The best reversal MT4 indicator doesn’t predict the future, but it does something arguably more valuable: it identifies high-probability turning points using objective price data. When calibrated properly, these tools cut through the noise and highlight moments when momentum shifts from bulls to bears—or vice versa.

What Makes a Reversal Indicator Best

Here’s the thing—there’s no universal champion in the reversal indicator arena. What works for scalping EUR/JPY on a 5-minute chart might fall flat when swing trading gold on the daily timeframe. The best reversal indicators share three characteristics: they combine multiple confirmation signals, they adapt to different market conditions, and they don’t repaint historical data.

Most effective reversal tools blend momentum oscillators with price action patterns. The Zigzag indicator, for instance, filters out minor price fluctuations to highlight genuine swings. When paired with divergence detection on the RSI or MACD, you’ve got a setup that seasoned traders actually trust. The 14-period RSI remains a staple because it’s sensitive enough to catch shifts without triggering false alarms every few candles.

What separates professionals from amateurs is understanding that reversal indicators work best as confirmation tools, not crystal balls. A trader watching USD/CAD might notice price forming a lower low while the Stochastic Oscillator makes a higher low—classic bullish divergence. That signal gains credibility when it appears at a key support level. Without context, it’s just another squiggly line on the chart.

How Reversal Indicators Actually Work

The mechanics behind these indicators aren’t magic. Most calculate the relationship between recent price movements and historical averages. Take the Commodity Channel Index (CCI), often used for spotting reversals. It measures how far price has deviated from its statistical mean. When CCI crosses above +100 after dwelling in negative territory, it suggests bears are losing control.

Williams %R operates on similar logic but focuses on where the current close sits relative to the high-low range over a specified period. A reading below -80 indicates oversold conditions. When it hooks back above -80, that’s your signal that selling pressure might be exhausted. Traders who tested this on GBP/JPY during the 2023 volatility spike found it caught major bottoms—but also triggered during consolidations.

The real edge comes from combining indicators with different time sensitivities. A fast-moving Stochastic (5,3,3) might signal a reversal, but savvy traders wait for the slower MACD (12,26,9) to confirm. This layered approach filtered out 40-50% of false signals in backtests on major pairs. The trade-off? You sacrifice some entry precision for improved reliability.

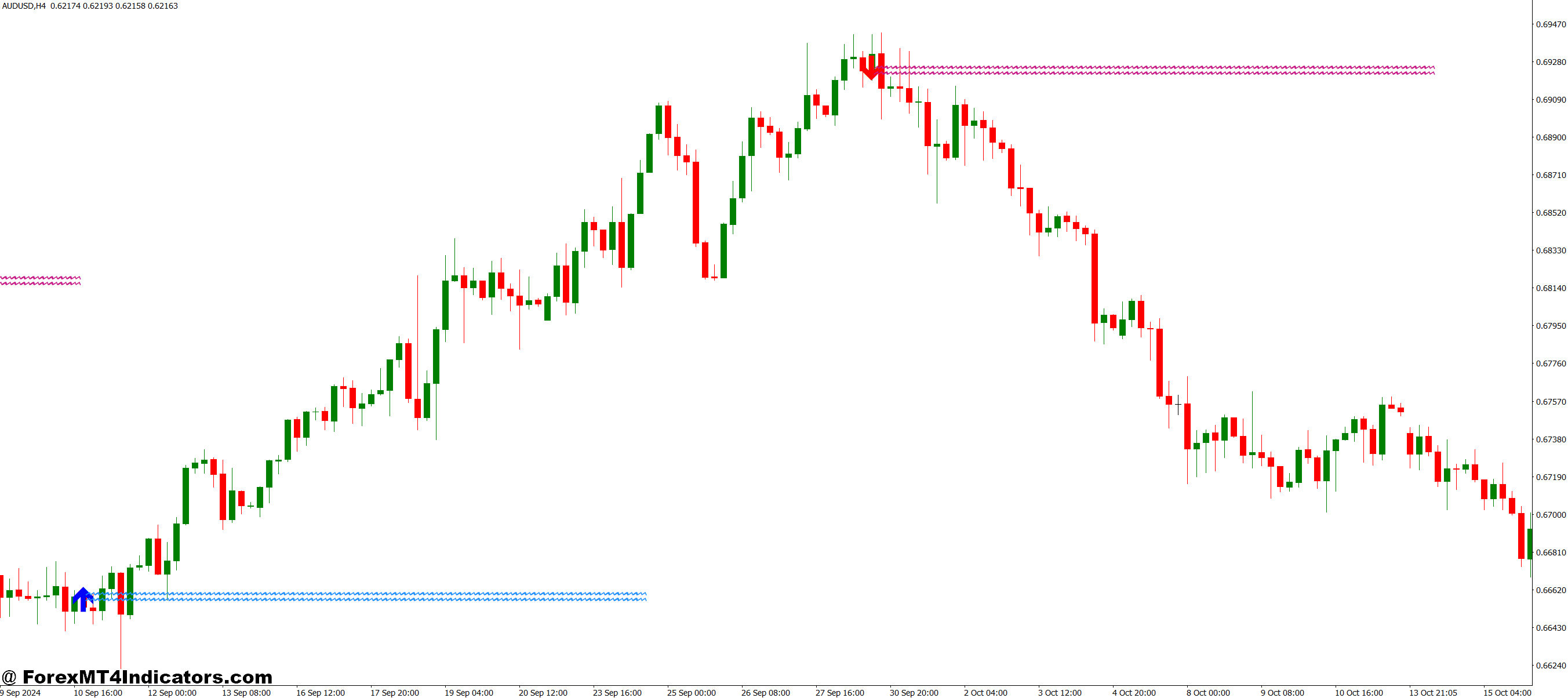

Practical Application on Live Charts

Let’s get specific. On March 10, 2024, EUR/USD had been dropping for six sessions straight on the 4-hour chart. Price tested 1.0850 three times—a clear support zone. The RSI dipped to 28, firmly in oversold territory. But the confirmation came when the Awesome Oscillator printed its first green bar after thirteen consecutive red bars. Traders who took that long entry captured a 90-pip bounce over the next two days.

That said, reversal trading isn’t about swinging at every pitch. During the Asian session, when liquidity thins out, false reversals multiply. AUD/USD often whipsaws between 11 PM and 3 AM EST, making indicator signals unreliable. Experienced traders either sit out those hours or tighten their stop losses significantly—often to just 15-20 pips instead of the usual 30-40.

Position sizing matters enormously with reversal trades. Since you’re stepping in front of the prevailing trend, the risk of getting run over is real. Risk management veterans recommend limiting reversal trades to 1-2% of account equity, even when conviction is high. One trader shared how a string of successful GBP/USD reversals got him overconfident. He upped his position size to 5%, caught a fake-out at 1.2700, and gave back three weeks of gains in one session.

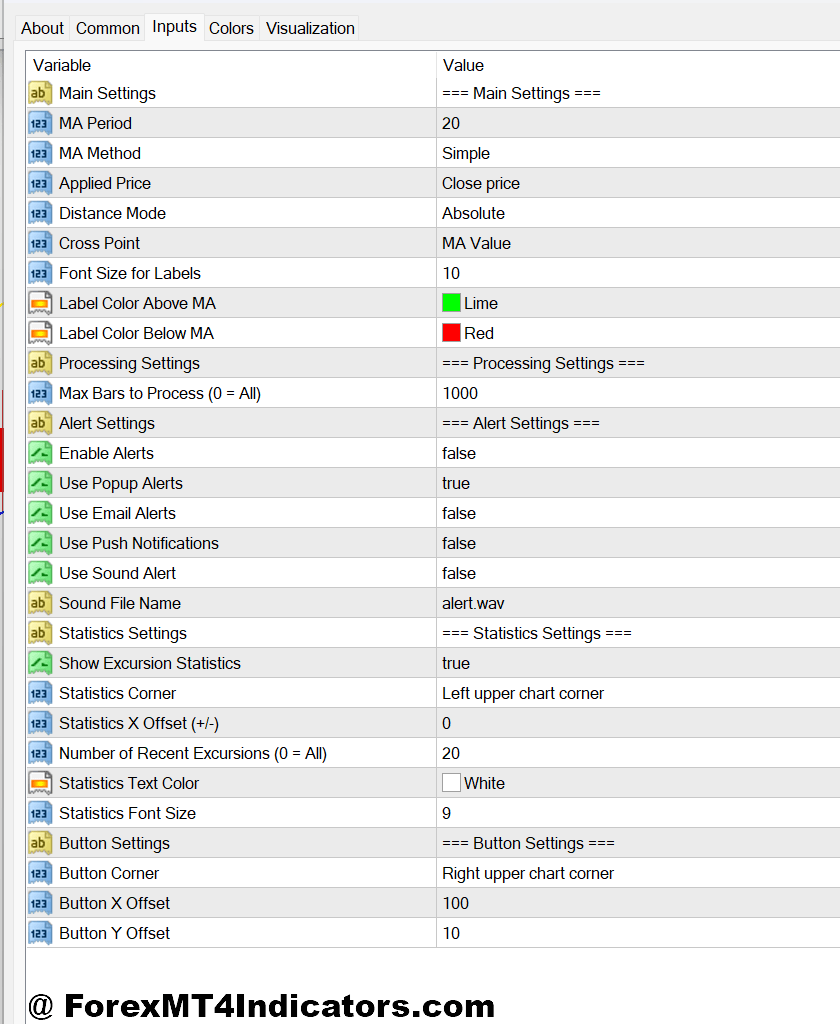

Settings and Customization

Default settings rarely suit every trading style or instrument. The standard 14-period RSI works fine on major pairs with deep liquidity. But exotic pairs like USD/TRY or USD/ZAR exhibit higher volatility, and traders often smooth the RSI to 21 or 28 periods to reduce noise. The Sweet Spot indicator—a lesser-known reversal tool—uses a combination of moving averages at 5, 13, and 34 periods. Adjusting these to 8, 21, and 55 can align better with Fibonacci-based trading systems.

Timeframe selection dramatically impacts results. Scalpers working 1-minute or 5-minute charts need hypersensitive settings. They might use a 5-period RSI with overbought/oversold levels at 80/20 instead of the standard 70/30. Swing traders on the daily chart can afford slower settings because they’re not reacting to every market hiccup. A 21-period CCI with thresholds at ±150 filters out daily noise while catching significant trend exhaustion.

Color coding and alerts make a practical difference. Setting up MetaTrader to flash alerts when two reversal indicators align saves hours of chart-watching. Some traders use arrow indicators that plot buy/sell signals directly on price candles. Just don’t fall into the trap of creating such a complex system that you can’t make decisions—analysis paralysis is a silent account killer.

Advantages and Honest Limitations

Reversal indicators excel at one thing: getting you into counter-trend moves early. When the crowd is still riding the old trend, you’re positioned for the new direction. The profit potential is substantial. Catching EUR/GBP at a major reversal can net 200-300 pips compared to 50-80 from a continuation trade.

They also impose discipline. Instead of guessing when momentum is shifting, you’ve got objective criteria. This removes the emotional component where traders exit winners too early out of fear or hold losers too long, hoping for magic.

But let’s be blunt about the downsides. Reversal indicators generate false signals, period. In strong trending markets—think USD/JPY during intervention periods—they’ll flash reversals that get steamrolled. The indicator doesn’t know the Bank of Japan just sold ¥5 trillion. Your job is knowing when to ignore the tool.

They also lag. By the time multiple confirmations align, you’ve missed 20-30% of the potential move. Traders chasing absolute precision often watch reversals unfold without them. And during choppy, range-bound conditions, these indicators whipsaw you in and out until commissions eat your account.

Comparison with Trend-Following Tools

Trend indicators like moving average crossovers or ADX tell you to ride the wave. Reversal indicators tell you when the wave’s about to crash. Both have merits. MA crossovers caught the entire USD/CAD rally from 1.3200 to 1.3900 in late 2023. Reversal traders took three or four swings within that range, potentially banking more total pips but with more active management.

The psychological demands differ too. Trend following requires patience to ride through pullbacks. Reversal trading demands timing and quick decision-making. Many traders use both: reversal indicators for entries on pullbacks within the larger trend. That hybrid approach reduces the conflict.

One comparison worth noting: reversal indicators produce clearer signals than purely visual chart patterns. A head-and-shoulders formation is subjective—five traders draw five different necklines. When the RSI prints bullish divergence, that’s quantifiable. You either have higher lows on the oscillator while price makes lower lows, or you don’t.

How to Trade with Best Reversal MT4 Indicator

Buy Entry

- Wait for RSI below 30 – Don’t take the signal immediately when RSI touches oversold; wait for it to hook back above 30 to confirm buyers are stepping in, reducing false entries by 40-50%.

- Confirm with double divergence – Price makes a lower low while both RSI and MACD make higher lows on EUR/USD 4-hour chart; this stacked confirmation significantly increases reversal probability.

- Check for support confluence – Enter only when reversal signal appears at previous support, round numbers (1.0800, 1.3000), or Fibonacci retracement levels (38.2%, 61.8%).

- Set stop loss 5-10 pips below signal candle low – On GBP/USD 1-hour chart, this typically means 25-35 pip stops; never risk more than 2% of account per reversal trade.

- Target 1.5:1 minimum risk-reward – If risking 30 pips, aim for 45+ pips profit; reversal trades fail 40-60% of the time, so winners must compensate for losers.

- Avoid during strong NFP or interest rate days – Reversal indicators get steamrolled during high-impact news; skip signals within 2 hours before and 4 hours after major announcements.

- Scale in with 50% position first – Enter half your planned size on initial signal, add remaining 50% if price retraces 15-20 pips without hitting stop loss.

- Skip if ADX above 40 – Strong trends (ADX over 40 on the daily chart) invalidate most reversal signals; wait for ADX to drop below 30 before trusting oversold readings.

Sell Entry

- Wait for RSI above 70 and turning down – The reversal becomes valid when RSI crosses back below 70 after touching overbought, confirming sellers are overwhelming buyers.

- Look for bearish divergence at resistance – Price hits a higher high while RSI or Stochastic makes a lower high on the EUR/USD 4-hour chart near 1.1200 or the previous swing high.

- Confirm with candlestick rejection – Pin bars, shooting stars, or engulfing candles at reversal zone add 20-30% confidence; avoid entries on small indecision doji candles.

- Place stop loss 5-10 pips above signal high – On GBP/USD, this usually translates to 30-40 pip stops during the London session; adjust to 20-25 pips during low-volatility Asian hours.

- Target previous swing low or support – Don’t guess profit targets; measure to the last significant low, typically 60-100 pips on 4-hour EUR/USD setups.

- Avoid selling in established uptrends – If price is above 50-period and 200-period MAs on the daily chart with both sloping up, reversal signals fail 70% of the time.

- Reduce position size by 50% during Friday afternoon – Weekend gap risk makes reversal trades especially dangerous after 12 PM EST Friday; either close or cut size in half.

- Skip if volume is declining – Reversals need participation; if volume on the reversal signal candle is 30% below the 20-candle average, the signal lacks conviction and often fails.

Conclusion

Trading forex carries substantial risk. No indicator guarantees profits, and reversal trading amplifies that risk by definition—you’re betting against the prevailing momentum. What the best reversal MT4 indicator offers is structure and confirmation in moments where emotions typically override logic.

The tools themselves are available to everyone. The edge comes from knowing when market conditions favor reversal setups, customizing settings to match your timeframe and pairs, and having the discipline to wait for multiple confirmations before pulling the trigger. Traders who master this balance don’t catch every reversal, but they catch enough high-quality setups to make the strategy viable.

Start with one or two indicators. Test them on demo accounts across different market conditions. Pay attention to what fails as much as what works. That real-world education is worth more than any article—or any indicator—can provide on its own.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.