A liquidity sweep occurs when price temporarily violates an obvious support or resistance level to trigger clusters of stop losses, then reverses sharply in the opposite direction. Banks and hedge funds need liquidity to fill large orders. Retail stop losses sitting just beyond round numbers, swing highs, and swing lows provide that liquidity.

The liquidity sweep indicator for MT4 identifies these patterns by tracking price wicks that extend beyond key levels followed by immediate rejection candles. It differs from standard support and resistance indicators because it specifically looks for the “grab and go” price behavior that characterizes institutional accumulation or distribution.

Most retail traders place stops in predictable locations—just below the recent swing low for longs, or just above the swing high for shorts. Market makers know this. They’ll push price through these levels with minimal volume, scoop up the liquidity, then drive price back in the intended direction with heavy volume. The indicator flags these moments using a combination of wick length analysis, volume spikes, and rapid price rejection.

How the Indicator Identifies Stop Hunt Patterns

The MT4 liquidity sweep indicator uses several calculation parameters to detect potential sweeps. It measures the wick-to-body ratio of candles near significant price levels. A classic liquidity sweep candle shows a long wick extending beyond a key level with a small body that closes back inside the level.

Here’s what the indicator tracks: First, it identifies swing highs and lows based on a customizable lookback period (typically 20-50 bars). Second, it monitors when price breaches these levels. Third, it confirms the sweep when price reverses and closes back inside the range within 1-3 candles. The indicator then plots an arrow or alert signal on the chart.

Some versions incorporate volume analysis. A true liquidity sweep often shows relatively low volume during the sweep itself, followed by increased volume as price reverses. This volume pattern confirms that the initial breakout was false—designed to hunt stops rather than signal a genuine trend change.

The indicator also considers the speed of the reversal. Quick rejections within the same candle or the next one carry more weight than gradual drifts back into range. On the GBP/JPY 4-hour chart, for example, a liquidity sweep might show price spiking 40 pips below support within one candle, then closing 30 pips back above support—that sharp V-shaped move is the giveaway.

Setting Up and Customizing for Different Trading Styles

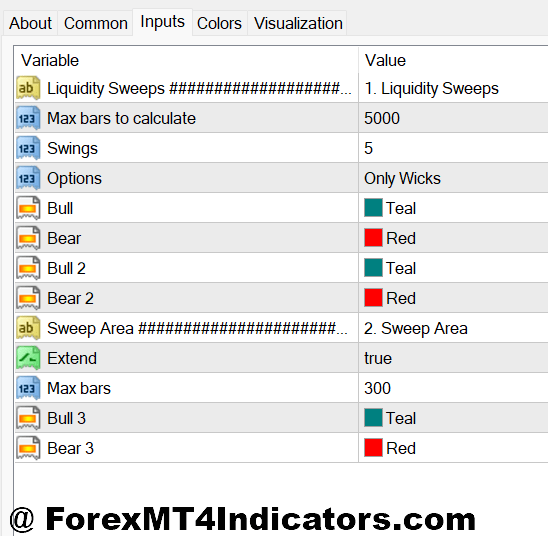

Installing the indicator follows standard MT4 procedures: drop the file into the Indicators folder, restart the platform, and attach it to your chart. But the real value comes from proper customization.

The “Swing Lookback” parameter determines how many candles the indicator examines to identify swing points. Day traders using the 15-minute chart might set this to 20 bars. Swing traders on the daily chart could extend it to 50 bars. Shorter lookback periods generate more signals but increase false positives. Longer periods produce fewer but higher-probability setups.

“Wick Threshold” defines how far price must extend beyond a level to qualify as a sweep. Setting this too tight generates noise; setting it too loose misses genuine sweeps. A threshold of 5-10 pips works well on major pairs like EUR/USD. Pairs with wider average ranges like GBP/NZD need 15-20 pips.

Some indicators include a volume multiplier setting. This filters signals by requiring volume on the reversal candle to exceed the average volume by a specified factor—usually 1.5x to 2x. This feature helps on timeframes where volume data is reliable (1-hour and above).

Alert settings matter too. Enable push notifications for tested setups only. Getting bombarded with every potential sweep leads to alert fatigue and missed opportunities when real setups emerge.

Practical Trading Applications and Real Examples

The indicator shines when combined with broader market context. Don’t trade sweeps blindly—use them as confirmation within an existing analysis framework.

During the September 2024 consolidation on EUR/USD, price ranged between 1.1050 and 1.1150 for three weeks. Multiple times, price swept above 1.1150 by 8-12 pips, triggering breakout traders’ stops, before plummeting back into range. Traders watching the liquidity sweep indicator could fade these false breaks, entering shorts at 1.1150 with stops above the sweep wick. The reward-to-risk on these setups averaged 1:3 because the sweep itself defined a tight stop level.

The indicator works exceptionally well during news events. NFP releases often trigger liquidity sweeps as the initial spike hunts stops before revealing the true directional move. In October 2024, a stronger-than-expected jobs report initially drove USD/JPY up 45 pips, sweeping obvious resistance. The indicator flagged the move. Within 20 minutes, price reversed and dropped 120 pips as the market focused on wage growth data instead.

That said, sweeps don’t always lead to immediate reversals. Sometimes price sweeps a level, consolidates, then sweeps it again before the real move begins. On choppy days, the indicator generates multiple signals without clear follow-through. This happens frequently on lower timeframes during Asian session hours when liquidity is thin.

Advantages, Limitations, and What Traders Need to Know

The liquidity sweep indicator’s primary advantage is objectivity. It removes guesswork about whether a level break is genuine or manipulative. Instead of agonizing over whether to enter on a breakout, traders get clear visual signals showing when institutions are hunting stops.

It also improves risk management. Because sweeps define precise invalidation points (just beyond the sweep wick), traders can use tighter stops than traditional support/resistance trading allows. This improves reward-to-risk ratios significantly.

But the indicator has limitations that honest traders acknowledge. It’s a lagging tool—it confirms sweeps after they occur, not before. Traders can’t enter at the absolute best price because they need confirmation of the reversal. Sometimes by the time the indicator signals, price has already moved 20-30 pips.

False signals appear during genuine breakouts. When a major trend begins, the initial thrust through resistance might look like a liquidity sweep but actually represents the start of a strong directional move. The indicator can’t distinguish between the two in real-time. This is why combining it with trend indicators like the 200-period moving average or market structure analysis is essential.

The indicator also struggles in extremely choppy markets. During low-volume periods or when major news is pending, price can sweep levels repeatedly without establishing direction. Traders who act on every signal in these conditions rack up losses quickly.

Compared to standard pivot point or support/resistance indicators, the liquidity sweep tool offers more nuanced insights into institutional behavior. However, it requires more interpretation. A basic pivot indicator simply marks levels; the liquidity sweep indicator demands traders understand order flow concepts and market manipulation tactics.

How to Trade with Liquidity Sweep Indicator MT4

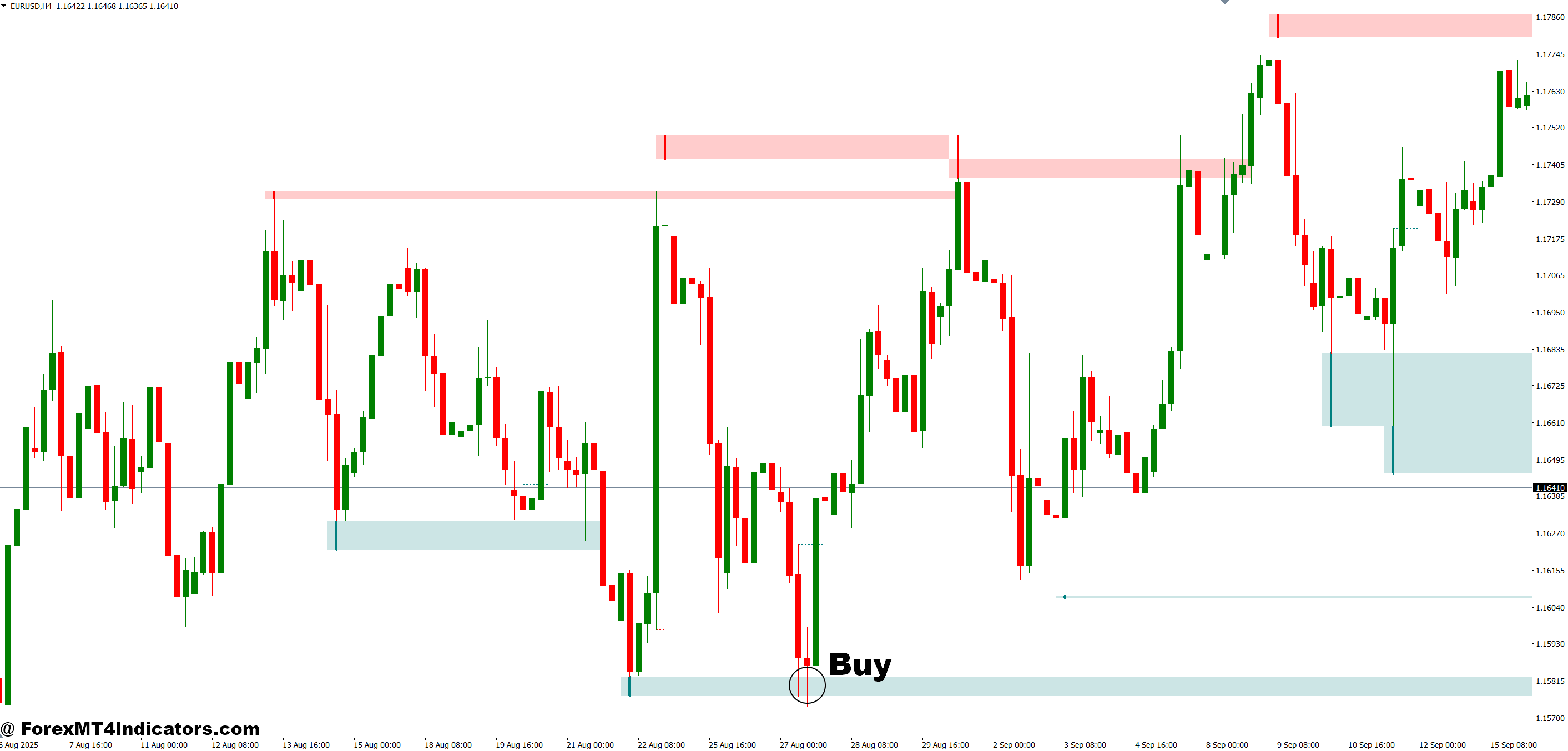

Buy Entry

- Wait for downside sweep below support – Enter long only after price spikes 5-15 pips below a key swing low on EUR/USD or GBP/USD, then closes back above that level within 1-2 candles.

- Confirm with strong rejection wick – Look for a bottom wick that’s at least 2x the size of the candle body; this shows sellers got trapped and buyers regained control quickly.

- Check higher timeframe alignment – If trading the 1-hour chart, ensure the 4-hour or daily trend is bullish; don’t buy sweeps into strong downtrends.

- Place stop 3-5 pips below the sweep low – Your stop sits just under the liquidity grab wick, giving tight risk while protecting against genuine breakdowns.

- Target previous range high – Aim for 20-40 pips on majors or the opposite side of the consolidation zone; liquidity sweeps often propel price across the full range.

- Avoid during major news releases – Skip signals within 15 minutes before or after NFP, CPI, or central bank decisions; volatility creates multiple false sweeps.

- Volume must spike on reversal candle – Look for 1.5-2x average volume when price recovers from the sweep; low volume recoveries often fail.

- Scale out at resistance levels – Take 50% profit at the first resistance, move stop to breakeven, and let the rest run toward the range high.

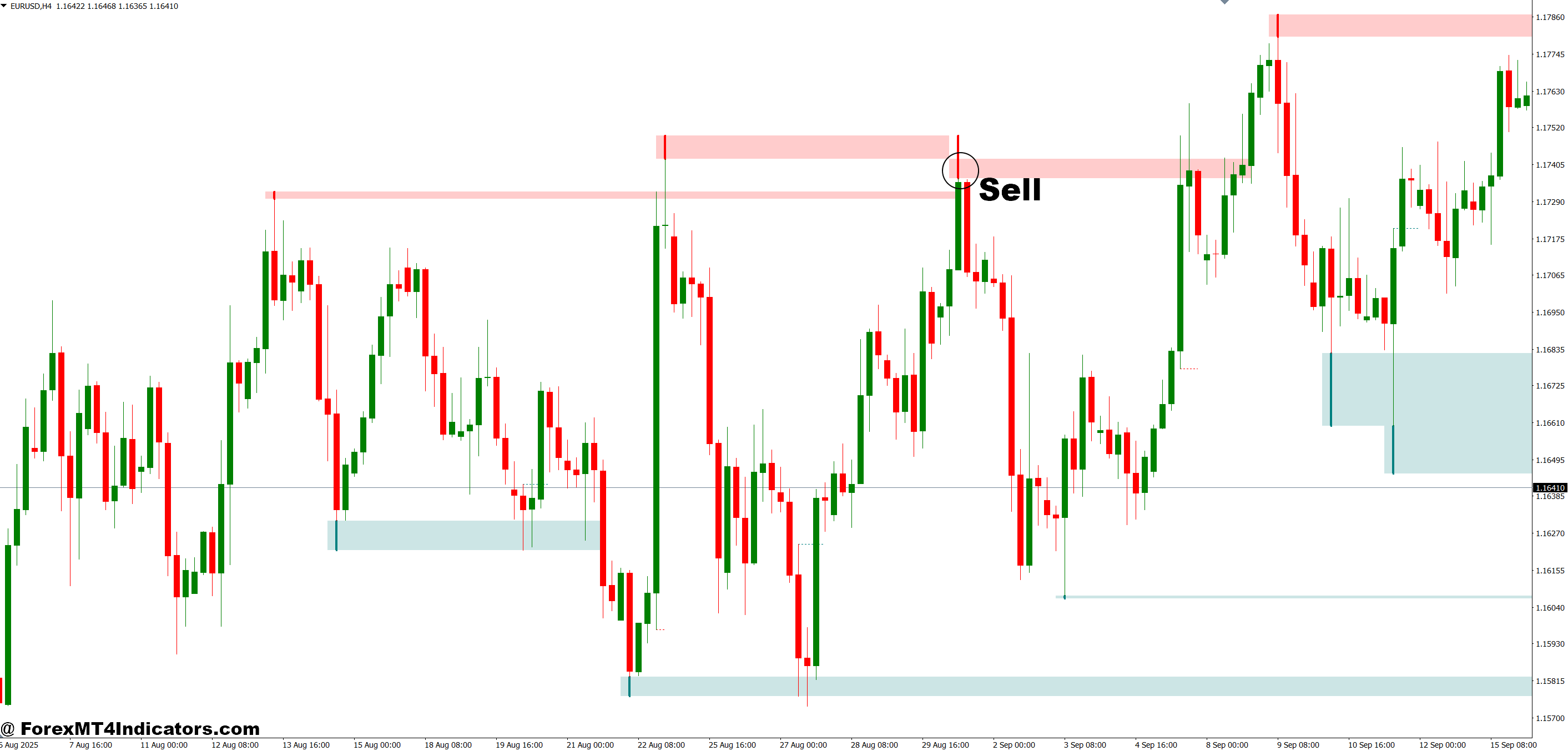

Sell Entry

- Wait for upside sweep above resistance – Enter short only after price spikes 5-15 pips above a swing high, then reverses and closes back below within 1-2 candles.

- Confirm with rejection wick at top – The upper wick should extend beyond resistance with a small body closing near the low; this signals bulls got trapped.

- Verify bearish higher timeframe context – Don’t short sweeps on the 15-minute chart if the 4-hour shows a strong uptrend; trade with the bigger picture.

- Set stop 3-5 pips above sweep high – Position your stop just beyond the liquidity grab wick to minimize risk while avoiding normal volatility.

- Target 2-3x your risk minimum – If risking 10 pips, aim for at least 20-30 pips; liquidity sweeps on GBP/JPY 4-hour often deliver 50-80 pip moves.

- Skip thin liquidity sessions – Avoid trading sweeps during Asian session on EUR/USD; low volume creates choppy, unreliable price action.

- Watch for double sweeps – If price sweeps the same high twice within 3-4 hours without follow-through, skip the setup; market is indecisive.

- Exit if price reclaims swept level – Close the trade immediately if price breaks back above resistance by 5+ pips; the sweep failed and reversal is unlikely.

Putting It All Together

The liquidity sweep indicator for MT4 gives traders a systematic approach to identifying stop hunts and positioning themselves alongside institutional money. It works best when traders understand that sweeps are part of normal market structure—not every sweep leads to a reversal, and not every reversal is preceded by a sweep.

Use the indicator as one component of a complete trading strategy. Combine it with trend analysis, key support and resistance levels, and solid risk management. Test different parameter settings on demo accounts before risking real capital. What works on EUR/USD may need adjustment for exotic pairs or different timeframes.

The indicator won’t prevent all stop-outs or turn losing traders into winners overnight. Trading forex carries substantial risk, and no indicator guarantees profits. But for traders who repeatedly find themselves on the wrong side of fake breakouts, this tool provides valuable insights into how smart money operates. That knowledge, applied consistently with proper risk controls, can tilt the odds back in a retail trader’s favor.

The key is patience. Wait for sweeps that align with broader market context rather than chasing every signal. That discipline transforms the indicator from a noise generator into a genuine edge.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.