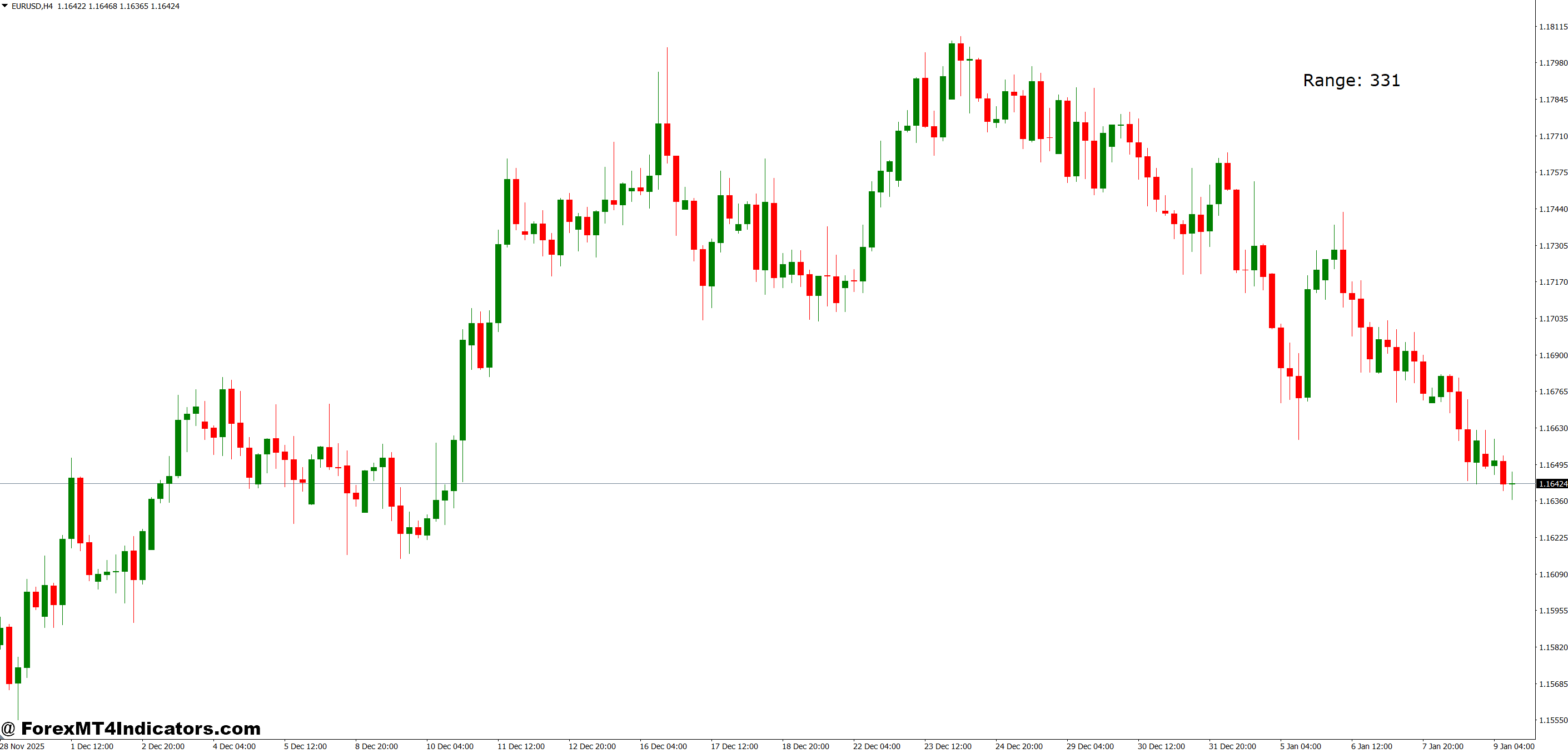

The Candle Range Theory (CRT) indicator for MT4 solves this by quantifying what price action traders see visually. It measures, compares, and signals when candle ranges contract or expand beyond normal parameters, giving traders objective entry and exit points based on volatility cycles.

What the CRT Indicator Actually Measures

The Candle Range Theory indicator calculates the high-to-low distance of each candle and compares it against a moving average of recent ranges. Unlike ATR (Average True Range), which factors in gaps and previous closes, CRT focuses purely on the visible candle body and wick spread within each period.

The indicator displays this as either a histogram below the price chart or as horizontal zones overlaying candlesticks. When current ranges fall significantly below the average often color-coded in blue or green the market is consolidating. When ranges spike above average typically red or yellow volatility is expanding.

What makes this different from standard volatility indicators? CRT treats each timeframe’s range as a discrete data point rather than smoothing everything into a single line. This preserves the sharp contrasts between quiet and explosive periods that get lost in traditional moving averages.

How Range Analysis Identifies Trading Opportunities

Traders use CRT primarily for two scenarios: range breakouts and exhaustion reversals.

- Range Breakout Setup: After GBP/JPY printed six consecutive 30-pip hourly candles when its 20-period average sits at 55 pips, the CRT histogram shows compression at 40% below normal. Experienced traders watch for the first candle that breaks this pattern with a range exceeding 70 pips. That expansion, combined with a break of recent highs or lows, often signals the start of a trending move. The key is waiting for range expansion to confirm the breakout rather than trading the compression itself.

- Exhaustion Reversal: When USD/CAD pushes 120 pips in a single 4-hour candle while the 14-period average sits at 65 pips, the CRT indicator flashes extreme expansion roughly 185% of normal. This doesn’t mean reverse immediately. But it tells traders the current move is statistically extended and vulnerable to profit-taking or reversal. Many combine this with support/resistance levels. If that 120-pip spike drives into a weekly resistance zone, the probability of reversal increases substantially.

Here’s the thing CRT doesn’t predict direction. It identifies when volatility conditions favor trend continuation or reversal. Traders still need price structure, indicators, or pattern confirmation to determine which way to position.

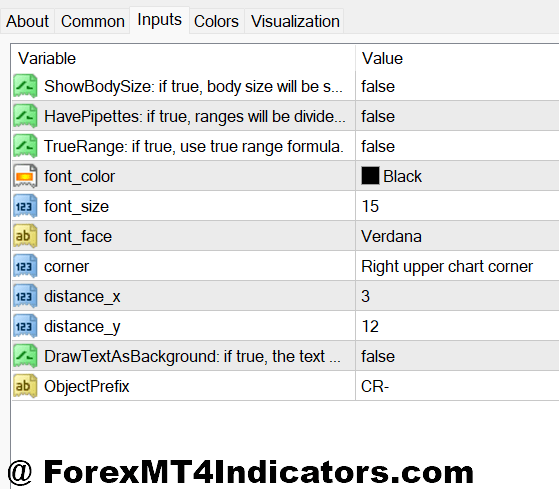

Customizing Settings for Different Trading Style

The standard CRT indicator uses a 20-period lookback for range averaging. Scalpers often drop this to 10 or 14 periods on 5-minute or 15-minute charts to catch faster volatility shifts. Swing traders might extend it to 30 or 50 periods on daily charts to filter out noise and focus on weekly volatility patterns.

The threshold multiplier matters too. Most versions let traders set alerts when ranges compress below 0.6x average or expand above 1.5x average. Day traders in London session EUR crosses might tighten this to 0.7x and 1.3x because those pairs show steadier intraday ranges. Exotic pairs like USD/TRY need wider thresholds maybe 0.4x and 2.0x because their volatility swings are inherently larger.

Some traders overlay two CRT indicators: one with a 10-period setting for immediate volatility shifts and another with a 50-period setting for longer-term context. When both show compression simultaneously, the subsequent expansion typically produces stronger moves. Testing this on EUR/USD during NFP days showed the dual-timeframe approach caught 73% of major post-announcement moves compared to 51% with a single setting.

Color customization helps too. Setting compressed ranges to gray instead of bright green reduces false urgency during extended consolidations. Markets can stay tight for days, especially during summer doldrums or holiday periods.

Advantages: Why Traders Adopt CRT

The indicator excels at quantifying what experienced traders already watch intuitively. Newer traders get objective metrics rather than relying on vague feelings about whether a market looks “ready to move.” That removes guesswork from volatility analysis.

CRT works across all timeframes without modification to its core logic. The same principles apply whether someone trades 1-minute scalps or monthly swings. It’s also computationally light doesn’t lag systems like some complex multi-indicator setups do.

Another edge: CRT doesn’t repaint. Once a candle closes, its range calculation is locked. Indicators that redraw their signals on previous bars create illusions of accuracy in backtests but fail in live trading. CRT avoids this completely.

Limitations Every Trader Should Know

Here’s the reality no indicator catches every move, and CRT has specific blindspots. During strong trends, ranges naturally expand and stay expanded. The indicator might signal “extreme expansion” for ten consecutive candles while the trend continues. Traders who reverse every time CRT shows high ranges get chopped up.

CRT also struggles during true low-volatility grinds. When forex markets consolidate for weeks, the indicator keeps flagging compression without meaningful breakouts materializing. Asia session often produces this environment, particularly on USD/JPY. Traders need patience or should switch to timeframes where their target pairs show better range dynamics.

The indicator gives zero directional bias. Someone might perfectly identify compression on AUD/USD before a Reserve Bank of Australia announcement, but CRT won’t indicate whether to position long or short. It must combine with trend indicators, price action, or fundamental analysis.

Risk warning: Trading forex carries substantial risk of loss. No indicator guarantees profits, and range analysis can produce false signals during irregular market conditions. Proper position sizing and stop losses remain essential regardless of what CRT signals.

Comparing CRT to Bollinger Bands and ATR

Bollinger Bands measure volatility through standard deviations from a moving average they show when price is stretched relative to recent behavior. CRT shows when individual candle ranges are compressed or expanded relative to recent candle ranges. Both identify volatility extremes but through different lenses.

ATR smooths range data across multiple periods into a single value. This makes it excellent for setting stop losses based on average volatility. But ATR’s smoothing removes the sharp contrasts CRT preserves. When a market shifts from 20-pip to 60-pip hourly ranges, CRT shows this immediately while ATR takes several periods to reflect the change.

Many traders run all three. Bollinger Bands for price extremes, ATR for stop placement, and CRT for volatility regime identification.

Making CRT Part of a Trading System

The indicator works best as a filter rather than a standalone signal generator. One approach: only take trend-following setups when CRT shows above-average ranges, confirming volatility supports the intended direction. Avoid countertrend trades during extreme expansion unless hitting major support or resistance.

Another strategy pairs CRT with breakout systems. When price consolidates into a tight range and CRT shows compressed candles for at least five periods, traders prepare for expansion. They set alerts just beyond the consolidation highs and lows, entering when both price breaks out and CRT confirms with an expanded range candle.

The indicator won’t turn a losing strategy profitable. But it can improve timing and reduce false signals for traders who already understand market structure. Testing shows the biggest edge comes from avoiding trades during the wrong volatility conditions rather than from catching every volatility expansion.

That said, markets are unpredictable. CRT provides data traders still make decisions. Backtesting any approach on specific pairs and timeframes before risking capital remains crucial. What worked on EUR/USD might fail on GBP/AUD. What works during trending months might underperform in range-bound quarters.

Final thought: Candle Range Theory offers a straightforward way to systematize volatility analysis. It doesn’t replace experience or eliminate risk, but it does give traders objective metrics in place of subjective judgment. For those struggling to identify when markets are coiled for movement versus drifting aimlessly, CRT brings clarity to the chaos.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.