The Stochastic indicator compares a currency pair’s closing price to its price range over a set number of periods. George Lane developed it in the 1950s on a simple observation: in an uptrend, prices tend to close near the highs, while downtrends see closes near the lows.

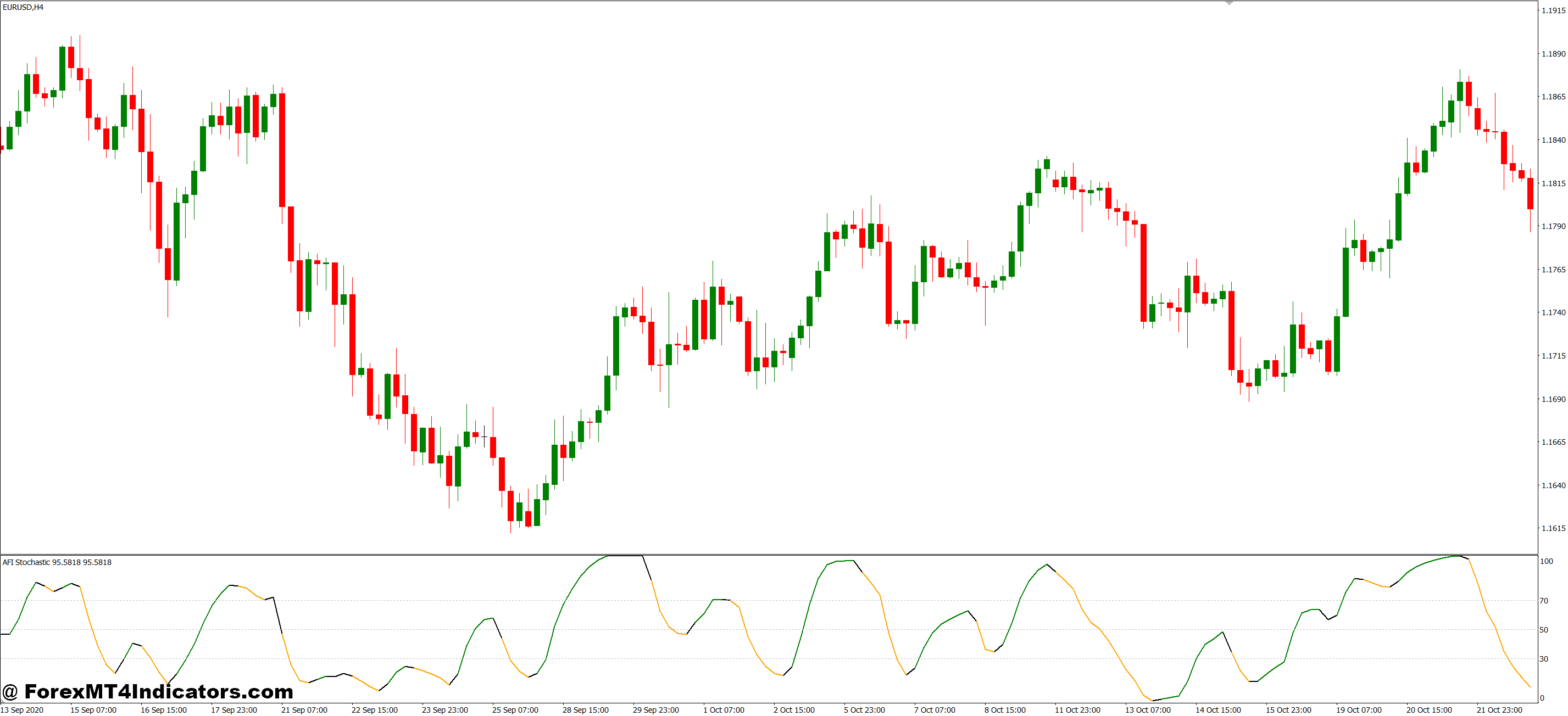

The indicator produces two lines—%K and %D—that oscillate between 0 and 100. The %K line is the faster, more reactive line. The %D line smooths out %K, acting like a signal line. When %K crosses above %D near the oversold zone (below 20), it suggests buying pressure is building. A cross below %D near overbought levels (above 80) warns that sellers might take control.

Here’s what makes it different from simple moving averages or trend indicators: Stochastic doesn’t care whether price is at 1.0850 or 1.0950. It only cares where the current close sits within the recent range. This relative positioning reveals momentum shifts that absolute price levels miss.

The Math Behind the Signal

The standard calculation uses a 14-period lookback. The formula divides the difference between the current close and the 14-period low by the total 14-period range, then multiplies by 100.

So if GBP/USD closes at 1.2650, and over the past 14 hours (on a 1-hour chart) the low was 1.2600 and the high was 1.2700, you’d calculate: (1.2650 – 1.2600) / (1.2700 – 1.2600) × 100 = 50. A reading of 50 means price is closing right in the middle of its recent range—no momentum edge either way.

When readings climb above 80, price has been closing near the top of its range repeatedly. That’s strong bullish momentum, but it also means the move might be overextended. Below 20 signals the opposite—consistent closes near the lows, suggesting either strong bearish momentum or an oversold bounce opportunity.

The %D line applies a 3-period moving average to %K, which is why crossovers between these lines generate trading signals.

Real Trading Scenarios: Where Stochastic Shines

Let’s get specific. On July 18, 2024, EUR/USD spent the Asian and early London sessions grinding higher on the 15-minute chart. By 9:00 AM GMT, Stochastic had pushed above 80 and stayed there for three consecutive candles. Price looked strong, but momentum was stalling.

At 9:15 AM, %K crossed below %D at the 83 level. Within two candles, EUR/USD reversed 25 pips. Traders using Stochastic avoided chasing that high and either stayed flat or positioned for the pullback.

But here’s the thing—Stochastic also generated a false signal earlier that morning. At 7:30 AM, it dipped to 25 and crossed upward, suggesting a buy. Price did bounce 10 pips before rolling over into new lows. That’s the trade-off: you get early signals, but not all of them play out.

Range-bound markets are where Stochastic really earns its keep. When USD/JPY trades between 149.50 and 150.20 for an entire session, traditional trend indicators give choppy, conflicting signals. Stochastic, however, helps pinpoint the range extremes. Readings above 80 near 150.20 suggest shorting toward the range bottom. Below 20 near 149.50 signals a probable bounce.

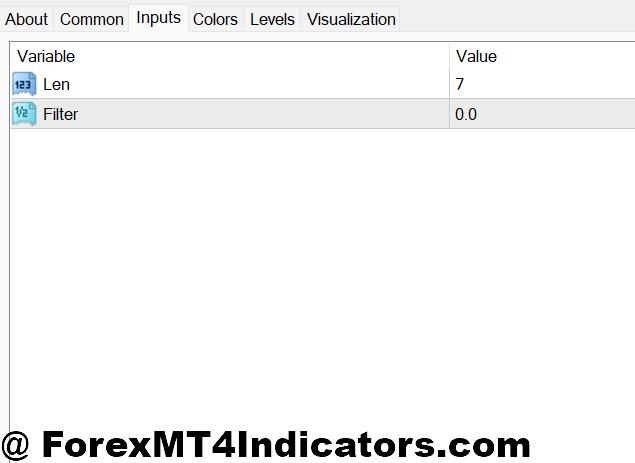

Customizing Settings for Different Style

The default 14-period setting works well for swing trading on 4-hour or daily charts. But scalpers and day traders often need faster signals.

For the 5-minute chart, some traders drop the %K period to 8 or 9. This makes the indicator more responsive, catching quick momentum shifts during London or New York sessions. The downside? More whipsaws. You’ll see overbought and oversold readings constantly, many leading nowhere.

On the flip side, position traders using daily or weekly charts might extend the period to 21 or even 25. This filters out noise but means fewer signals. You won’t catch every swing, but the ones you do catch tend to be higher quality.

The smoothing period (typically 3 for both %K and %D) can also be adjusted. Increasing it to 5 creates smoother lines with fewer crossovers. Fewer signals, less noise, but potentially slower entries. Day traders generally stick with 3, while swing traders experiment with 4 or 5.

Currency pair volatility matters too. GBP/JPY swings harder than EUR/CHF, so identical settings produce different results. Testing on your specific pairs and timeframes beats blindly accepting defaults.

Strengths, Weaknesses, and What Traders Get Wrong

Stochastic excels at identifying potential reversals before they happen. That’s powerful in range-bound markets or when trading counter-trend pullbacks in strong trends. It also helps avoid the classic mistake of buying breakouts right as momentum dies.

The limitation? Strong trends break Stochastic. During a powerful directional move, the indicator can stay pegged above 80 or below 20 for hours or even days. Traders who short simply because readings hit 85 get steamrolled when momentum persists.

That’s why experienced traders combine it with trend filters. If the 200-period moving average slopes upward and price trades above it, ignore oversold Stochastic readings—they’re just pullbacks in a healthy uptrend. Only take overbought signals against the trend or look for divergences.

Divergence is where Stochastic shows its expertise. When EUR/GBP makes a higher high but Stochastic makes a lower high, momentum is weakening despite rising prices. This divergence often precedes reversals. Spotting it requires experience, but it’s one of the most reliable Stochastic setups.

Stochastic vs. RSI: Picking the Right Tool

Traders often confuse Stochastic with RSI since both oscillate between 0 and 100 and identify overbought/oversold conditions. The key difference: RSI measures the magnitude of recent price changes, while Stochastic measures where the close sits within the recent range.

In trending markets, RSI tends to perform better. It doesn’t stay pinned at extremes as long as Stochastic does, so you get fewer false reversal signals during strong runs.

Stochastic wins in ranging markets and for timing specific entries. The dual-line crossover system provides clearer entry signals than RSI’s single line. Many traders run both—RSI for trend context, Stochastic for entry timing.

How to Trade with MT4 Stochastic Indicator

Buy Entry

- %K crosses above %D below 20 – Wait for both lines to drop under the 20 level on EUR/USD 1-hour chart, then enter when %K crosses upward through %D, targeting 20-30 pip moves.

- Bullish divergence at support – When GBP/USD makes a lower low but Stochastic makes a higher low near the 15-25 zone, price momentum is shifting; enter on the next bullish candle close with a 25-pip stop.

- Double-bottom in oversold zone – If Stochastic touches below 20 twice within 10-15 candles on the 4-hour chart without breaking lower, buy the second bounce as selling pressure exhausts.

- Exit oversold during uptrend – On daily charts with price above the 200 EMA, buy when Stochastic climbs back above 20 after an oversold dip; don’t wait for it to reach 50—momentum is already turning.

- Confirmed by price action – Never buy on Stochastic signal alone; wait for a bullish engulfing candle or pin bar rejection at the oversold level to confirm buyer interest.

- Risk 1.5% maximum per trade – Even with perfect Stochastic alignment, limit position size so a 30-pip stop equals no more than 1.5% of your account; indicators fail, risk management saves you.

- Avoid during strong downtrends – Skip all buy signals when price is below the 50 and 200 EMA on the 4-hour chart; Stochastic can stay oversold for 20+ candles in powerful selloffs.

- Set realistic profit targets – Book 50-70% of the position at 2:1 risk-reward (40-60 pips if risking 20); let the remainder run with a trailing stop as Stochastic approaches 80.

Sell Entry

- %K crosses below %D above 80 – Enter short on EUR/USD 1-hour chart when %K drops through %D after both lines exceed 80, placing stops 5 pips above the recent swing high.

- Bearish divergence at resistance – When price makes a higher high but Stochastic peaks lower on the 4-hour GBP/USD chart above 75, momentum is fading; short the next bearish candle with 30-pip stop.

- Rejection from extreme overbought – If Stochastic hits 95+ and immediately reverses on the 15-minute chart during London open, sell aggressively for quick 15-20 pip scalps before the pullback completes.

- Failed breakout above 80 – When %K pushes above 80 but can’t pull %D with it and instead crosses back down, it signals weak buying; short with conviction on the crossover.

- Overbought in ranging markets – Between 8 AM-12 PM GMT when USD/JPY trades in a 40-pip range, sell every Stochastic reading above 85 toward the range midpoint with tight 15-pip stops.

- Don’t fight extended rallies – Ignore overbought signals above 80 if the daily chart shows price climbing with strong bullish candles; wait for actual trend structure breaks or lower timeframe divergence first.

- Trail stops as Stochastic drops – Once short and profitable with Stochastic declining from 80 toward 50, move your stop to breakeven at 10 pips profit, then trail it 15 pips behind price.

- Exit before oversold extremes – Close 75% of your short position when Stochastic reaches 25-30 on the 1-hour chart; trying to squeeze out the last 10 pips often results in giving back 20.

Putting It All Together

The Stochastic oscillator gives traders a window into momentum shifts that price alone doesn’t reveal. It works best in ranging markets, for timing pullback entries in trends, and for spotting divergences that signal exhaustion. The dual-line crossover system provides specific entry signals, while overbought/oversold zones identify potential reversal areas.

But it’s not perfect. Strong trends render it useless unless you’re filtering signals with the broader context. False signals happen, especially on lower timeframes or with aggressive settings. And like any technical tool, it requires practice to read correctly.

Trading forex carries substantial risk. No indicator guarantees profits, and past performance doesn’t predict future results. Stochastic can improve your timing and decision-making, but only when combined with solid risk management and realistic expectations.

Start by adding it to your charts and simply observing. Watch how readings behave during different market conditions. Note when crossovers lead to actual price movement and when they fail. That hands-on experience will teach you more than any article can. The indicator is just a tool—your judgment about when to use it makes all the difference.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.