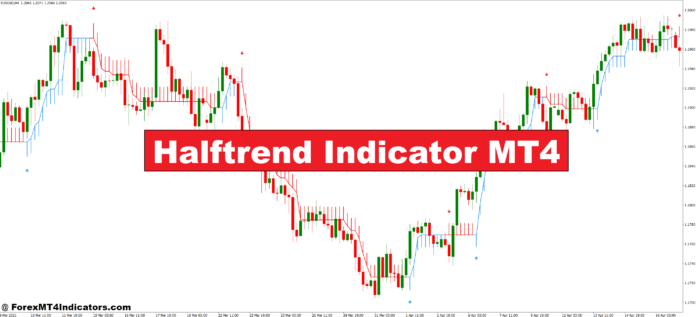

The Halftrend indicator was designed to cut through this noise. Unlike traditional moving averages that lag or oscillators that generate false signals in trending markets, Halftrend uses a unique calculation method to identify trend direction while filtering out minor price fluctuations. It’s not a magic solution—no indicator is—but it offers a cleaner visual approach to trend-following that many traders find more actionable than standard tools.

What the Halftrend Indicator Actually Does

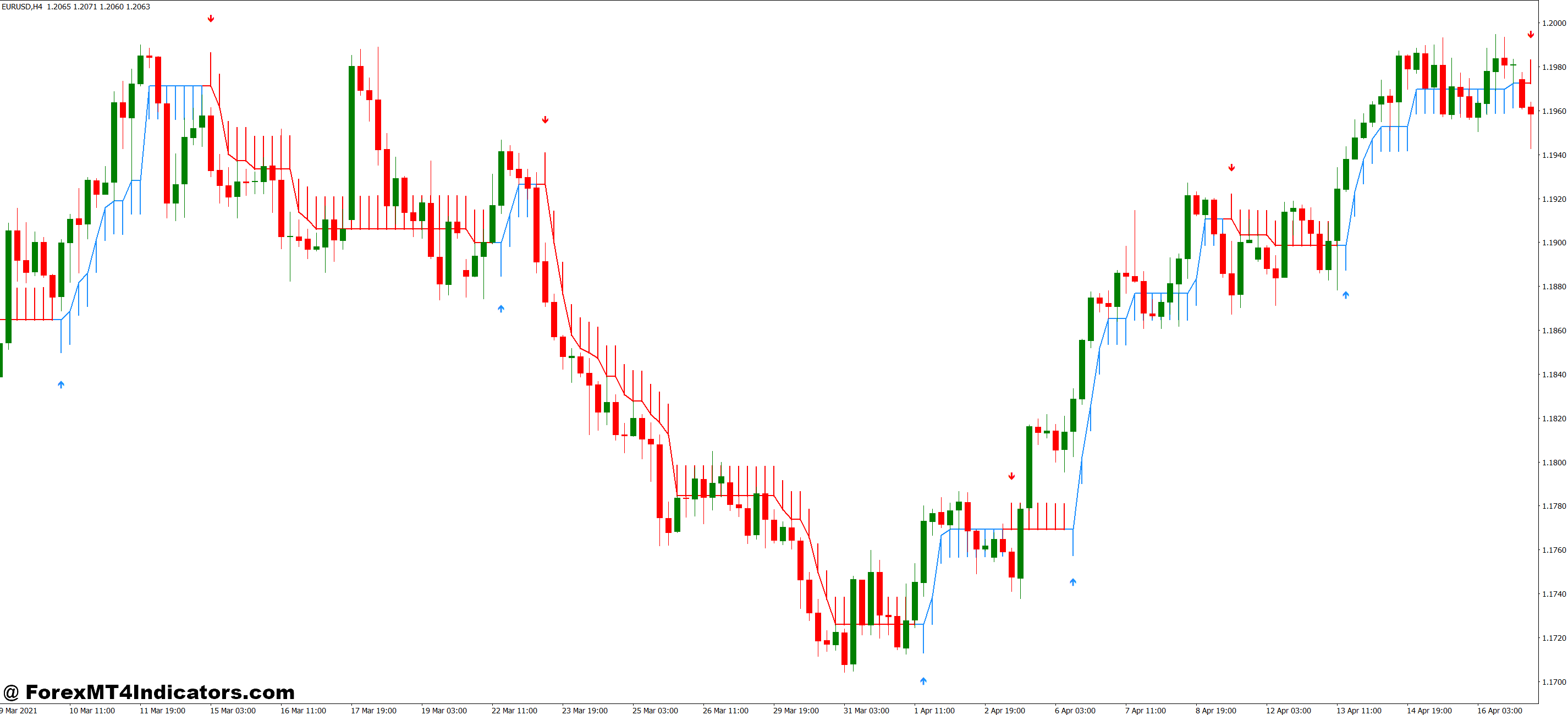

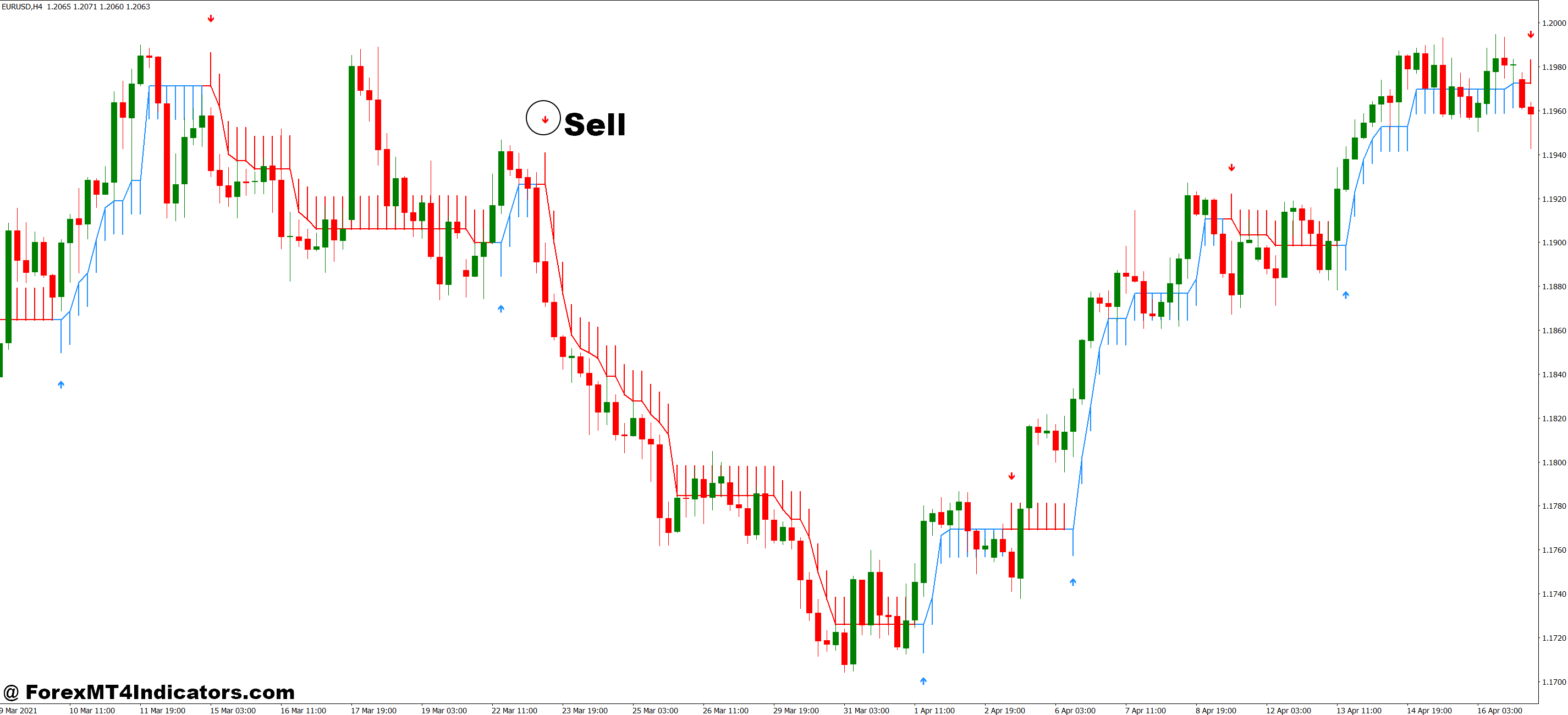

At its core, Halftrend is a trend-following indicator that plots above or below price candles to show directional bias. When the indicator line sits below price and displays in blue (or green, depending on your settings), it signals an uptrend. When it flips above price and turns red, it indicates a downtrend.

The calculation involves high and low price data combined with a smoothing mechanism. Specifically, Halftrend takes the average of the high and low over a set period, then applies an ATR-based (Average True Range) offset to determine when a genuine trend change has occurred versus just market noise. This ATR component is what separates it from simple moving averages—it adapts to volatility.

The result? Fewer false reversals during consolidation periods. The indicator doesn’t flip with every minor pullback because the ATR filter requires a meaningful shift in price action before signaling a trend change.

How Traders Apply Halftrend in Real Markets

Let’s get practical. Most traders use Halftrend as a trend filter rather than a standalone entry system. Here’s how that plays out on the charts.

On GBP/USD’s 4-hour timeframe, Halftrend can help traders stay in winning positions longer. When price makes a strong move from 1.2650 to 1.2850, the indicator remains blue and below price throughout the rally. Traders who exit at the first minor pullback miss 70-80 pips of continuation. But those using Halftrend as a trend filter? They stay in the trade until the indicator actually flips red, often capturing significantly more of the move.

The entry strategy works differently. Some traders wait for price to retrace to the Halftrend line itself, treating it as dynamic support in uptrends or resistance in downtrends. On USD/JPY’s 1-hour chart, this might look like: price rallies away from the Halftrend line, pulls back to touch it at 148.50, then bounces higher. That touch becomes the entry point, with a stop placed just below the line.

But here’s the thing—this approach works best when the larger trend is already established. Trying to catch reversals as Halftrend changes color often results in getting chopped up during the transition between trends.

Customizing Settings for Different Trading Styles

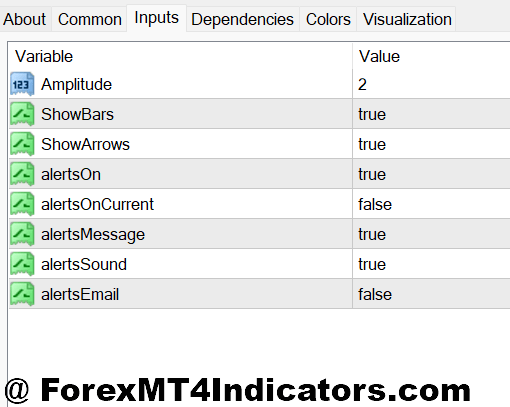

The default Halftrend settings work okay for daily charts, but most active traders need to adjust parameters based on their timeframe and risk tolerance.

The amplitude parameter controls sensitivity. Lower values (around 1-2) make the indicator more responsive, generating more signals but also more whipsaws. Higher values (3-4) produce fewer signals that carry more weight. Scalpers on 5-minute charts might use amplitude of 1.5 to catch quick shifts. Swing traders on daily charts often stick with 3 or higher to avoid noise.

The period setting, typically set between 2-10, affects the lookback window for the calculation. A period of 2 creates an extremely reactive indicator that flips frequently—useful for ranging markets where you want to catch reversals quickly. A period of 10 smooths things out considerably, better for trending pairs like AUD/NZD that make sustained directional moves.

Currency pair matters too. Volatile pairs like GBP/JPY often need higher amplitude settings (3-4) to avoid getting stopped out by normal intraday swings. Meanwhile, slower pairs like EUR/CHF can handle more sensitive settings without excessive false signals.

One setting traders overlook: combining Halftrend on multiple timeframes. Running it on both 1-hour and 4-hour charts creates a filter system. Only take trades when both timeframes show the same color. This dramatically reduces losing trades, though it also means missing some valid setups.

The Advantages (and the Catches You Should Know)

Halftrend’s biggest strength is visual clarity. There’s no interpreting complex oscillator readings or waiting for multiple confirmations. Blue line below price? Bias is long. Red line above price? Look for shorts. That simplicity helps traders execute without overthinking.

The ATR-based filtering also shines during news events. When NFP data drops and EUR/USD spikes 50 pips in two minutes, traditional moving averages might generate false crossover signals. Halftrend’s volatility adjustment typically holds steady through the initial chaos, preventing premature trend-change signals.

That said, Halftrend isn’t perfect. The main limitation hits during sideways markets. When EUR/GBP trades in a 40-pip range for two weeks, the indicator will flip back and forth, generating losing signals. There’s no way around this—trend-following tools struggle when there’s no trend to follow.

The indicator also lags by nature. It’s identifying trends that have already started, not predicting future moves. By the time Halftrend confirms a trend change, price may have already moved 20-30 pips in that direction. For scalpers hunting 15-pip targets, that lag is problematic.

Another catch: Halftrend doesn’t tell you anything about trend strength. A weak, grinding uptrend and a strong breakout rally both show as blue lines below price. Traders need additional context—volume, candlestick patterns, support/resistance levels—to gauge whether a trend has legs.

How It Compares to Other Trend Tools

Against Parabolic SAR, Halftrend offers more stable signals. SAR dots can flip multiple times during a consolidation phase, while Halftrend’s ATR filter keeps it anchored longer. However, SAR provides built-in stop-loss levels (the dot positions), which Halftrend doesn’t.

Compared to the Supertrend indicator, the two are cousins. Both use ATR-based calculations and plot above/below price. The main difference? Supertrend uses a multiplier on ATR, while Halftrend employs amplitude and period settings. Some traders find Halftrend’s signals slightly smoother, though the differences are subtle.

Traditional moving average crossovers (like 20/50 EMA) generate more signals than Halftrend, both true and false. The MA approach works better for active traders who want frequent opportunities. Halftrend suits traders who prefer fewer, higher-probability setups.

How to Trade with Halftrend Indicator MT4

Buy Entry

- Wait for color flip to blue – Enter long only after the Halftrend line turns blue and positions itself below price, confirming the uptrend has begun (don’t anticipate the change).

- Enter on pullback to the line – When EUR/USD rallies 30-40 pips away from the blue Halftrend line, wait for price to retrace and touch the line before entering, using it as dynamic support.

- Confirm with higher timeframe alignment – Check that the 4-hour Halftrend is also blue before taking 1-hour buy signals to avoid counter-trend trades that fail quickly.

- Set stop-loss 10-15 pips below the line – Place your stop just under the Halftrend indicator line on GBP/USD 1-hour charts, adjusting for ATR to avoid normal volatility.

- Avoid entries during ranging markets – Skip buy signals when price has been chopping sideways for 3+ days within a 50-pip range, as Halftrend will generate false signals.

- Risk 1-2% maximum per trade – Never risk more than 2% of your account on a single Halftrend signal, regardless of how strong the setup looks.

- Target previous swing high plus 20 pips – Set your take-profit at the most recent resistance level and add 20 pips, or trail your stop below the Halftrend line as it moves up.

- Exit when line flips red – Close your long position immediately when Halftrend changes to red and moves above price, signaling the trend has reversed.

Sell Entry

- Wait for color flip to red – Enter short only after the Halftrend line turns red and positions itself above price, confirming downtrend initiation (never predict the flip).

- Enter on pullback to the line – When USD/JPY drops 40-50 pips below the red Halftrend line, wait for price to retrace up and touch the line before shorting, treating it as dynamic resistance.

- Confirm with higher timeframe alignment – Verify the daily Halftrend is also red before taking 4-hour sell signals to avoid fighting the larger trend direction.

- Set stop-loss 10-15 pips above the line – Place your stop just above the Halftrend indicator line on EUR/USD 4-hour charts, adding a buffer for spread and volatility.

- Skip signals during low-volatility sessions – Avoid sell entries during Asian session on GBP/USD when average hourly range drops below 25 pips, as trends rarely develop.

- Never go all-in on one signal – Risk only 1.5% per trade maximum, even if Halftrend, RSI, and MACD all confirm the same sell signal simultaneously.

- Target previous swing low minus 20 pips – Set take-profit at the nearest support level and subtract 20 pips, or trail your stop above the Halftrend line as price descends.

- Exit immediately on color change to blue – Close your short position the moment Halftrend flips blue and drops below price, regardless of whether you’re in profit or loss.

Making Halftrend Work for Your Trading

The indicator functions best as part of a complete system, not as a solo act. Combining it with price action context—horizontal support/resistance levels, chart patterns, candlestick formations—improves the win rate significantly.

Risk management stays critical. Trading forex carries substantial risk, and no indicator guarantees profits. Even with Halftrend confirming a trend, individual trades can fail. Position sizing and stop-loss discipline matter more than indicator choice.

For traders who struggle with trend identification or holding winners long enough, Halftrend provides a structured framework. It won’t eliminate losing trades, but it can reduce the emotional component of deciding when a trend has truly changed. The visual clarity alone helps many traders stick to their plan rather than exiting prematurely.

Test it on your preferred pairs and timeframes before risking real capital. What works for daily GBP/USD trends might fail on 15-minute EUR/JPY scalping. The only way to know if Halftrend fits your style is to put it through its paces in different market conditions and see how it performs when the setup actually matters.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.