The DiNapoli and Fibos MT4 Indicator is designed to merge two powerful trading concepts: Fibonacci retracements and Joe DiNapoli’s strategies. Fibonacci levels help traders understand where price may pause, reverse, or continue. DiNapoli’s methods refine these levels, giving them more precision in real-world trading. Together, they form a tool that not only maps out key support and resistance but also helps identify areas where traders can plan entries and exits with higher probability.

How It Works in Practice

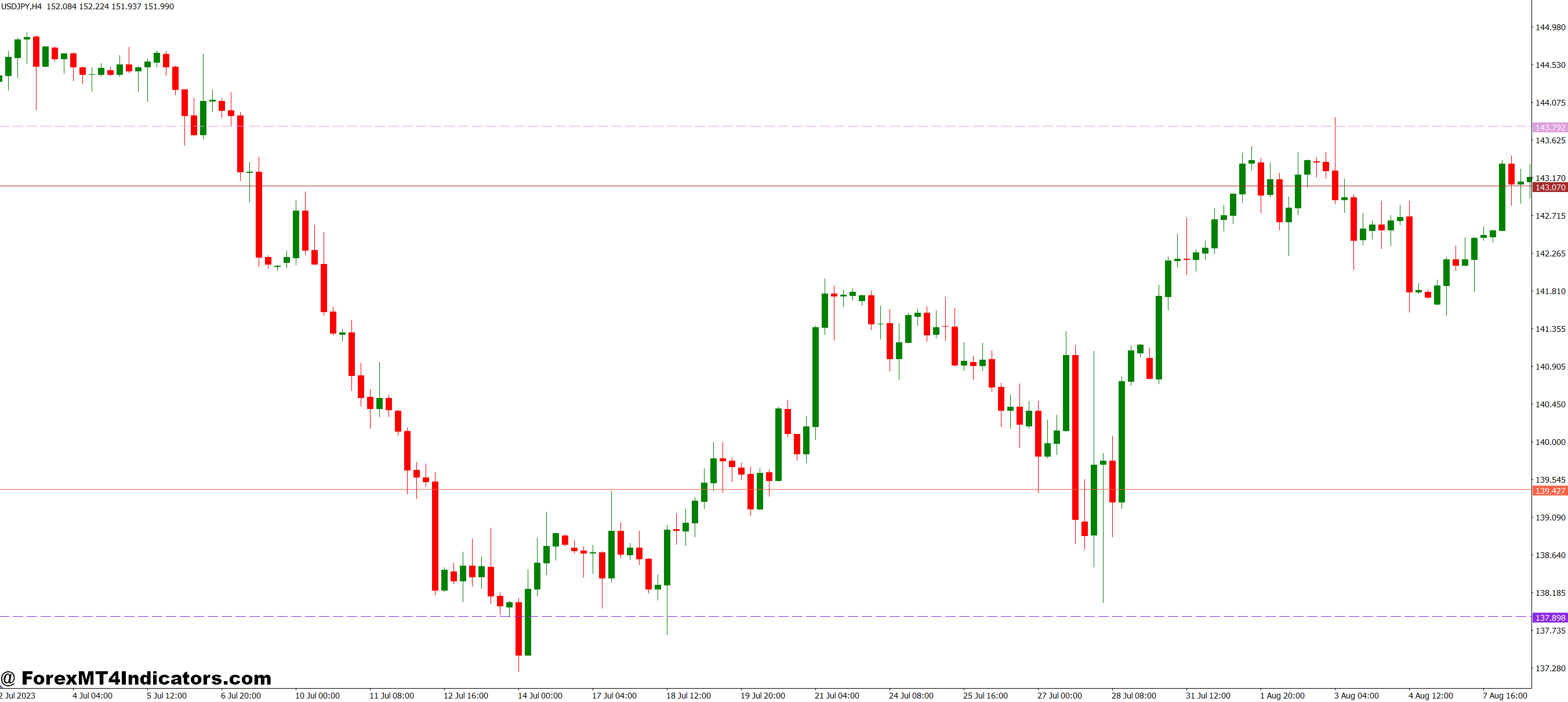

When applied on a chart, the indicator automatically plots Fibonacci levels based on recent price swings. These levels are adjusted according to DiNapoli’s techniques, making them more reliable than standard Fibonacci tools. Traders can use these zones to anticipate turning points in the market. For example, if price pulls back to a DiNapoli-adjusted level during a trend, it can signal a potential continuation. On the other hand, if the market struggles at these levels, it may point to a reversal. This clear structure helps traders cut through market noise and focus on meaningful price action.

Benefits for Everyday Traders

One of the biggest advantages of this indicator is its simplicity. Traders don’t have to calculate levels manually, which saves time and reduces errors. It also adapts across multiple timeframes, making it suitable for scalpers, day traders, and swing traders alike. By combining Fibonacci analysis with DiNapoli’s fine-tuned approach, it helps traders avoid random entries and stick to a proven framework. This not only improves consistency but also builds confidence in decision-making.

How to Trade with DiNapoli and Fibos MT4 Indicator

Buy Entry

- Wait for price to be in an overall uptrend (higher highs and higher lows).

- Look for price to pull back toward a DiNapoli Fibonacci retracement level (e.g., 38.2%, 50%, or 61.8%).

- Confirm bullish candlestick signals (like a strong bullish engulfing or pin bar) at or near the Fib level.

- Enter a buy trade when price bounces from the support zone.

- Place a stop loss just below the next lower Fib level.

- Take profit at the next Fibonacci extension or resistance area.

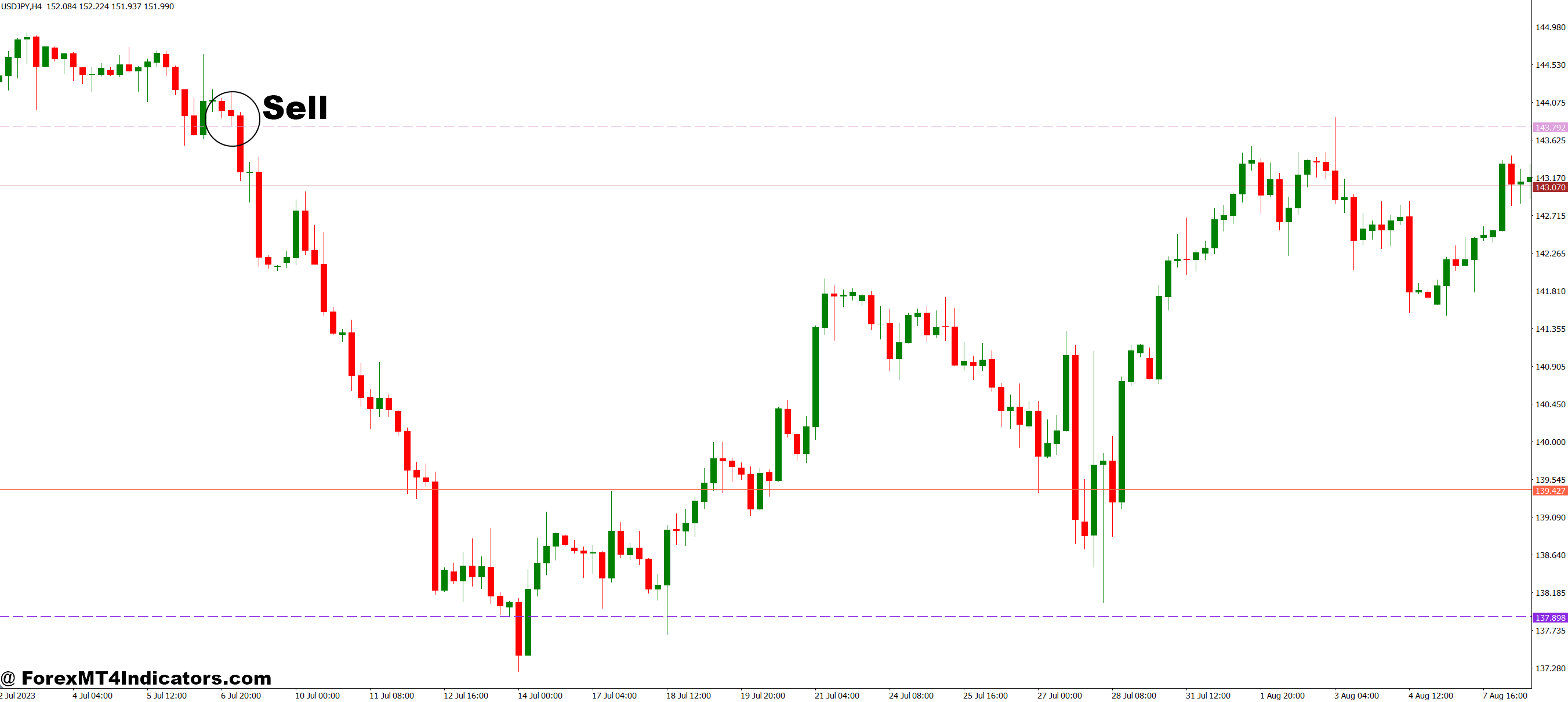

Sell Entry

- Ensure the market is in a clear downtrend (lower highs and lower lows).

- Wait for price to retrace upward to a DiNapoli Fibonacci level.

- Confirm with bearish candlestick signals (such as a bearish engulfing or rejection wick).

- Enter a sell trade when price rejects the resistance zone.

- Place a stop loss just above the next higher Fib level.

- Set your take profit at the next Fibonacci extension or support level.

Conclusion

The DiNapoli and Fibos MT4 Indicator gives traders a practical way to merge traditional Fibonacci tools with professional-level strategies. By highlighting accurate support and resistance zones, it helps traders spot better opportunities, manage risk, and avoid emotional trading. For anyone looking to refine their strategy and trade with more structure, this indicator can be a powerful addition to their MT4 toolbox.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.