A non repainting indicator commits to its signals. Once an arrow prints on a closed candle, it stays there—period. The code doesn’t look back and redraw based on future price action.

Most repainting indicators use look-ahead functions or recalculate values on current bars. They might show a buy arrow at 1.0850 on EUR/USD, but when the next candle closes at 1.0840, that arrow shifts or disappears entirely. Traders who acted on the original signal find themselves in losing positions based on data that no longer exists in the indicator’s memory.

Non repainting versions avoid this trap through strict coding discipline. They calculate signals on closed candles only, using confirmed data. When a specific condition triggers—say, a moving average crossover combined with momentum confirmation—the arrow appears and becomes permanent history. This creates accountability. You can backtest the exact signals you’d receive in live trading.

How These Indicators Calculate Entry Signals

The mechanics vary, but quality non repainting arrow indicators typically combine multiple filters. A basic version might track:

- Price structure: Higher highs and higher lows for uptrends

- Momentum confirmation: RSI crossing above 50 or MACD histogram turning positive

- Volatility check: ATR readings to avoid signals during flat, choppy periods

When all conditions align on a closed candle, the indicator prints an arrow. That’s the entry signal. The key detail is a closed candle. If the price is still forming the current bar, the indicator waits. No premature signals, no repainting.

Take the GBP/JPY on a 15-minute chart during the London session. Price breaks above a consolidation zone at 187.20. The indicator checks: trend filter confirms upward bias, RSI reads 58, and ATR shows sufficient movement. A blue arrow appears after the 15-minute candle closes at 187.35. Traders entering at the next candle’s open (187.36) have a documented signal they can trust.

Practical Application Across Different Trading Styles

Scalpers use these indicators on 1-minute and 5-minute charts, though the signal frequency can be intense. During the New York-London overlap, a trader might see 8-12 arrows on USD/CAD within an hour. Not all will be winners, but at least they’re real signals, not phantom opportunities that looked good only in replay mode.

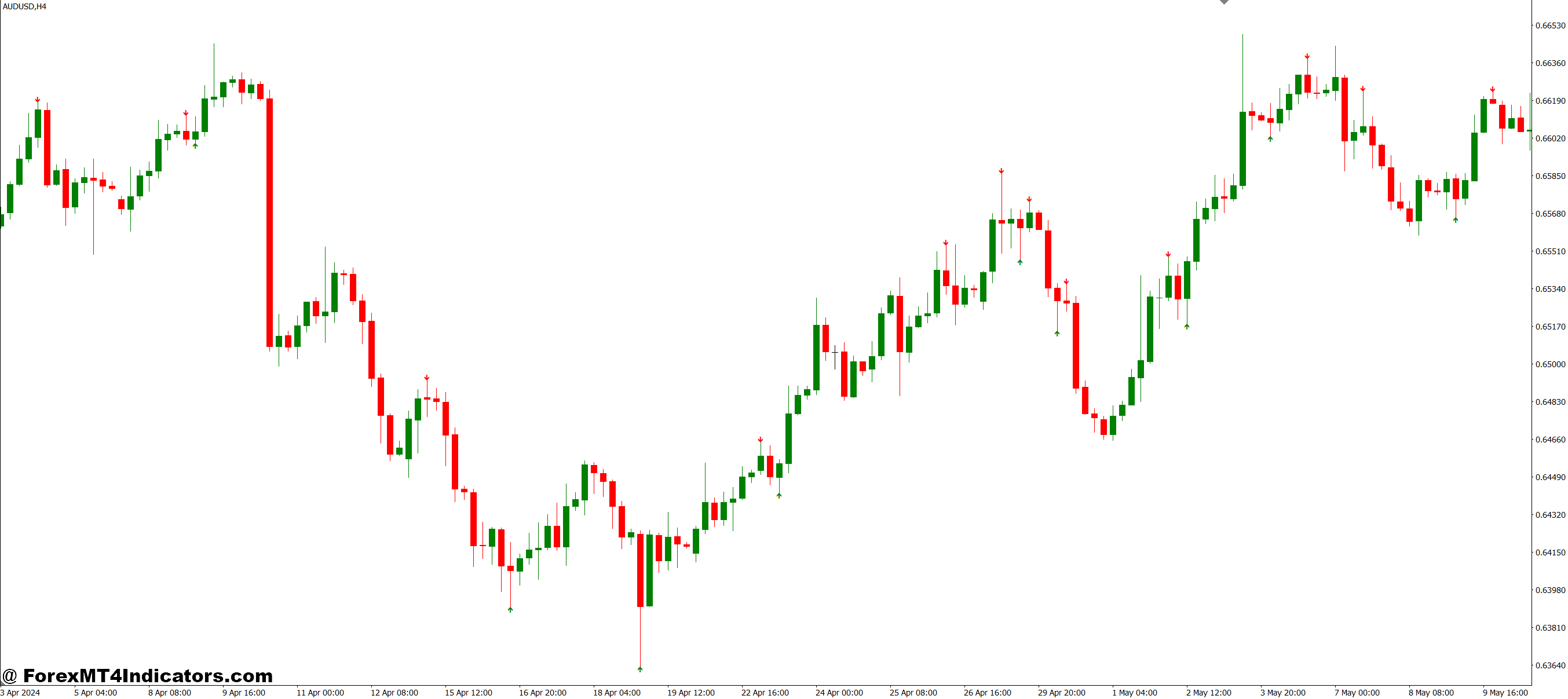

Swing traders prefer the 4-hour or daily timeframes. The arrows appear less frequently—maybe 2-3 times per week on a single pair—but they carry more weight. A sell arrow on the AUD/USD daily chart at 0.6420, confirmed by a broader downtrend structure, offers a higher probability setup than dozens of 1-minute signals.

The indicator works best when traders layer it with their existing system. Using it alone invites trouble. Combine arrow signals with support and resistance levels, trend analysis, or session timing. For instance, a buy arrow that appears right at a key support zone carries more conviction than one printed in the middle of nowhere.

Settings and Customization Options

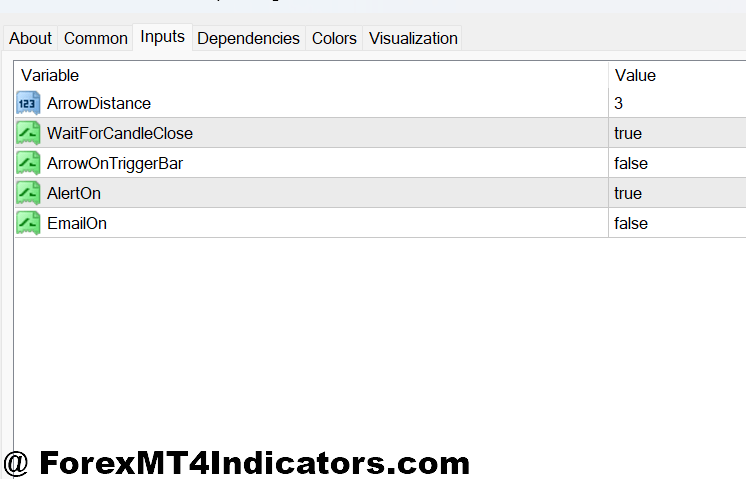

Most MT4 versions let traders adjust sensitivity. The main parameters include:

- Period settings: Higher values (20-30) filter out noise but reduce signal frequency. Lower values (5-10) generate more arrows but increase false signals. Testing on the EUR/USD 1-hour chart, a 14-period setting produced about 15 signals per week, while a 7-period setting jumped to 40+ signals with noticeably lower accuracy.

- Alert types: Audio notifications, email alerts, or push notifications to mobile. Traders managing multiple charts appreciate mobile alerts—no need to stare at screens waiting for the next arrow.

- Color schemes: Customizable arrow colors help distinguish buy from sell signals quickly. Some traders prefer green/red, others use blue/orange to avoid emotional color associations.

The danger is over-optimization. Spend three hours tweaking settings to perfection on historical data, and you’ve probably curve-fit the indicator to past price action. It won’t hold up in live markets. Start with default settings, trade them for two weeks, then make minor adjustments based on actual results.

Advantages That Actually Matter

- Consistency in backtesting: Historical results match forward performance because signals don’t change retroactively. When backtesting shows 58% win rate with 1.8 risk-reward ratio, that data has legitimacy.

- Psychological clarity: Knowing arrows won’t disappear removes second-guessing. The signal appeared, you took it or you didn’t. No ambiguity about whether your entry was “really” an indicator signal or your imagination.

- Reduced screen time: Alerts handle the monitoring. Set them up, walk away, return when genuine opportunities emerge. Particularly valuable for traders with day jobs who can’t watch charts continuously.

That said, limitations exist. No indicator catches every move. During the 2023 USD strength surge, even solid non repainting arrows missed the initial thrust higher on several pairs because momentum indicators lagged the breakout. The tool identifies potential entries; it doesn’t predict market regime changes.

How It Compares to Popular Alternatives

Standard moving average crossovers don’t repaint but often lag significantly. By the time the 50 EMA crosses the 200 EMA on the GBP/USD daily chart, the trend move is half over. Arrow indicators incorporating faster momentum factors catch trends earlier.

Oscillator-based systems like Stochastic or RSI provide entry signals but require interpretation. When RSI hits 35, is that a buy signal or just a pause in a downtrend? Arrow indicators decide for you, removing discretionary guesswork (for better or worse).

Price action purists might argue that arrows create dependency. There’s truth there. Traders who rely solely on indicator arrows often struggle when market conditions shift outside the indicator’s parameters. The 2020 COVID crash saw many algorithmic signals fail spectacularly because volatility spiked beyond historical norms.

The Reality Check Every Trader Needs

Here’s the thing: a non repainting arrow indicator is a tool, not a money printer. It removes one problem (signal repainting) but doesn’t solve fundamental trading challenges like risk management, position sizing, or trading psychology.

A trader using this indicator with poor risk management—risking 5% per trade with no stop losses—will still blow their account. The arrows might be accurate 60% of the time, but three consecutive losers at 5% each means a 15% drawdown before any wins materialize.

And watch out for vendors claiming “90% accuracy” or “guaranteed profits.” Any arrow indicator, repainting or not, faces market randomness. Forex markets whipsaw. Central bank announcements create chaos. Sometimes price just does what it wants, indicators be damned.

Trading forex carries substantial risk. No indicator guarantees profits, and past performance never ensures future results. Traders should only risk capital they can afford to lose entirely.

How to Trade with Non Repainting Arrow Indicator MT4

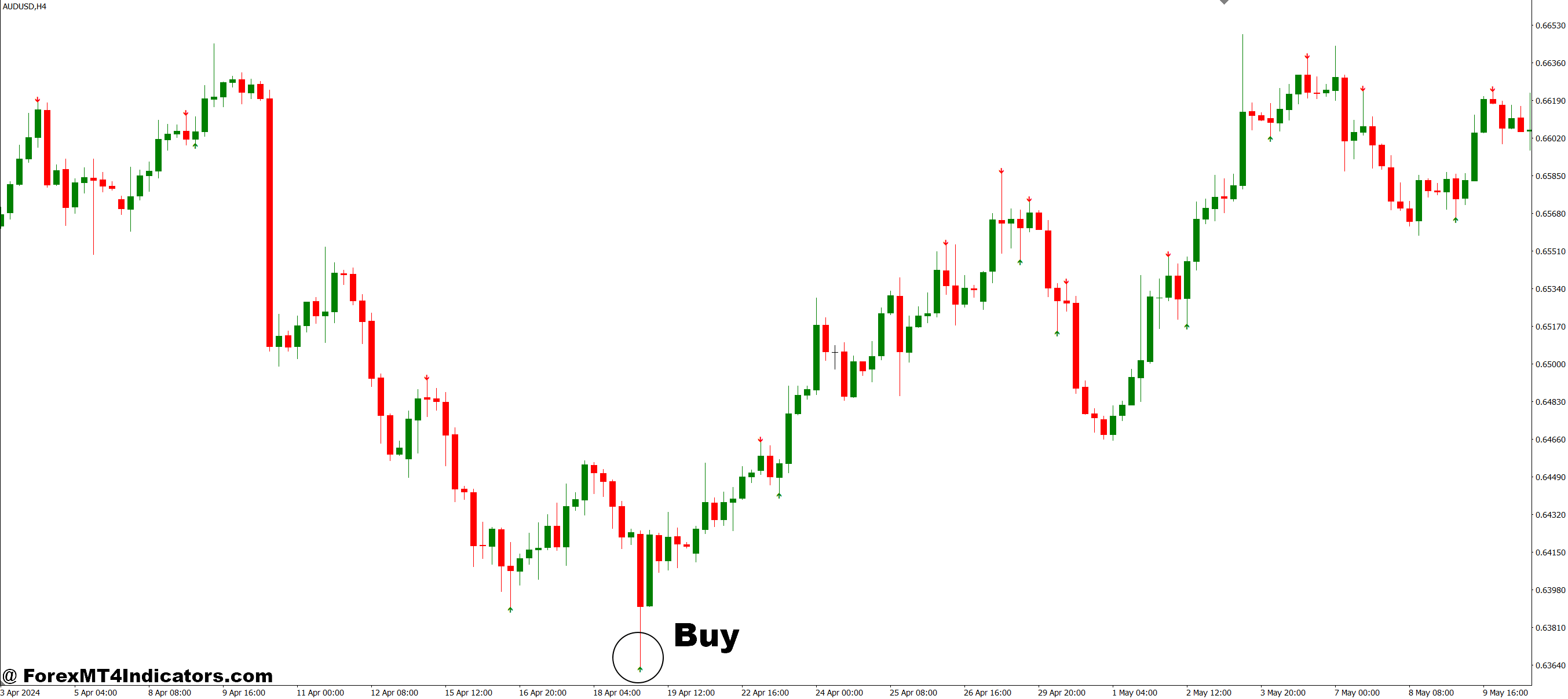

Buy Entry

- Wait for candle close – Never enter when the arrow first appears on a forming candle. Let the current bar close completely, then enter at the open of the next candle to avoid false signals on EUR/USD or any major pair.

- Confirm the trend direction – Only take buy arrows when the price is above the 50-period moving average on your chosen timeframe. A buy signal at 1.0850 on the EUR/USD 1-hour chart means nothing if the 4-hour trend is clearly bearish.

- Check recent support levels – Buy arrows appearing within 10-20 pips of key support zones carry a higher probability. If GBP/USD prints a signal at 1.2650 and support sits at 1.2640, that’s confluence worth acting on.

- Set your stop loss 5-10 pips below the arrow candle low – On a 15-minute chart, if the buy arrow forms with a low at 1.0835, place your stop at 1.0825. This protects against immediate reversals without giving the trade excessive room.

- Risk only 1-2% per signal – Don’t let a clean-looking arrow tempt you into risking 5% of your account. Even non repainting indicators produce losing trades 40-45% of the time during choppy conditions.

- Avoid arrows during major news releases – Skip any buy signal appearing 15 minutes before or after NFP, FOMC, or central bank announcements. Volatility spikes create whipsaws that invalidate technical signals regardless of indicator quality.

- Target a minimum 1.5:1 reward-risk ratio – If your stop is 20 pips, aim for at least 30 pips profit. Buying arrows on the EUR/USD daily charts can support 100-150 pip targets, while 5-minute signals rarely justify more than 15-20 pips.

- Skip signals in tight consolidation ranges – When price has been stuck in a 30-pip range on GBP/USD for the past 4 hours, that buy arrow is likely a trap. Wait for a clear breakout first.

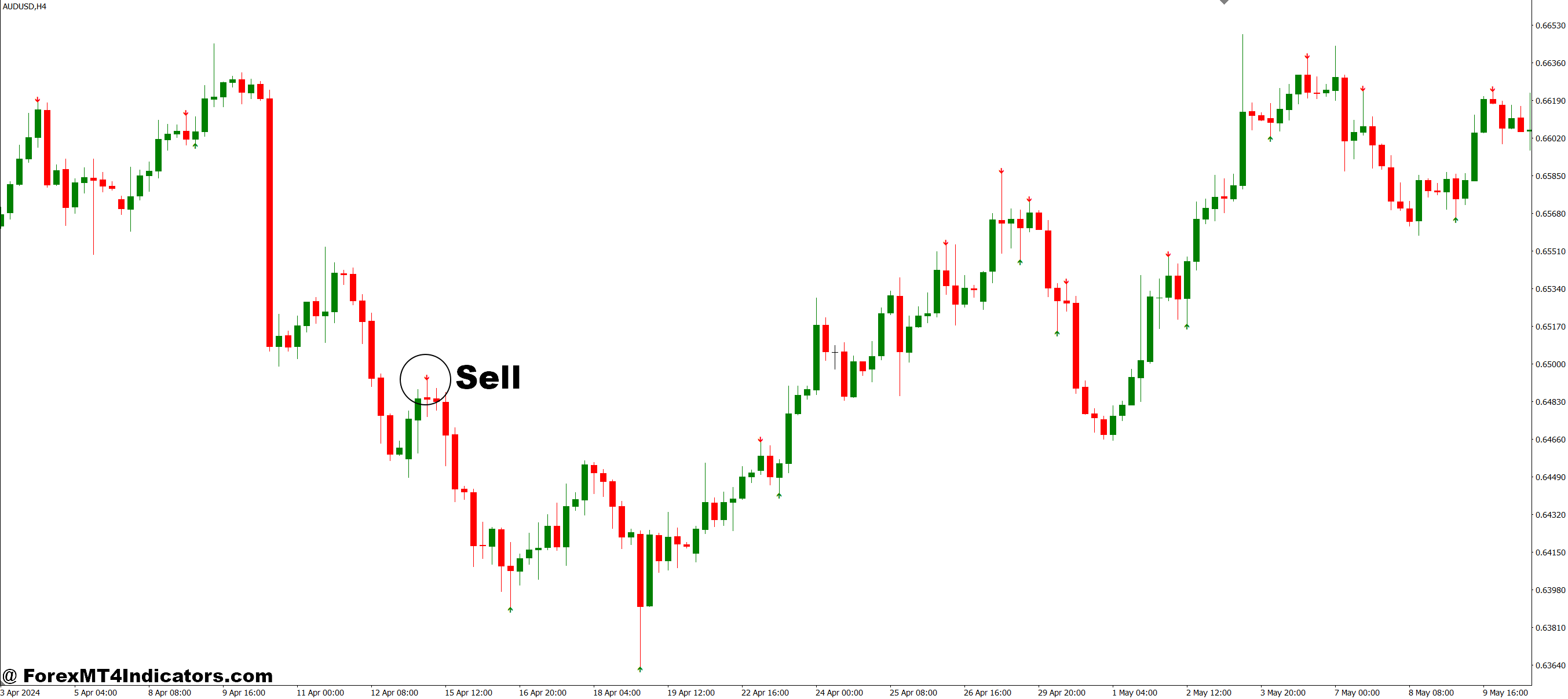

Sell Entry

- Confirm candle completion before entering – The sell arrow must appear on a fully closed bar. Entering mid-candle on a 4-hour chart means you’re trading a signal that hasn’t been validated yet.

- Verify downtrend alignment – Only act on sell arrows when price trades below the 50-period MA on your timeframe. A sell signal at 1.0920 on EUR/USD 1-hour is suicide if the daily chart shows a strong uptrend.

- Look for resistance confluence – Sell arrows within 10-20 pips of major resistance levels offer better odds. If USD/JPY prints a signal at 148.80 and resistance clusters at 149.00, that’s a high-probability short setup.

- Place stops 5-10 pips above the signal candle high – For a sell arrow on GBP/USD 15-minute chart with a high at 1.2785, set your stop at 1.2795. Tight enough to limit damage, loose enough to avoid random spikes.

- Never risk more than 2% on a single arrow – Even the cleanest sell signal can fail when market sentiment shifts. Keep position sizes manageable so three consecutive losses don’t cripple your account.

- Ignore signals during low liquidity sessions – Sell arrows appearing during the Asian session on EUR/USD often lack follow-through. The real moves happen during the London and New York overlap when volume supports directional momentum.

- Aim for 2:1 minimum reward-risk – If risking 15 pips, target at least 30 pips. On daily charts, sell signals on USD/CAD can justify 150-200 pip targets, but 1-minute scalps rarely deliver more than 8-10 pips reliably.

- Reject arrows after extended downtrends – When GBP/JPY has already dropped 200 pips in two days, that fresh sell arrow might catch the final 20 pips before a reversal. Wait for consolidation and a new trend leg instead.

Conclusion

Test the indicator on a demo account for at least 30 days. Track every signal: date, pair, timeframe, entry price, stop loss, take profit, outcome. After 50-100 trades, patterns emerge. Maybe it performs better on trending pairs like USD/JPY versus choppy ones like EUR/GBP. Perhaps 4-hour signals outperform 15-minute noise.

Use the arrows as confirmation, not gospel. When your trend analysis says “buy,” your support/resistance levels align, and the arrow agrees—that’s a higher-probability setup. If the arrow says buy, but everything else screams sell, skip it.

Set realistic expectations. A win rate around 55-60% with proper risk-reward ratios builds accounts steadily. Chasing 80%+ accuracy leads to over-optimization and eventual disappointment. Accept losses as part of the process. Even the best non repainting indicators produce losing trades—they just do it honestly, without erasing their mistakes from history.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.