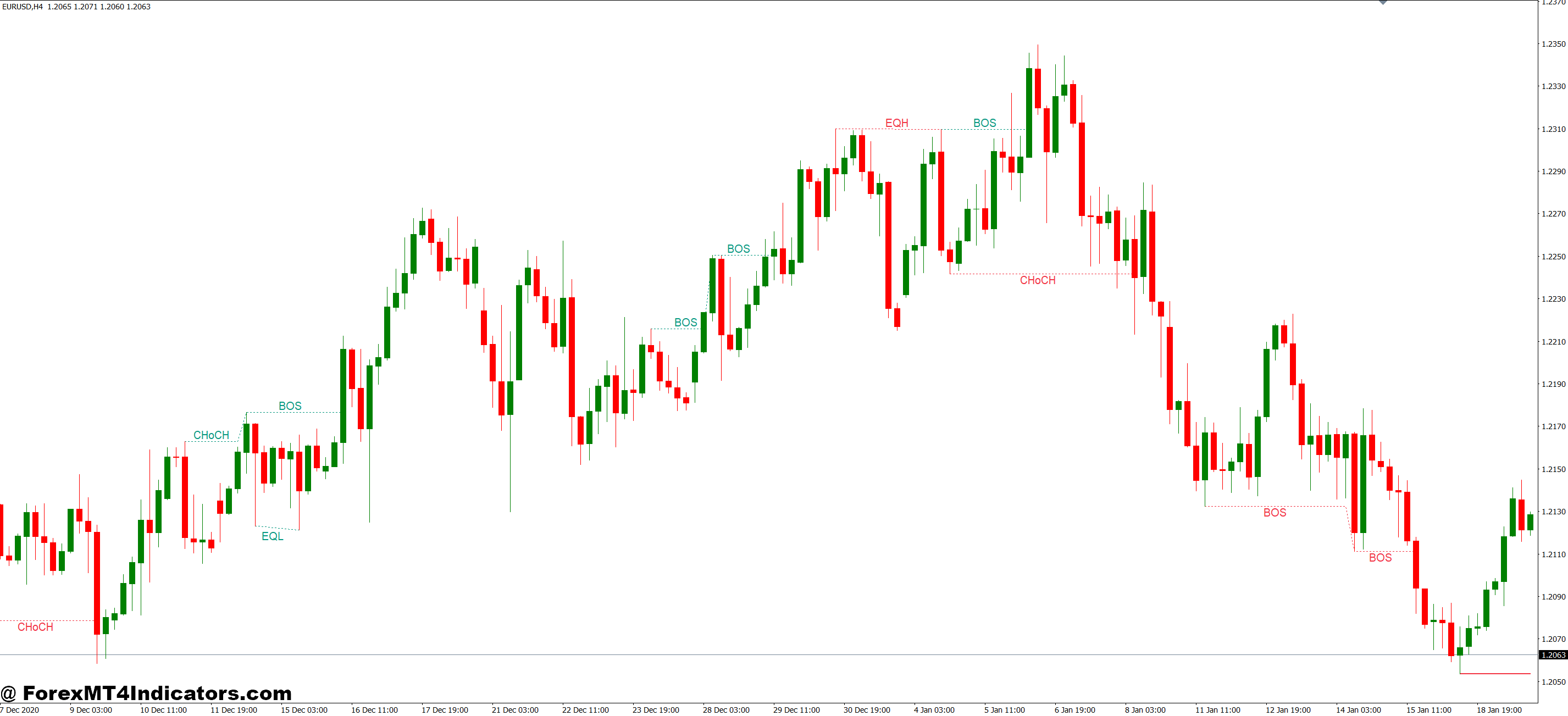

The Smart Money Concepts indicator builds on price action principles that institutional traders have used for decades. At its core, SMC identifies three key elements: order blocks, fair value gaps, and liquidity sweeps.

Order blocks represent the last opposing candle before a strong directional move. When GBP/USD consolidates for hours then suddenly drops 80 pips, that final bullish candle before the drop marks an order block. Institutions likely placed large sell orders there, creating supply that overwhelms retail demand. The indicator automatically highlights these zones, which often act as future resistance.

Fair value gaps appear when price moves so aggressively that it leaves inefficiencies—areas where no actual trading occurred at certain price levels. On a 15-minute USD/JPY chart, if price jumps from 149.20 to 149.50 in one candle with the next candle opening above the first candle’s high, that gap between them represents unfilled orders. Price frequently returns to fill these gaps, offering high-probability reversal setups.

Liquidity zones mark areas where stop losses cluster. Retail traders typically place stops just below swing lows or above swing highs. The indicator identifies these zones because institutions deliberately push price into them, triggering stops to accumulate positions at better prices before the real move begins.

Practical Trading Applications

The real value emerges when combining these elements in actual market conditions. Here’s a scenario that played out repeatedly during September 2024’s EUR/USD volatility.

Price was trending down on the daily chart but had created a bullish order block at 1.0920 on the 1-hour timeframe. Smart money traders waited for price to retrace into this zone. When it did, the indicator showed confluence: the order block aligned with a fair value gap from the previous week. Traders entered long positions at 1.0925 with stops below 1.0900. Price respected the zone, bouncing 60 pips within twelve hours.

But the indicator doesn’t guarantee every setup works. Two days later, price returned to the same zone and sliced through it, hitting stops before reversing higher. That’s the nature of forex—even institutional levels fail when larger market forces dominate.

The indicator works best when identifying high-timeframe structure breaks. On AUD/USD’s 4-hour chart, traders watch for liquidity sweeps above daily highs. When price quickly spikes above a high then reverses, leaving a fair value gap, that’s often a manipulation move. The indicator marks both the swept liquidity and the gap, creating a high-probability short setup as price fills the inefficiency.

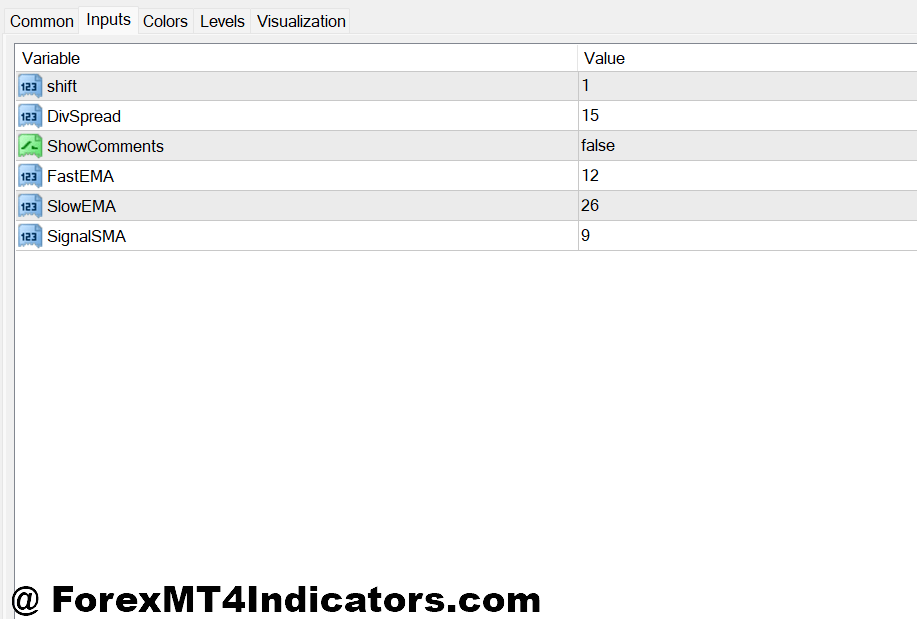

Customizing Settings for Trading

MT4’s version offers flexibility that scalpers and swing traders both appreciate. The order block sensitivity parameter adjusts how many blocks appear on charts. Setting it to “High” on a 5-minute chart floods the display with zones—useful for scalpers hunting quick reversals but overwhelming for position traders.

Swing traders typically dial sensitivity to “Medium” or “Low” on 4-hour or daily charts. This filters noise, showing only the most significant institutional zones. A day trader working EUR/JPY might use “High” sensitivity on the 15-minute chart, catching smaller order blocks during London session volatility.

The fair value gap minimum size setting prevents tiny inefficiencies from cluttering charts. On volatile pairs like GBP/JPY, setting the minimum to 20 pips filters out noise while catching meaningful gaps. Calmer pairs like EUR/CHF might use 10-pip minimums since gaps appear less frequently.

Color customization matters more than traders expect. Marking bullish order blocks in green and bearish blocks in red creates quick visual recognition during fast markets. Some traders prefer subtle grays and blues to reduce chart clutter while maintaining clarity.

Comparing SMC to Traditional Indicators

Traditional support and resistance indicators mark horizontal lines based on swing highs and lows. The Smart Money Concepts indicator differs fundamentally—it identifies where institutions likely placed orders, not just where price historically reversed.

A standard pivot point indicator might show resistance at 1.1000 on EUR/USD because price touched that level twice. The SMC indicator shows resistance there only if an order block formed—meaning institutions demonstrated actual selling interest through price action. This distinction matters. Price can blow through technical levels that lack institutional backing.

Compared to supply and demand zone indicators, SMC adds the liquidity component. A demand zone indicator marks an area where buying occurred. The SMC indicator goes further, showing not just where buying happened but also where retail stops cluster above that zone. This reveals potential manipulation scenarios that traditional zone indicators miss.

Fibonacci retracement tools work well alongside SMC. When a 61.8% retracement level aligns with an order block and fair value gap, confluence strengthens the setup. The SMC indicator doesn’t replace Fibonacci—it complements it by adding the institutional perspective.

Real Limitations Every Trader Should Know

Trading forex carries substantial risk. No indicator guarantees profits, and the Smart Money Concepts indicator certainly has weaknesses traders must understand.

Order blocks fail during fundamental events. When the Federal Reserve announces an unexpected rate hike, even the strongest daily order block on USD/CAD gets obliterated. The indicator can’t predict news-driven volatility that overrides technical structure.

False signals appear regularly in ranging markets. During consolidation periods, price creates multiple order blocks that don’t lead to significant moves. A trader might enter five consecutive setups based on order blocks, with four stopping out before the fifth finally works. This tests patience and bankroll management.

The indicator also shows historical zones—it can’t predict which ones remain relevant. That bullish order block from three weeks ago might no longer hold institutional interest, but it still appears on the chart. Traders must combine SMC with market context, not blindly trade every marked zone.

Subjectivity creeps in despite automation. Two traders using identical settings might interpret liquidity sweeps differently. One sees manipulation above a high; another sees a valid breakout. The indicator marks the levels, but trade decisions still require judgment.

How to Trade with Smart Money Concepts Indicator MT4

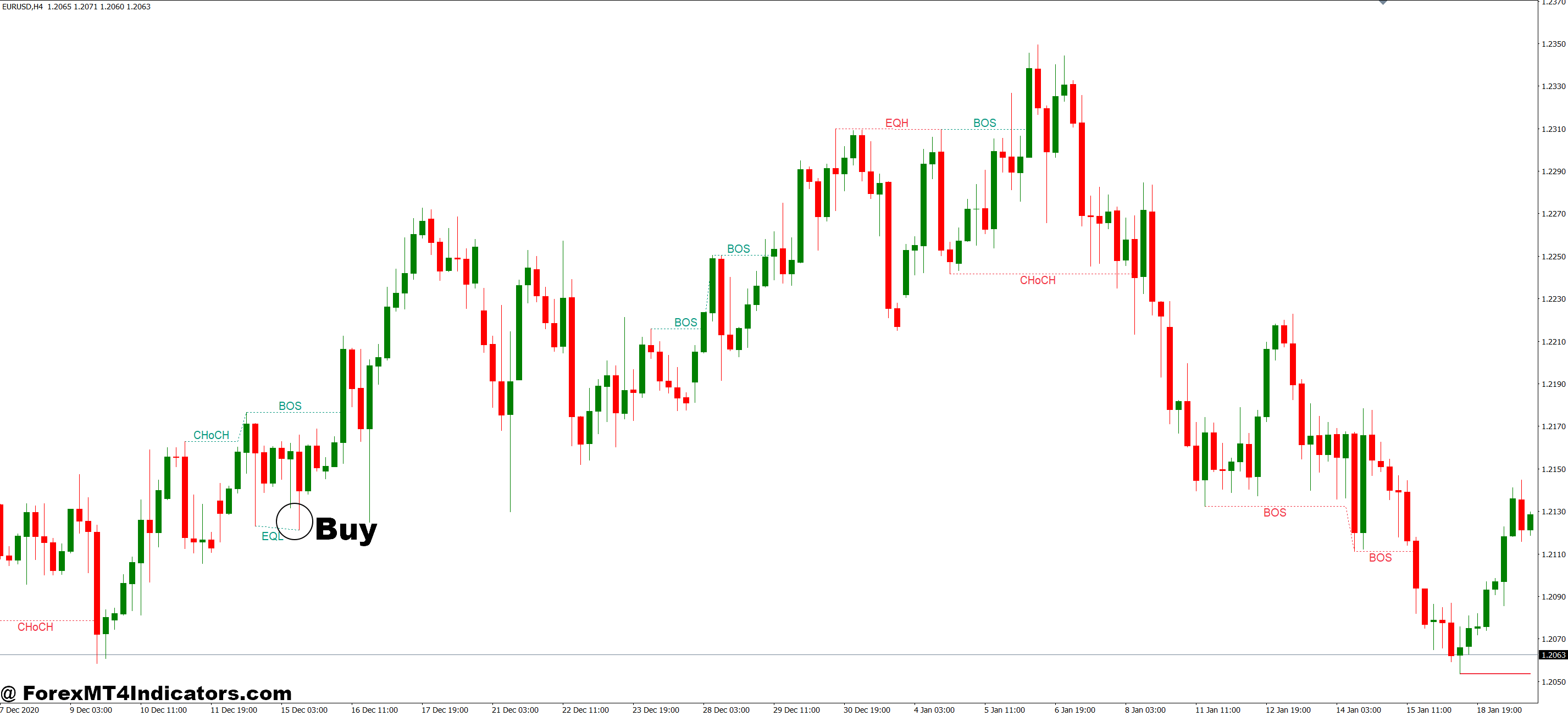

Buy Entry

- Bullish order block retest – Enter long when price returns to a bullish order block on the 1-hour or 4-hour chart with a rejection wick of at least 10-15 pips; place stop loss 5-10 pips below the block.

- Fair value gap fill from below – Buy when price drops into an unfilled fair value gap on EUR/USD or GBP/USD; target the gap’s upper boundary for quick 20-30 pip scalps on 15-minute charts.

- Liquidity sweep below support – Go long immediately after price spikes below a swing low (sweeping retail stops) then closes back above it within 1-2 candles; this signals institutional accumulation.

- Higher timeframe alignment – Only take buy signals when the daily chart shows bullish structure and the 4-hour order block aligns with the trend; avoid countertrend longs that fight institutional flow.

- Risk 1-2% maximum – Never risk more than 2% of your account on any single SMC setup, even when confluence looks perfect; order blocks fail during high-impact news events.

- Confirm with price action – Wait for a bullish engulfing candle or pin bar rejection at the order block before entering; don’t buy just because price touched the zone.

- Avoid during ranging markets – Skip buy setups when the 4-hour chart shows sideways consolidation; SMC signals produce more false breakouts in choppy conditions without clear directional bias.

- Target premium zones – Set take profit at the next bearish order block or fair value gap overhead, typically 40-80 pips away on major pairs during trending conditions.

Sell Entry

- Bearish order block rejection – Enter short when price rallies into a bearish order block on the 4-hour chart and forms a rejection candle; place stops 10-15 pips above the block’s high.

- Fair value gap fill from above – Sell when price spikes into an unfilled gap on GBP/USD 1-hour charts; these often provide 25-40 pip reversals as institutions fill the inefficiency.

- Liquidity grab above resistance – Go short after price briefly breaks above a swing high (triggering retail buy stops) then reverses back below within 1-3 candles; confirms manipulation.

- Daily trend confirmation – Only take sell signals when the daily chart is bearish and the lower timeframe order block sits near daily resistance; don’t short into strong uptrends.

- Tighten stops on volatility – Reduce position size by 50% and use tighter 20-pip stops during major news releases (NFP, FOMC); SMC levels often get violated during high-impact events.

- Wait for displacement – Don’t sell until you see a strong bearish impulse candle (30+ pips on EUR/USD 1-hour) breaking below the order block; this confirms institutional selling pressure.

- Skip weak setups – Avoid selling if multiple order blocks exist within 20-30 pips of each other; overlapping zones create confusion and reduce probability of clean reversals.

- Exit at discount zones – Take profits when price reaches the next bullish order block or fair value gap below, usually 50-100 pips away on 4-hour timeframes during strong trends.

Making SMC Work in Your Strategy

Smart money concepts shine brightest when traders treat them as confluence factors rather than standalone signals. A bullish order block on the 1-hour chart gains strength when the 4-hour trend aligns, price shows bullish divergence on RSI, and a fair value gap sits just above.

Risk management determines success more than indicator accuracy. Even with perfect order block identification, overleveraging destroys accounts. Risking 1-2% per trade while targeting 2:1 or 3:1 reward-to-risk ratios allows traders to survive the inevitable losing streaks that come with any method.

The indicator works across all pairs, but certain markets respond better to smart money concepts. Major pairs like EUR/USD and GBP/USD show clearer institutional behavior than exotic crosses where liquidity is thin and price action more erratic.

Start by marking higher timeframe structure on daily and 4-hour charts, then drop to 1-hour or 15-minute charts for entries. This multi-timeframe approach prevents traders from taking countertrend setups against larger institutional flow. When the daily chart shows a bearish order block overhead and the 1-hour chart gives a short signal near that zone, confluence improves dramatically.

The Smart Money Concepts Indicator MT4 won’t turn losing traders into winners overnight. But it does provide a framework for understanding how institutional players operate—and that perspective can shift a trader’s entire approach from chasing retail breakouts to patiently waiting for institutional levels. That shift, combined with solid risk management and realistic expectations, creates a foundation for long-term consistency in the forex market.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.