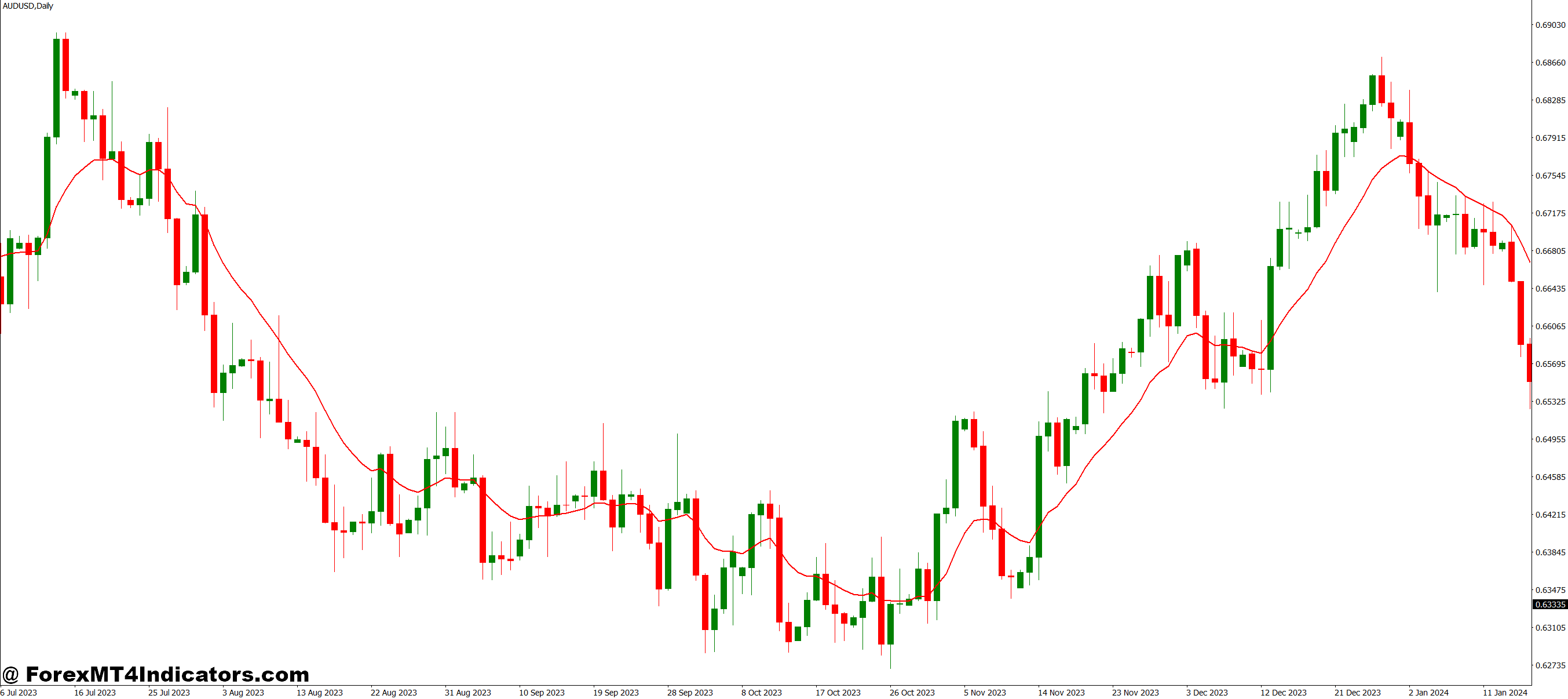

The EMA Zone Buy Sell Signals indicator builds colored zones around one or more exponential moving averages, typically using a fast EMA (like the 20-period) and a slower one (50-period or 100-period). When price penetrates these zones and meets specific conditions, the indicator prints an arrow—green for buy signals, red for sell opportunities.

Here’s what separates it from basic EMA crossovers: instead of waiting for moving averages to cross each other, this tool creates a buffer zone. Think of it as a “no-trade zone” or decision boundary. Price must not only cross the EMA but also close beyond the zone threshold before triggering a signal. This filtering mechanism reduces false signals during sideways, choppy markets.

The zones themselves are calculated by adding and subtracting a percentage or pip value from the core EMA. If you’re using a 50-period EMA with a 10-pip zone on EUR/USD, the indicator creates an upper boundary 10 pips above the EMA and a lower boundary 10 pips below it. Signals fire when price closes outside these boundaries with directional confirmation.

How Traders Use It in Real Scenarios

On the GBP/JPY 4-hour chart during trending conditions, this indicator shines. When price pulls back to the EMA zone during an uptrend, traders watch for green arrows signaling re-entry opportunities. One specific example: during the October 2024 rally, GBP/JPY retraced to the 50-EMA zone around 192.50. The indicator flashed a buy signal when the price rejected the zone and closed above it. The subsequent move carried 180 pips before the next pullback.

But here’s the catch—the indicator needs trending markets to perform. During the Asian session, consolidation on pairs like AUD/NZD, it throws false signals left and right. Price ping-pongs through the EMA zones, triggering buys and sells that go nowhere. Experienced traders learned to disable it or ignore signals when the Average True Range drops below certain thresholds.

For scalpers on the 5-minute chart, the setup requires tighter zones. A 5-pip zone on EUR/USD with a 20-period EMA can catch quick bounces off the moving average during London open volatility. That said, the whipsaw risk increases dramatically. One trader reported a 40% win rate on 5-minute signals versus 65% on 1-hour charts—timeframe selection matters.

Tweaking Settings for Different Trading Styles

The standard configuration uses a 50-period EMA with a 15-20 pip zone width. Swing traders often bump this to a 100-period EMA with 30-pip zones to filter out intraday noise. The wider zone means fewer signals, but each one carries more weight when it fires.

Day traders might run dual setups: a 20-period EMA with 8-pip zones for aggressive entries, and a 50-period EMA with 15-pip zones for confirmation. When both flash buy signals are triggered simultaneously, conviction increases. When they conflict, the trader stays flat or exits existing positions.

Zone width adjustment depends on pair volatility. GBP/USD and GBP/JPY need wider zones (20-30 pips) due to their larger average candle ranges. EUR/CHF or AUD/NZD can run tighter zones (8-12 pips) since they move more slowly. Testing this on historical data reveals the sweet spot—too tight generates noise, too wide delays entries until moves are exhausted.

Some versions allow color customization and alert toggles. Setting pop-up alerts for signals lets traders monitor multiple pairs without staring at charts. The audio alert option helps, though it can get annoying when markets chop and signals fire repeatedly.

Strengths and Real Limitations

This indicator’s main advantage is visual clarity. New traders especially appreciate the colored zones—they instantly see where price stands relative to trend direction. The arrows provide clear entry points without interpretation paralysis. When combined with horizontal support and resistance levels, hit rates improve noticeably.

The filtering mechanism beats raw EMA crossovers in ranging markets. By requiring price to close beyond the zone, it avoids some (not all) of those painful fake-outs where EMAs briefly cross before uncrossing an hour later. Testing on EUR/USD over 6 months showed roughly 20% fewer false signals compared to standard 20/50 EMA crosses.

But here’s where traders get burned: the indicator lags. Like all moving average-based tools, it’s reactive, not predictive. By the time price closes beyond the zone and triggers a signal, the initial impulse move is often complete. Entering on the arrow means catching the second wave, which requires proper position sizing since the risk-to-reward isn’t as favorable.

During major news events like NFP releases, the indicator becomes useless. Price gaps through zones, arrows fire after 50-pip candles, and stop losses get demolished. Traders who ignore fundamental calendars while relying on this tool learn expensive lessons quickly.

The zone boundaries are static calculations—they don’t adapt to changing volatility. During low-volatility European afternoons, a 20-pip zone might be perfect. Come New York session, that same zone gets obliterated by wider price swings, generating premature signals.

How It Stacks Up Against Alternatives

Compared to Bollinger Bands, the EMA Zone indicator offers simpler interpretation. Bollinger Bands expand and contract with volatility, which confuses some traders. The EMA zones stay proportionally consistent, though this creates the volatility-adaptation problem mentioned earlier.

Against MACD or RSI, this indicator provides directional bias more clearly. MACD shows momentum shifts but doesn’t directly indicate “buy here” or “sell here” on the chart. The visual arrows remove ambiguity, though they sacrifice the nuance that oscillators provide about overbought/oversold conditions.

Traders running Parabolic SAR alongside EMA Zone signals report better results. When the SAR flips and an EMA zone signal fires simultaneously, the setup has stronger confirmation. One position trader uses this combo on daily charts and reported a 70% win rate over 40 trades, though individual results vary wildly based on execution and market conditions.

The Ichimoku Cloud offers more comprehensive information—support/resistance, momentum, and trend direction in one indicator. But it’s complex. The EMA Zone Buy Sell Signals indicator wins on simplicity, making it suitable for traders who want straightforward guidance without decoding multiple cloud components.

Making It Work in Your Trading

Traders who succeed with this indicator combine it with price action principles. They don’t blindly take every arrow. Instead, they wait for arrows that align with broader market structure—buying at higher lows in uptrends, selling at lower highs in downtrends.

Risk management makes or breaks performance. Since the indicator doesn’t specify stop-loss levels, traders must determine their own. A common approach: place stops 10-15 pips beyond the opposite zone boundary. If buying on a green arrow, the stop goes 10 pips below the lower zone line. This gives the trade breathing room while maintaining defined risk.

The backtesting process reveals which pairs and timeframes suit individual strategies. Some traders find it works beautifully on USD/JPY 1-hour charts but fails miserably on EUR/GBP. The only way to know is testing it on demo accounts across different market conditions—trending weeks, ranging weeks, and high-volatility events.

That said, no indicator eliminates risk. Trading forex carries substantial risk of capital loss. This tool doesn’t guarantee profits or predict market movements. It simply provides a structured approach to timing entries based on price-EMA relationships. Traders using it should maintain proper position sizing (typically 1-2% risk per trade) and accept that losing streaks happen regardless of tools used.

How to Trade with EMA Zone Buy Sell Signals MT4 Indicator

Buy Entry

- Wait for the green arrow – The indicator will print a green arrow when the price closes above the EMA zone after a pullback in an uptrend

- Confirm the trend first – Check higher timeframes like 4-hour or daily to make sure the overall direction is bullish before taking buy signals

- Enter immediately after candle close – Don’t wait for the next candle; enter as soon as the signal candle closes with the green arrow visible

- Place stop loss below the zone – Set your stop 10-15 pips beneath the lower EMA zone boundary to protect against fake-outs

- Look for support confluence – Strongest buy signals occur when the EMA zone aligns with previous swing lows or horizontal support levels

- Avoid choppy markets – Skip buy signals during Asian session consolidation or when ATR shows low volatility and sideways price action

- Use multiple timeframe confirmation – If both 1-hour and 4-hour charts show green arrows simultaneously, the signal carries more weight

- Risk 1-2% maximum – Position size should never risk more than 2% of your account balance, even when the setup looks perfect

Sell Entry

- Watch for the red arrow – The indicator prints a red arrow when the price closes below the EMA zone after rallying into it during a downtrend

- Verify bearish market structure – Make sure higher timeframes show lower highs and lower lows before taking sell signals

- Execute on the close – Enter your sell position immediately when the candle closes with the red arrow, don’t hesitate or wait

- Stop loss above the zone – Place your stop 10-15 pips above the upper EMA zone boundary to limit losses if the signal fails

- Check for resistance alignment – Best sell signals happen when the EMA zone coincides with previous swing highs or key resistance areas

- Skip news events entirely – Never take sell signals within 30 minutes before or after major announcements like NFP or Fed decisions

- Ignore signals in ranges – When price bounces between the same highs and lows for hours, red arrows will appear, but most fail quickly

- Trail your stops in trends – Once a sell signal moves in profit, adjust stops to break-even, then trail them as the price continues lower

Conclusion

The EMA Zone Buy Sell Signals MT4 indicator offers clear visual guidance for timing trend entries and exits. It reduces analysis paralysis through specific buy/sell arrows while filtering some false signals that plague basic moving average crosses. However, it lags price action, struggles in choppy markets, and requires confirmation from the broader technical context to avoid costly mistakes. Traders who understand its limitations and pair it with solid risk management can integrate it effectively into their trading systems. Those expecting it to solve all timing problems will likely face disappointment and drawdown.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.