The Kaufman Volatility MT4 Indicator measures the strength and intensity of price movements. It uses an adaptive calculation method that adjusts to market conditions, helping traders understand whether volatility is increasing or decreasing. Unlike simple volatility tools, this indicator offers a more responsive view of market behavior, allowing traders to recognize when momentum is picking up or slowing down.

How It Works

This indicator tracks volatility by analyzing price fluctuations over a set period. When volatility rises, it signals potential trend changes or breakout conditions. During low volatility periods, traders can expect consolidation or sideways movements. The Kaufman Volatility Indicator helps identify these transitions early, enabling traders to plan entries and exits more effectively. Its visual representation makes it easy to read, even for beginners, while providing reliable data for advanced users.

Benefits for Traders

With this tool, traders can make more informed decisions about position sizing, stop-loss placement, and trade timing. It reduces emotional trading by providing a clear picture of market dynamics. When volatility is high, traders might tighten stops or reduce lot sizes to control risk. When it’s low, they can prepare for possible breakouts. This balance of precision and simplicity makes the Kaufman Volatility MT4 Indicator a valuable addition to any trading setup.

How to Trade with Kaufman Volatility MT4 Indicator

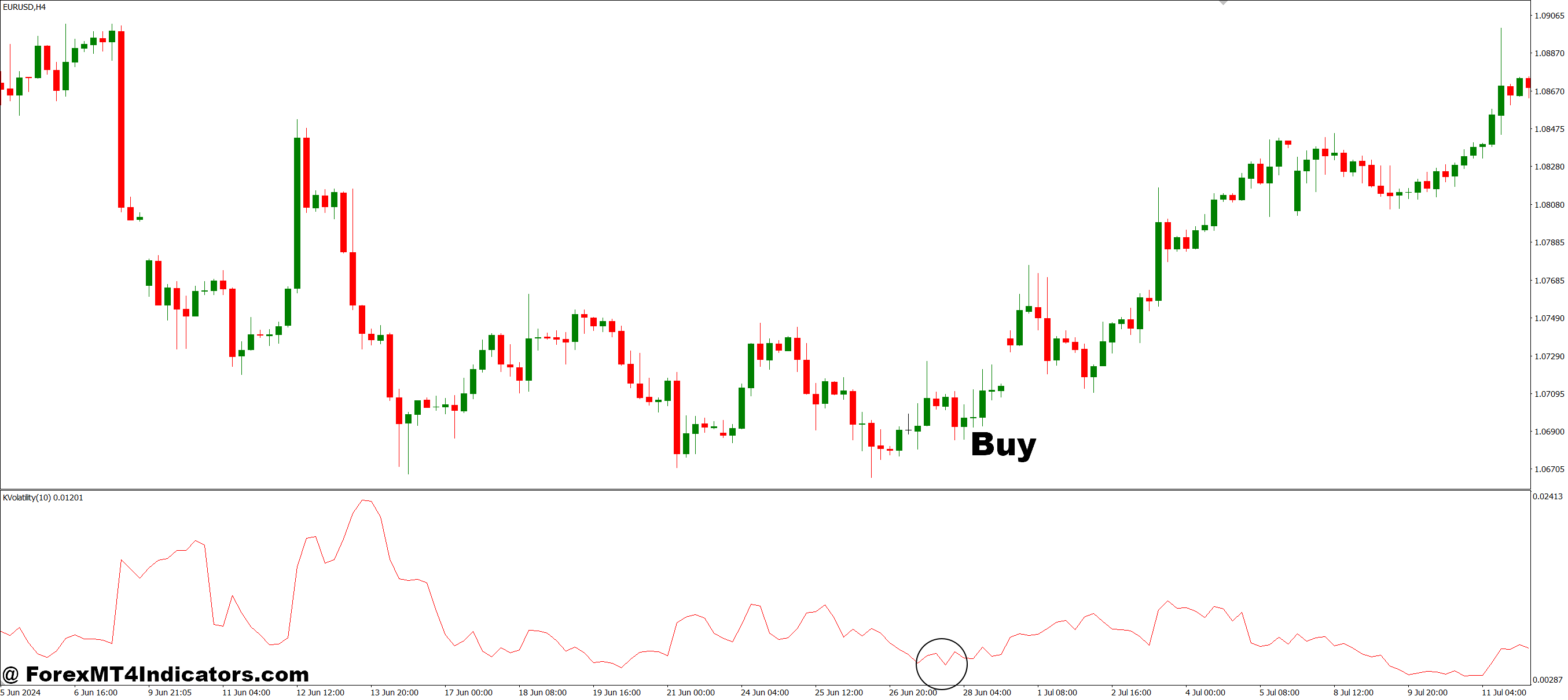

Buy Entry

- Wait for the volatility line to rise, showing increased market activity.

- Confirm that price action is forming higher highs and higher lows (uptrend confirmation).

- Enter a buy trade when volatility increases after a period of consolidation, signaling a potential breakout.

- Place your stop-loss below the recent swing low to minimize risk.

- Exit the trade when volatility starts to drop, indicating a slowdown in momentum.

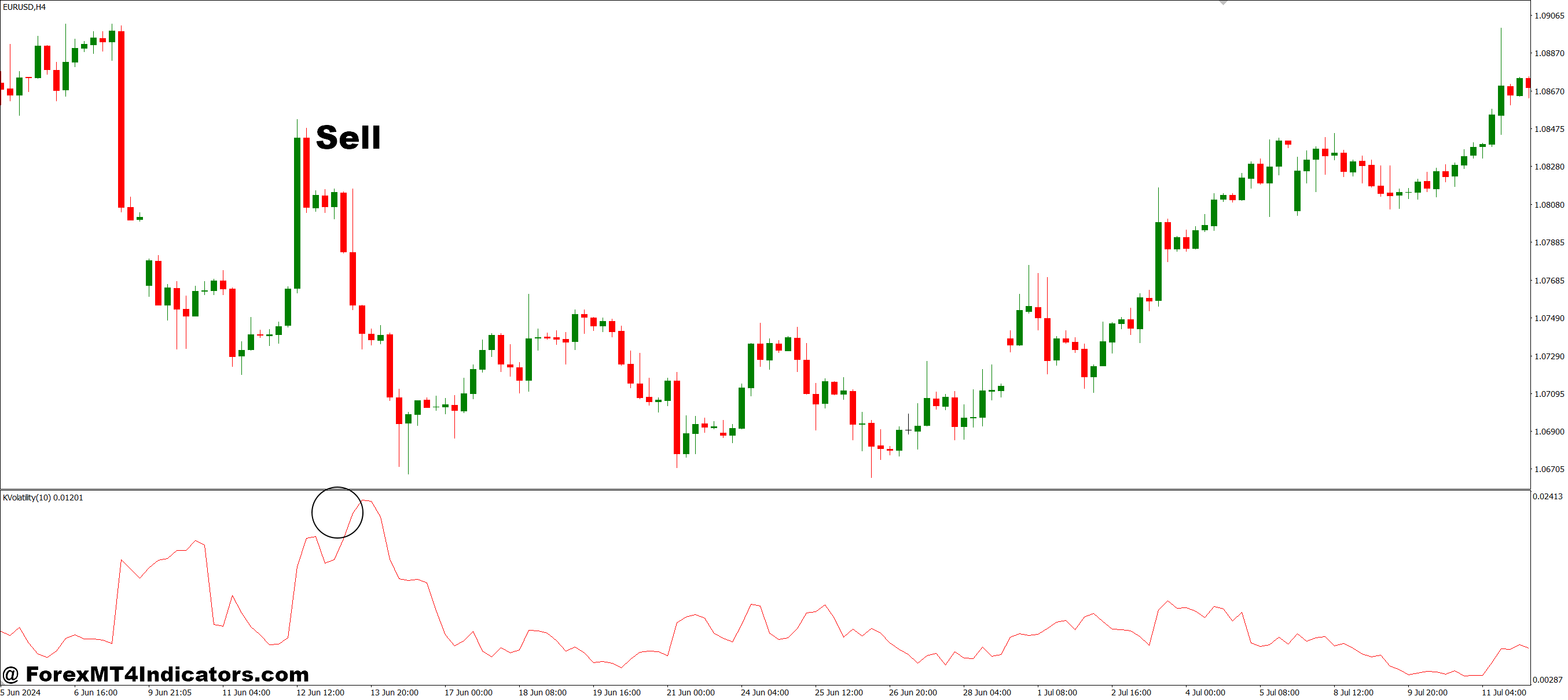

Sell Entry

- Watch for the volatility line to rise while the market shows lower highs and lower lows (downtrend confirmation).

- Enter a sell trade when volatility increases after a tight or sideways price range, suggesting a bearish breakout.

- Set your stop-loss above the recent swing high for protection.

- Close the trade when volatility begins to fall, showing a possible end to the strong price movement.

Conclusion

Understanding volatility is the key to consistent success in today’s fast-paced forex market. The Kaufman Volatility MT4 Indicator empowers traders to stay ahead of market shifts, reduce risk, and seize better opportunities. Whether used alone or alongside other indicators, it brings clarity and confidence to every trade.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.