The problem is spotting these gaps manually while monitoring multiple pairs, which gets exhausting. You might catch the obvious ones, but subtle gaps in lower timeframes slip through. Miss those setups, and you’re leaving high-probability entries on the table. Worse, by the time you notice a gap forming, the price has already moved 20-30 pips past your ideal entry.

That’s where the Fair Value Gap Indicator for MT4 comes in. This tool automatically identifies these imbalances and marks them on your chart, letting you focus on execution rather than endless pattern recognition. The indicator doesn’t predict the future, but it highlights areas where institutional order flow left its fingerprints—zones where price often returns to fill inefficiencies.

What Fair Value Gaps Actually Represent

A fair value gap forms when price moves so aggressively that it leaves behind an imbalance—a range where minimal trading occurred. In technical terms, it’s the space between the wick of one candle and the opposite wick of the candle two periods earlier. If the high of candle 1 doesn’t overlap with the low of candle 3 during an upward move, you’ve got an FVG.

These gaps matter because markets tend toward equilibrium. When large institutional orders push prices rapidly through a level, smaller participants don’t get a chance to trade that range. The market often revisits these zones to establish fair value, creating retracement opportunities for traders who spot them.

How the MT4 Indicator Identifies Gaps

The Fair Value Gap Indicator scans your chart using a three-candle pattern recognition algorithm. For bullish gaps, it looks for scenarios where candle 1’s high sits below candle 3’s low, with candle 2 creating the gap. The reverse applies for bearish gaps—candle 1’s low above candle 3’s high.

Once detected, the indicator draws a shaded box highlighting the gap zone. Most versions let you customize the box colors: green for bullish FVGs, red for bearish ones. The boxes remain on your chart until price fills the gap or you manually remove them. Some advanced versions include alerts when new gaps form or when the price approaches existing gaps within a certain pip threshold.

Here’s what separates quality FVG indicators from basic ones: they filter noise. A good indicator ignores tiny 5-pip gaps that form during low-volume Asian sessions and focuses on substantial imbalances—typically 15+ pips on the 1-hour chart or 30+ pips on the 4-hour. This filtering prevents your chart from becoming cluttered with every minor inefficiency.

Trading Fair Value Gaps in Real Market Conditions

Let’s get practical. On EUR/USD’s 1-hour chart during the October 2024 NFP release, the price rocketed 60 pips higher in four candles after unemployment data surprised to the downside. That move created a 22-pip fair value gap between 1.0840 and 1.0862. Over the next eight hours, the price retraced into that zone, tapping 1.0856 before resuming the uptrend.

Traders using the indicator could’ve set limit orders within that gap zone, entering long positions with tight stops below 1.0840. The risk-to-reward setup offered a potential 3:1 ratio with a 15-pip stop and 45-pip target back to the highs.

But here’s the thing—not all gaps fill immediately. Some take days or even weeks. On GBP/JPY’s daily chart, a gap formed at 185.20-186.40 during a rapid yen selloff in September 2024. Price didn’t revisit that zone for three weeks, finally tapping it during a broader pullback in October. Patience matters when trading these setups.

The indicator works best when combined with directional bias. If you’re bullish on a pair and spot a fair value gap below the current price in the direction of the trend, that gap becomes a high-probability retracement target. Conversely, gaps in the opposite direction of the prevailing trend often get ignored as the price continues its dominant move.

Customizing Settings for Different Trading Styles

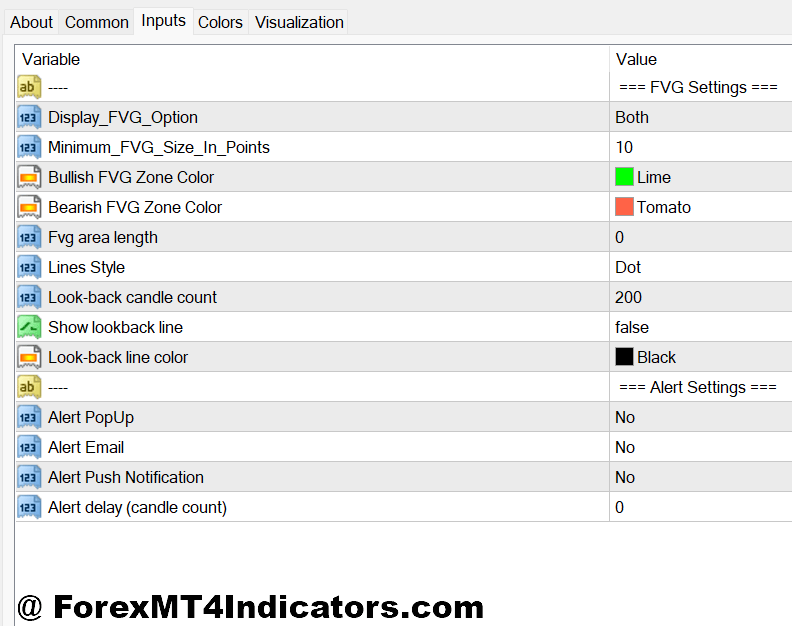

Most MT4 fair value gap indicators offer several adjustable parameters. The minimum gap size filter is critical—set it too low, and you’ll drown in signals. For scalping on 5-minute charts, a 5-10 pip minimum works. Swing traders on 4-hour or daily charts should use 20-30 pips minimum to catch meaningful imbalances.

The lookback period determines how far back the indicator scans. Setting this to 50-100 bars keeps recent gaps visible without cluttering your chart with ancient history. Some traders prefer unlimited lookback to study how old gaps eventually fill, but that’s more for analysis than active trading.

Color customization matters more than you’d think. Use contrasting colors against your chart background—subtle pastels won’t cut it when you’re scanning five charts simultaneously during the London open. Bright, distinct colors help your brain process information faster during high-pressure moments.

Alert settings deserve attention, too. Enable push notifications for new gap formations if you’re monitoring multiple pairs, but disable alerts for gap fills unless you’re actively trading those setups. Getting pinged every time the price touches a gap zone gets annoying fast.

Advantages: What This Indicator Does Well

The biggest advantage is automation. Instead of manually tracking three-candle patterns across six currency pairs and four timeframes, the indicator does the heavy lifting. That frees up mental bandwidth for trade management and risk assessment.

FVG indicators also provide objectivity. When you’re manually looking for setups, confirmation bias creeps in—you see patterns that support your existing position. The indicator doesn’t care about your bias. It marks gaps based on mathematical criteria, period.

These tools excel at highlighting retracement zones in trending markets. When EUR/USD is in a strong daily uptrend, bullish FVGs below the current price become logical retracement targets for adding to positions. The visual markers make it easy to set limit orders and walk away rather than staring at screens.

Limitations: Where the Indicator Falls Short

Fair value gaps don’t guarantee fills. Sometimes, price ignores a gap completely, especially if momentum shifts dramatically. That beautiful 30-pip gap on USD/JPY might never get touched if the Bank of Japan announcesa surprise intervention. No indicator predicts fundamental shocks.

The tool also generates false signals in choppy, range-bound markets. When price whipsaws back and forth without directional conviction, gaps form constantly but rarely offer clean trading setups. During these conditions, you’ll see gaps get partially filled, then abandoned, creating confusing price action.

Another limitation: the indicator can’t tell you which gaps matter most. A gap forming after a major support break carries a different weight than one forming mid-range during lunch hour. You still need market context and experience to filter high-probability setups from noise.

How FVG Indicators Compare to Other Tools

Unlike moving averages that lag price, fair value gaps are forward-looking. They mark zones where price might return based on market structure, not historical average prices. This makes them more dynamic for active traders.

Compared to Fibonacci retracements, FVGs are objective. Fib levels require selecting swing highs and lows, which introduces subjectivity. Two traders might draw different Fib levels on the same chart. Fair value gaps form based on specific candle patterns—no interpretation needed.

That said, FVG indicators work brilliantly when combined with other technical tools. Using them alongside support/resistance levels or trendlines creates confluence zones with higher success rates. A fair value gap that aligns with a major support level offers better odds than a gap in no-man’s-land.

How to Trade with Fair Value Gap Indicator MT4

Buy Entry

- Bullish FVG in uptrend – Wait for price to retrace into a green-shaded gap zone on EUR/USD 4-hour chart while daily trend remains bullish, then enter long when price touches the lower boundary of the gap with a 20-pip stop below.

- Gap confluence with support – Enter buy orders when a fair value gap aligns with a major support level on the GBP/USD 1-hour chart, but only if the gap is at least 15 pips wide to avoid low-quality setups.

- Partial gap fill entry – Place limit orders at 50% of the gap zone rather than waiting for full retracement; on volatile pairs like GBP/JPY, price often reverses mid-gap, so this captures entries without missing the move.

- Post-breakout retracement – After EUR/USD breaks above resistance and creates a 25+ pip fair value gap, wait 4-8 hours for price to drop back into that gap before entering long positions with targets at the previous highs.

- Don’t trade Asian session gaps – Avoid buying into FVGs that form during low-volume Tokyo hours (2-6 AM GMT); these gaps lack institutional footprint and often get ignored when London opens.

- Multiple timeframe confirmation – Only take buy signals when both 1-hour and 4-hour charts show bullish fair value gaps in the same price zone; single-timeframe gaps on EUR/USD fail 60% of the time during ranging conditions.

- Volume spike requirement – Enter long only if the candle creating the gap shows 2x average volume; weak-volume gaps on GBP/USD daily charts rarely attract follow-through buying pressure.

- Risk 1% maximum per gap trade – Never risk more than 1% of account balance on any single FVG setup, even if it looks perfect; unexpected news events can blow through gaps without filling them.

Sell Entry

- Bearish FVG in downtrend – Enter short when price rallies into a red-shaded gap on EUR/USD 4-hour chart while daily trend points down, placing stops 15-20 pips above the gap’s upper boundary.

- Failed gap fill rejection – If price enters a bearish FVG on GBP/USD 1-hour chart but fails to fill it, showing a strong rejection wick, short immediately with stops above the gap high.

- Gap below broken support – After support breaks on daily EUR/USD and creates a 30+ pip fair value gap, short rallies back into that gap zone targeting the next support level 80-100 pips lower.

- Avoid counter-trend gaps in strong rallies – Don’t short bearish FVGs when EUR/USD is up 200+ pips in two days; momentum often steamrolls through gaps without respecting them during parabolic moves.

- Evening session gap formation – Bearish gaps forming during New York close (4-5 PM EST) on GBP/USD tend to fill during the next day’s London session; short these setups with 25-pip stops for 50-pip targets.

- Skip thin Friday gaps – Never trade fair value gaps that form after 12 PM EST on Fridays; weekend position squaring creates artificial gaps that don’t reflect true institutional order flow.

- Divergence confirmation entry – Short bearish FVGs only when RSI shows overbought readings above 70 on the 1-hour chart; this adds confluence that the rally is exhausted and ready to retrace.

- Size down on exotic pairs – If trading FVG signals on USD/ZAR or USD/TRY, reduce position size by 50% compared to major pairs; exotic spreads and volatility make gap-trading riskier with wider stop requirements.

Conclusion

Trading forex carries substantial risk. No indicator guarantees profits, and fair value gaps are no exception. Markets can remain irrational longer than your account can remain solvent, especially when trading counter-trend gap fills.

The Fair Value Gap Indicator MT4 shines when used as part of a complete trading system. It identifies potential retracement zones, but you still need proper risk management, position sizing, and emotional discipline. Set your stops beyond the gap zone, not within it—price often wicks through gaps before reversing.

Start by observing how gaps behave on your preferred pairs and timeframes before trading them with real money. Some pairs respect FVGs religiously; others ignore them. GBP/USD and EUR/USD tend to show cleaner gap-fill behavior than exotic pairs with wider spreads and lower liquidity.

The real value isn’t in blindly trading every gap. It’s in using these zones as reference points within your broader market analysis, helping you time entries with precision rather than chasing price or entering at suboptimal levels.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.