The Fair Value Gap Indicator automates the detection of these price imbalances on MetaTrader 5, highlighting zones where institutional order flow created inefficiencies. Instead of manually scanning charts for three-candle patterns, traders get visual alerts showing potential reversal or continuation zones. Let’s break down how this tool actually works and whether it deserves a spot in your trading arsenal.

What Fair Value Gaps Actually Represent

Fair value gaps (FVGs) occur when price moves so aggressively that it skips over certain price levels, creating an imbalance. In technical terms, this happens when the high of candle one doesn’t overlap with the low of candle three. That middle candle—the one driving the sharp move—leaves behind what some traders call an “inefficiency” or “liquidity void.”

Here’s the thing: markets hate inefficiencies. Price gravitates back to these zones like a magnet, often providing high-probability entries. When GBP/JPY gaps up during the London session, leaving an FVG between 185.20 and 185.50, there’s a strong chance it’ll retrace to “balance” that zone before continuing higher. The Fair Value Gap Indicator MT5 automatically identifies these patterns and marks them as rectangular boxes on your chart.

The concept comes from the ICT (Inner Circle Trader) methodology and smart money concepts. Institutions don’t care about clean, orderly price action. When they need to move size, they create gaps. Retail traders using traditional indicators miss these entirely because moving averages and oscillators don’t account for structural imbalances.

How the Indicator Calculates and Displays FVGs

The calculation logic is straightforward but requires precise execution. The indicator scans for three consecutive candles where a gap exists between candle one’s extreme and candle three’s extreme. For bullish FVGs, it identifies when candle one’s high is below candle three’s low, with candle two bridging the gap through aggressive buying.

Most MT5 versions of this indicator offer customization for:

- Minimum gap size: Filters out tiny imbalances that lack significance (typically set to 5-10 pips)

- Maximum gaps displayed: Prevents chart clutter by showing only recent FVGs

- Color coding: Bullish gaps in one color, bearish in another

- Alert settings: Pop-ups or mobile notifications when new gaps form

When testing this on AUD/USD during the Sydney session, the indicator flagged a bullish FVG at 0.6385-0.6395 after a sharp move off support. Price rallied 60 pips, retraced into the gap, and launched another 80-pip leg higher. Without the visual box, that reentry would’ve been easy to miss.

The indicator doesn’t predict direction—it marks zones. That’s a critical distinction. The gap shows where an imbalance exists, but context determines whether it’s a reversal zone or a continuation setup.

Trading Fair Value Gaps in Live Market Conditions

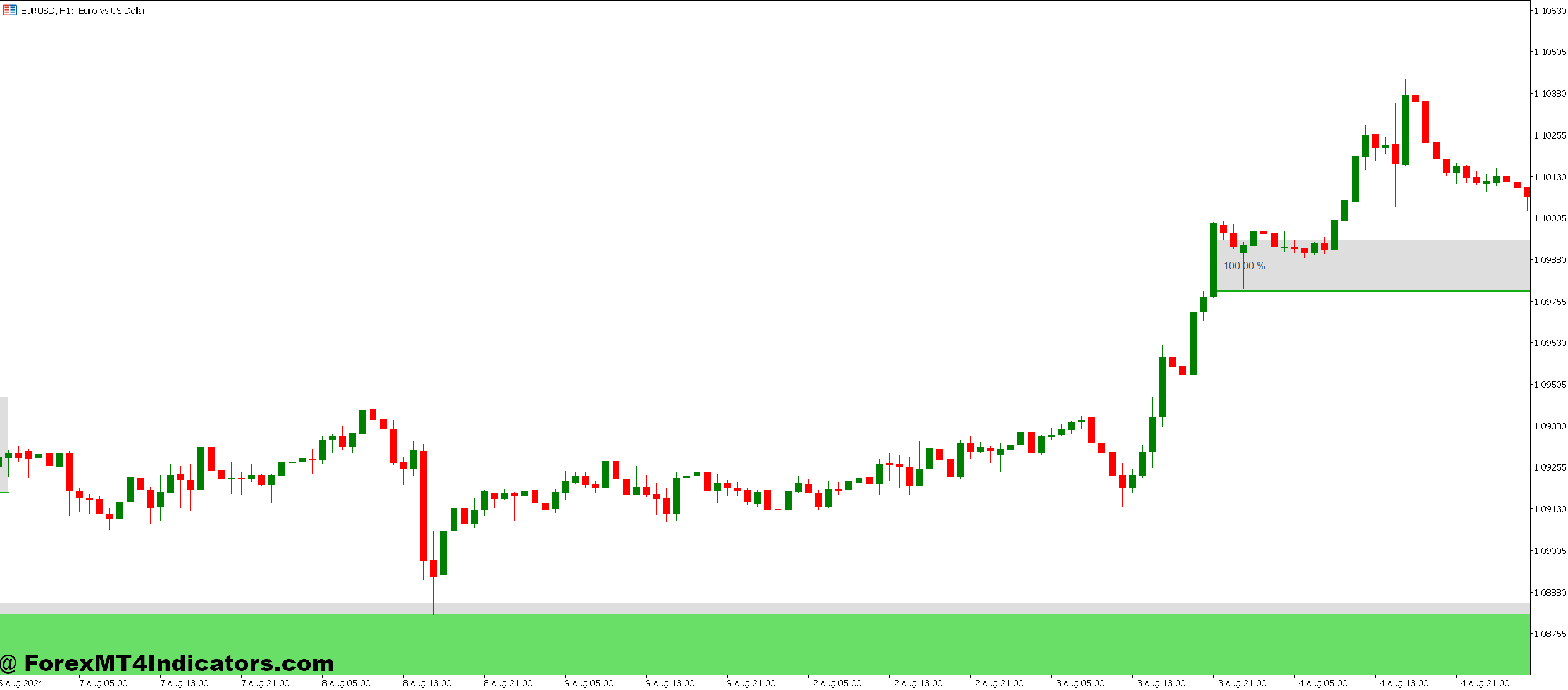

Smart traders don’t blindly buy every gap fill. Context matters. During trending conditions on the 1-hour EUR/USD chart, bullish FVGs act as continuation zones. When price pulls back into a gap that formed during a strong uptrend, it often bounces and extends the move. But in ranging conditions, those same gaps might trigger reversals.

Here’s a practical approach: Wait for the price to enter the FVG zone, then look for confirmation. That could be a bullish engulfing candle, a rejected wick, or momentum divergence. On USD/CAD’s 4-hour chart, there was a bearish FVG between 1.3580 and 1.3610. Price rallied into it, formed a shooting star, and dropped 120 pips. The gap provided the zone; the candlestick pattern gave the entry signal.

Timeframe selection changes everything. The 15-minute chart produces tons of gaps, most meaningless. The daily chart shows fewer but more significant imbalances. Swing traders prefer 4-hour and daily FVGs, while scalpers might use 5-minute gaps during high-volatility sessions. Each timeframe requires different risk management since smaller timeframes generate more false signals.

One mistake traders make is expecting immediate fills. Sometimes the price runs 200 pips before returning to fill a gap. Patience separates profitable FVG traders from those who chase price and sabotage their accounts.

Limitations Every Trader Should Understand

No indicator guarantees profits, and FVGs have clear weaknesses. First, they’re lagging by nature—the gap appears after the price already moved. You’re essentially trading a retracement, not catching the initial impulse. That means you’ll miss the strongest part of the move.

Second, not all gaps are filled. During strong trends, the price can leave multiple FVGs behind without ever returning. If EUR/USD is in a 500-pip downtrend, that bullish gap from two days ago might never fill. The market doesn’t owe you a retracement just because an imbalance exists.

Third, false signals pop up constantly on lower timeframes. The 1-minute chart creates FVGs that mean nothing in the bigger picture. Combine this indicator with higher timeframe analysis and price action confirmation. Using FVGs alone is like trying to build a house with just a hammer.

Risk management remains non-negotiable. A gap on GBP/USD spanning 40 pips doesn’t mean you risk 40 pips. Place stops beyond the zone, account for spread and slippage, and never risk more than 1-2% per trade. Trading forex carries substantial risk, and even the best setups fail regularly.

How FVGs Compare to Traditional Supply and Demand Zones

Supply and demand zones mark areas where institutional orders sat historically. Fair value gaps identify inefficiencies created by aggressive order flow. Both concepts overlap, but FVGs offer more precise zones since they’re mathematically defined by three specific candles.

Support and resistance levels show where the price reversed previously. FVGs show where price skipped levels entirely. On NZD/USD, you might have resistance at 0.6250, but if the price gaps through it, the FVG between 0.6245-0.6255 becomes the focus, not the old level.

Compared to Fibonacci retracements, FVGs provide objective zones without subjective swing point selection. Two traders using Fibs might mark different levels; two traders using the Fair Value Gap Indicator MT5 see identical zones. That consistency helps when backtesting and journaling trades.

That said, combining FVGs with support/resistance creates a powerful confluence. When a bullish gap aligns with a previous demand zone on the daily chart, the setup gains validity. USD/JPY showed this perfectly when a 4-hour FVG landed exactly on the 145.00 psychological level—price bounced 90 pips.

Making the Indicator Work for Your Trading Style

Day traders benefit from 5-minute and 15-minute gaps during the London and New York sessions. Volatility increases during these windows, creating cleaner imbalances. Set alerts so you don’t miss new gaps forming on your watchlist. When EUR/GBP forms a bullish FVG at 8:30 AM EST, you want to know immediately.

Swing traders should focus on daily and 4-hour FVGs. These gaps have more significance and offer better risk-reward ratios. A daily chart gap spanning 50 pips on AUD/JPY provides room for a 2:1 or 3:1 target, while 15-minute gaps barely offer 1:1.

Scalpers need to be selective. Yes, the 1-minute chart produces gaps, but most are noise. Filter by minimum gap size (at least 10 pips on major pairs) and only trade during peak liquidity. Outside London and New York overlap, those tiny gaps rarely lead anywhere.

The indicator shines when combined with other tools. Use it alongside RSI to spot oversold bounces within bullish gaps. Add moving averages to confirm trend direction before trading gap fills. Layer FVGs with volume analysis to gauge whether smart money is accumulating or distributing. No single indicator tells the complete story.

How to Trade with Fair Value Gap Indicator MT5

Buy Entry

- Wait for price to enter the bullish FVG zone – Don’t chase the initial move up; let price retrace into the gap between 50-75% for optimal risk-reward on EUR/USD 4-hour charts.

- Confirm with bullish candlestick pattern – Look for engulfing candles, hammer wicks, or morning stars forming inside the gap on 1-hour timeframes before entering.

- Check higher timeframe trend alignment – Only take bullish FVG entries when the daily chart shows an uptrend; counter-trend gap fills fail 60% of the time.

- Set stop loss 5-10 pips below the FVG zone – On GBP/USD, if the gap spans 1.2650-1.2680, place stops at 1.2640 to account for spread and avoid premature exits.

- Target previous high or next FVG – Aim for 2:1 minimum risk-reward; if risking 20 pips, target at least 40 pips toward the swing high that created the gap.

- Avoid trading gaps smaller than 15 pips – Tiny imbalances on major pairs lack institutional significance and often produce whipsaw losses during choppy sessions.

- Skip entries during major news releases – NFP, FOMC, or central bank announcements create erratic price action that invalidates FVG setups within seconds.

- Reduce position size if the gap is older than 10 candles – Stale gaps on the 15-minute chart lose relevance; cut risk by 50% or wait for fresher setups.

Sell Entry

- Enter when price rallies into bearish FVG – Wait for retracement into the gap zone (typically 50-80% fill) on EUR/USD 1-hour charts before selling.

- Require bearish confirmation candle – Shooting star, bearish engulfing, or strong rejection wick inside the gap validates the reversal on 4-hour timeframes.

- Verify downtrend on higher timeframe – Only short bearish FVGs when the daily chart shows a clear downward structure; range-bound markets produce unreliable signals.

- Place stops 5-10 pips above the FVG high – If GBP/USD bearish gap runs from 1.2750-1.2780, set stop at 1.2790 to survive minor volatility spikes.

- Target lower swing low or support – Project minimum 2:1 reward; risking 25 pips means targeting 50+ pips toward the demand zone that created the gap.

- Ignore gaps formed during Asian session lows – Low-volume periods on USD/JPY create false FVGs that often fail when London opens with real liquidity.

- Don’t sell into gaps near major support – Bearish FVG at 1.0800 on EUR/USD (psychological level) typically reverses; context beats pattern every time.

- Exit immediately if price closes above the gap – Failed bearish FVG means invalidation; don’t hold losing trades hoping price returns—it won’t.

Final Thoughts on Fair Value Gap Trading

The Fair Value Gap Indicator MT5 offers a systematic way to spot price inefficiencies that market makers eventually fill. It excels at providing high-probability reentry zones during trends and potential reversal areas when gaps align with key levels. Traders who understand market structure and order flow find FVGs complement their strategy naturally.

But it’s not magic. Gaps don’t guarantee fills, and fills don’t guarantee profitable trades. You’ll still need proper risk management, confirmation signals, and the discipline to skip mediocre setups. The indicator simply highlights zones worth watching—what you do with that information determines results.

Test it on a demo account first. Track how often gaps fill on your preferred pairs and timeframes. Notice which sessions produce the cleanest setups. Build rules around position sizing and stop placement. Once you’ve got a process that makes sense, then consider applying it with real capital.

The market will keep creating imbalances as long as institutions need to move size. Learning to read those gaps gives you a lens into where smart money operated. Whether that edge translates to consistent profits depends on everything else you bring to the table.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.