The MT4 price action indicator strips away that complexity. Instead of calculating derivatives of price data, it highlights what actually matters: support and resistance zones, swing highs and lows, and candlestick patterns that institutional traders watch. This tool doesn’t predict the future. It simply organizes price structure so traders can make informed decisions based on what markets are doing right now.

What the MT4 Price Action Indicator Actually Does

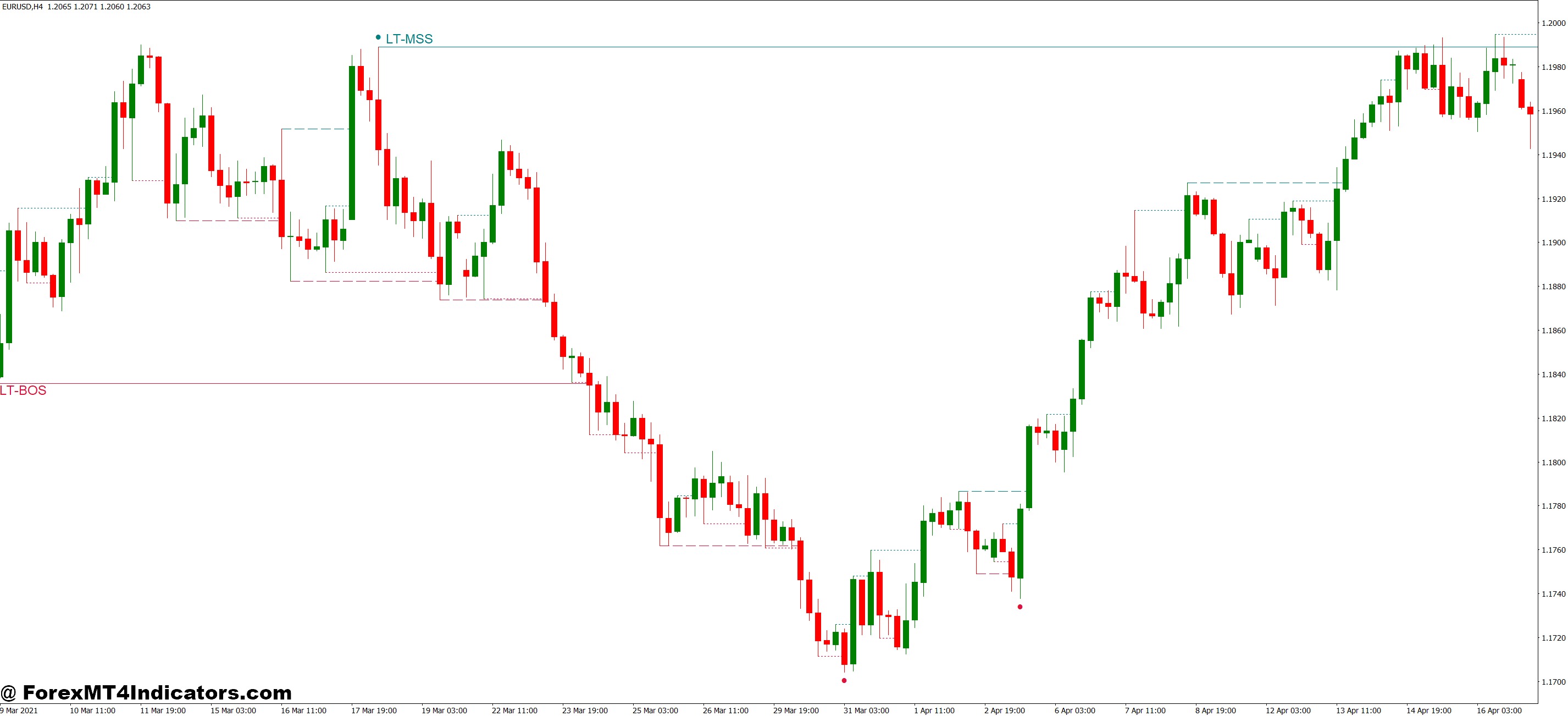

Unlike oscillators that calculate mathematical formulas from closing prices, the MT4 price action indicator identifies and marks key price levels directly on the chart. Think of it as automated pattern recognition. The indicator scans recent price history—typically 50 to 200 candles depending on settings—and flags significant swing points where price reversed or consolidated.

Some versions mark support and resistance zones using horizontal lines at price levels that rejected moves multiple times. Others identify candlestick patterns like pin bars, engulfing candles, or inside bars that often precede directional moves. The better ones combine both approaches, giving traders a visual map of market structure.

The core logic is straightforward. When price makes a higher high followed by a lower high, that’s a swing high—potential resistance. When price makes a lower low followed by a higher low, that’s a swing low—potential support. The indicator automates what experienced traders do manually: marking these pivot points to understand where supply and demand showed up previously.

How Price Action Indicators Calculate Key Levels

Most MT4 price action indicators use a swing detection algorithm. The indicator looks back a set number of bars (the “lookback period”) to identify local peaks and troughs. For a swing high, price must make a high that’s greater than the bars both before and after it. A 5-bar swing high means the middle candle’s high exceeds two candles on each side.

Here’s where it gets practical. On a 4-hour GBP/USD chart with a 5-bar swing setting, the indicator might flag a swing high at 1.2750 from last Tuesday. That level matters because sellers previously overwhelmed buyers there. If price approaches 1.2750 again, traders watch for rejection—a clue that sellers might defend that zone again.

The calculation for support and resistance zones varies. Some indicators draw rectangles around price clusters where candles overlapped heavily, indicating consolidation. Others use percentage-based proximity—if price touched within 0.5% of a level three times in 100 bars, that’s a valid zone. The specific math matters less than understanding the concept: these tools identify where price memory exists.

Advanced versions incorporate candlestick pattern recognition. They scan for specific formations—a pin bar requires a small body with a long wick (at least 2:1 ratio), positioned in the outer third of the total range. When this pattern forms at a key support or resistance level, the indicator generates an alert. That’s not a trade signal. It’s a heads-up that price structure is showing potential setup conditions.

Real Trading Scenarios: Where This Tool Shines

Testing this indicator on EUR/USD during the September 2024 rally provided clear examples. On the daily chart, the indicator marked swing lows at 1.0780 and 1.0820, zones where price bounced multiple times in August. When price pulled back to 1.0830 in early September, traders watching those levels had context—would this be another bounce?

The indicator flagged a bullish pin bar at 1.0835 on September 11th. The setup made sense: price tested support, rejected lower, and closed near the high. Traders entering long at 1.0845 with stops below 1.0790 caught a 150-pip move to 1.1000 over the next week. The indicator didn’t predict that move. It simply highlighted favorable risk-reward structure at a proven support zone.

But the tool isn’t magic. That same month, GBP/JPY chopped sideways between 190.00 and 192.50 for two weeks. The indicator marked both levels as valid support and resistance—which they were. But price whipsawed between them daily, triggering six false breakout signals. Traders taking every setup got chopped up. The lesson? Price action indicators work best in trending markets or at major swing extremes, not during tight consolidation.

On the 1-hour chart, the indicator helps with intraday timing. During NFP releases, price often spikes then retraces to a swing level before making the real move. In October 2024, USD/CAD spiked from 1.3580 to 1.3630 on strong jobs data, then pulled back to test 1.3600—a swing level the indicator had marked from earlier that week. The rejection at 1.3600 provided a cleaner entry than chasing the initial spike.

Customizing Settings for Different Styles

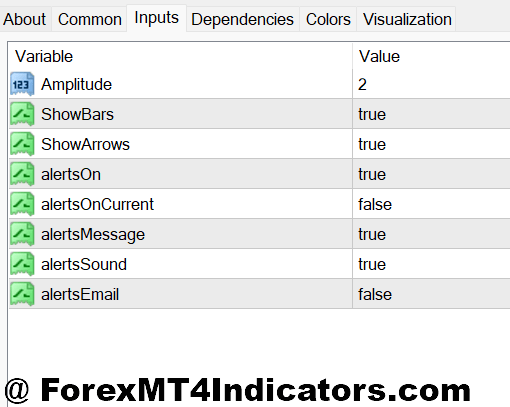

The lookback period determines how many recent candles the indicator analyzes. Shorter periods (20-50 bars) identify near-term swings, useful for scalpers and day traders. Swing traders prefer 100-200 bars to focus on weekly or monthly pivots. There’s no “correct” setting—it depends on holding time preference.

For GBP/USD on the 15-minute chart, a 30-bar lookback identifies swing levels from the past seven to eight hours—relevant for London session traders. The same 30-bar setting on a daily chart looks back six weeks, more appropriate for position traders. Matching the lookback to trading timeframe prevents the indicator from cluttering charts with irrelevant levels.

The swing sensitivity setting controls how strict the pivot detection is. A 3-bar swing (price must exceed one bar on each side) generates more levels but includes minor fluctuations. A 10-bar swing (five bars on each side) produces fewer, more significant pivots. Beginners often start with lower sensitivity, then increase it as they learn to distinguish major from minor structure.

Color coding helps. Some traders set major support in green, major resistance in red, and minor levels in gray. Others use zones instead of lines—a 10-pip rectangle around each level accounts for spread and slippage. On volatile pairs like XAU/USD (gold), wider zones (20-30 pips) make more sense than exact lines.

Alert settings deserve attention. Too many notifications create noise and lead to alert fatigue. Setting alerts only for price approaching major swing levels or confirmed candlestick patterns keeps signals actionable. The goal is relevance, not constant pings.

Advantages Over Lagging Indicators

The primary benefit is immediacy. Moving averages lag by definition—a 20-period EMA reflects where price was 10 periods ago. Price action indicators respond to current structure. When GBP/USD forms a pin bar at 1.2650, that information is available now, not three candles later after an oscillator crosses a threshold.

Visual clarity matters too. Instead of interpreting whether RSI at 45 is bullish or bearish, traders see direct evidence: price rejected at prior resistance. That’s concrete. There’s less ambiguity, which reduces emotional decision-making. Newer traders especially benefit from this directness—they’re reading market footprints, not mathematical transformations of footprints.

These indicators also work across all timeframes without adjustment. The same principles of support and resistance apply whether examining a 5-minute or monthly chart. That universality helps traders maintain consistent analysis regardless of trading style. An oscillator might need different settings for different timeframes; price structure doesn’t.

Limitations Every Trader Should Understand

Price action indicators are reactive, not predictive. They show where price reversed before, not where it will reverse next. That’s crucial. Markets evolve. A support level that held three times might break on the fourth test. The indicator can’t forecast that change—it only knows historical data.

During ranging markets, these tools generate excessive signals. When EUR/JPY bounces between 160.00 and 162.00 for weeks, the indicator marks both levels as valid. And they are. But taking every touch results in dozens of small losses from failed breakouts. The indicator needs context from higher timeframe trends or fundamental catalysts to filter quality setups.

False patterns create problems. A candlestick might look like a perfect pin bar but form during ultra-low volume Asian hours when price drifts randomly. The indicator flags it mechanically because the geometry matches—long wick, small body. But that pattern lacks the conviction of one formed during London-New York overlap with real volume behind it. Traders must add discretion.

Subjectivity still exists. What constitutes a “major” versus “minor” swing level? The indicator uses mathematical criteria, but traders ultimately decide which levels merit attention. Two traders using identical settings might interpret results differently based on their broader market analysis. That’s not a flaw—it’s the nature of discretionary trading.

How It Compares to Alternative Approaches

Fibonacci retracement tools and price action indicators overlap conceptually—both identify potential reversal zones. But Fibonacci requires manually drawing from swing high to swing low, while price action indicators automate level detection. The tradeoff: Fibonacci levels often align with psychological round numbers (like 1.3000 on USD/CAD), while indicator-generated levels might land at 1.3047—technically valid but less watched by the broader market.

Traditional support and resistance indicators draw horizontal lines at recent highs and lows. Price action indicators go further by incorporating candlestick pattern recognition and zone width calculations. They’re more nuanced but also more complex. For traders who prefer simplicity, manually marking levels might be clearer.

Ichimoku Cloud provides dynamic support and resistance that adjusts with price movement. Price action indicators typically use static levels—once drawn, they don’t move unless price creates new swing points. Static levels offer consistency (you know where to watch), while dynamic systems adapt to changing volatility. Neither approach is superior; they serve different philosophies.

How to Trade with MT4 Price Action Indicator

Buy Entry

- Wait for bullish pin bar at support – Enter 2-5 pips above the pin bar high when price rejects a marked support zone on EUR/USD 4-hour chart, with stop loss 5 pips below the pin bar low for tight risk-reward.

- Confirm the swing low hold – Only take long entries after price tests a swing low level marked by the indicator at least twice and bounces; single touches on GBP/USD often fail during ranging conditions.

- Check higher timeframe alignment – Before entering on 1-hour bullish signals, verify the daily chart shows price above a major swing support zone; counter-trend trades against daily structure have 60-70% failure rates.

- Enter on bullish engulfing at resistance-turned-support – When price breaks above resistance, wait for a pullback to that level where a bullish engulfing candle forms, then enter 3 pips above candle close with 30-40 pip stop loss.

- Avoid buy signals during major resistance clusters – Skip long entries when the indicator shows 3+ resistance levels within 20 pips above current price on EUR/USD; price typically stalls and reverses in these zones.

- Size down during Asian session setups – Cut position size by 50% for buy signals that form between 11 PM – 5 AM EST when volume is thin and price action patterns produce more false breaks.

- Trail stops to breakeven after 20 pips – Once a buy entry moves 20 pips in profit, move stop loss to entry price to eliminate risk; price action setups often retrace 40-50% before continuing.

- Require momentum confirmation above 1.5% daily range – Don’t take buy signals on days when EUR/USD has moved less than 60 pips total; low volatility days produce weak follow-through even on valid patterns.

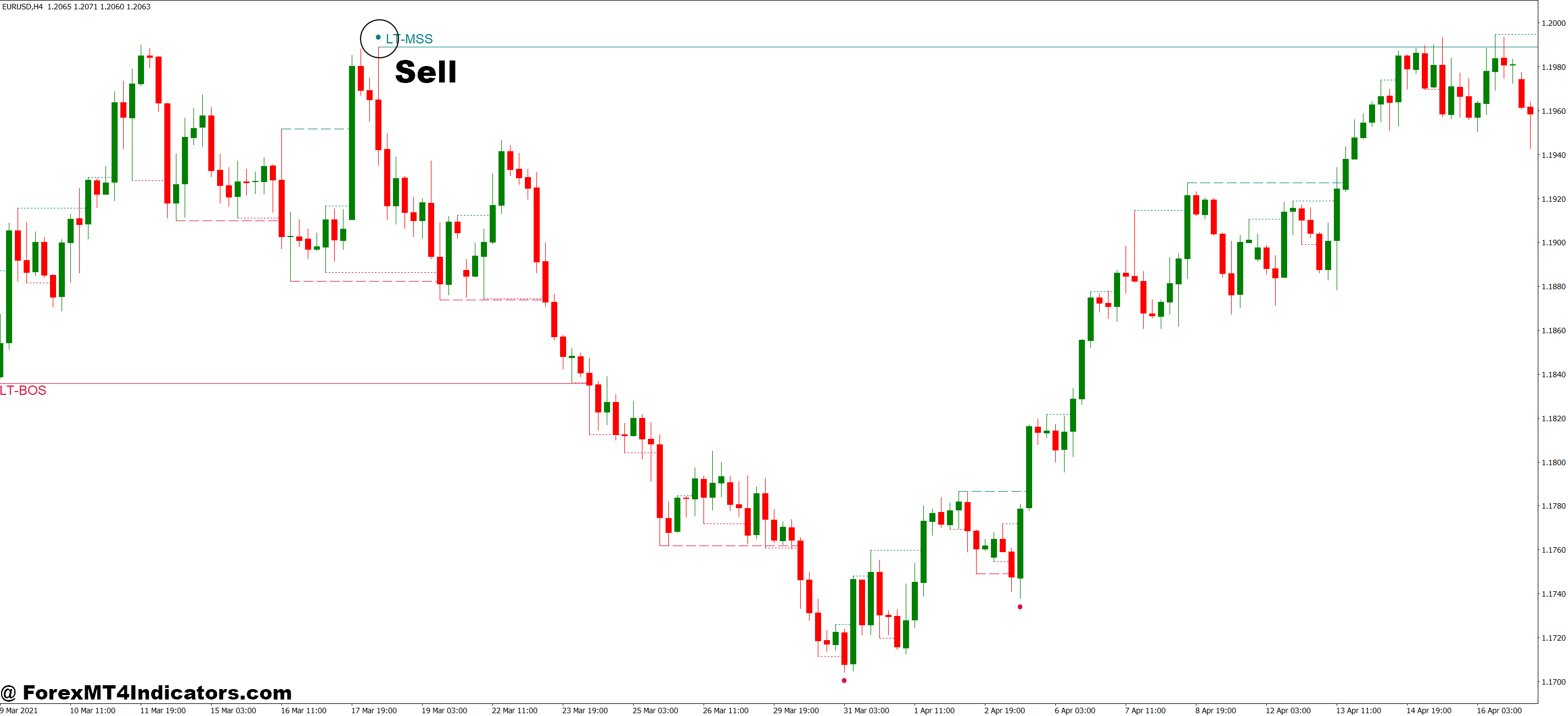

Sell Entry

- Enter below bearish pin bar at resistance – Sell 2-5 pips below the pin bar low when price rejects indicator-marked resistance on GBP/USD 4-hour chart, placing stop loss 5 pips above the wick high.

- Wait for double-top rejection confirmation – After price tests resistance twice and forms lower high, enter short on break below the valley between peaks with stop 15 pips above second rejection point.

- Verify downtrend on daily before shorting – Only take 1-hour sell signals when daily chart shows price below major swing resistance; trading against daily trend direction reduces win rate to 35-40%.

- Sell bearish engulfing at broken support – When support breaks, wait for price to rally back and form bearish engulfing candle at former support-turned-resistance, then short 3 pips below candle close.

- Skip sell signals near major support clusters – Avoid shorting when indicator shows 3+ support levels within 20 pips below price on EUR/USD; these zones typically produce strong bounces that stop out sellers.

- Reduce size by 50% before high-impact news – Don’t take full position short entries within 30 minutes of NFP, CPI, or central bank announcements; price action patterns fail during volatile whipsaws.

- Move stop to breakeven after 25 pips profit – Protect short positions by adjusting stop loss to entry once trade gains 25 pips; resistance rejections often see 30-40% retracements before continuing down.

- Ignore sell signals during Friday afternoon – Avoid new short entries after 12 PM EST on Fridays when liquidity dries up and Monday gaps frequently reverse Friday’s late-session moves by 40-60 pips.

Key Takeaways for Implementation

The MT4 price action indicator works best when traders understand its purpose: organizing market structure visually to support informed decisions. It identifies where supply and demand previously appeared, giving context for current price movement. That context helps assess risk-reward, not predict future direction. Traders using this tool should focus on major swing levels during trending conditions while staying selective during consolidation. Combining the indicator with volume analysis, higher timeframe context, or fundamental awareness improves results beyond using it in isolation. The real value comes from pattern recognition—seeing how price behaves at key levels repeatedly—which builds intuition over time. That’s something no automated tool can shortcut, though this indicator certainly accelerates the learning process.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.