Are you tired of losing money in forex trading? The market can be very hard to understand. But, there’s a new strategy that might help. It’s called the HLC Trend and Smoothed RSI Forex trading strategy.

This strategy uses trend analysis and momentum indicators. It gives clear signs when to buy or sell. This makes trading easier and more confident.

Key Takeaways

- Combines HLC trend and smoothed RSI for accurate signals

- Suitable for various time frames, optimal for day trading

- Uses specific moving average and CCI settings

- Targets 60% profitability with a profit factor > 1.15

- Provides clear buy and sell conditions

- Incorporates flexible exit strategies

- Adapts to different market conditions

Understanding Trading Oscillators and Their Role in Forex

Trading oscillators are key in forex analysis. They show market momentum and trend changes. With over 100 tools, traders can boost their strategies.

What are Trading Oscillators?

These tools measure price changes in a range. They show trend strength and market growth. The RSI and Stochastic Oscillator are well-known. The RSI shows when prices are too high or too low.

Historical Development of Oscillators

Oscillators have changed a lot over time. Early ones looked at simple price changes. Now, they use complex math. The MACD, from the 1970s, is a top choice for finding buy and sell signals.

Importance in Modern Trading

In today’s fast forex market, oscillators are very useful. They spot when prices are too high or too low. They also show market volatility and trend changes. The ADX shows trend strength, with values above 25 meaning a strong trend.

Traders use many oscillators together with other tools. This helps make better trading choices in different market situations.

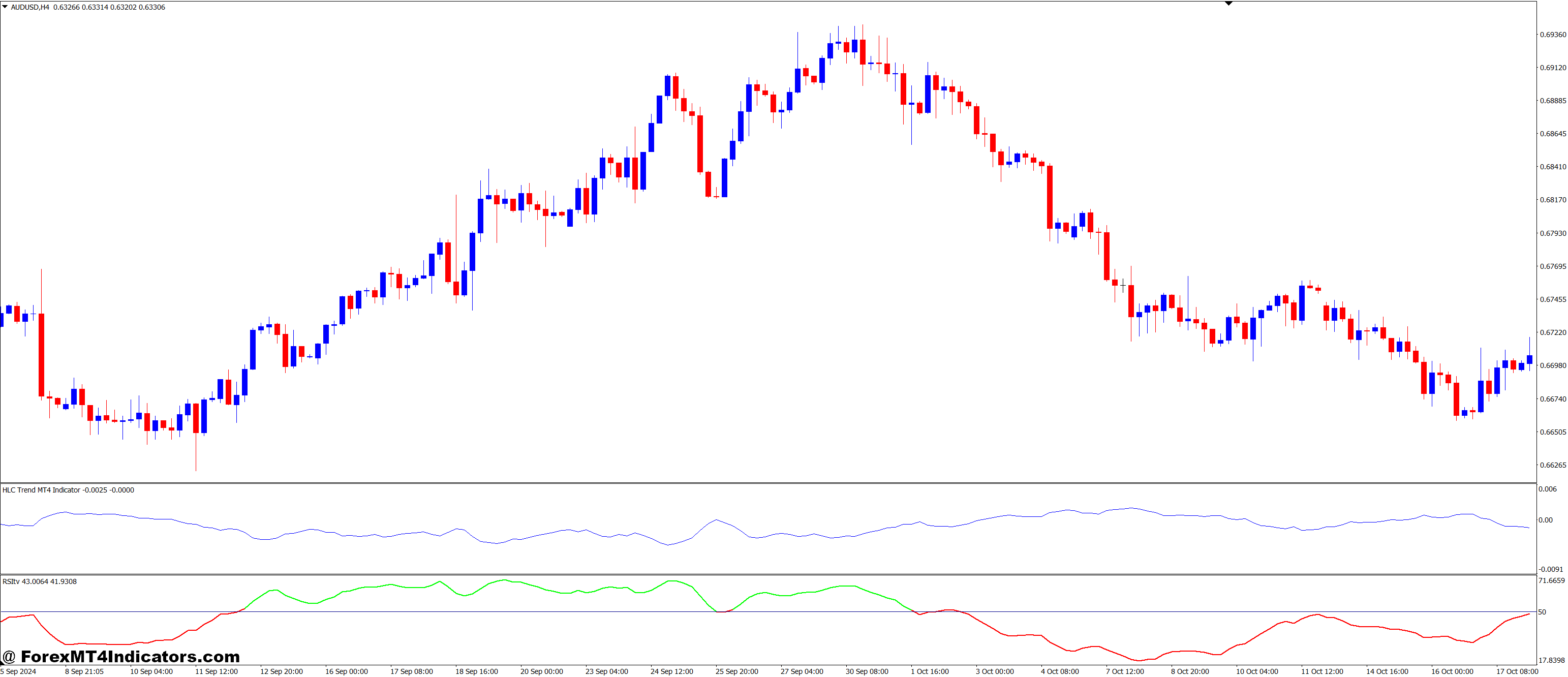

HLC Trend and Smoothed RSI Forex Trading Strategy

The HLC Trend and Smoothed RSI Forex Trading Strategy combines powerful forex strategy components. It uses HLC trend analysis and a smoothed RSI indicator. This mix helps traders make better decisions.

HLC trend analysis looks at the High, Low, and Close prices of currency pairs. It helps traders understand market direction and strength. The smoothed RSI indicator shows when prices are too high or too low.

For the best results, traders use specific settings. Short-term traders like a 9-11 day RSI period. Medium-term traders prefer the default 14-day setting. Long-term investors might choose a 20-30 day RSI period.

Key components of this forex strategy include:

- HLC Bars for price action analysis

- Smoothed RSI for momentum measurement

- Moving averages for trend confirmation

- Bollinger Bands for volatility assessment

By combining these elements, traders can find better entry and exit points. This strategy works well in trending markets. It also helps during ranging and volatile times.

Components of the RSI Indicator

The Relative Strength Index (RSI) is a strong tool in forex analysis. Knowing its parts helps set up RSI for better trading.

RSI Length Parameter

The RSI length sets how many periods are used. A common choice is 14 periods. But, traders can change it to fit their strategy.

Short lengths make the RSI more sensitive. Long lengths smooth out changes.

Smoothing Factor

The smoothing factor makes RSI readings clearer. It adds a moving average to the raw RSI. This makes the indicator more stable.

This helps avoid false signals in busy markets.

Signal Line Configuration

The signal line is important for spotting trades. It’s a moving average of the RSI. When the RSI crosses the line, it can signal a buy or sell.

RSI values range from 0 to 100. Values over 70 mean the market might be overbought. Values under 30 suggest it might be oversold.

These levels are key for finding market reversals.

- Overbought: RSI above 70

- Oversold: RSI below 30

- Neutral: RSI between 30 and 70

By adjusting these parts, traders can make RSI work better for them. This improves its ability to give accurate trading signals.

Setting Up Your Trading Platform

Getting your Forex trading platform ready for the HLC Trend and Smoothed RSI strategy is key. First, open your favorite platform, like cTrader. It has great charting tools. Then, go to the indicator setup menu and find the RSI indicator.

Put the RSI on your chart and tweak its settings. Set the RSI length to 14 and adjust the smoothing factor. Also, set up the signal line. After that, add the HLC Trend indicator to your chart. Make sure both indicators are easy to see and color-coded.

Now, pick the right timeframe for your charts. H1 or H4 charts work well for this strategy. Make your chart layout clear to see price action and indicators. A neat chart helps with analysis and making trades.

| Indicator | Default Settings | Recommended Settings |

|---|---|---|

| RSI Length | 14 | 14 |

| RSI Overbought Level | 70 | 75 |

| RSI Oversold Level | 30 | 25 |

| HLC Trend Period | 20 | 25 |

After setting up your platform, practice finding trade signals. Look for when the HLC Trend meets RSI crossovers. This helps spot good trade chances. With the right setup, you’re ready to use this strong Forex trading strategy.

Risk Management Guidelines

Effective Forex risk management is key to success. This section covers important strategies to protect your money and increase profits. We use the HLC Trend and Smoothed RSI strategy.

Position Sizing

Controlling risk through trade position sizing is vital. Limit each trade to 1-2% of your total account balance. This keeps your capital safe during losses and helps it grow steadily.

Stop Loss Placement

Stop-loss strategies are key to limiting losses. Set stop losses below recent swing lows for long trades. For short trades, place them above swing highs. This method protects against market ups and downs.

Take Profit Targets

Set realistic take-profit targets based on key levels. Aim for a 1:2 risk-reward ratio. This means your profit should be at least double your risk. It ensures wins are more than losses over time.

- Use the Momentum indicator with a period of 21 for short-term trend analysis

- Consider breakouts above 100 as possible buy signals

- Watch for divergences between price and Momentum for trend reversal hints

By following these risk management tips, traders can handle Forex market challenges better. This improves their long-term success.

Momentum Trading Principles

Forex momentum trading focuses on how fast prices change. It’s key for understanding trends and market moves. Traders look for strong trends and possible reversals.

In forex, momentum is tracked over time. The quicker prices move, the higher the momentum. This helps traders catch big swings and follow trends.

Standard Deviation (StdDev) shows market volatility. It tells us how far prices are from the average. A StdDev of 0.0009 means low volatility, while 0.0011 means it’s higher.

The time frame is important in momentum trading. Most prefer 30-minute charts or longer. Shorter charts can give confusing signals. A 20-period setting is common for StdDev.

Market conditions change how traders use momentum. In trending markets, StdDev goes up with each candlestick. In flat markets, it stays low. Traders adjust their strategies based on these signs.

Using momentum indicators with tools like ATR gives a better view of the market. This helps traders make better choices in their forex strategies.

Market Condition Analysis

Understanding Forex market analysis is key. Traders need to know how to spot market trends. The HLC Trend and Smoothed RSI strategy works well in many situations.

Trending Markets

In trending markets, prices go in one direction. The RSI oscillator is great for finding market trends. RSI values over 50 mean the market is going up. Values under 50 mean it’s going down.

Traders can use this info to match their trades with the trend.

Ranging Markets

Ranging markets have prices moving sideways. Here, the RSI’s overbought and oversold zones are very important. Traders might sell when RSI goes over 70 and buy when it goes under 30.

Volatile Conditions

Volatile markets are full of both chances and dangers. The Smoothed RSI helps clear up signals. Traders should be careful in these times, adjusting their sizes and risk management.

Using RSI with other indicators can help make better choices.

Strategy Optimization Techniques

Improving your Forex strategy is key to success in the fast-changing currency markets. Let’s look at important ways to optimize your Forex strategy to boost your trading skills.

Parameter Adjustment

Adjusting trading parameters is critical for keeping up with market shifts. Try different RSI lengths, smoothing levels, and HLC trend settings. Begin with standard settings, then tweak them based on test results. Keep in mind, that what works for one pair might not work for another.

Timeframe Selection

Picking the right timeframe is important for your strategy’s success. Longer timeframes like weekly and monthly charts give more reliable signals but fewer chances to trade. Shorter timeframes offer more signals but can be noisy. Find a mix that fits your trading style and risk level.

Currency Pair Selection

Choosing the right currency pairs is vital for success. Look for pairs with high liquidity and moderate volatility. Also, think about how pairs relate to each other to spread out your risk. Pairs like EUR/USD and GBP/USD are often good choices for consistent trading.

Remember, making your strategy better is a continuous effort. Always check your performance, like win rate and average profit. Use these numbers to fine-tune your strategy and get better over time.

Common Trading Mistakes to Avoid

Forex trading errors can ruin even the best plans. One big mistake is counting too much on technical indicators. Tools like moving averages are helpful, but they shouldn’t decide everything.

Ignoring fundamental analysis is another big mistake. Traders often get too caught up in charts. But, it’s key to remember that economic events move currencies.

Not managing risk well can be very bad. Many forget to size their positions right and set stop-losses. Keeping your money safe is just as important as making money. Good risk management means setting clear profit goals and sticking to them.

Letting emotions guide your trading is another big mistake. Fear and greed can make you act without thinking. It’s vital to have a strong trading mindset. Stay focused, follow your rules, and don’t try to catch every market move.

| Common Mistake | Impact | Solution |

|---|---|---|

| Overreliance on indicators | Missed opportunities, false signals | Combine multiple analysis methods |

| Ignoring fundamentals | Unexpected market moves | Stay informed on economic events |

| Poor risk management | Large losses, account depletion | Use proper position sizing, stop-losses |

| Emotional trading | Impulsive decisions, strategy deviation | Develop trading discipline, stick to plan |

How to Trade with HLC Trend and Smoothed RSI Forex Trading Strategy

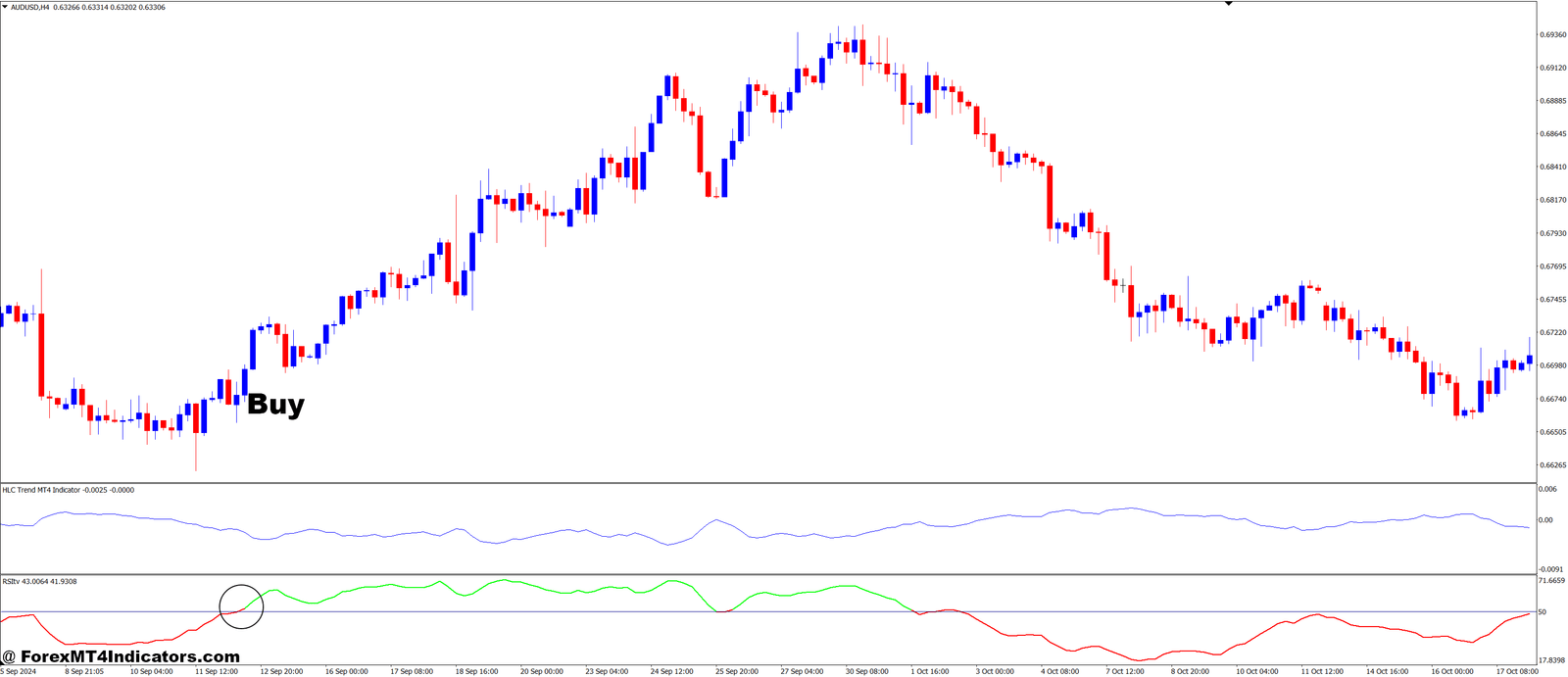

Buy Entry

- HLC Trend: Ensure the HLC trend line is upward (indicating an uptrend).

- Smoothed RSI: Wait for the Smoothed RSI to cross above 30 from the oversold zone (indicating potential upward momentum).

- Confirm: Optionally, look for the Smoothed RSI to approach 50 or higher for further confirmation of bullish momentum.

- Entry Point: Enter a buy position when the Smoothed RSI crosses above 30 and the HLC trend confirms an uptrend.

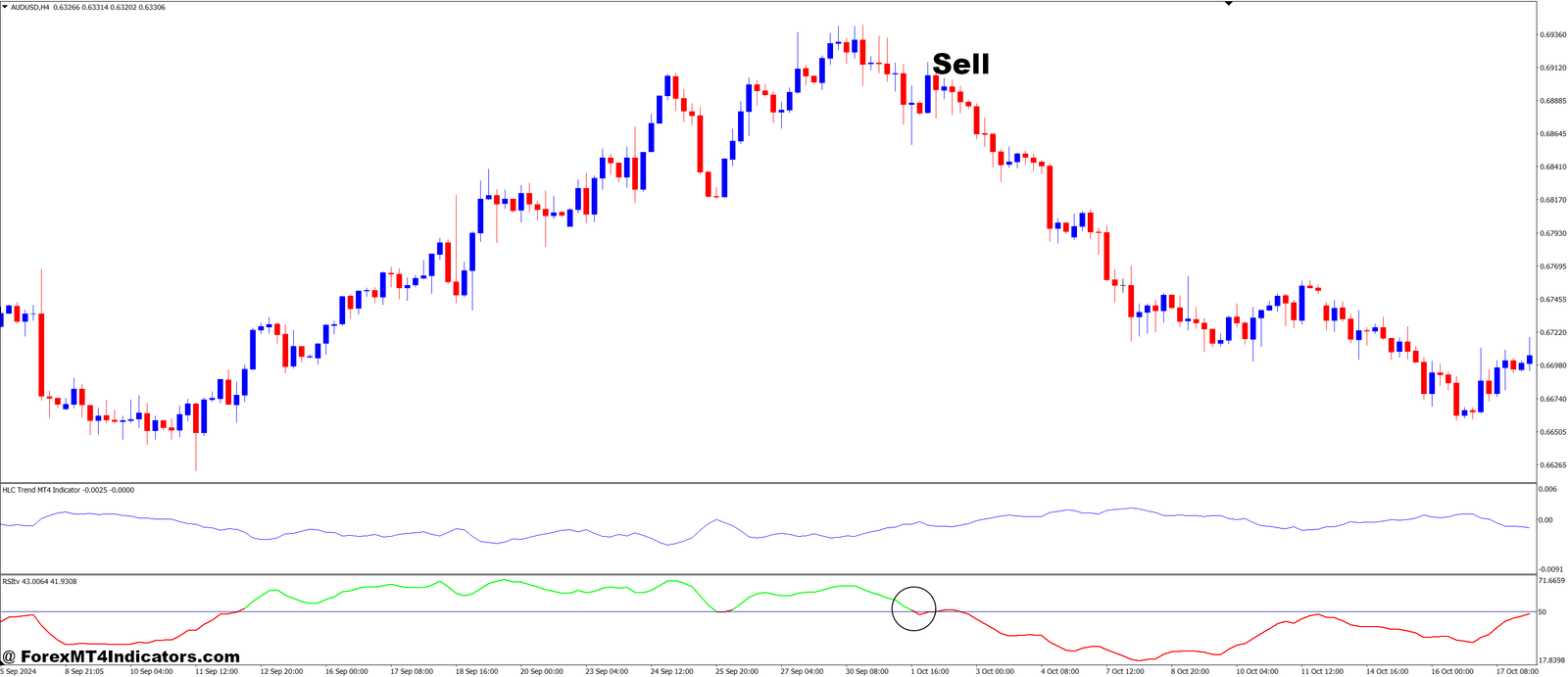

Sell Entry

- HLC Trend: Ensure the HLC trend line is downward (indicating a downtrend).

- Smoothed RSI: Wait for the Smoothed RSI to cross below 70 from the overbought zone (indicating a reversal or pullback).

- Confirm: Optionally, look for the Smoothed RSI to approach 50 or lower for further confirmation of bearish momentum.

- Entry Point: Enter a sell position when the Smoothed RSI crosses below 70 and the HLC trend confirms a downtrend.

Conclusion

The HLC Trend and Smoothed RSI Forex Trading Strategy helps traders succeed. It mixes trend analysis with oscillator power. This gives deep insights into market moves.

The strategy’s heart is HLC trend analysis and smoothed RSI use. These parts help make smart trading choices.

Getting the most from this strategy means paying attention to details. Use the right RSI length and EMA settings. This boosts your chances of winning.

For example, using 14 periods for RSI and 5 and 3 periods for EMA is key. Also, managing risk well is important. This can lead to better results, like with EUR pairs and BTC.

Improving your trading skills is vital for lasting success. Always check how you’re doing and change your ways if needed. Try new things, like different timeframes or moving averages.

By always learning and getting better, you can make your strategy stronger. This can lead to steady profits in the fast-changing forex market.

Recommended MT4 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

Click here below to download:

Enter Your Email Address below, download link will be sent to you.