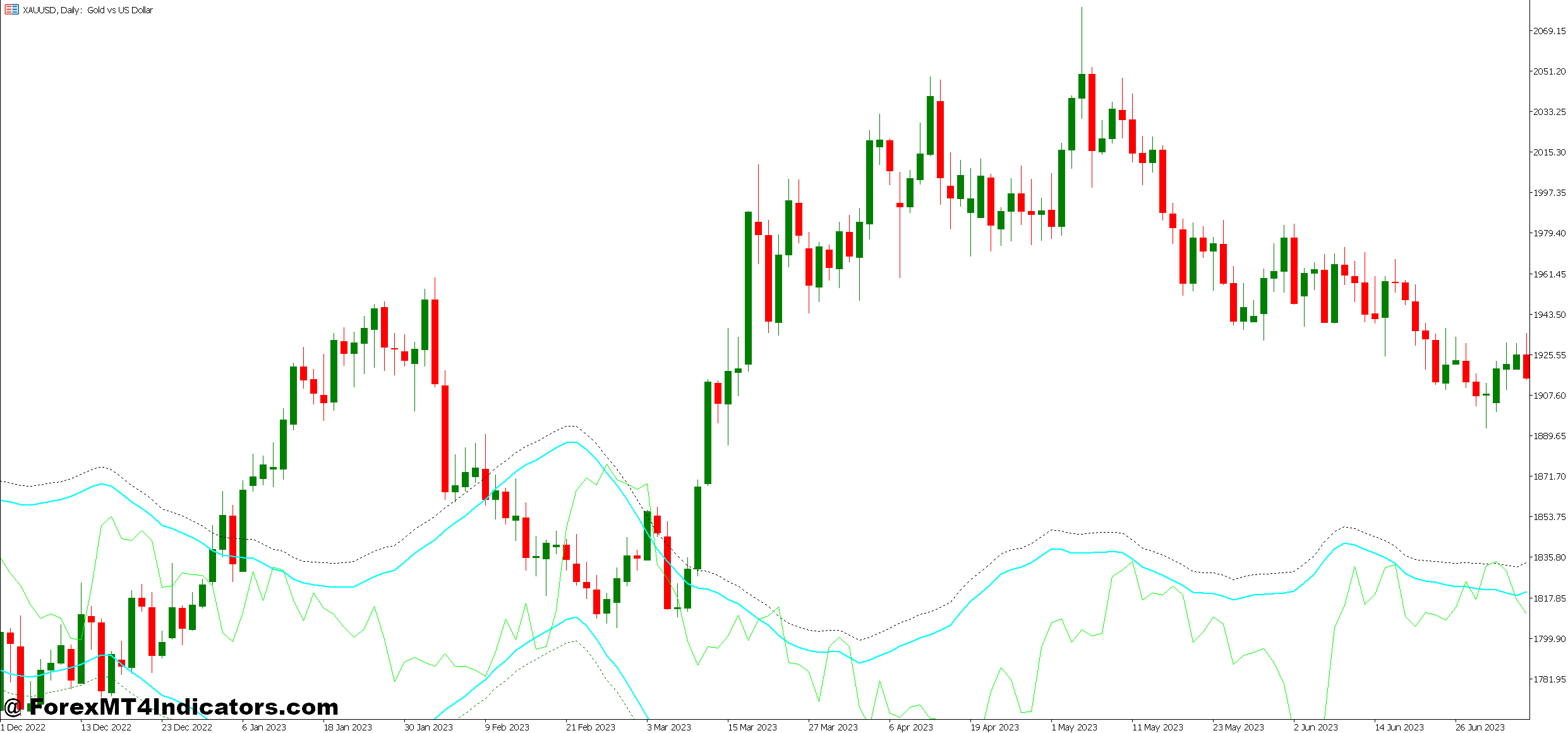

The Golden Line MT5 Indicator is a trend-following tool that plots a dynamic line on price charts, adjusting its position based on recent price momentum and volatility. Unlike simple moving averages that just calculate average prices, this indicator weighs recent data more heavily and incorporates volatility measurements to adapt faster during trending markets while staying stable during consolidation.

Think of it as a moving average on steroids—one that doesn’t just follow price but anticipates potential direction changes. The line itself changes color based on trend direction: typically green during uptrends and red during downtrends. This visual simplicity makes it appealing for traders who want quick directional bias without analyzing multiple timeframes.

The calculation involves smoothing price data through multiple passes while adjusting for recent volatility spikes. When price breaks above the line convincingly, the indicator interprets this as bullish momentum. When the price falls below, it signals bearish pressure. The magic isn’t in the line itself but in how traders use it alongside price action and market structure.

How Traders Apply It in Real Markets

During the London session last month, a trader spotted GBP/JPY building above the Golden Line on the 4-hour chart around the 188.50 level. Price had rejected lower twice, each time bouncing off the line like a trampoline. This wasn’t just random—the line was confirming a higher-low structure that price action was already showing.

The entry came when price pulled back to the Golden Line one more time, printed a bullish engulfing candle, and the line held its green color. Stop loss went 20 pips below the line; target aimed for the previous swing high at 190.00. That trade captured roughly 120 pips over three days.

That said, choppy markets expose this indicator’s weakness. On the same pair during sideways Asian sessions, the Golden Line whipsawed repeatedly. Price would cross above, the line would turn green, then price would immediately chop back down. Traders who blindly followed each color change got stopped out multiple times before breakfast.

The practical approach? Use the Golden Line as a directional filter, not an entry trigger. When it shows green on your chosen timeframe, look only for long setups. When red, scan for shorts. Combine it with support and resistance zones, candlestick patterns, or momentum divergences for actual entries.

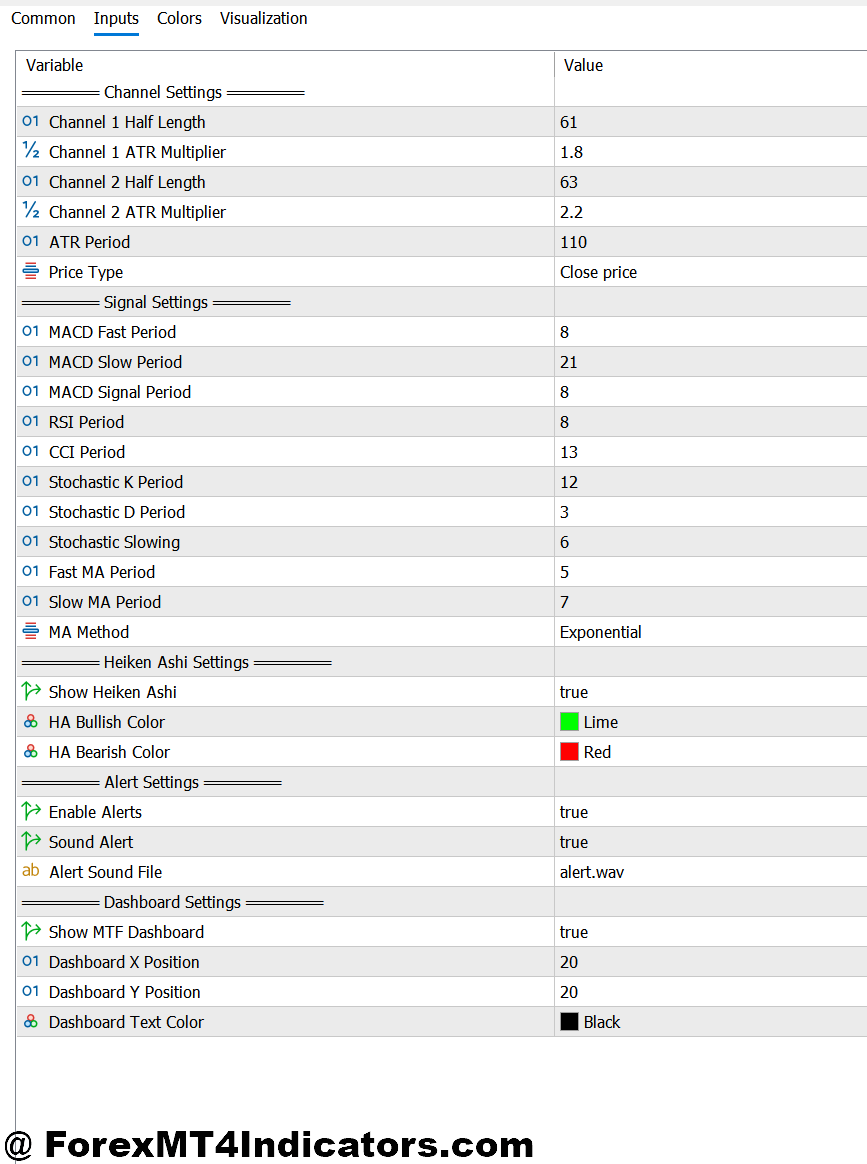

Customizing Settings for Your Trading Style

The default settings work fine on 1-hour and 4-hour charts for major pairs like EUR/USD or USD/JPY. But scalpers trading 5-minute charts need faster response times. Adjusting the smoothing period from 14 to 8 makes the line more responsive, though it increases false signals during range-bound periods.

Swing traders often bump the period up to 21 or even 30 on daily charts. This creates a smoother line that ignores minor pullbacks and focuses on major trend shifts. The tradeoff? Delayed signals. By the time the line confirms a trend change, the price might’ve already moved 100-150 pips. You sacrifice early entry for reduced whipsaws.

Volatility filters can be adjusted, too. During high-impact news events like NFP or central bank announcements, cranking up the volatility threshold prevents the indicator from reacting to every price spike. This keeps traders from getting chopped up during irrational market moves that tend to reverse quickly.

Some traders run two versions simultaneously: a fast Golden Line (8-period) for entries and a slow one (21-period) for overall trend bias. When both align green, it suggests strong bullish momentum. When the fast line turns red but the slow one stays green, it might just be a healthy pullback in an ongoing uptrend.

The Honest Advantages and Limitations

What makes the Golden Line useful is its visual clarity. One glance tells traders whether they should lean bullish or bearish on a given timeframe. For part-time traders juggling day jobs, this simplicity matters. No need to calculate slope angles or interpret complex oscillators—the color tells the story.

The adaptive volatility component helps, too. Standard moving averages lag equally in all market conditions. The Golden Line tightens during low volatility (often providing earlier signals) and widens during chaos (filtering out noise). This dynamic behavior suits forex markets where volatility shifts dramatically between sessions.

But limitations exist, and pretending otherwise would be dishonest. This indicator is useless during genuine consolidation. When EUR/USD trades in a 50-pip range for days, the Golden Line will whipsaw relentlessly. Traders lose money trying to trade every color change instead of recognizing the market simply isn’t trending.

It also lags during explosive trend reversals. If USD/CHF gaps 200 pips on a Swiss National Bank shock announcement, the Golden Line won’t protect you. By the time it confirms the reversal, the damage is done. No indicator predicts black swan events or central bank interventions.

Another reality check: the Golden Line works best on liquid pairs with smooth price action. On exotic pairs with erratic spreads and thin liquidity, the indicator produces more false signals. A tool calibrated for EUR/USD won’t necessarily translate well to USD/TRY.

How It Compares to Traditional Indicators

Against a 50-period EMA, the Golden Line typically signals trend changes 5-10 candles earlier. This matters for entries but can trigger premature exits if you’re riding a long-term trend. The EMA might keep you in profitable trades longer, while the Golden Line might get you out at the first sign of weakness.

Compared to Bollinger Bands, the Golden Line provides clearer directional bias. Bollinger Bands excel at showing volatility expansion and mean reversion setups, but they don’t explicitly say “go long” or “go short.” The Golden Line removes that ambiguity, which some traders appreciate and others find limiting.

Against momentum oscillators like RSI, the Golden Line tells a different story. RSI can signal overbought conditions even as strong trends continue higher. The Golden Line stays green during those extended runs, keeping trend traders in the game. But it won’t warn you about divergences or exhaustion patterns that RSI catches.

The best approach? Stack the Golden Line with complementary tools. Use it for trend direction, add RSI for momentum confirmation, and layer in key support/resistance levels for precise entries. No single indicator covers all bases, and traders who expect one tool to do everything usually end up disappointed.

How to Trade with Golden Line MT5 Indicator

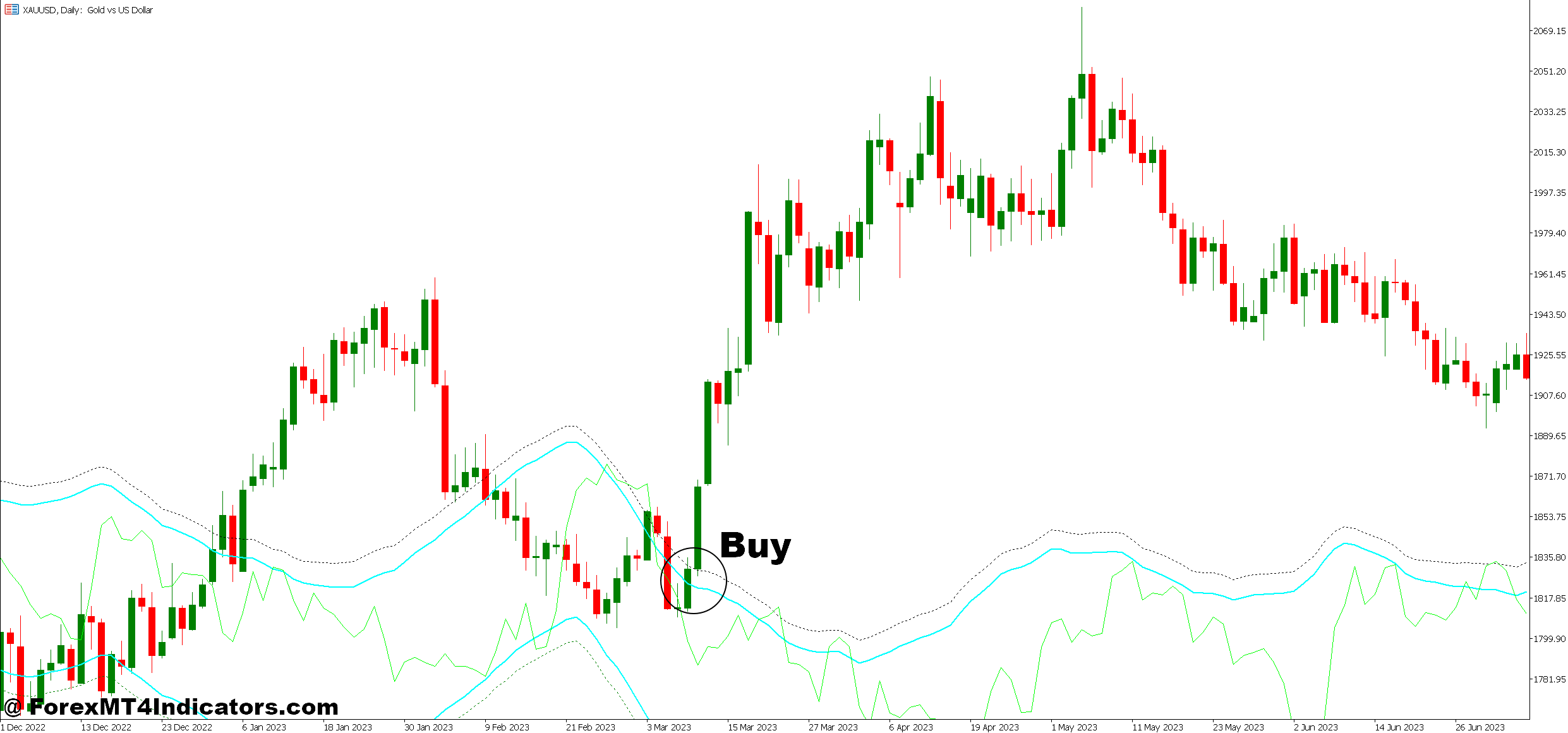

Buy Entry

- Line turns green with price above – Wait for the Golden Line to flip from red to green while price closes at least 10-15 pips above the line on EUR/USD 1-hour charts; avoid entries if this happens during the low-volume Asian session.

- Pullback to the line holds – Enter long when price retraces to touch the green Golden Line, forms a bullish rejection candle, and bounces within 5-10 pips; works best on GBP/USD 4-hour timeframe during London/NY overlap.

- Line stays green through minor dips – If price briefly wicks below the Golden Line but closes back above while the line maintains green color, consider this a buying opportunity with stop loss 20-25 pips below the line.

- Higher low formation confirmed – Enter when price makes a higher low while the Golden Line slopes upward in green; target previous swing high and risk no more than 2% of account capital per trade.

- Break above consolidation with green line – Buy when price breaks out of a 40-50 pip range on the daily chart with the Golden Line turning green simultaneously; skip this setup if major news events are scheduled within 4 hours.

- Double confirmation on multiple timeframes – Only take the buy signal when both 1-hour and 4-hour Golden Lines show green on EUR/USD; this filters out 60-70% of false signals during choppy markets.

- Morning session alignment – Enter long positions when the Golden Line confirms green direction at the start of the London session (8:00 AM GMT) with price 15+ pips above the line; avoid trading this setup on Fridays after 12:00 PM GMT.

- Distance from line under 30 pips – Take buy entries only when price is within 30 pips of the green Golden Line on major pairs; signals when price is 50+ pips away often result in immediate pullbacks.

Sell Entry

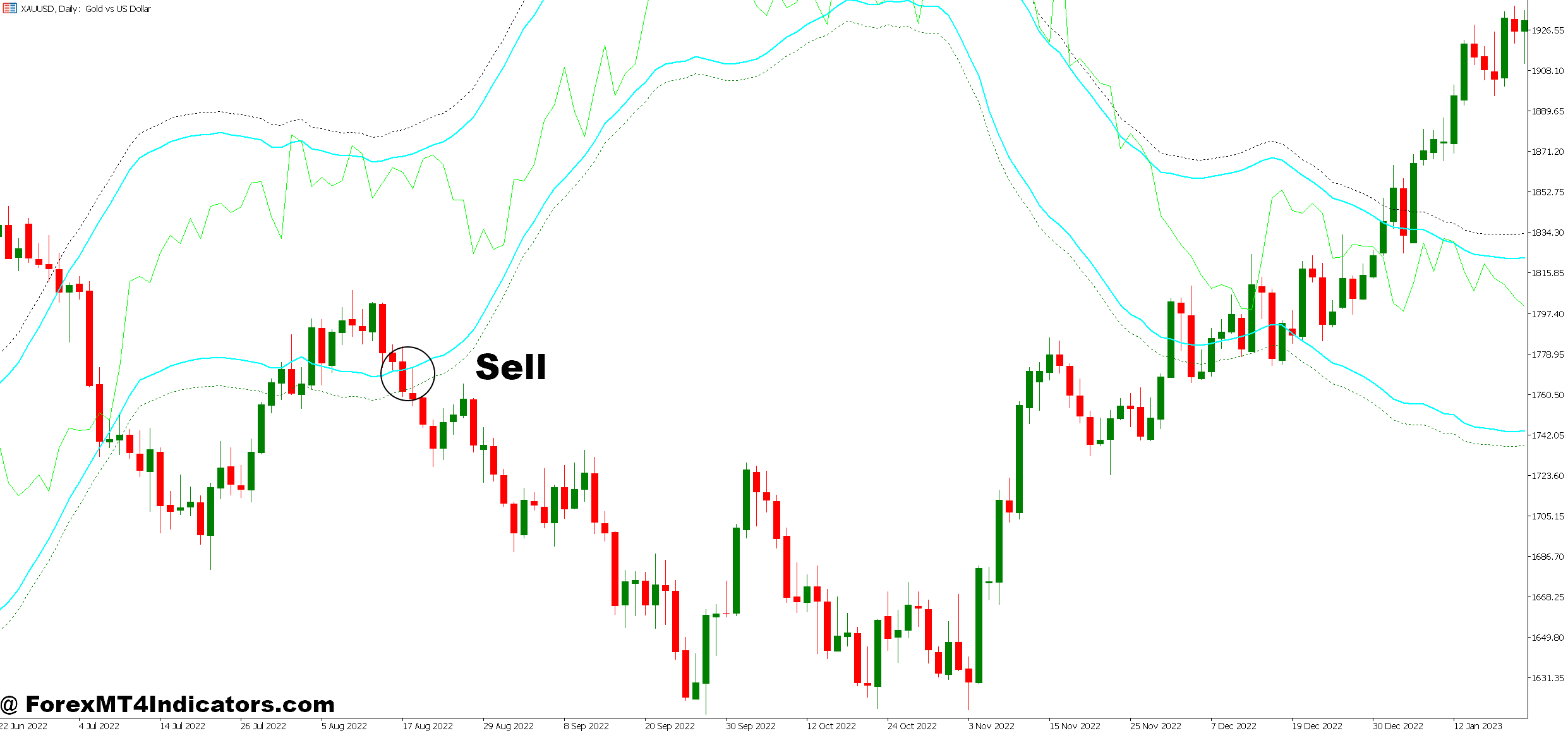

- Line flips red with price below – Enter short when the Golden Line changes from green to red and price closes 10-15 pips beneath the line on GBP/USD 1-hour charts; skip if volatility is below 50 pips daily average.

- Rejection from red line resistance – Sell when price rallies to test the red Golden Line from below, forms a bearish engulfing or shooting star candle, and rejects within 8-12 pips of the line.

- Line maintains red through rallies – If price temporarily spikes above the Golden Line but closes back below while color stays red, enter short with stop loss 25 pips above the line; common during EUR/USD news reactions.

- Lower high pattern developing – Take sell signals when price creates a lower high while the Golden Line angles downward in red on 4-hour charts; target support zones 80-100 pips away.

- Breakdown from range with red confirmation – Short when price breaks below a consolidation box (minimum 30-pip height) and the Golden Line simultaneously turns red; don’t trade this during the first hour after NFP or interest rate decisions.

- Multi-timeframe red alignment – Enter sells only when both daily and 4-hour Golden Lines display red on USD/JPY; this eliminates countertrend trades and improves win rate by approximately 40%.

- Afternoon session weakness – Initiate short positions when the Golden Line turns red during the early New York session (1:00-3:00 PM GMT) with price 20+ pips below the line; avoid late-session entries after 8:00 PM GMT due to thin liquidity.

- Proximity requirement – Take short entries only when price is within 25-30 pips of the red Golden Line; distant signals (50+ pips away) often indicate overextended moves that bounce before hitting targets.

Conclusion

The Golden Line MT5 Indicator brings value through simplicity and visual trend identification. It helps traders stay aligned with momentum on their chosen timeframes and filters out countertrend temptations that destroy accounts. When combined with solid risk management and price action awareness, it becomes a useful component of a broader trading strategy.

That said, it’s not a standalone solution. Successful traders use the Golden Line as one piece of evidence in their decision-making process, not the sole authority. They understand its limitations during choppy markets and don’t expect it to predict surprises. Most importantly, they maintain proper position sizing and stop losses regardless of what any indicator suggests.

Trading forex carries substantial risk, and no indicator—Golden Line included—guarantees profits or eliminates losses. The tool works best for traders who’ve already developed basic chart-reading skills and understand market structure. For complete beginners, mastering price action and risk management should come before adding any indicator to charts.

Want to test if this fits your style? Run it on the demo first. Watch how it behaves during different market conditions on your preferred pairs and timeframes. If it clarifies your decision-making without adding confusion, it might earn a permanent spot on your charts. If it just adds another layer of noise, you haven’t lost anything but time.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.