The MT5 divergence indicator solves this problem. It automatically scans charts for these price-momentum discrepancies, highlighting potential reversal points before they become obvious. No more squinting at oscillators or second-guessing what you’re seeing. The signals appear directly on the chart, giving traders an edge in timing entries and exits.

Understanding Divergence in Technical Analysis

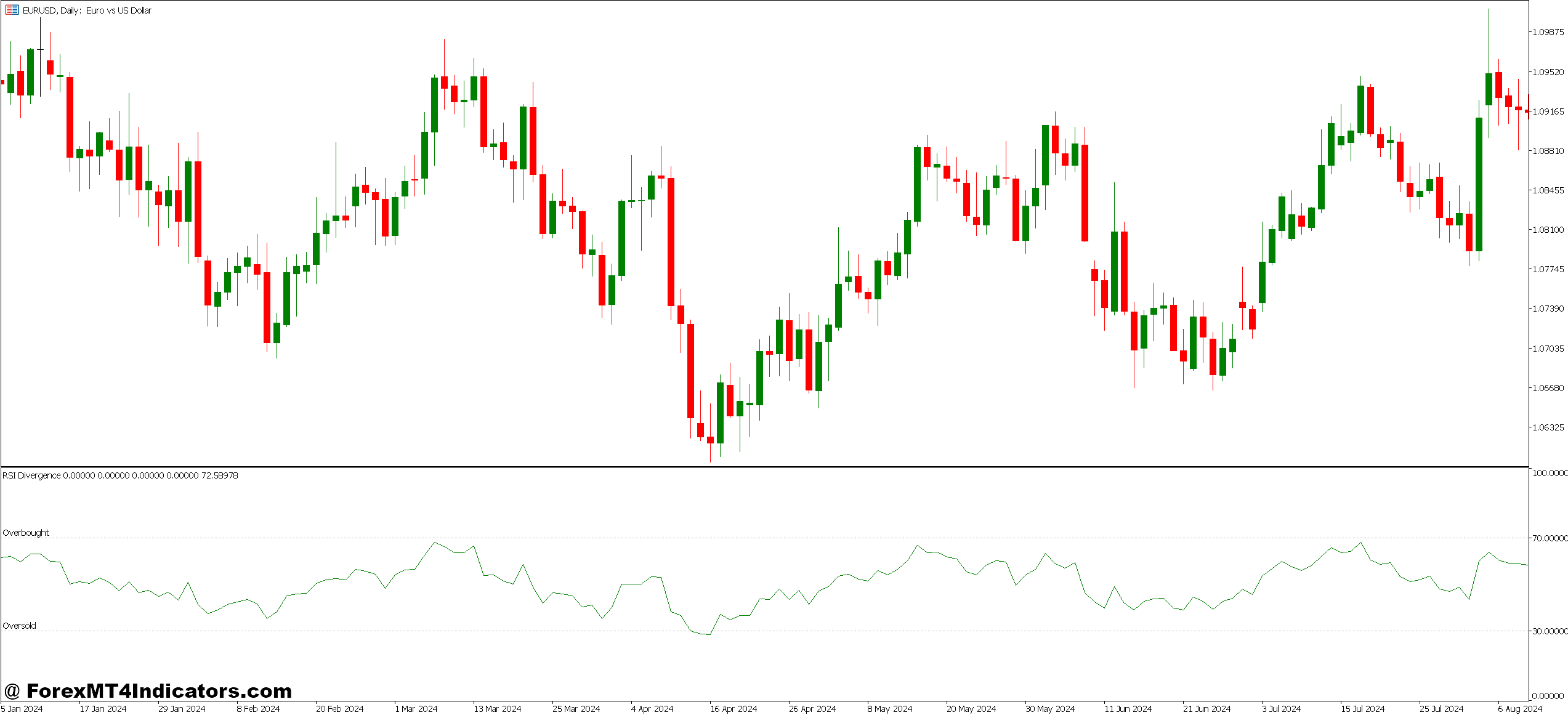

Divergence occurs when price action and a momentum oscillator move in opposite directions. The MT5 divergence indicator typically works with popular oscillators like RSI, MACD, or Stochastic to identify these mismatches. When EUR/USD hits a higher high but the RSI makes a lower high, that’s bearish divergence—momentum is weakening despite price pushing higher.

The logic is straightforward. Price reflects what’s happening. Momentum indicators show the strength behind those moves. When they disagree, something’s got to give. Usually, it’s price that adjusts to match momentum.

Here’s the thing: Not all divergences are created equal. Regular divergence signals potential reversals. Hidden divergence indicates trend continuation after pullbacks. The MT5 indicator can be configured to spot both types, though most traders focus on regular divergence for reversal trades.

The calculation method depends on which oscillator the indicator pairs with. For RSI-based divergence, the tool compares swing highs and lows in the 14-period RSI against corresponding price pivots. It draws connecting lines automatically when it detects misalignment. Some versions include alert functions that notify traders the moment divergence forms.

Real-World Application: Trading the Signals

Testing this indicator on USD/JPY during the March 2024 volatility spike revealed its practical value. On the daily chart, the price made a lower low at 147.20, but the MACD histogram printed a higher low. Classic bullish divergence. Traders who entered long at that signal caught a 200-pip rally over the next week.

But context matters. That same setup would’ve failed in a strong downtrend without additional confirmation. Smart traders combine divergence with support/resistance levels. When bullish divergence appears at a major support zone, the probability improves dramatically. The indicator identifies the signal; the trader evaluates whether the market structure supports the trade.

Timeframe selection changes everything. On the 15-minute chart, divergence signals fire constantly—most result in minor pullbacks or fail. The 4-hour and daily charts produce fewer but higher-quality signals. A divergence that develops over several days carries more weight than one that forms in a few hours.

One practical approach: Use divergence on higher timeframes for direction, then drop to lower timeframes for precise entries. When the daily chart shows bearish divergence on AUD/USD, wait for a 1-hour bearish engulfing candle to enter short. This layered strategy reduces false entries.

Customizing Settings for Different Markets

Most MT5 divergence indicators allow parameter adjustments. The pivot sensitivity controls how easily the indicator identifies swing points. Lower settings (3-5) mark every minor wiggle as a pivot, creating noise. Higher settings (10-15) only flag significant swings, reducing false signals but potentially missing valid divergences.

The oscillator period affects signal generation, too. A 14-period RSI is standard, but shorter periods like 9 create faster, more responsive signals. That works for scalping volatile pairs like GBP/JPY during London session hours. Longer periods like 21 or 25, smooth out noise, better suited for swing trading major pairs like EUR/USD.

Alert customization matters for traders monitoring multiple charts. Set the indicator to trigger push notifications when divergence forms on specific timeframes. This prevents missing setups while focusing on other tasks. Some advanced versions include filters that only alert when divergence appears near key price levels.

Color coding helps distinguish signal quality. Many indicators use different colors for regular versus hidden divergence, or for strong versus weak signals based on the divergence angle. Steeper divergence angles typically indicate stronger momentum shifts.

Strengths and Honest Limitations

The MT5 divergence indicator excels at identifying potential reversals before they’re obvious on price alone. It works across all currency pairs and timeframes, providing consistent logic regardless of market conditions. Automation saves time—no manual comparison of oscillator peaks and price pivots required.

That said, divergence is a leading indicator, which means early signals and false positives. Not every divergence leads to a reversal. In strong trending markets, prices can remain “diverged” for extended periods, creating losses for counter-trend traders. The 2023 USD rally provided countless bearish divergence signals that failed as the dollar kept climbing.

Whipsaws happen, especially on lower timeframes. The indicator might signal divergence, price reverses briefly, then continues the original direction. Stop losses get hit before the actual reversal occurs. This frustrates traders who don’t understand that divergence signals probability, not certainty.

Unlike some indicators that can be used in isolation, divergence requires context. A divergence signal near no significant support or resistance level, with no trend exhaustion signs, carries minimal value. Traders need to integrate price action analysis, market structure, and sometimes additional indicators for confirmation.

Trading forex carries substantial risk. No indicator guarantees profits. The MT5 divergence indicator identifies potential setups, but risk management, position sizing, and market understanding determine long-term success. Relying solely on divergence signals without a proper strategy leads to inconsistent results.

How Divergence Compares to Other Reversal Indicators

Candlestick patterns like engulfing candles or shooting stars also signal reversals, but they’re reactive—showing what happened after the reversal starts. Divergence offers warning, giving traders better entry points. The trade-off? More false signals due to that leading nature.

Moving average crossovers lag significantly. By the time two MAs cross, much of the reversal move has already occurred. Divergence can spot exhaustion while the trend is still active, allowing entries closer to the turning point with tighter stops.

Compared to the Relative Strength Index alone, the divergence indicator provides visual clarity. Raw RSI requires traders to manually compare peaks and price action. The automated drawing of divergence lines and alert functions make pattern recognition effortless, especially for less experienced traders.

How to Trade with MT5 Divergence Indicator

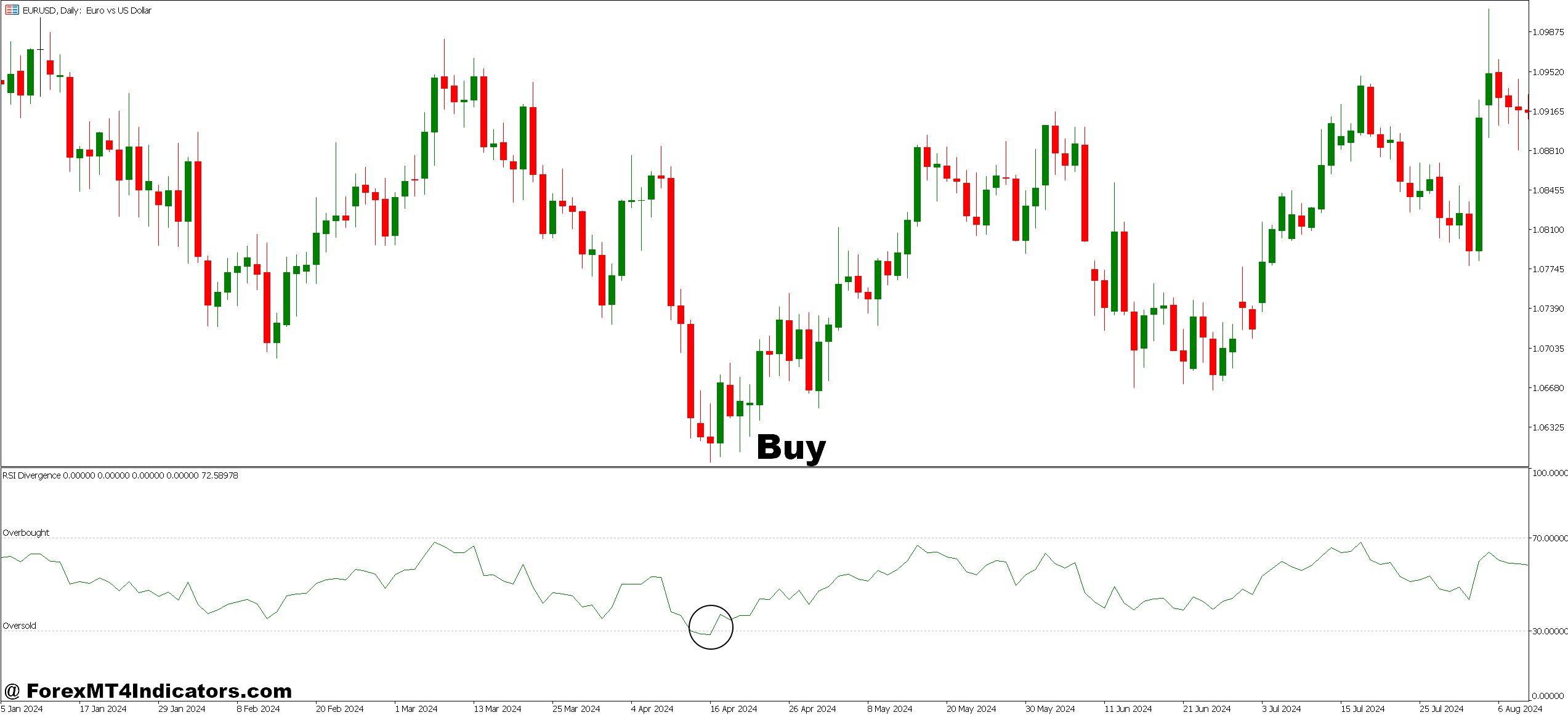

Buy Entry

- Identify bullish divergence at support – Wait for price to make a lower low near a key support level (like EUR/USD at 1.0500) while your oscillator shows a higher low on the 4-hour chart or above.

- Confirm with price action – Don’t enter on divergence alone; wait for a bullish engulfing candle or pin bar to form after the divergence signal before going long.

- Set stops below the swing low – Place your stop loss 10-20 pips below the price low that created the divergence to protect against false signals and extended moves.

- Target 2:1 risk-reward minimum – If risking 30 pips on GBP/USD, aim for at least 60 pips profit to the next resistance level to account for the 40-50% divergence failure rate.

- Avoid in strong downtrends – Skip bullish divergence signals when price is below the 200-period moving average on the daily chart; counter-trend trades fail more often in established trends.

- Check higher timeframe alignment – Only take 1-hour bullish divergence if the 4-hour or daily chart shows no conflicting bearish divergence or strong downward momentum.

- Risk 1% maximum per signal – Divergence produces false signals regularly, so never risk more than 1% of your account on a single setup, regardless of how “perfect” it looks.

- Use hidden divergence for pullback entries – When EUR/USD is in an uptrend and makes a higher low with the oscillator showing a lower low, enter long as this signals trend continuation, not reversal.

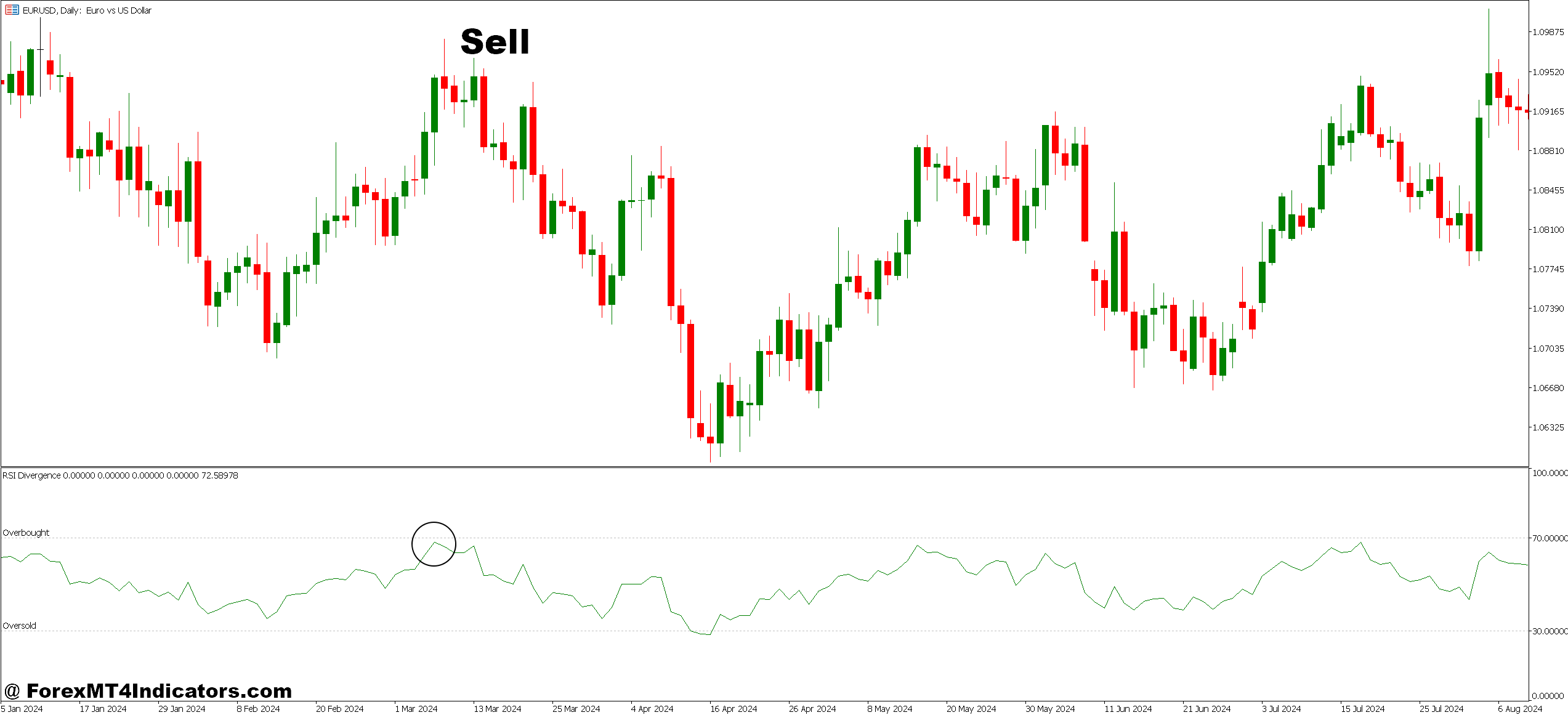

Sell Entry

- Spot bearish divergence at resistance – Look for price making a higher high at a key resistance zone (like GBP/USD at 1.2800) while RSI or MACD prints a lower high on 4-hour charts or higher.

- Wait for confirmation candle – Enter short only after a bearish engulfing, shooting star, or strong rejection candle forms following the divergence signal on your chosen timeframe.

- Place stops above the swing high – Set your stop loss 10-20 pips above the price high that created the divergence to avoid getting stopped out by minor fluctuations before the reversal.

- Scale out at key levels – Take 50% profit at the first support level (typically 30-50 pips on majors), then trail your stop to breakeven on the remaining position.

- Skip in strong uptrends – Ignore bearish divergence when price is making higher highs above the 200 EMA on daily charts; trend strength often overpowers divergence signals.

- Require multiple timeframe confirmation – If you see bearish divergence on the 1-hour chart, verify that the 4-hour chart isn’t showing bullish momentum or opposing divergence patterns.

- Avoid during major news events – Don’t take divergence signals 30 minutes before or after high-impact news releases like NFP or central bank decisions; volatility invalidates technical signals.

- Exit if divergence invalidates – Close your short position immediately if price makes a new higher high with the oscillator also making a higher high, as the divergence pattern has failed.

Making the Indicator Work for You

The MT5 divergence indicator shines when traders understand its role: A filter and timing tool, not a complete trading system. It identifies where reversals might occur. Confirmation from price action, support/resistance, or trend analysis determines which signals to take.

Start by backtesting on major pairs across different market conditions. Notice which timeframes produce the best risk-reward setups for your trading style. Scalpers might find the 5-minute chart workable with strict filters, while position traders stick to daily divergences only.

Combine it with risk management that accounts for the false signal rate. If divergence signals win 60% of the time, position sizing and stop placement need to reflect that. Don’t risk more than 1-2% per trade regardless of how “perfect” the divergence looks.

In practice, the indicator serves traders best as a heads-up system. When it flags divergence on EUR/GBP, that’s a cue to watch price action closely for reversal confirmation. The divergence creates the thesis; price action provides the entry trigger. That two-step approach filters out many losing trades while keeping the winners.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.