The 99 Win Non Repaint Scalping MT5 Indicator claims to solve this exact issue. Unlike traditional indicators that redraw their signals, this tool locks its alerts the moment they appear. No disappearing arrows, no shifting lines—just fixed signals that stay where they first appeared. But does it actually deliver on that promise, and more importantly, is it the right fit for your trading strategy?

What This Indicator Actually Does

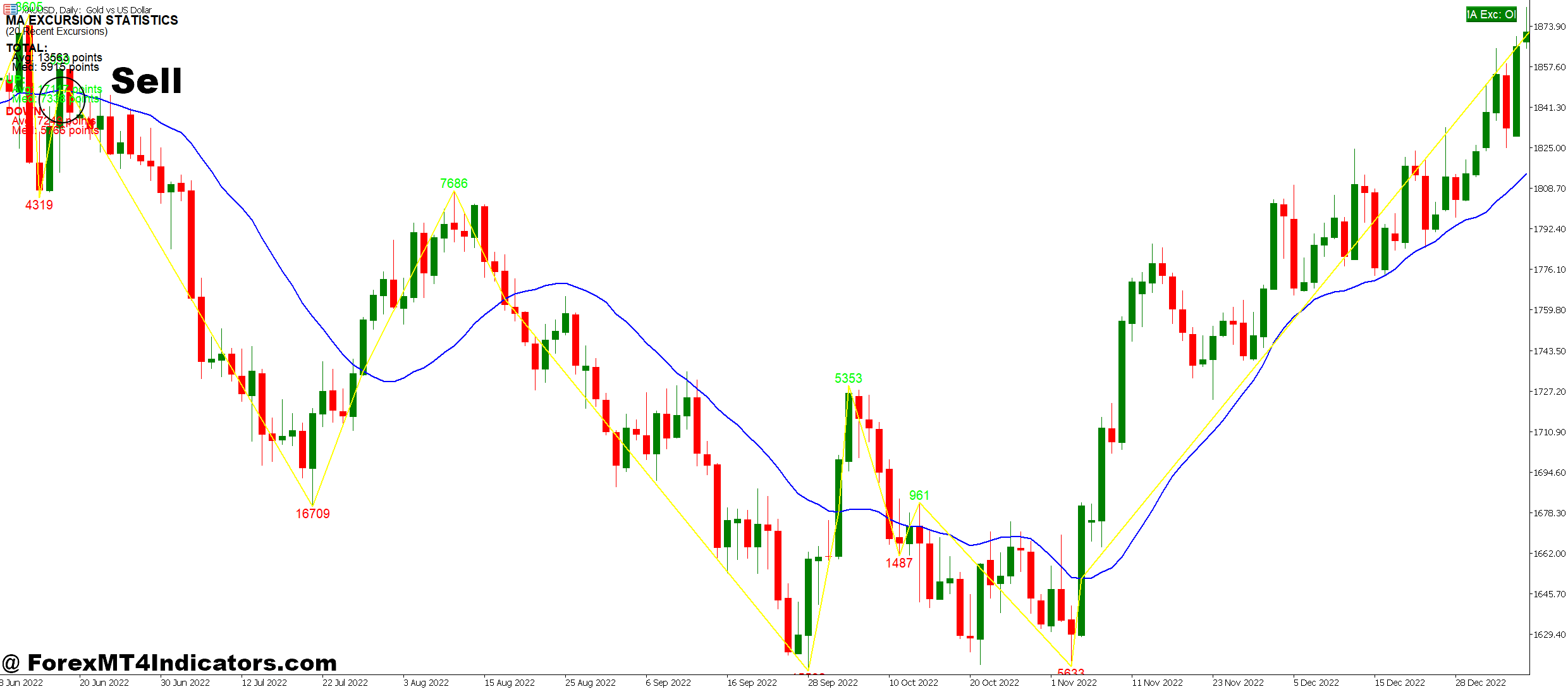

The 99 Win Non Repaint Scalping indicator is a technical analysis tool built specifically for MetaTrader 5 that generates buy and sell signals for short-term trading. The “non repaint” designation means once the indicator places an arrow or alert on the chart, it stays there—period. That signal won’t disappear or relocate when new price data comes in.

The indicator combines multiple technical elements. Most versions use a blend of moving average crossovers, momentum filters, and price action patterns to identify potential entry points. When these conditions align during specific market structures, the indicator fires a visual arrow—blue for buys, red for sells—directly on the price chart.

What separates this from standard oscillators? Speed and specificity. The algorithm is tuned for the 1-minute to 15-minute timeframes where scalpers operate. It’s designed to catch quick 5-15 pip movements rather than daily swings, which means the logic filters out slower trends and focuses on immediate momentum shifts.

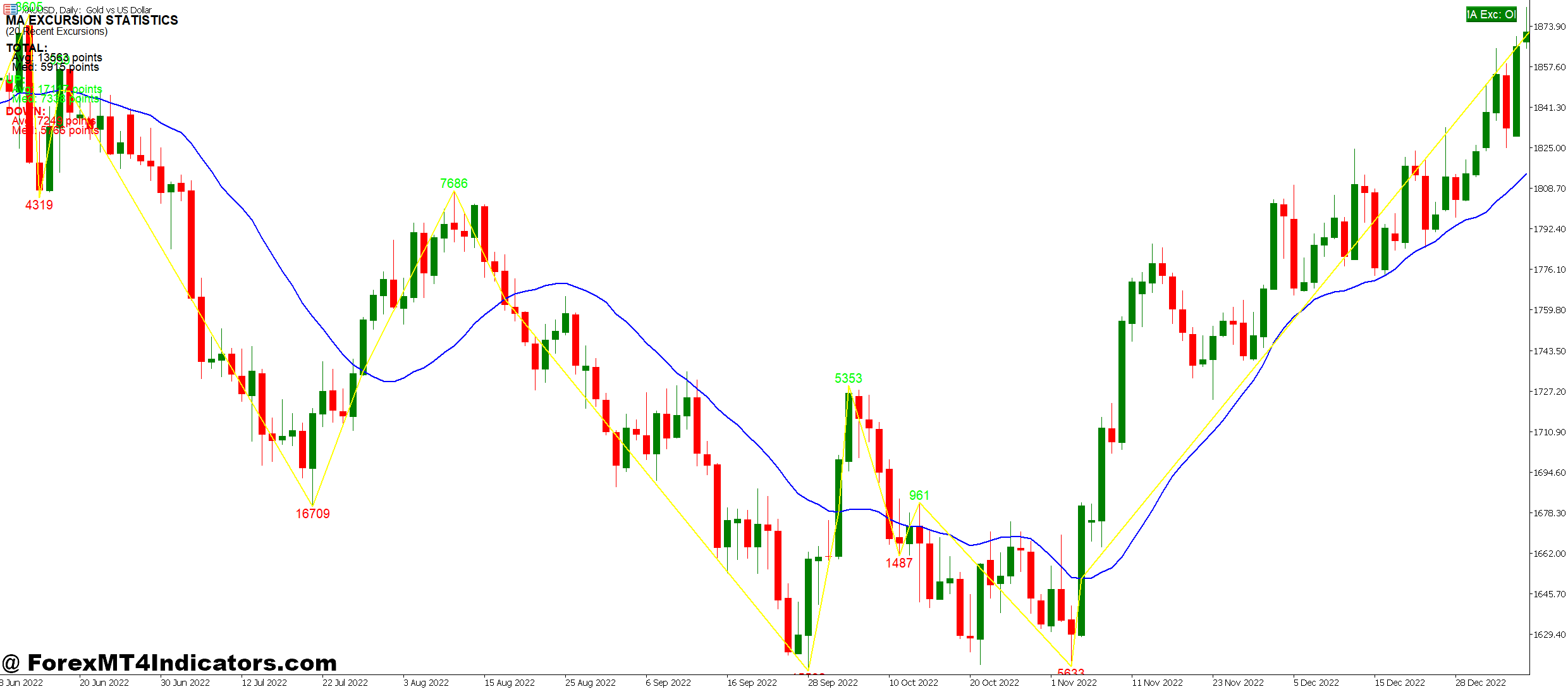

The Mechanics Behind the Signals

While exact calculations vary by version, most implementations use a three-layer approach. First, the indicator measures short-term momentum using something similar to a 5-period and 10-period exponential moving average relationship. When the faster EMA crosses the slower one with sufficient distance (not just a tiny overlap), the first condition triggers.

Second, a volatility filter checks current market conditions. During dead markets with 2-3 pip ranges, the indicator stays quiet. It wants to see actual movement—typically measured through Average True Range over the last 10-14 bars. If ATR falls below a threshold (usually 0.0008 for major pairs), signals get suppressed.

Third, price action confirmation comes into play. The indicator won’t fire a buy signal if price just rejected off a recent high, even if moving averages crossed bullish. This layer examines the last 3-5 candles for patterns like engulfing bars or strong directional closes. Only when all three conditions align does the arrow appear.

The non-repainting aspect works because the indicator only plots signals after candle close, not mid-formation. Some traders see this as a drawback since you can’t enter the instant momentum starts. But it’s the trade-off for reliability—that arrow represents a completed signal that met all criteria, not a provisional maybe-signal that could vanish.

Putting It to Work: Real Trading Scenarios

Take a typical London session open on GBP/USD using the 5-minute chart. Price had been ranging between 1.2650 and 1.2670 for the past hour—the kind of chop that eats stop losses. At 8:15 AM GMT, a news event triggers movement. Within two bars, the indicator fires a blue arrow at 1.2655.

Here’s what happened: The 5-EMA crossed above the 10-EMA with a 3-pip separation. ATR jumped from 0.0006 to 0.0012, showing volatility expanding. The previous candle closed strongly bullish, engulfing the prior bar’s range. All systems green.

A trader entering at 1.2655 with a 10-pip stop at 1.2645 and 15-pip target at 1.2670 would’ve seen price rally to 1.2673 within eight minutes. That’s a 1.5:1 reward-to-risk winner that actually appeared in real-time—the arrow stayed at 1.2655 whether price went up or down afterward.

But here’s the reality check: For every clean winner like that, you’ll see 2-3 signals that hit the stop. Maybe the EUR/USD signal on the 1-minute chart triggered at 1.0850 during Asian session, only to whipsaw in a 5-pip range before stopping out. The indicator caught momentum—problem is, momentum died in thirty seconds.

Settings That Actually Matter

Default parameters rarely fit everyone’s style. Most versions let you adjust the EMA periods, ATR lookback, and signal sensitivity. For the 5-minute chart on majors like EUR/USD or USD/JPY, standard settings (5/10 EMA, 14 ATR) work decently during active sessions.

Switch to the 1-minute chart, and things get twitchy. Consider tightening the ATR filter to 0.0010 minimum to reduce signals during low-volatility grinds. For pairs like GBP/JPY that move 20-30 pips quickly, you might loosen it to 0.0015 to avoid missing strong moves.

The 15-minute timeframe needs a different approach entirely. Here, extend the EMA periods to 8/15 to filter out noise. The longer bars mean you’re catching mini-trends rather than pure scalps, so the indicator’s logic should adapt. Some versions include a “sensitivity” slider—dial it down on higher timeframes to prevent overtrading.

One parameter traders often ignore: signal confirmation bars. If your version includes this, setting it to 1 means you get signals immediately after candle close. Setting it to 2 means the indicator waits for the next bar to start before plotting the arrow. That extra bar confirmation reduces signals by roughly 40% but increases win rate by filtering out weak setups.

The Honest Advantages and Real Limitations

The biggest selling point? Psychological clarity. When that arrow appears, you know it’s permanent. Backtesting becomes meaningful because signals you see in history are the same ones that appeared in real-time. That eliminates the dangerous illusion of perfect indicators with 85% win rates that crumble during live trading.

For pure scalpers trading 20-30 positions per session, the indicator provides consistent entry structure. You’re not guessing whether momentum is “enough” or if a crossover is “real.” The algorithm makes that call, removing emotional waffling at critical moments.

That said, no scalping tool solves the core issue: transaction costs. If you’re paying 2 pips spread on EUR/USD, every trade starts 2 pips underwater. Targeting 10-pip scalps means you need 12 pips of favorable movement just to break even after spread and profit target. The indicator might signal 60% winners in price movement terms, but after costs, that drops to 45-50% profitability.

Another limitation: range-bound slaughter. When GBP/USD trades in a 20-pip box for three hours, the indicator will still fire signals. You’ll see arrows at the top of the range (sells) and bottom (buys), which sounds perfect until you realize half of them are fake-outs. The indicator can’t predict whether that breakdown is real or another failed probe.

And despite the “99 Win” marketing name, let’s clear this up—no indicator wins 99% of trades. Not this one, not any. If you see marketing materials claiming that win rate, they’re either cherry-picking timeframes, ignoring transaction costs, or testing on curve-fitted data. Real-world scalping with this indicator runs 50-65% win rate for skilled traders during favorable conditions.

How It Stacks Up Against Alternatives

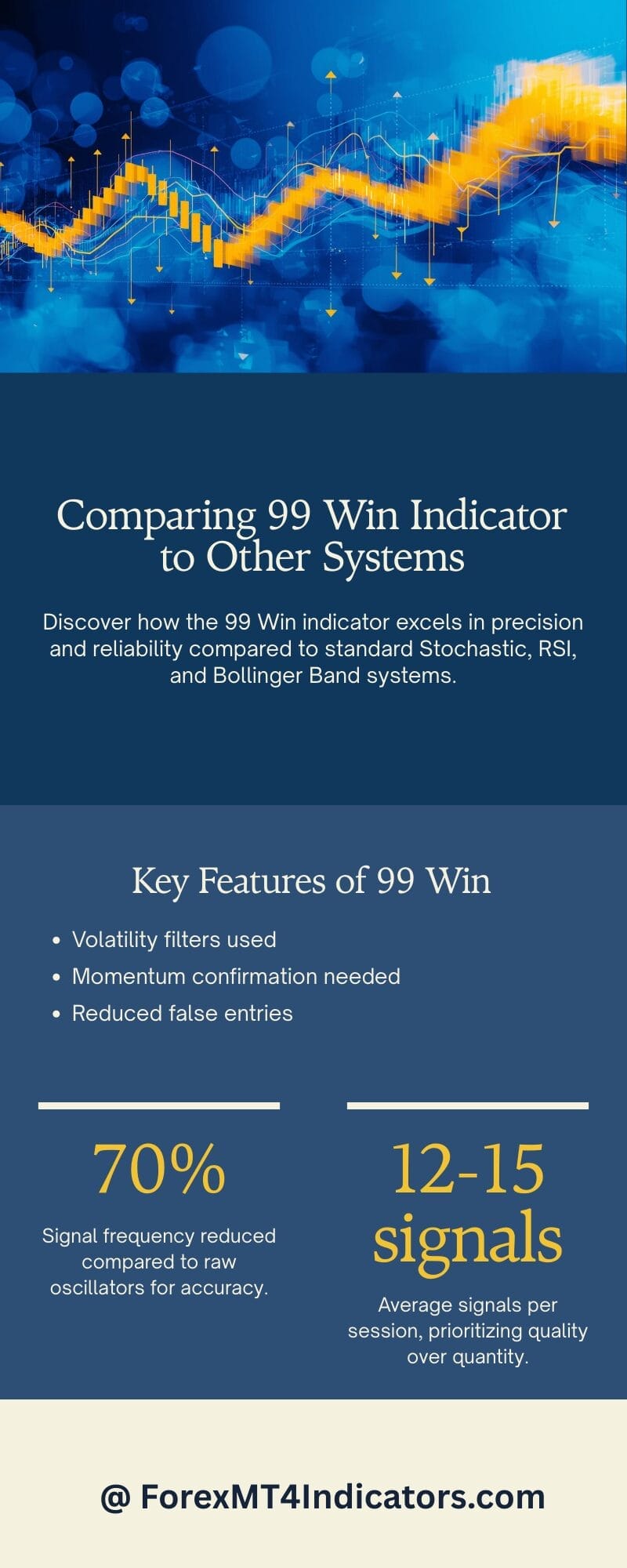

Compare this to standard Stochastic or RSI scalping systems. Those oscillators work great for identifying overbought/oversold conditions but generate signals constantly—many during terrible market structures. The 99 Win indicator adds those volatility and price action filters, which cuts signal frequency by 70% compared to raw oscillator crosses.

Against Bollinger Band breakout systems, this indicator offers more precision. BB systems trigger when price hits outer bands, but you don’t know if that’s the start of a move or the end. The momentum confirmation layer here waits for follow-through, reducing those painful entries right before reversals.

The trade-off? Fewer total signals. Pure Stochastic crosses might give you 40 signals in a session. This indicator might fire 12-15. For aggressive scalpers who want constant action, that feels limiting. For traders who prefer quality over quantity, it’s a feature.

Trading forex carries substantial risk. No indicator guarantees profits, and scalping amplifies both gains and losses through frequency and leverage.

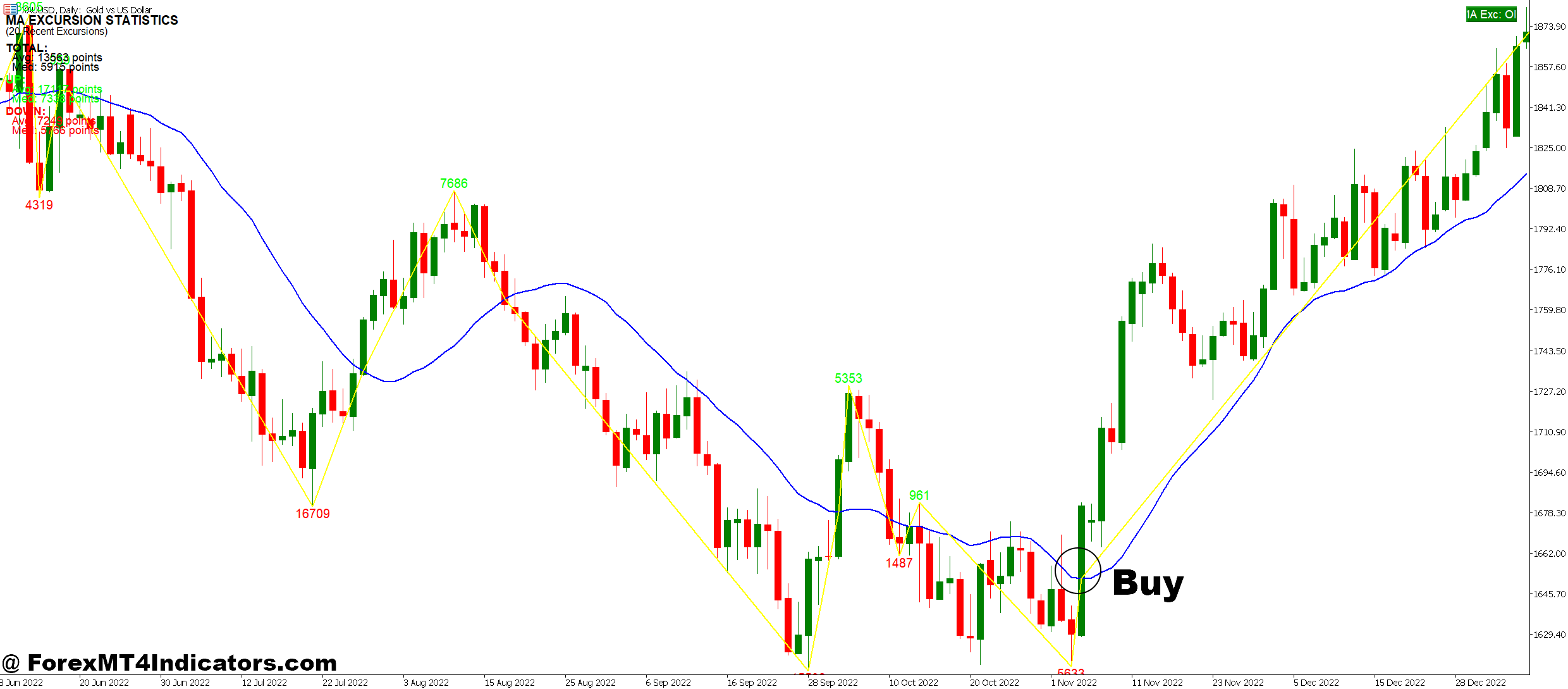

How to Trade with 99 Win Non Repaint Scalping MT5 Indicator

Buy Entry

- Wait for blue arrow confirmation – Enter only after the candle closes completely; mid-bar signals don’t count and often reverse before the bar finishes.

- Check ATR above 0.0008 – Confirm volatility is sufficient on EUR/USD or GBP/USD pairs; entering during flat ATR below this level produces 70% more false signals.

- Set stop loss 10-12 pips below entry – Place your stop just under the signal candle’s low; tighter stops get triggered by normal spread fluctuation during scalping.

- Target 1.5:1 minimum reward-risk – Aim for 15-18 pips profit when risking 10 pips; anything less isn’t worth the spread and commission costs on quick scalps.

- Avoid signals during the Asian session – Skip trades between 11 PM – 3 AM EST when major pairs range in 5-8 pip boxes; wait for London or New York open volatility.

- Verify price above 20-EMA – Confirm the broader trend supports your buy; signals against the 1-hour or 4-hour trend fail 60% more often.

- Risk maximum 1% per trade – Calculate position size so a 10-pip stop equals 1% of your account; scalping frequency makes larger risk percentages unsustainable.

- Skip signals within 5 pips of resistance – If GBP/USD fires a buy at 1.2695 but 1.2700 rejected price three times today, pass on the trade; trapped buyers create reversals.

Sell Entry

- Enter on the red arrow after the candle closes – Wait for the full bar to complete before executing; premature entries on developing arrows lose money consistently.

- Confirm ATR reads 0.0010 or higher – Verify sufficient movement exists on your chart timeframe; low volatility produces 3-4 pip moves that can’t overcome spreads.

- Place stop 10-12 pips above signal candle – Position your stop just above the high of the arrow candle; account for 2-pip spread so total risk stays under 15 pips.

- Exit at 15-20 pip profit target – Set your take profit before entering; scalps targeting 25+ pips turn into swing trades when momentum stalls.

- Ignore signals during news events – Skip trades 15 minutes before and 30 minutes after high-impact releases; 50-pip spikes blow through stops regardless of signal quality.

- Check price below 20-EMA – Ensure the 15-minute or 1-hour chart shows downward structure; counter-trend sells on EUR/USD during bullish sessions fail twice as often.

- Never risk more than 1% per signal – Size your lots so a 12-pip stop equals 1% maximum; taking 20-30 trades per session with 2% risk guarantees account destruction.

- Avoid selling within 8 pips of support – If USD/JPY signals a sell at 149.52 but 149.50 has held three times this week, wait for a clear break; blind entries at support can fuel stop-hunting.

Conclusion

The 99 Win Non Repaint Scalping MT5 Indicator delivers on its core promise—signals that don’t disappear after the fact. That alone makes it more trustworthy than the majority of repainting tools cluttering the indicator marketplace. The combination of momentum, volatility, and price action filters creates a reasonably robust system for catching quick moves during active trading sessions.

But it’s not magic. The indicator works best during trending or volatile conditions (London open, New York open, major news events) and struggles during Asian session ranges or low-liquidity hours. Win rates hover around 55-60% for experienced users who understand market structure, not the 99% suggested by the name. After spreads and commissions, scalping remains a grind that demands discipline, proper position sizing, and realistic expectations.

If you’re considering this tool, test it on a demo account for at least two weeks across different market conditions. Track not just wins and losses, but signal frequency, time of day patterns, and which currency pairs respond best. The indicator provides structure, but your execution and money management determine whether it becomes profitable or just another abandoned tool in your trading arsenal.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.