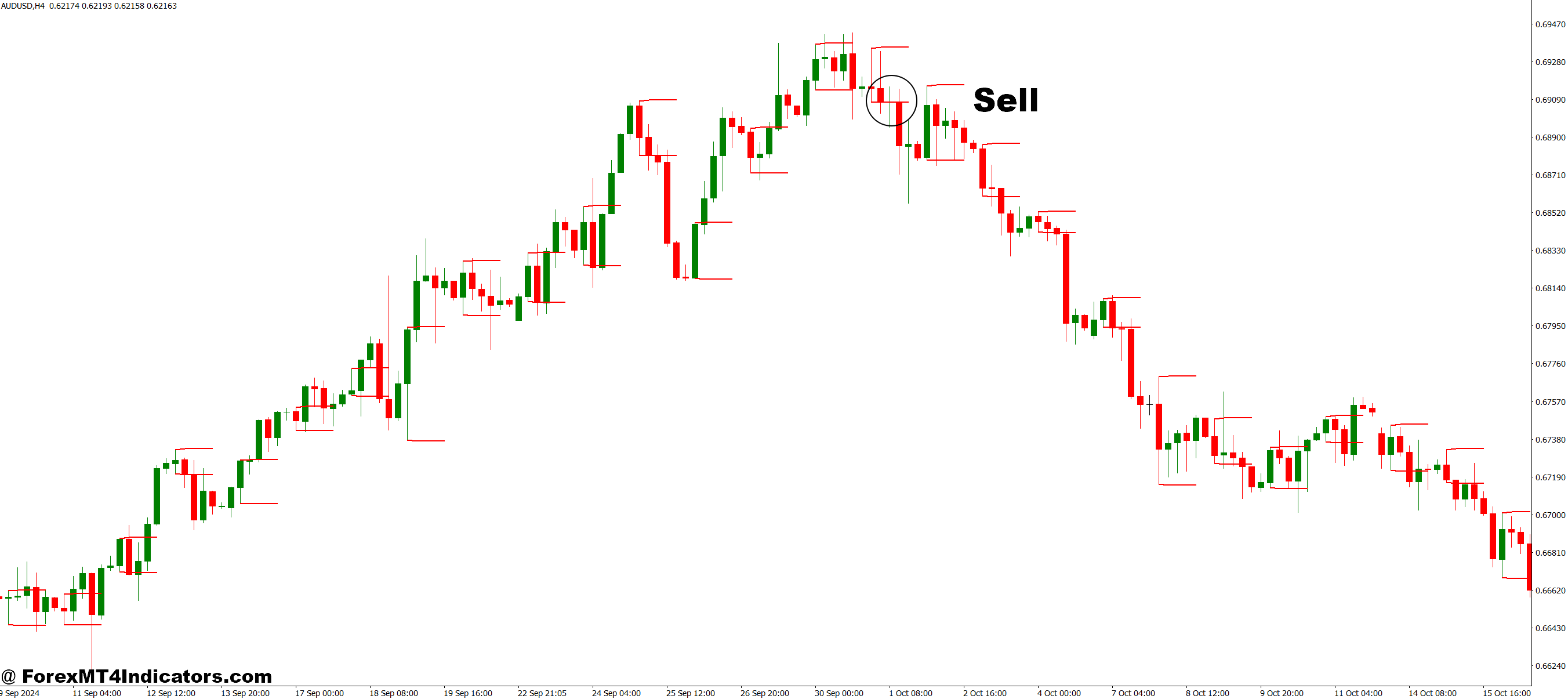

Sell Entry

- Require 70%+ downside probability reading – Only short when the indicator shows 70% or higher probability for downward breakouts; readings between 50-65% on 1-hour USD/JPY charts frequently fail.

- Enter on candle close below support – Wait for a full 4-hour or daily candle to close 5-10 pips beneath the consolidation’s lowest point; never sell on the initial spike down.

- Verify increasing volatility (ATR rising) – The breakout needs fuel; if ATR is flat or declining while probability shows 75%, the range will likely trap sellers and reverse higher.

- Position stops above range high plus buffer – Place stop-losses 5-15 pips above the consolidation’s highest point; GBP/JPY breakouts often need wider stops (50-70 pips) due to higher volatility.

- Skip setups during thin liquidity hours – Avoid short signals during the Asian session (00:00-03:00 GMT) or Friday afternoons; low volume allows market makers to trigger stops and reverse false breakouts easily.

- Trail stops as probability strengthens – If a short trade moves 30+ pips in profit and probability increases to 85%+, move stops to breakeven; protect capital on EUR/USD daily chart breakdowns.

- Don’t sell into strong support zones – If the breakout approaches weekly or monthly support levels, exit before contact; probability indicators don’t account for institutional order clusters at major zones.

- Close trades if upside probability exceeds 60% – When the indicator flips and shows a stronger probability for upward movement, exit immediately; this signals the breakdown is losing conviction and reversal risk is high.

Conclusion

Trading forex carries substantial risk. No indicator guarantees profits, and the Breakout Probability MT4 Indicator is no exception. Probability scores above 70% still fail roughly 30% of the time by definition. Position sizing and stop-loss placement remain critical regardless of indicator readings.

The indicator works best as a filter, not a standalone system. Combining it with price action analysis, support and resistance levels, and broader market context improves results. A 75% probability reading means more when it aligns with a daily trend, institutional order levels, and positive risk sentiment.

For traders tired of getting faked out on breakouts, this tool offers a systematic approach. It won’t eliminate losses, nothing does, but it can shift the odds in your favor when used properly. The key is treating probability scores as one piece of evidence, not the final verdict. Test it on a demo account across different timeframes and pairs. Track which settings and probability thresholds work for your trading style.

In breakout trading, an edge of just 5-10% can mean the difference between consistent profits and slow account erosion. If this indicator provides even half that edge, it’s worth the learning curve.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.