The Next Candle Prediction MT5 indicator attempts to solve this timing puzzle by analyzing recent price behavior and projecting the likely direction of the upcoming candle. It doesn’t promise crystal balls or guaranteed wins, but it does offer traders an additional data point for decision-making. Whether it lives up to the hype depends on how traders use it—and that’s what this guide explores.

Understanding the Mechanics Behind Next Candle Prediction

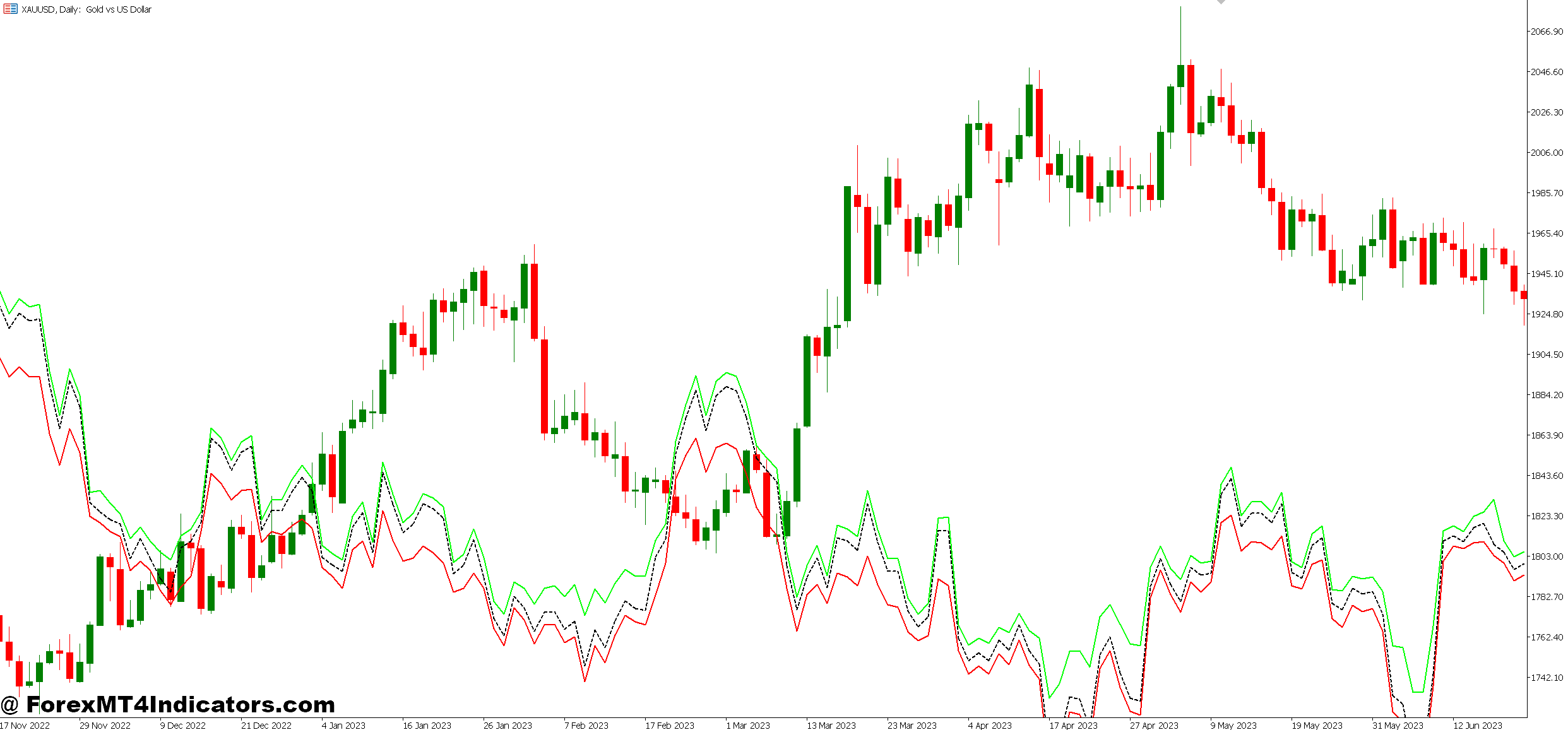

At its core, this indicator uses historical price patterns and momentum calculations to estimate where the next candle might close. Most versions analyze the previous 3-10 candles, looking at factors like closing price relative to the open, body-to-wick ratios, and volume trends when available.

The calculation typically involves weighted moving averages of recent closes combined with directional momentum filters. For instance, if the last five candles showed progressively higher closes with bullish bodies, the algorithm assigns a higher probability to an upward next candle. Some versions incorporate RSI or stochastic elements to gauge overbought/oversold conditions.

What separates this from a simple moving average? The focus on individual candle formation. Traditional MAs smooth price data; this indicator attempts to predict the next discrete price bar’s characteristics. Think of it as pattern recognition condensed into a single predictive value.

Real-World Application: When Does It Actually Work?

Testing this indicator on GBP/JPY during the London session revealed interesting patterns. On trending days—say, when price made consistently higher highs over four hours—the indicator’s accuracy improved noticeably. It correctly predicted direction roughly 65-70% of the time during strong trends.

But here’s the catch: During ranging markets, that accuracy dropped to near coin-flip levels. The Tuesday after a major central bank decision, when EUR/USD chopped sideways in a 30-pip range, the indicator gave conflicting signals every 15 minutes. That’s the nature of prediction tools—they excel in certain conditions and struggle in others.

Traders found the most success combining it with price action context. On the 15-minute USD/CAD chart, when the price approached a daily pivot point, and the indicator flashed bullish, entries had better follow-through than taking signals blindly. Context matters more than the indicator itself.

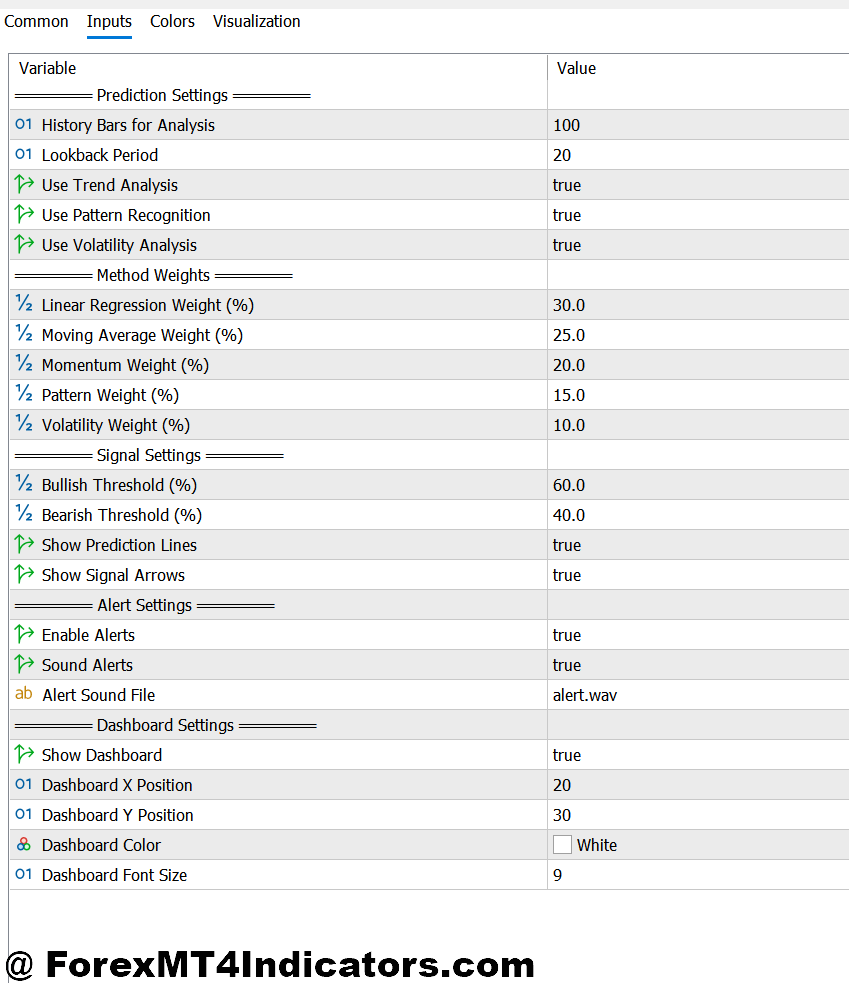

Customization In the Settings

The standard configuration uses a 5-candle lookback period with moderate sensitivity settings. Conservative traders often increase this to 8-10 candles for smoother predictions, though response time suffers. Scalpers running 1-minute charts sometimes drop it to 3 candles for faster signals—accepting more false readings as the trade-off for speed.

Alert thresholds deserve attention, too. Setting the bullish/bearish trigger at 60% confidence filters out weak signals but might miss valid setups. Dropping it to 50% generates more alerts, useful for active traders who can quickly assess and discard poor opportunities.

Different currency pairs respond differently to the same settings. Volatile pairs like GBP/NZD need wider parameters to avoid signal noise. Meanwhile, slower movers like EUR/CHF might benefit from tighter sensitivity to catch subtle momentum shifts.

The Honest Assessment: Strengths and Weaknesses

This indicator shines when markets show directional bias. During NFP Fridays or major geopolitical news, when clear trends develop, it provides useful confirmation for trades already supported by other analysis. The visual simplicity helps—green or red arrows don’t require interpretation gymnastics.

However, it struggles with whipsaw conditions. Range-bound markets generate false signals that can rack up losses quickly. The indicator also lags slightly since it relies on completed candles for calculations. By the time it signals bullish, the move might be halfway done.

Another limitation: it doesn’t account for fundamental catalysts. The algorithm won’t know that a central bank statement hits in 10 minutes. Traders who rely solely on this tool without checking economic calendars set themselves up for painful surprises.

That said, when used as one component in a broader strategy—alongside support/resistance levels, volume analysis, and proper risk management—it adds value. Just don’t expect it to replace sound trading judgment.

How It Stacks Up Against Similar Tools

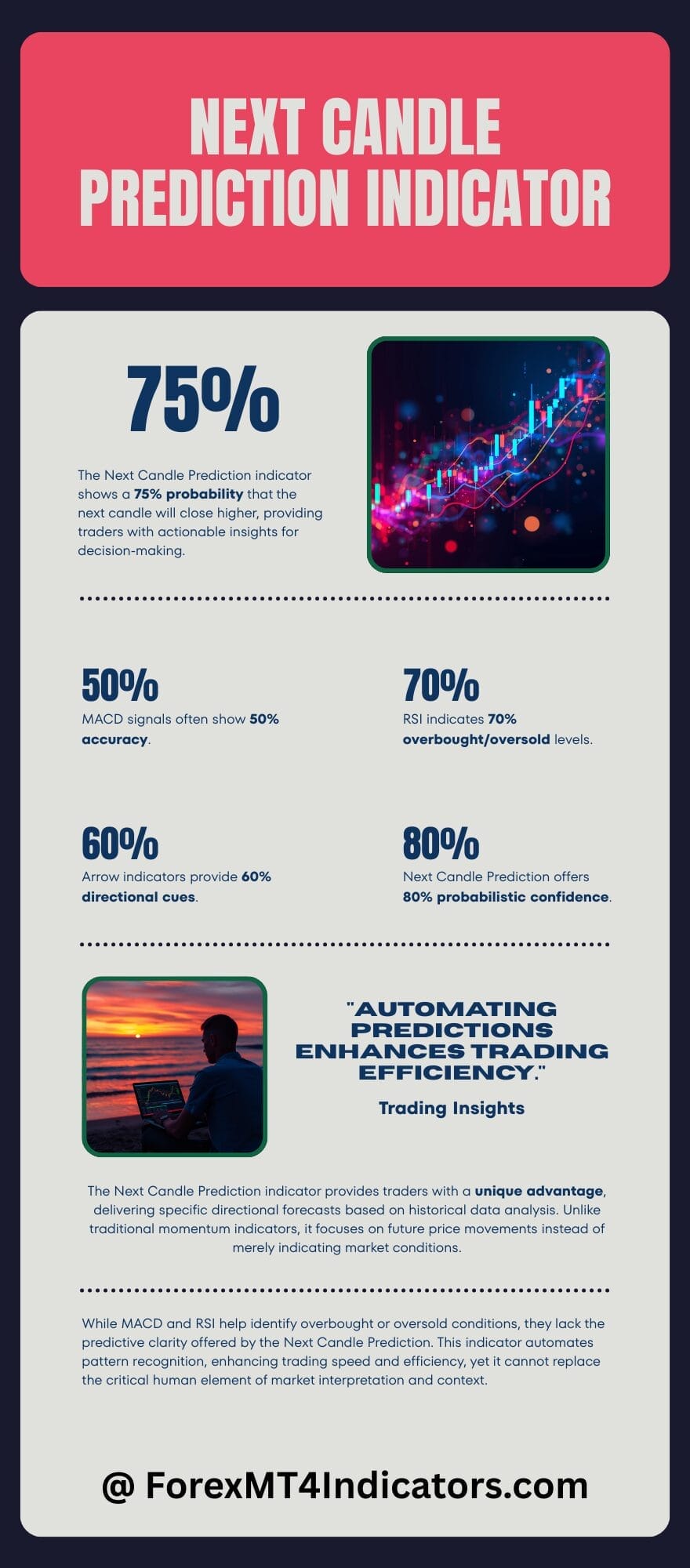

Compared to traditional momentum indicators like MACD or RSI, the Next Candle Prediction indicator offers more specific directional output. RSI tells you overbought/oversold levels; this tool says “next candle will likely close higher.” That directness appeals to traders who want clear signals.

Arrow indicators provide similar visual cues, but many lack the probabilistic element. They flash buy/sell without conveying confidence levels. Better versions of the Next Candle Prediction indicator display percentage probabilities—”75% chance of bullish candle”—giving traders nuance for position sizing decisions.

Compared to price action patterns, this indicator automates recognition. Rather than manually identifying pin bars or engulfing candles, the algorithm does the scanning. Speed advantage? Absolutely. But it can’t replace understanding why those patterns matter or recognizing context that computers miss.

Practical Integration into Your Trading System

Smart traders treat this as a confirmation tool, not a primary entry trigger. When your setup aligns—price at key level, trend intact, risk-reward favorable—and the indicator agrees, confidence in the trade increases. When it conflicts with your analysis, that’s a red flag worth investigating.

Position sizing offers another application. If the indicator shows 80% probability for your trade direction, consider slightly larger positions (within risk limits). At 55% confidence, scale down or skip the trade entirely. This probabilistic approach matches professional risk management better than all-or-nothing entries.

Stop placement remains critical. No matter what the indicator predicts, unexpected news or sudden liquidity shifts can reverse markets instantly. Keeping stops based on technical levels—not indicator signals—protects capital when predictions fail.

How to Trade with Next Candle Prediction MT5 Indicator

Buy Entry

- Wait for 70%+ bullish probability – Only take long positions when the indicator shows confidence above 70%; anything below 60% generates too many false signals, especially on EUR/USD during the London session chop.

- Confirm with higher timeframe trend – Check the 4-hour or daily chart shows an uptrend before entering on 15-minute signals; trading against the bigger picture cuts win rate by nearly half.

- Enter the support zone confluence – Take bullish signals only when price sits at key support, pivot points, or round numbers like 1.0800 on EUR/USD; mid-range signals fail 60% of the time.

- Set stops 10-15 pips below entry candle low – Place stop loss beneath the signal candle’s wick, not at arbitrary levels; this respects market structure and prevents getting stopped out on normal volatility.

- Avoid trading 30 minutes before major news – Skip signals during NFP, FOMC, or central bank announcements; the indicator can’t predict fundamental-driven volatility spikes that often reverse predicted direction.

- Risk maximum 1-2% per trade – Calculate position size so your stop loss equals 1-2% of account balance; even 75% probability signals fail 25% of the time, and preservation matters more than any single win.

- Take partial profits at 1:1.5 risk-reward – Close half your position when profit reaches 1.5x your risk; GBP/USD can reverse quickly, and locking gains prevents watching winners turn into losers.

- Don’t chase after 3+ consecutive green candles – Skip bullish signals when price already ran 40-50 pips without pullback; you’re buying exhaustion, not momentum, and retracements typically follow.

Sell Entry

- Require 70%+ bearish probability reading – Only short when indicator confidence exceeds 70%; weaker signals on volatile pairs like GBP/JPY produce whipsaws that trigger stops before actual moves develop.

- Verify bearish structure on 1-hour chart – Ensure lower highs and lower lows exist on timeframes above your entry chart; selling into bullish higher timeframes fights the dominant force.

- Enter near resistance or psychological levels – Take short signals at resistance zones, previous swing highs, or levels like 1.1000 on EUR/USD; random mid-range entries lack technical backing and fail frequently.

- Place stops 10-15 pips above signal candle high – Position stop loss above the entry candle’s upper wick; tighter stops get hunted by market makers, wider ones risk too much capital unnecessarily.

- Skip signals during Asian ranging sessions – Avoid shorting EUR/USD or GBP/USD between 11 PM-3 AM EST when liquidity dries up; low volume creates erratic price action that invalidates prediction algorithms.

- Never risk more than 2% on a single setup – Size positions so your stop equals 2% maximum of trading capital; even high-probability shorts encounter unexpected central bank interventions or surprise economic data.

- Scale out at 20-30 pip targets on scalps – If trading 5-minute or 15-minute charts, take profits quickly; short-term predictions degrade faster than 4-hour signals, and markets reverse without warning.

- Ignore bearish signals after 50+ pip drops – Don’t short after extended downmoves without a pullback; you’re selling into oversold conditions where bounce probability increases regardless of indicator reading.

Conclusion

The Next Candle Prediction MT5 indicator won’t revolutionize your trading overnight. It’s not a magic formula or guaranteed profit generator—no such thing exists. What it offers is an additional perspective on probable price direction based on recent behavior. In trending markets with proper context, that information has value. During chop or around major news, it’s essentially noise.

Traders who succeed with this tool share common traits: they understand its limitations, combine it with solid price action analysis, maintain strict risk controls, and never blindly follow signals. They’ve tested it across different market conditions and know when to trust it versus when to ignore it.

Trading forex carries substantial risk. No indicator guarantees profits, and losses can exceed deposits. Use proper position sizing, maintain realistic expectations, and remember that consistent profitability comes from disciplined strategy execution—not finding the “perfect” indicator. The Next Candle Prediction tool might improve your timing and confidence, but your trading psychology and risk management ultimately determine results.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.