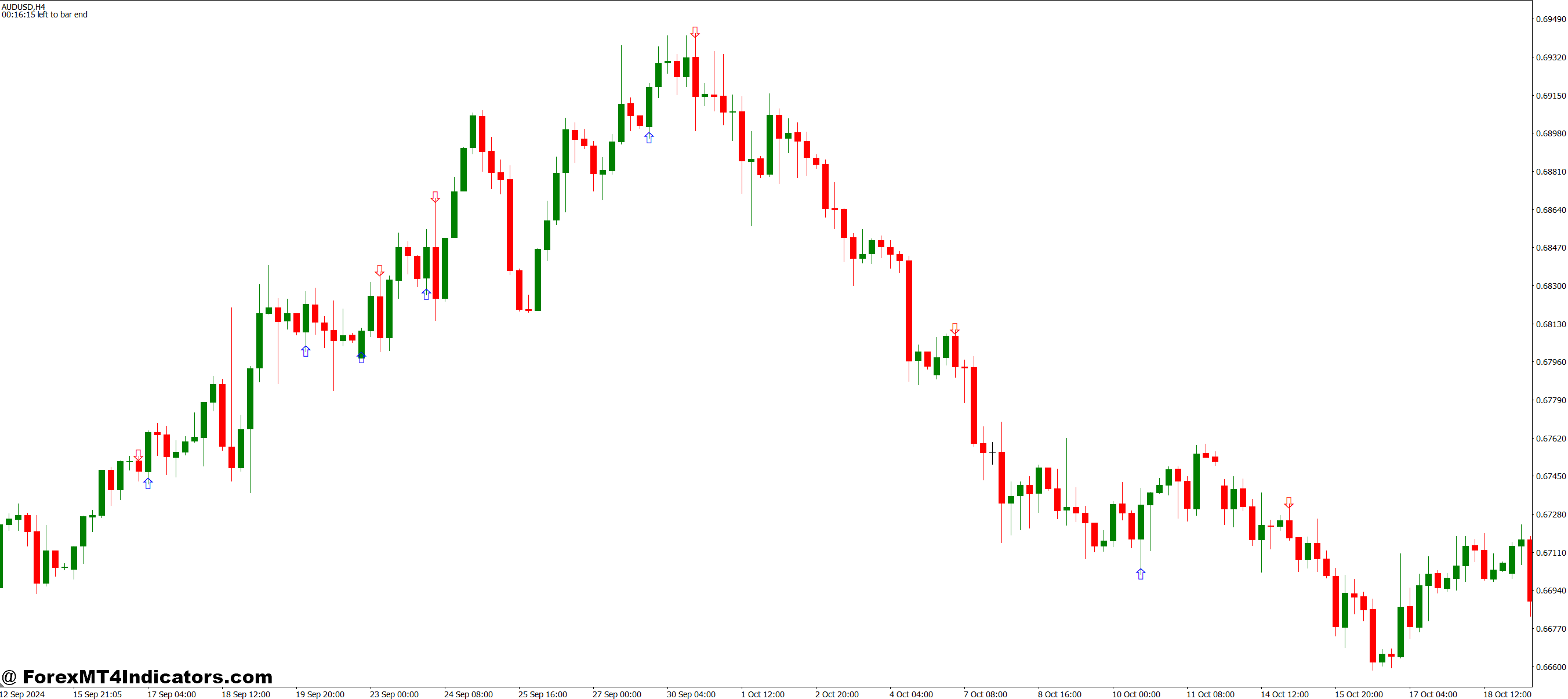

The Engulfing Candle MT4 Indicator solves this by automating the detection process. It scans price action in real-time, identifies valid bullish and bearish engulfing patterns, and alerts traders the moment they form. No more squinting at charts or questioning whether that candle really engulfed the previous one.

How the Engulfing Candle Indicator Actually Works

The indicator operates on a straightforward premise: it identifies when a candle’s body completely engulfs the previous candle’s body. For a bullish engulfing pattern, the current candle must open below the prior candle’s close and close above the prior candle’s open. Bearish engulfing patterns work in reverse—opening above and closing below.

What separates this indicator from manual scanning is precision. Human eyes might miss subtle engulfing patterns during fast markets or when monitoring multiple pairs. The algorithm checks every candle close systematically. When an engulfing pattern forms, the indicator places an arrow on the chart and can trigger audio alerts or push notifications.

Most versions of this tool also include filters. Some traders only want engulfing patterns that occur at support or resistance levels. Others prefer signals that align with the dominant trend direction. These filters help reduce false signals in choppy, range-bound markets where engulfing patterns appear frequently but lack follow-through.

Real Trading Applications That Actually Matter

The indicator shines during trend exhaustion phases. Consider EUR/USD on the 4-hour chart after a strong downtrend. Price hits a support zone around 1.0800, and a bullish engulfing pattern appears. The indicator marks it immediately. Traders who act on this signal can enter long positions with stops below the engulfing pattern’s low, targeting the next resistance level at 1.0850. That’s a 50-pip opportunity with a 20-pip risk—solid risk-reward.

But here’s the thing: not every engulfing pattern deserves action. On the 5-minute chart, these patterns form constantly during London session chop. A trader testing this indicator on GBP/JPY scalping might see 15-20 signals in one session, most leading nowhere. Context matters more than the pattern itself.

The indicator works best when combined with confluence factors. An engulfing pattern at a Fibonacci retracement level carries more weight than one in the middle of nowhere. Same goes for patterns forming at round numbers like 1.3000 on USD/CAD or at previous swing highs and lows. Experienced traders use the indicator as a trigger within a broader trading plan, not as a standalone system.

Customizing Settings for Your Trading Style

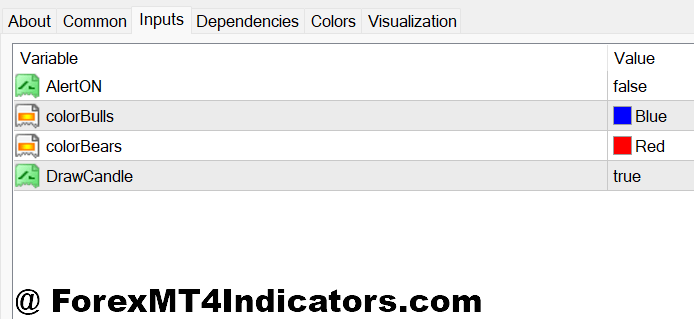

Most engulfing candle indicators offer adjustable parameters. The minimum body size filter is crucial. Setting this to 5 or 10 pips prevents the indicator from flagging tiny, insignificant engulfing patterns that occur during low-volatility periods. Asian session traders dealing with AUD/JPY might need a 10-pip minimum to filter out noise, while someone trading GBP/USD during New York hours could use 15-20 pips.

Alert settings deserve attention too. Visual arrows on the chart are helpful, but audio alerts prevent traders from gluing their eyes to the screen. Some versions allow email or mobile notifications—useful for swing traders checking setups once or twice daily rather than watching charts constantly.

Color customization seems trivial until you’re monitoring eight currency pairs simultaneously. Setting bullish signals to bright green and bearish signals to red makes patterns pop visually. Traders using dark chart backgrounds might need to adjust transparency settings so arrows don’t blend into candlesticks.

One parameter that often gets overlooked is the lookback period for trend determination. Some indicators won’t signal bearish engulfing patterns during established uptrends, filtering counter-trend trades automatically. This setting can be expanded from 20 to 50 bars for swing traders who want alignment with longer-term trends.

The Honest Truth: Advantages and Limitations

The biggest advantage is speed. The indicator identifies patterns in milliseconds that might take a trader 30-60 seconds to spot and verify manually. In volatile markets after economic releases, that speed difference captures entries other traders miss. Automation also removes emotional bias—the indicator doesn’t care about the previous losing trade or hesitate because of fear.

Pattern consistency is another win. Manual traders might have slightly different criteria for what constitutes a “valid” engulfing pattern. The indicator applies the same logic every time, creating consistency in signal generation. This makes backtesting and performance tracking more reliable.

That said, the indicator can’t read market context. It’ll flag an engulfing pattern at 3 AM during low liquidity just as readily as one during London open. Traders need to filter signals themselves based on market conditions, news events, and overall volatility. An engulfing pattern right before Non-Farm Payrolls? Probably not the best time to act on it.

False signals are inevitable. Range-bound markets produce engulfing patterns regularly without meaningful price movement afterward. The indicator might show three bearish engulfing patterns on USD/JPY in a 20-pip range, none leading to sustained moves. This is where win rates come in—successful traders accept that maybe 40-50% of signals will be losers and focus on risk-reward ratios that compensate.

Why This Beats Manual Pattern Hunting

Manually scanning for engulfing patterns across multiple timeframes and pairs is mentally exhausting. A trader watching EUR/USD, GBP/USD, USD/JPY, and AUD/USD on both 1-hour and 4-hour charts needs to check eight different chart combinations constantly. The engulfing candle indicator handles this monitoring automatically, freeing mental bandwidth for trade management and analysis.

The indicator also eliminates the “should I or shouldn’t I” paralysis. When a pattern meets the indicator’s criteria, there’s no ambiguity about whether it’s “engulfing enough.” The signal either fires or it doesn’t. This removes a significant source of hesitation that causes traders to miss entries while they’re still deciding.

Compared to similar reversal indicators like the Pin Bar detector or Doji scanner, the engulfing pattern indicator tends to produce clearer signals with less room for interpretation. Pin bars can be subjective—is that wick long enough? Is the body small enough? Engulfing patterns have more definitive criteria, making the indicator’s job simpler and its signals more reliable.

How to Trade with Engulfing Candle MT4 Indicator

Buy Entry

- Wait for confirmation close – Don’t enter when you first see the bullish engulfing pattern forming; wait until the candle actually closes to avoid fake-outs that reverse in the final 2-3 minutes.

- Check the timeframe context – Use 1-hour charts or higher (4-hour, daily) for reliable signals; 5-minute and 15-minute charts generate too many false engulfing patterns during choppy sessions.

- Verify you’re at support – Only take bullish engulfing signals when price is at a clear support level, previous swing low, or round number like 1.0800 on EUR/USD—random patterns mid-range usually fail.

- Set stop loss 5-10 pips below the pattern low – Place your stop just beneath the engulfing candle’s lowest point; if price breaks this level, the reversal setup has failed, and you need to exit.

- Target previous resistance or 1:2 risk-reward minimum – Aim for at least twice what you’re risking; if your stop is 20 pips away, target should be 40+ pips toward the nearest resistance zone.

- Skip signals during major news releases – Avoid taking bullish engulfing patterns within 30 minutes before or after NFP, FOMC, or central bank announcements—volatility invalidates technical patterns.

- Confirm with RSI below 40 – The signal is stronger when RSI on the same timeframe shows oversold conditions; bullish engulfing patterns with RSI above 60 often lead to quick reversals against you.

- Avoid patterns in strong downtrends – If GBP/USD is down 200+ pips in one day or below the 200 EMA, bullish engulfing patterns are counter-trend trades with lower success rates—wait for trend alignment.

Sell Entry

- Enter after the bearish engulfing candle closes – Don’t jump in mid-candle formation; wait for the full close to confirm the pattern is valid and not just temporary selling pressure.

- Use 4-hour or daily charts for swing trades – These timeframes filter out intraday noise; bearish engulfing on the USD/JPY daily chart carries more weight than one on a 15-minute scalping chart.

- Look for resistance rejection – Only act on bearish engulfing patterns at previous swing highs, resistance zones, or psychological levels like 1.3000 on GBP/USD—patterns in the middle of ranges fail frequently.

- Place stop loss 5-10 pips above pattern high – Your stop goes just above the engulfing candle’s highest point; if price breaks through, the reversal has failed, and you’re out.

- Target support with 1:2 minimum risk-reward – If you’re risking 25 pips, aim for 50+ pips toward the next support level; taking profits too early kills your account even with a good win rate.

- Don’t trade during low liquidity sessions – Skip bearish engulfing patterns during the Asian session on EUR/USD or Sunday evening opens—thin liquidity creates false signals that don’t follow through.

- Check RSI is above 60 – Bearish engulfing patterns with RSI in overbought territory (60-70+) have a higher probability; signals when RSI is at 40 often reverse quickly.

- Ignore signals in strong uptrends – If AUD/USD rallied 150 pips today or is above 200 EMA with no bearish structure, counter-trend bearish engulfing patterns typically fail—trade with the trend, not against it.

Practical Takeaways for Traders

Trading forex carries substantial risk. No indicator guarantees profits, and the Engulfing Candle MT4 Indicator is no exception. Its value lies in improving efficiency and consistency rather than magically predicting market direction.

The indicator works best when traders understand what it’s showing them and filter signals through their own analysis. An engulfing pattern at a key level during trending markets warrants attention. One in the middle of a range during dead volume doesn’t. Combining this tool with support/resistance analysis, volume indicators, or momentum oscillators creates a more complete trading approach.

For traders spending hours hunting reversal patterns manually, this indicator recovers valuable time. For those who’ve missed key turning points because they weren’t watching at the right moment, the alert function provides a safety net. But at the end of the day, the indicator is a tool—its effectiveness depends entirely on how traders use it, when they trust its signals, and how well they manage the trades that follow.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.