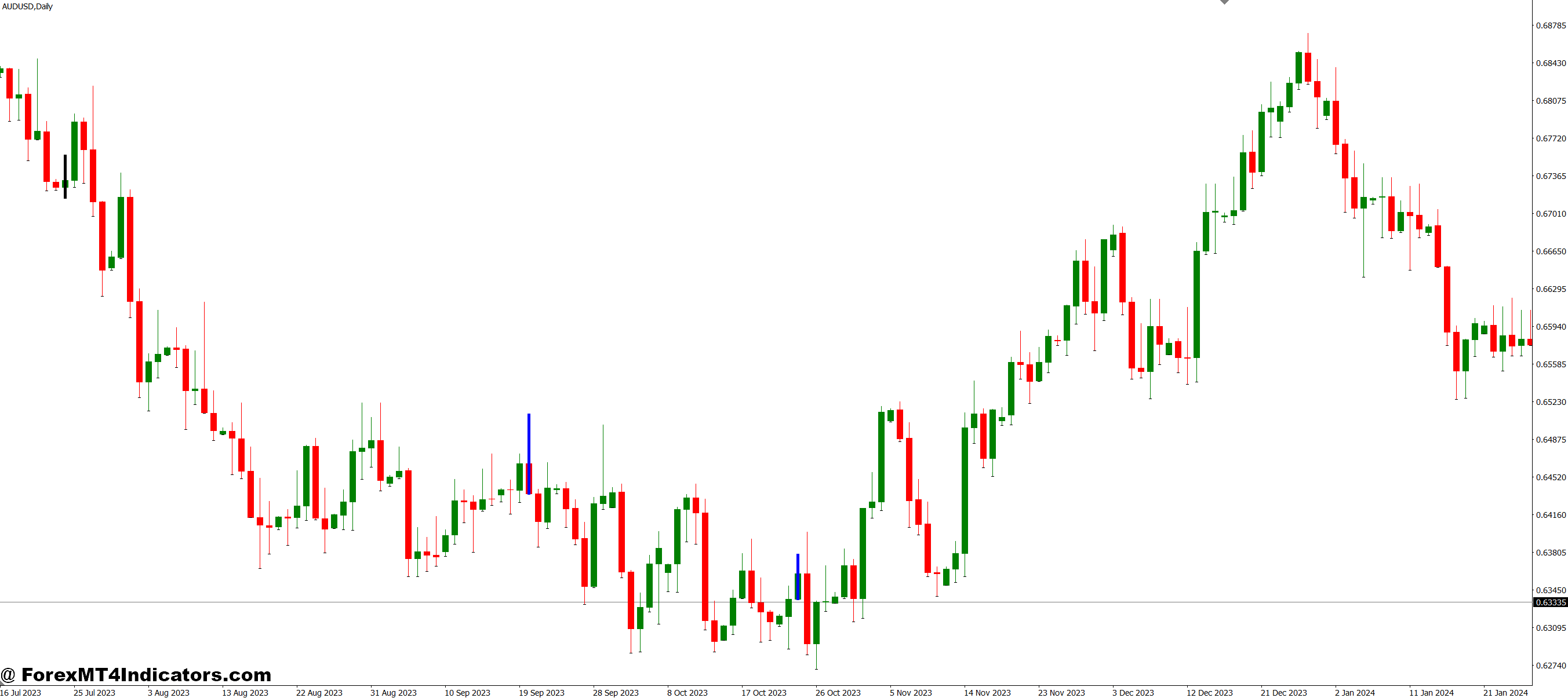

Divergence occurs when price action and a momentum oscillator move in opposite directions. The MT4 divergence indicator automates the process of spotting these discrepancies across multiple timeframes and currency pairs. Instead of manually drawing trendlines on both price and oscillator windows, the indicator does the heavy lifting.

Most MT4 divergence indicators scan for four types: regular bullish, regular bearish, hidden bullish, and hidden bearish. Regular divergence signals potential trend reversals. Hidden divergence suggests trend continuation after a pullback. Traders who understand this distinction avoid confusing signals that occur during different market phases.

The calculation logic varies by indicator, but most scan for pivot points in price and compare them to corresponding pivot points in oscillators like RSI, MACD, or Stochastic. When price makes a new high, but the oscillator doesn’t, the algorithm flags it. The same principle applies in reverse for lows.

How Traders Apply It to Real Setups

Here’s where theory meets reality. On GBP/JPY’s daily chart during volatile sessions, a trader might spot the price making a new swing low at 180.50, breaking below the previous low of 181.20. But the RSI forms a higher low. That’s regular bullish divergence—momentum is strengthening even as price drops. Smart traders don’t jump in immediately. They wait for confirmation: a candlestick reversal pattern, a break above a minor resistance level, or volume confirmation.

The indicator shines brightest on the 1-hour and 4-hour charts. Lower timeframes generate too many false signals during choppy markets. Daily charts work, but signals appear less frequently. When trading the EUR/USD during the London session overlap, the 1-hour chart often provides the sweet spot between signal frequency and reliability.

That said, divergence doesn’t work well in strong trending markets. During NFP releases or central bank announcements, momentum indicators can stay “oversold” or “overbought” for extended periods while the price continues trending. Experienced traders avoid divergence signals during high-impact news events.

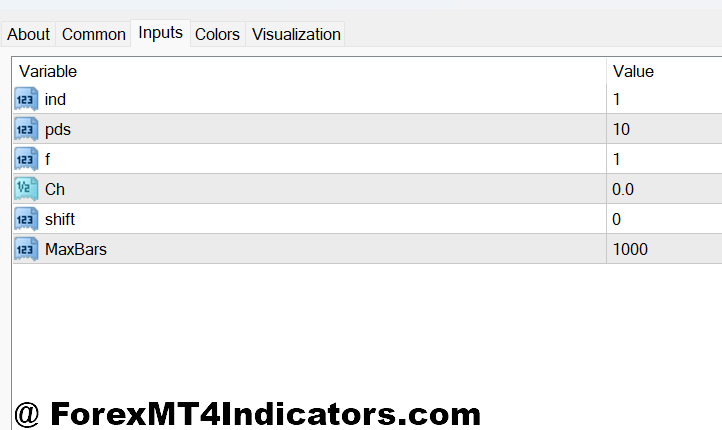

Settings That Actually Matter

Default settings on most MT4 divergence indicators include a 14-period RSI or a 12/26/9 MACD. These work fine for standard timeframes, but customization improves results. For scalping on the 15-minute chart, some traders reduce the RSI period to 9 or 10 for more responsive signals. Swing traders on the 4-hour chart might increase it to 21 for smoother readings.

The lookback period—how many bars the indicator scans for pivot points—affects signal generation. A 5-bar lookback catches divergences quickly but produces more noise. A 10-bar lookback filters out minor fluctuations but might lag during fast reversals. There’s no perfect setting. It depends on the currency pair’s volatility and the trader’s timeframe.

Alert settings deserve attention too. Pop-up alerts, email notifications, or mobile push alerts help traders catch divergences without staring at charts all day. But here’s the catch: too many alerts lead to alert fatigue. Traders start ignoring them. Setting alerts only for divergence on higher timeframes (4-hour or daily) keeps the signal-to-noise ratio manageable.

The Honest Truth: Advantages and Limitations

The biggest advantage? Early warning signals. Divergence often appears before price reversals become obvious. On USD/CAD, traders who caught the bearish divergence near the 1.3800 level in early trend exhaustion had better entry prices than those who waited for a confirmed downtrend.

Another plus: it works across all currency pairs and timeframes. The logic behind momentum-price disagreements applies whether trading majors, crosses, or exotics. It’s not pair-specific like some support/resistance levels that only matter on certain instruments.

But let’s be real about the limitations. Divergence can persist for dozens of bars before price actually reverses. That’s called “staying wrong longer than you can stay solvent.” Price might make multiple new highs with divergence showing on each one. Traders who short too early get stopped out repeatedly.

False signals plague divergence indicators during ranging markets. When price chops sideways between support and resistance, oscillators generate divergence signals that go nowhere. The indicator can’t distinguish between a genuine trend reversal setup and meaningless noise in consolidation.

Trading forex carries substantial risk. No indicator guarantees profits. Divergence indicators improve decision-making when combined with price action analysis, support/resistance levels, and proper risk management. Used in isolation, they’re a recipe for frustration.

How It Stacks Up Against Other Tools

Compared to simple moving average crossovers, divergence indicators provide earlier signals. But they require more interpretation skill. A moving average crossover is binary—it happened or it didn’t. Divergence requires judgment: Is this divergence strong enough to act on? Is the trend mature enough to reverse?

Against Fibonacci retracements, divergence offers different information. Fibs show potential reversal zones based on price structure. Divergence shows momentum weakness. Combining them creates powerful setups: divergence forms near a 61.8% Fib level, for example.

The Elliott Wave traders often use divergence to confirm wave counts. Wave 5 frequently shows divergence as the final thrust exhausts. That’s a more advanced application, but it demonstrates how divergence fits into broader technical frameworks.

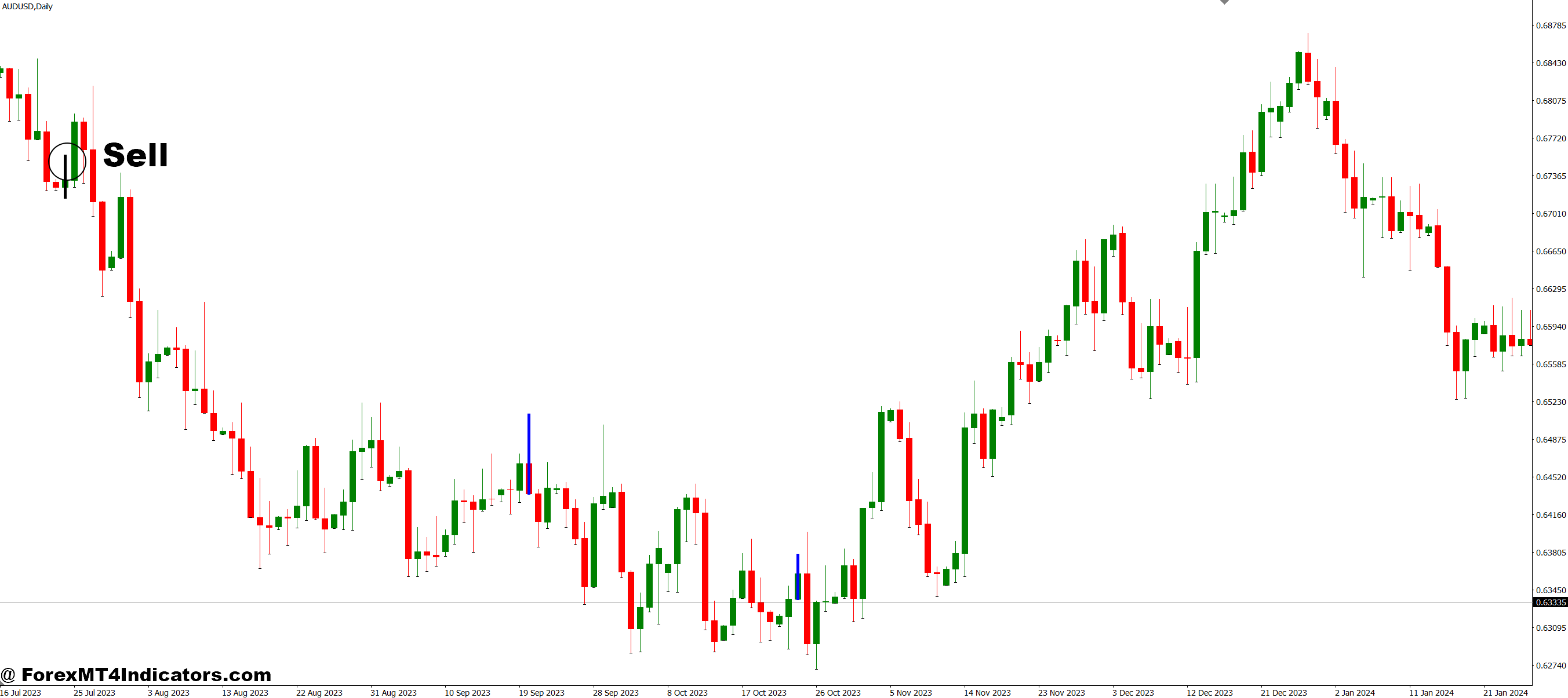

How to Trade with MT4 Divergence Indicator

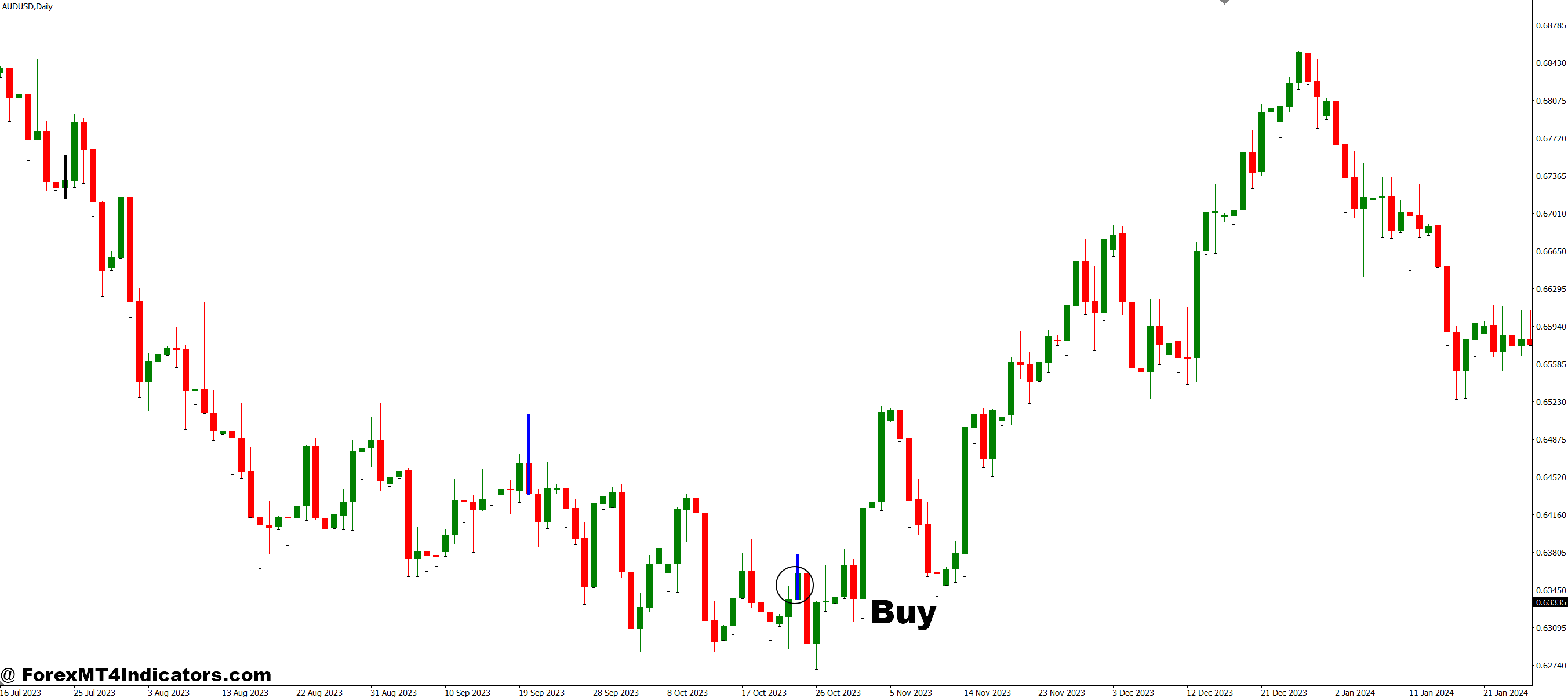

Buy Entry

- Wait for bullish divergence confirmation on the 1-hour chart – Price makes a lower low while RSI forms a higher low; enter only after a bullish engulfing candle closes above the divergence zone, typically 5-10 pips above the low.

- Set stop loss 10-15 pips below the divergence swing low – This protects against false signals while giving the trade room to breathe; on GBP/USD’s 4-hour chart, this usually means 15-20 pip stops during the London session.

- Target the previous swing high as the first profit level – Lock in 50% position when price reaches prior resistance; this banking strategy works best on EUR/USD daily charts where swings are 80-150 pips.

- Avoid divergence signals during strong downtrends – If price is below the 200-period moving average and making consistent lower lows, skip the signal; momentum can stay oversold for weeks during bearish trends.

- Combine with support zones for higher probability – Bullish divergence at a major support level (previous swing low, round number, or daily pivot) increases win rate by 15-20% compared to random divergence signals.

- Check higher timeframe direction before entry – If the 4-hour shows bullish divergence but the daily chart is in a strong downtrend, reduce position size by 50% or skip the trade entirely.

- Don’t chase after 3+ bullish candles post-divergence – If price has already rallied 30-40 pips from the divergence low, you’ve missed the entry; wait for a pullback or find a new setup instead of buying extended moves.

- Use 1-2% risk per trade maximum – Even high-probability divergence setups fail 40-50% of the time; risking more than 2% of account equity per signal leads to drawdowns that are hard to recover from.

Sell Entry

- Identify bearish divergence on 4-hour or daily charts – Price makes a higher high while MACD forms a lower high; enter 5-10 pips below the bearish candle that closes beneath the divergence peak.

- Place stop loss 15-20 pips above the divergence swing high – On volatile pairs like GBP/JPY, extend stops to 25-30 pips to avoid getting stopped out by normal price fluctuation before the reversal develops.

- Take profit at the previous swing low – Exit 50% of position when price drops to prior support; trail the remaining position with a 20-pip trailing stop to catch extended moves.

- Skip signals during news events or NFP releases – Divergence becomes unreliable when EUR/USD gaps 50+ pips on central bank announcements; momentum indicators can’t predict news-driven volatility.

- Confirm with resistance rejection – Bearish divergence plus a pin bar or shooting star at resistance increases probability; wait for the rejection candle to close before entering the short.

- Ignore divergence in ranging markets – If EUR/USD is chopping between 1.0800-1.0850 for days, divergence signals will whipsaw you; only trade divergence when there’s a clear trend to reverse.

- Check if RSI is actually overbought (above 70) – Bearish divergence works best when oscillators are in extreme zones; divergence at RSI 55 often fails because momentum isn’t truly exhausted.

- Don’t hold through major support levels – If bearish divergence trade reaches a weekly support zone and hasn’t triggered your profit target, exit manually; holding through strong support often results in quick reversals that erase profits.

Conclusion

MT4 divergence indicators excel at identifying momentum-price disconnects that signal potential reversals or continuation setups. They work best on 1-hour to daily charts, struggle during strong trends and news events, and require confirmation from price action before trades get placed. The key advantage—early warnings—comes with the key limitation—persistence of divergence without immediate price response.

Traders who master divergence analysis typically use it as one tool among many, not a standalone strategy. They adjust settings based on volatility and timeframe, filter signals through support/resistance levels, and always manage risk appropriately. Start by backtesting divergence signals on your favorite pairs. Note which timeframes and oscillator settings produce reliable signals in different market conditions. That hands-on experience beats any theoretical knowledge.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.