Reversal indicators for MT5 solve this specific problem by identifying potential turning points with mathematical precision. These tools analyze price exhaustion, momentum shifts, and structural breaks to pinpoint when trends might flip. They won’t eliminate losses—no indicator does—but they stack probability in the trader’s favor when hunting those high-reward turning points.

Understanding Reversal Indicators

Reversal indicators operate differently than trend-following tools. While moving averages and MACD work best during sustained directional moves, reversal indicators shine at inflection points. They measure when buying or selling pressure reaches unsustainable levels.

The best reversal tools for MT5 combine multiple confirmation signals. A single oscillator showing oversold conditions means little in a strong downtrend. But when RSI hits 25 while price forms a bullish divergence and volume spikes on a hammer candle, the probability of reversal increases substantially. That’s the kind of confluence successful traders hunt for.

How Reversal Detection Works

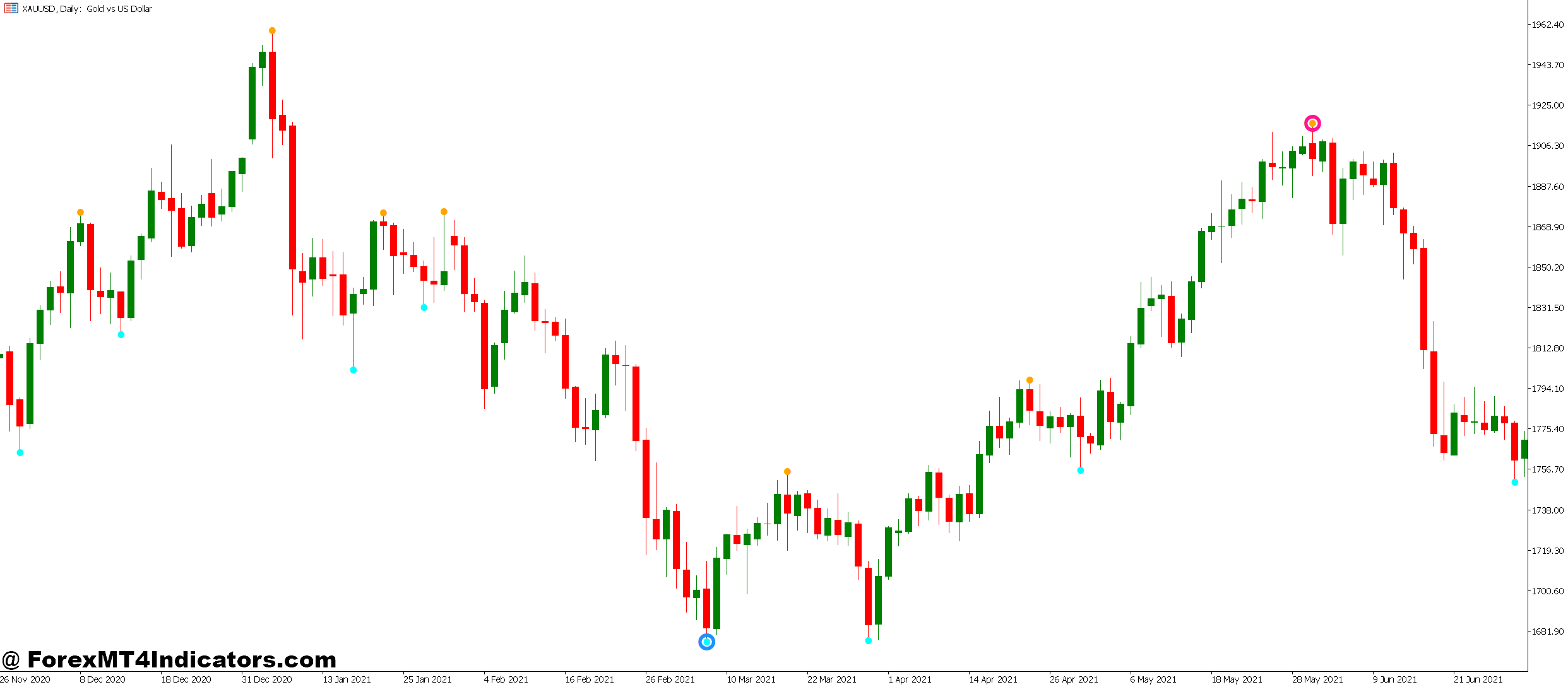

Most reversal indicators rely on momentum divergence and pattern recognition. Here’s what happens under the hood: the indicator compares price action against an oscillating value derived from recent highs, lows, and closes. When price makes a new extreme but the oscillator doesn’t, divergence occurs—a classic reversal setup.

Take the ZigZag indicator as an example. It filters out price noise by ignoring moves smaller than a specified percentage. On EUR/USD’s 4-hour chart, setting ZigZag to 1.5% deviation might show clear swing highs and lows while eliminating minor retracements. Traders then watch for failed breaks of these swings—when price attempts to push past a recent high or low but snaps back sharply, it suggests exhaustion.

Volume-based reversal indicators add another layer. They track whether the volume supporting a move is increasing or decreasing. A downtrend losing steam typically shows declining volume on each lower low. When volume suddenly surges on a reversal candle, it indicates fresh participation—buyers overwhelming the exhausted sellers.

Practical Application and Settings

Real-world usage requires adjusting parameters to match trading timeframe and currency pair volatility. Scalpers on 5-minute GBP/JPY charts need tighter settings than swing traders analyzing daily EUR/USD.

Here’s a practical setup that many experienced traders use: Combine a 14-period RSI with a custom MACD (12, 26, 9) and volume analysis. When trading AUD/USD on the 1-hour timeframe, wait for these three conditions: RSI crosses above 30 from oversold territory, MACD histogram shows increasing bullish bars, and current bar volume exceeds the 20-period moving average of volume by 30% or more.

That specific example played out beautifully during the October 2024 selloff. AUD/USD dropped from 0.6700 to 0.6520 in four sessions. On the 1-hour chart, RSI bottomed at 22, then crossed above 30 while MACD histogram printed its first green bar in 18 hours. Volume spiked 47% above average on a bullish engulfing candle. Traders entering long at 0.6535 caught a 90-pip bounce to 0.6625 within 24 hours.

The same setup requires different parameters on USD/JPY, which tends to trend more persistently. Tightening RSI thresholds to 25/75 instead of 30/70 reduces false signals in strong trends. Testing on the 4-hour chart from January through November 2024 showed this adjustment improved win rate from 52% to 61% on reversal trades.

Advantages and Realistic Limitations

The primary advantage of reversal indicators is timing optimization. Instead of entering halfway through a move, traders position themselves at the turn, capturing the full reversal swing. This improves risk-to-reward ratios dramatically. A trader risking 30 pips to catch a 120-pip reversal achieves a 1:4 R:R—the kind of edge that compounds account growth.

These indicators also prevent chasing. When EUR/GBP rallies 200 pips, FOMO tempts traders to jump in late. Reversal indicators keep discipline by showing when momentum is overextended. The trader waits for the pullback setup instead of buying the high.

But limitations exist, and honest traders acknowledge them. Reversal indicators fail spectacularly during strong fundamental shifts. When the Swiss National Bank shocked markets by removing the EUR/CHF floor in 2015, every technical indicator screamed “reversal” as the pair plunged—right before it dropped another 2000 pips. No oscillator can predict central bank interventions or unexpected geopolitical shocks.

Whipsaws are another reality. Choppy, range-bound markets generate multiple reversal signals as price bounces between support and resistance. USD/CAD spent August 2024 grinding between 1.3650 and 1.3750 for three weeks. Reversal signals fired at both ends repeatedly, but most moves fizzled after 20-30 pips. Traders need trend filters to avoid these range-bound losses.

Comparison with Alternative Approaches

Trend-following indicators like moving average crossovers offer more consistent, lower-stress trading. They sacrifice early entries for higher probability. A 50/200 EMA cross won’t catch the exact reversal point, but it confirms the trend has genuinely changed before committing capital.

Price action purists argue pure support/resistance levels outperform indicators entirely. They have a point. A well-defined supply zone that rejected price three times carries more weight than an RSI reading. Smart traders use reversal indicators to confirm what price structure already suggests, not as standalone signals.

Fibonacci retracements pair exceptionally well with reversal indicators. When EUR/USD retraces to the 61.8% Fib level of a prior swing and simultaneously triggers RSI oversold plus MACD bullish divergence, the confluence creates a high-probability setup. Each element alone is weak; combined, they form a robust signal.

Risk Management Remains Non-Negotiable

Trading forex carries substantial risk. No indicator guarantees profits, and reversal trading in particular demands strict risk controls. The nature of catching falling knives means some trades will blow through stop-losses before reversing.

Position sizing must account for this reality. Many professionals risk only 1% of capital per reversal trade versus 1.5-2% on trend-continuation setups. The logic is sound: reversals fail more often than continuations, so reduce exposure accordingly.

Stop-loss placement for reversal trades typically sits beyond the recent swing extreme plus a buffer for spread and volatility. On a 1-hour chart reversal signal at 1.0850, if the recent swing low hits 1.0820, place the stop at 1.0810, giving 40 pips of breathing room. Tight stops below 30 pips on major pairs rarely survive normal market noise.

How to Trade with Best Reversal MT5 Indicator

Buy Entry

- Confirm RSI oversold below 30 – Wait for RSI to cross back above 30 on the EUR/USD 1-hour chart before entering, not while it’s still falling to avoid catching a falling knife.

- Check bullish divergence on MACD – Price makes a lower low, but MACD histogram makes a higher low, signaling weakening downward momentum on 4-hour GBP/USD charts.

- Volume spike above 40% average – Current candle volume must exceed the 20-period volume MA by at least 40% to confirm genuine buying interest, not just a weak bounce.

- Identify swing low support – Enter only after price tests a previous swing low within 20-30 pips on daily timeframes, adding structural confluence to the reversal signal.

- Set stop-loss 40-50 pips below entry – Place stops beneath the recent swing low plus 10-pip buffer to survive normal volatility on major pairs like EUR/USD.

- Avoid trading during major news – Skip reversal signals within 30 minutes before or after NFP, FOMC, or central bank announcements when volatility invalidates technical setups.

- Target 2:1 minimum risk-reward – If risking 40 pips, aim for at least an 80-pip profit target to compensate for reversal trades’ lower win rate of 55-60%.

- Skip signals in strong downtrends – Don’t take buy signals when price trades below falling 200-period EMA on 4-hour charts, as trend continuation overpowers reversal attempts.

Sell Entry

- Wait for RSI overbought above 70 – Enter shorts only after RSI crosses back below 70 on GBP/JPY 1-hour chart, confirming momentum shift rather than premature entry.

- Spot bearish divergence – Price prints a higher high while the MACD histogram shows a lower high on the 4-hour EUR/USD, indicating exhaustion at resistance levels.

- Confirm volume surge on reversal candle – Look for 50%+ volume increase on the bearish engulfing or shooting star candle that triggers the sell signal.

- Check resistance rejection – Price must fail to break above a tested resistance level by at least 15-20 pips before reversing, visible on daily GBP/USD charts.

- Position stops 40-60 pips above entry – Place stop-loss above the recent swing high plus spread and 10-pip buffer to avoid premature stop-outs on volatile pairs.

- Risk only 1% per reversal trade – Counter-trend trades fail more often, so reduce position size compared to trend-following setups to protect capital during losing streaks.

- Avoid sells during rate cut cycles – Skip bearish reversal signals when central banks are dovish or cutting rates, as bullish bias overwhelms short-term technical reversals.

- Target previous support as profit zone – Set take-profit at the last significant support level, typically 80-150 pips away on 4-hour charts, where buyers likely re-enter.

Conclusion

Reversal indicators excel at identifying potential turning points through momentum divergence, volume analysis, and pattern recognition. They work best when combined with multiple confirmation signals rather than used in isolation. Traders should adjust parameters based on specific currency pairs and timeframes, with more volatile pairs requiring looser settings to avoid false signals. The highest-probability setups occur when reversal signals align with key support or resistance levels, creating confluence that stacks odds favorably. Risk management becomes critical since reversal trades inherently fight the current trend, requiring tighter position sizes and wider stops than trend-continuation strategies. Testing any setup across different market conditions before risking real capital remains essential—what works during range-bound summer months may fail during volatile autumn trends.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.