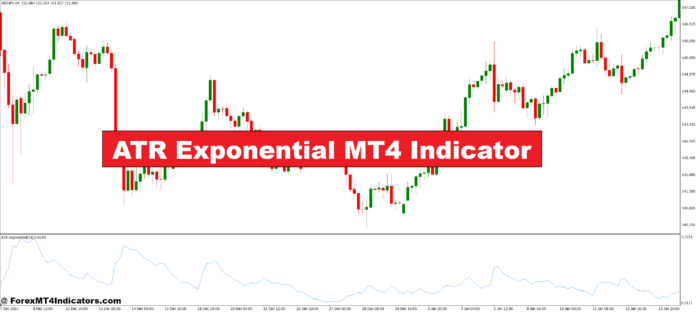

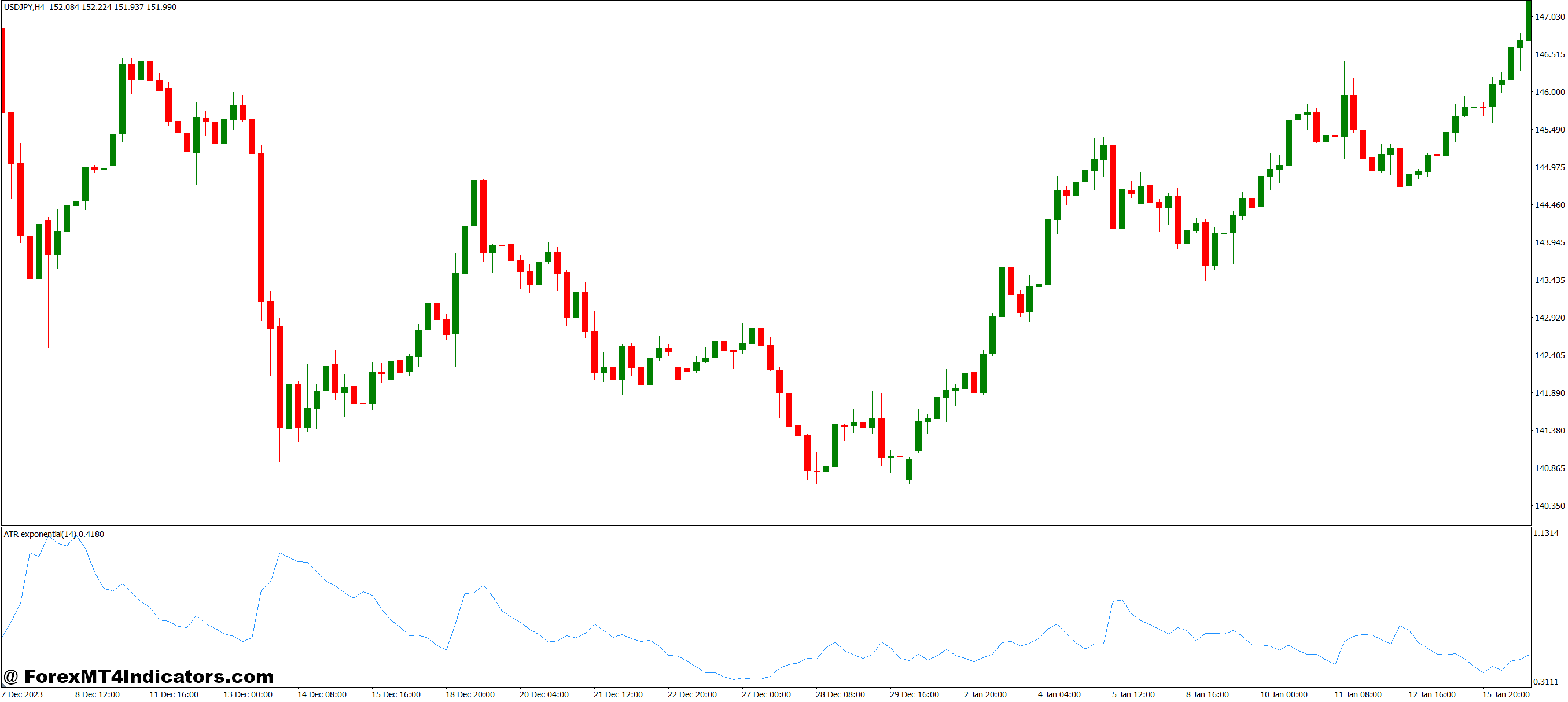

The ATR Exponential MT4 Indicator is a modified version of the standard ATR. While the traditional ATR calculates volatility using a simple moving average, this version uses an exponential moving average (EMA). The EMA reacts faster to price changes, which makes it more responsive to sudden shifts in the market. This gives traders a real-time view of volatility and helps them adapt their strategies without delay.

Why It Matters for Traders

Volatility is a key factor in risk management, and without understanding it, traders often place stop-losses too tight or too wide. The ATR Exponential helps solve this by showing precise volatility levels. For example, when volatility is high, traders can adjust their stop-losses further from the entry price to avoid getting stopped out by normal price noise. In low volatility conditions, they can tighten stop-losses to lock in profits.

Practical Applications

This indicator is especially useful for swing traders and day traders. Swing traders can use it to identify the best times to enter long-term positions, while day traders can track short-term market spikes. Many traders also combine it with trend indicators, such as moving averages or MACD, to filter out false signals. The ATR Exponential becomes a guide to position sizing, risk management, and trade timing, making it a versatile tool in any strategy.

User-Friendly and Effective

One of the strengths of the ATR Exponential MT4 Indicator is its simplicity. It does not clutter charts or overwhelm traders with too much data. Instead, it provides clear, actionable information that even beginners can understand. For advanced traders, it acts as a fine-tuning tool to sharpen entries and exits, especially when used alongside other indicators.

How to Trade with ATR Exponential MT4 Indicator

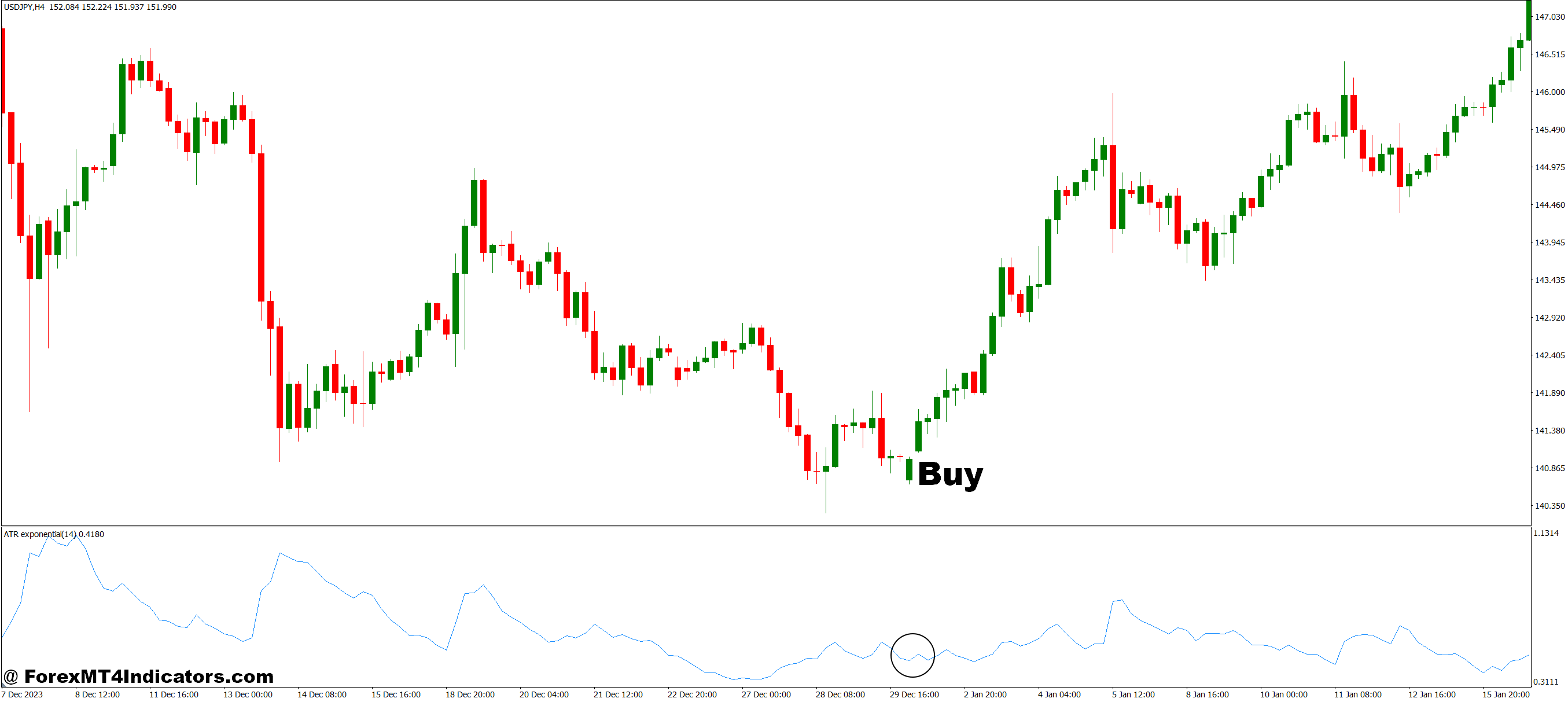

Buy Entry

- Confirm the market is in an uptrend using a trend filter (e.g., moving average).

- Wait for the ATR Exponential line to show increasing volatility, suggesting stronger price momentum.

- Enter a buy trade when the price breaks above a resistance level with rising ATR Exponential values.

- Place the stop-loss below the recent swing low or based on the ATR value.

- Set a take-profit target at the next resistance zone or use risk-to-reward (e.g., 1:2).

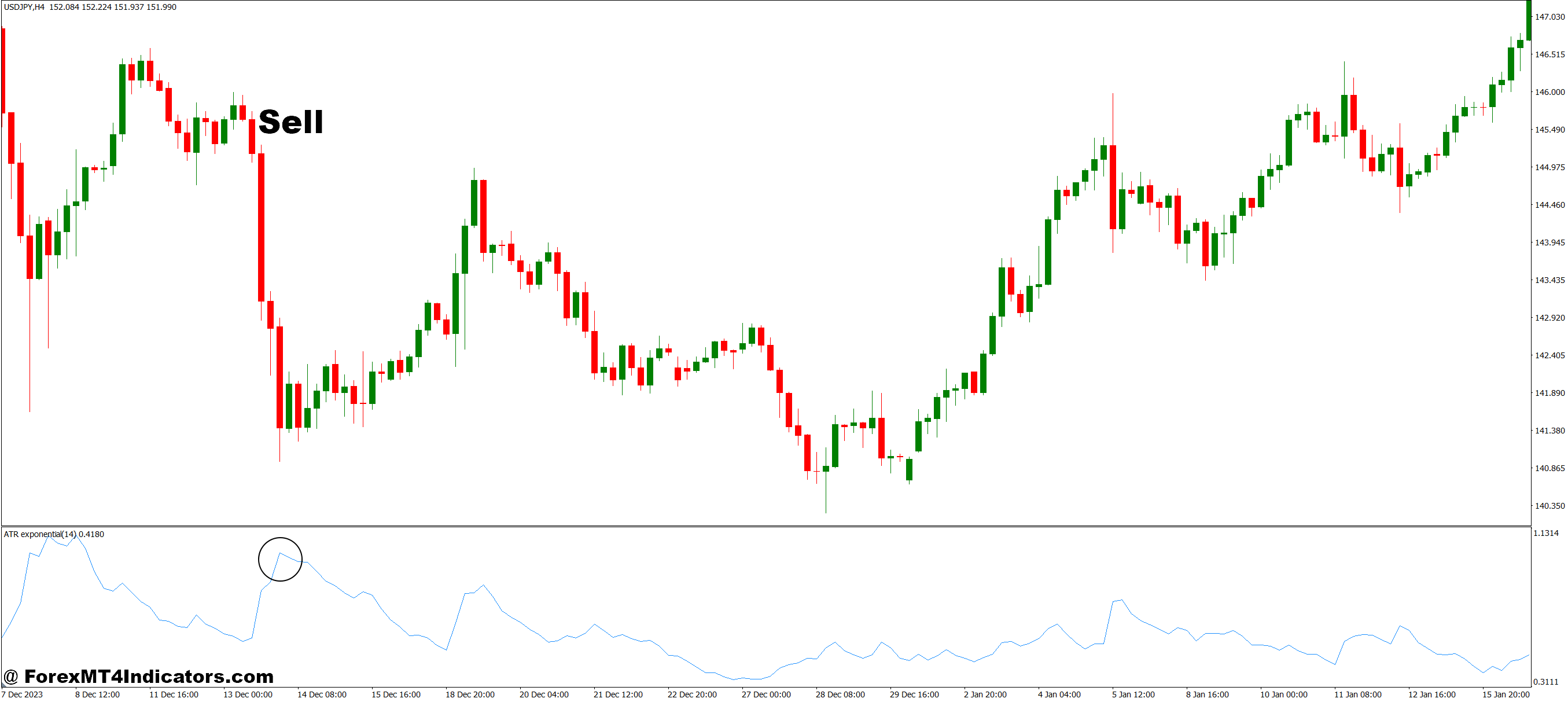

Sell Entry

- Confirm the market is in a downtrend using a trend filter.

- Watch for ATR Exponential values increasing during price declines, signaling stronger bearish momentum.

- Enter a sell trade when the price breaks below a support level with rising ATR Exponential values.

- Place the stop-loss above the recent swing high or according to the ATR value.

- Take profit at the next support level or follow a risk-to-reward ratio.

Conclusion

The ATR Exponential MT4 Indicator bridges the gap between standard volatility analysis and real-world trading needs. By offering faster, more accurate insights, it helps traders reduce risks and improve decision-making. Whether someone is new to trading or already experienced, this indicator can be a reliable companion for navigating volatile markets with confidence.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.