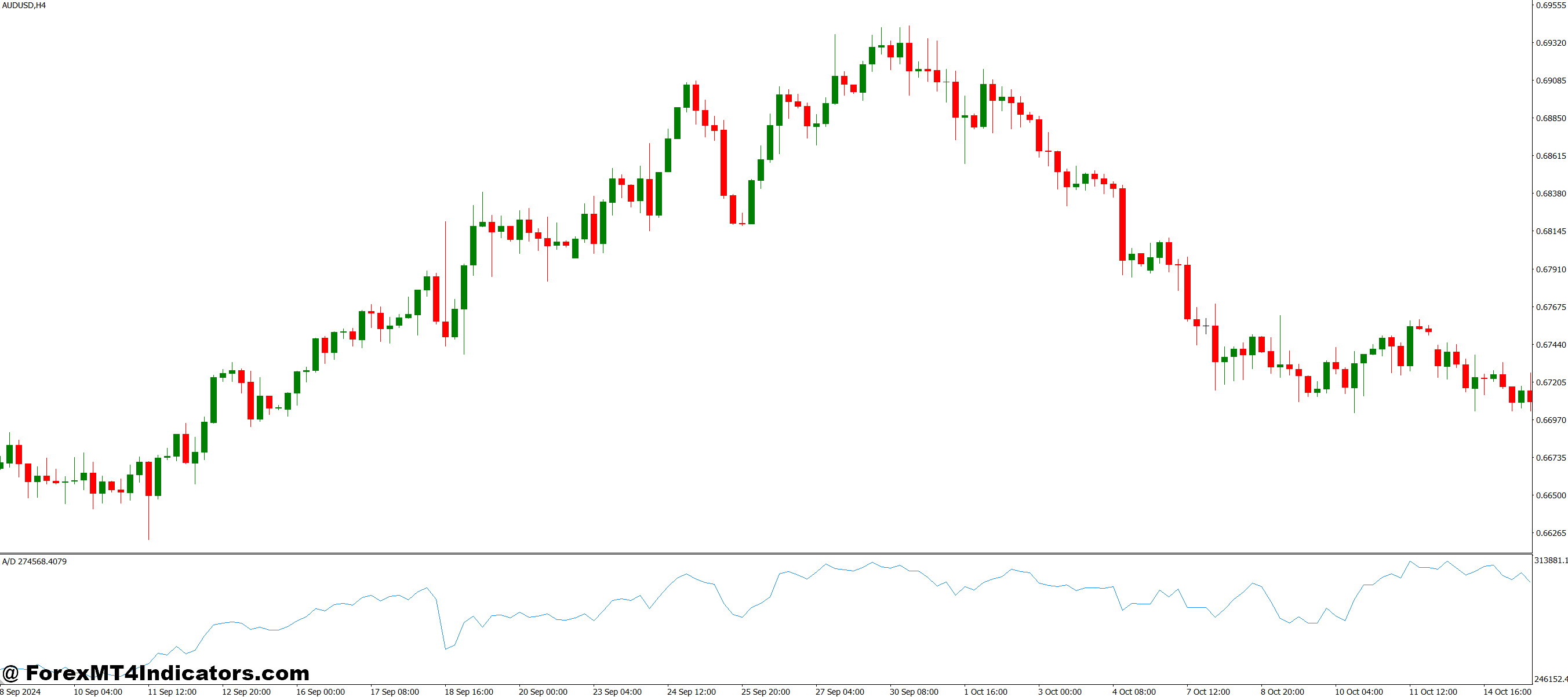

The Accu Dist indicator is designed to measure accumulation (buying strength) and distribution (selling pressure) for a single currency. Instead of focusing on just one chart, it collects data from multiple related currency pairs and displays the combined strength as a single line. This helps traders see true market behaviour without switching between charts.

The indicator works by analysing price movements and volume activity from all pairs involving the selected currency. It then translates that information into a smooth, easy-to-read graph. This makes it simple for traders to spot whether buyers or sellers are taking control at any given moment.

How the Indicator Helps Traders Make Better Decisions

This tool is especially useful for trend-following strategies. When the line rises, it shows accumulation, meaning buyers are supporting the currency. When the line drops, it signals distribution, meaning sellers are in control. Traders can use these changes to confirm trends before entering a trade.

Another benefit is that it reduces chart noise. Instead of reacting to quick spikes or false moves, the indicator smooths out the data so traders only see the major shifts. This is perfect for traders who want clear signals without complicated setups.

For example, if the indicator shows strong accumulation while the price is forming a pullback, a trader may consider a buy entry. On the other hand, if distribution rises during a rally, it can be a warning sign that buyers are losing power.

Why This Indicator Works Well for U.S. Market Traders

Many U.S. traders focus heavily on major currencies like USD, EUR, GBP, and JPY. The Accu Dist indicator makes it easier for them to quickly judge the strength of those currencies without juggling multiple charts. Its clean layout and simple curve help traders stay focused on the bigger movement happening behind the price.

The tool is also beginner-friendly. Traders at a 7th-grade reading level can understand how it works, making it ideal for new forex traders in the United States who want a simple but accurate way to read market strength.

How to Trade with Accu Dist for a Single Currency MT4 Indicator

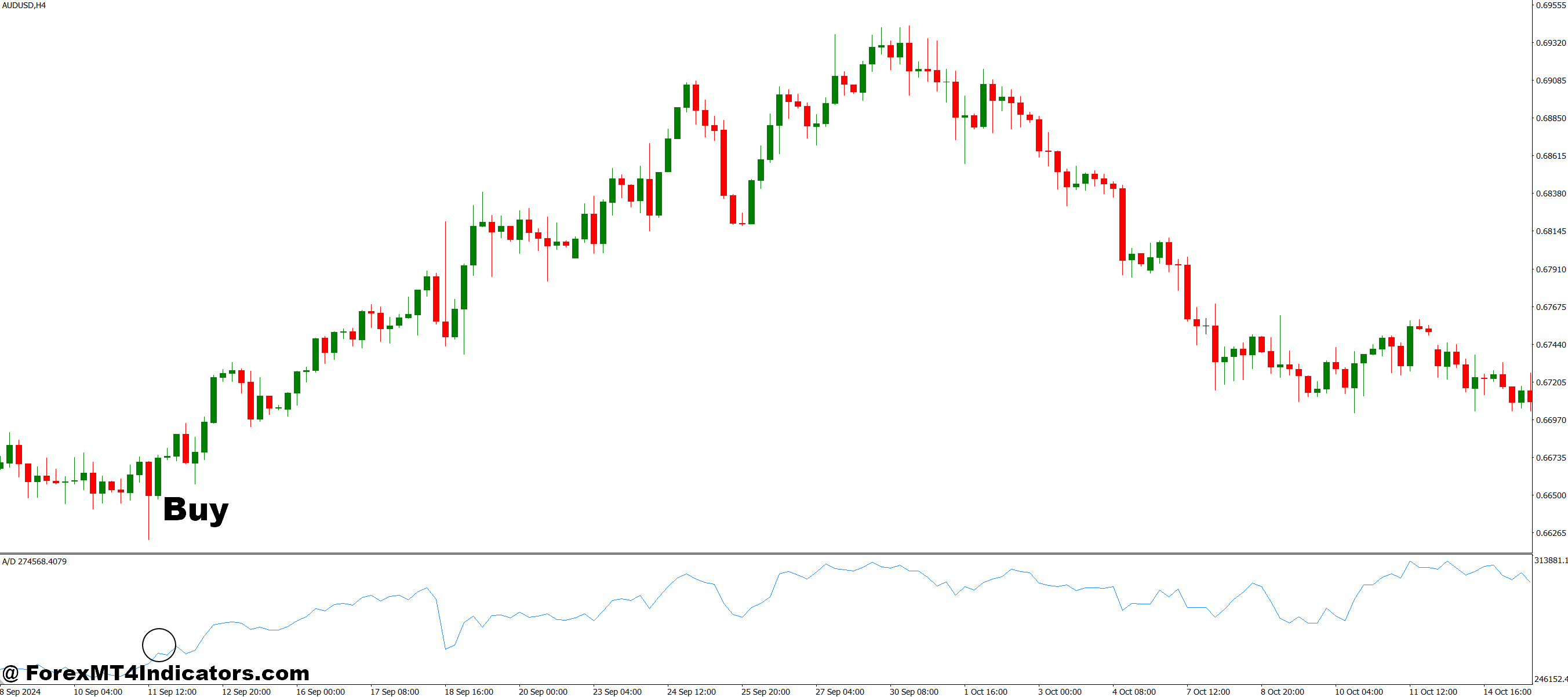

Buy Entry

- Look for the indicator line rising, showing accumulation (buyers are stronger).

- Ensure the price is in a pullback or consolidation phase near a support level.

- Confirm trend direction with the higher timeframe trend (optional but recommended).

- Enter a buy trade when the accumulation line continues upward after a pullback.

- Place a stop-loss below the recent swing low.

- Set take profit at the next resistance level or use a trailing stop to lock in profits.

Sell Entry

- Look for the indicator line falling, showing distribution (sellers are stronger).

- Ensure the price is near a resistance or after a small rally in a downtrend.

- Confirm the overall trend is bearish on a higher timeframe.

- Enter a sell trade when the distribution line continues downward after a rally.

- Place a stop-loss above the recent swing high.

- Set take profit at the next support level or use a trailing stop to secure gains.

Conclusion

The Accu Dist for a Single Currency MT4 Indicator gives traders a powerful yet simple way to understand real market strength. Showing accumulation and distribution phases in a clear curve helps traders avoid weak signals and focus on high-quality trade setups. Whether someone is new to forex or experienced, this indicator can make trend analysis easier and more reliable.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.