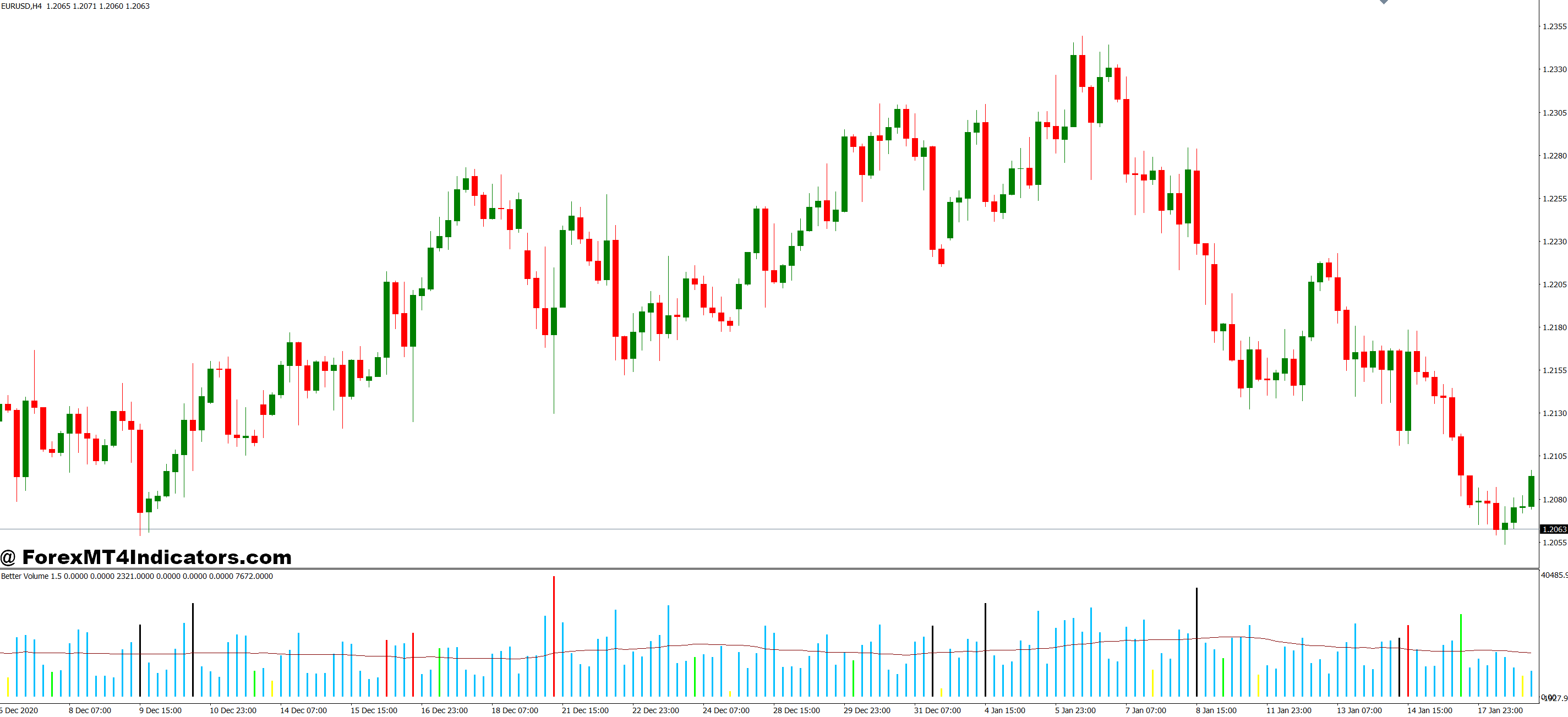

The volume indicator in MetaTrader 4 displays tick volume—the number of price changes that occurred during each time period. Here’s the thing: MT4 doesn’t have access to actual traded volume like you’d see on futures exchanges. Instead, it counts how many times the price ticked up or down within each candle.

A green or red histogram appears below your chart, with each bar representing one candle’s activity. Taller bars mean more price fluctuations happened during that period. Shorter bars indicate quieter price action with fewer ticks.

This tick volume correlates strongly with actual trading volume, especially on major pairs like EUR/USD or GBP/JPY. When institutional players are active, prices tick more frequently. During Asian session doldrums on a random Tuesday? You’ll see those volume bars shrink considerably.

The Math Behind the Indicator

The calculation is straightforward. MT4 counts every bid or ask price change during the candle’s formation. If EUR/USD ticks from 1.0850 to 1.0851, that’s one count. If it ticks back to 1.0850, that’s another. Sum all those movements, and you’ve got your volume reading for that candle.

Traders often misunderstand this. They think volume means something complicated, but it’s just a tally of price activity. That simplicity makes it reliable. You’re not dealing with complex formulas that repaints or lag behind price action.

The indicator updates in real-time as the current candle develops. Watch a live chart during London open, and you’ll see that volume bar climbing as European traders pile in. By contrast, Sunday evening usually shows anemic volume bars as traders wait for Monday’s liquidity.

Putting Volume to Work in Real Trades

Volume shines brightest when confirming breakouts. Let’s say USD/JPY consolidates between 149.50 and 150.00 for three hours on the 15-minute chart. Price finally breaks above 150.00. But is it real?

Check the volume bar for that breakout candle. If it’s significantly taller than the previous 10-20 candles—maybe double or triple the average—that suggests genuine momentum. Traders are actively participating in the move. That’s your confirmation to enter long with more confidence.

But what if that breakout candle shows weak volume, barely higher than the consolidation candles? That’s a red flag. The break might be a fake-out driven by thin liquidity or stop-hunting. Smart traders wait for the next candle or skip the trade entirely.

Volume also helps identify exhaustion. Picture EUR/USD grinding higher for two hours, making steady progress on decent volume. Then you get a massive bullish candle that shoots price up 30 pips in five minutes. The volume bar absolutely explodes—three times taller than anything you’ve seen all session.

That extreme volume spike often marks a climax. Everyone who wanted to buy just bought. The fuel runs out, and price stalls or reverses. Experienced traders recognize this pattern and look to take profits or even fade the move.

Customizing Volume Settings for Different Scenarios

The default MT4 volume indicator works fine right out of the box, but you can adjust the visual display. Right-click the indicator, select “Properties,” and you’ll find options to change colors or line thickness.

Some traders prefer setting bullish volume bars (up-close candles) to green and bearish bars (down-close candles) to red. This color coding helps spot divergences faster. When price makes higher highs but volume bars are declining, that’s bearish divergence suggesting weakening momentum.

For scalpers working 1-minute or 5-minute charts, comparing volume bars between timeframes adds context. A spike on the 5-minute chart carries more weight than one on the 1-minute. The higher timeframe volume confirms broader market participation, not just fleeting tick noise.

Day traders often combine volume with support and resistance zones. High volume at a key level—say, the 1.1000 handle on EUR/USD—suggests strong interest. If price bounces off that level with elevated volume, the level holds more significance than a low-volume touch.

Strengths and Limitations You Need to Know

The MT4 volume indicator’s biggest strength is availability and simplicity. It’s built into every MT4 platform, requires zero setup, and updates instantly. You don’t need expensive data feeds or complicated subscriptions.

Volume divergence detection represents another advantage. When price trends strongly but volume keeps declining, you’re seeing participation dry up. That divergence often precedes reversals. Spotting these patterns early gives you an edge in timing exits or reversals.

That said, tick volume has limitations. It’s not actual traded contracts or dollars changing hands. A single large institution can move price significantly without generating massive tick volume if they’re placing limit orders carefully. You won’t always see their footprint.

Another drawback: MT4 only shows volume from your broker’s liquidity pool. Broker A might display different volume readings than Broker B for the same currency pair and timeframe. This inconsistency means you can’t rely on absolute volume numbers—only relative changes matter.

The indicator also lacks sophistication compared to professional volume tools. You won’t get volume profile, delta analysis, or cumulative volume delta. For most retail spot forex traders, though? Those advanced tools don’t matter much anyway. Tick volume provides enough signal for practical trading decisions.

How Volume Stacks Up Against Other Confirmation Tools

Comparing volume to RSI or MACD reveals different strengths. RSI tells you when price is stretched (overbought/oversold), but it doesn’t show conviction. You might see RSI at 75 indicating overbought conditions, yet if volume keeps climbing, the trend could run much further.

MACD histogram shows momentum shifts through moving average crossovers. That’s useful, but it lags behind price. Volume doesn’t lag—it reflects current market activity as it happens. When MACD shows bullish momentum AND volume confirms with strong bars, you’ve got a high-probability setup.

Some traders use the On-Balance Volume (OBV) indicator as an alternative. OBV adds volume on up days and subtracts it on down days, creating a cumulative line. It’s more sophisticated but also more complex. The simple MT4 volume histogram gives you 80% of the benefit with 20% of the mental overhead.

Ichimoku Cloud users often ignore volume entirely, relying instead on cloud structure and price position. But adding volume to Ichimoku setups improves results. When price breaks out of the cloud with high volume, that breakout deserves more respect than a quiet, low-volume break.

How to Trade with MT4 Volume Indicator

Buy Entry

- Volume spike on support bounce – Enter long when EUR/USD touches a key support level (like 1.0800) and the volume bar is 2x the 20-candle average, confirming buyers are defending the zone.

- Breakout confirmation above resistance – Take the buy when price breaks a 4-hour resistance level with volume exceeding 150% of recent average; avoid if volume is weak as it signals a fake-out.

- Bullish divergence with rising volume – Buy when price makes lower lows but volume bars show higher lows on the 1-hour chart, indicating accumulation before a reversal.

- Volume expansion during uptrend – Add to longs when GBP/USD trends higher and each rally candle shows progressively larger volume bars, confirming strong momentum continuation.

- Low-volume pullback entry – Enter on retracements that show 50% less volume than the initial breakout move, signaling the pullback lacks conviction and the uptrend will resume.

- Morning breakout with London volume – Go long on EUR/USD breakouts between 8:00-10:00 GMT when volume doubles from Asian session levels, capturing institutional participation.

- Skip choppy, erratic volume – Don’t buy when volume bars fluctuate wildly without pattern on the 15-minute chart; this indicates confused market conditions with high whipsaw risk.

- Risk 1% maximum per signal – Never risk more than 1% of your account on volume-based signals; place stops 10-15 pips below the support level that triggered your entry.

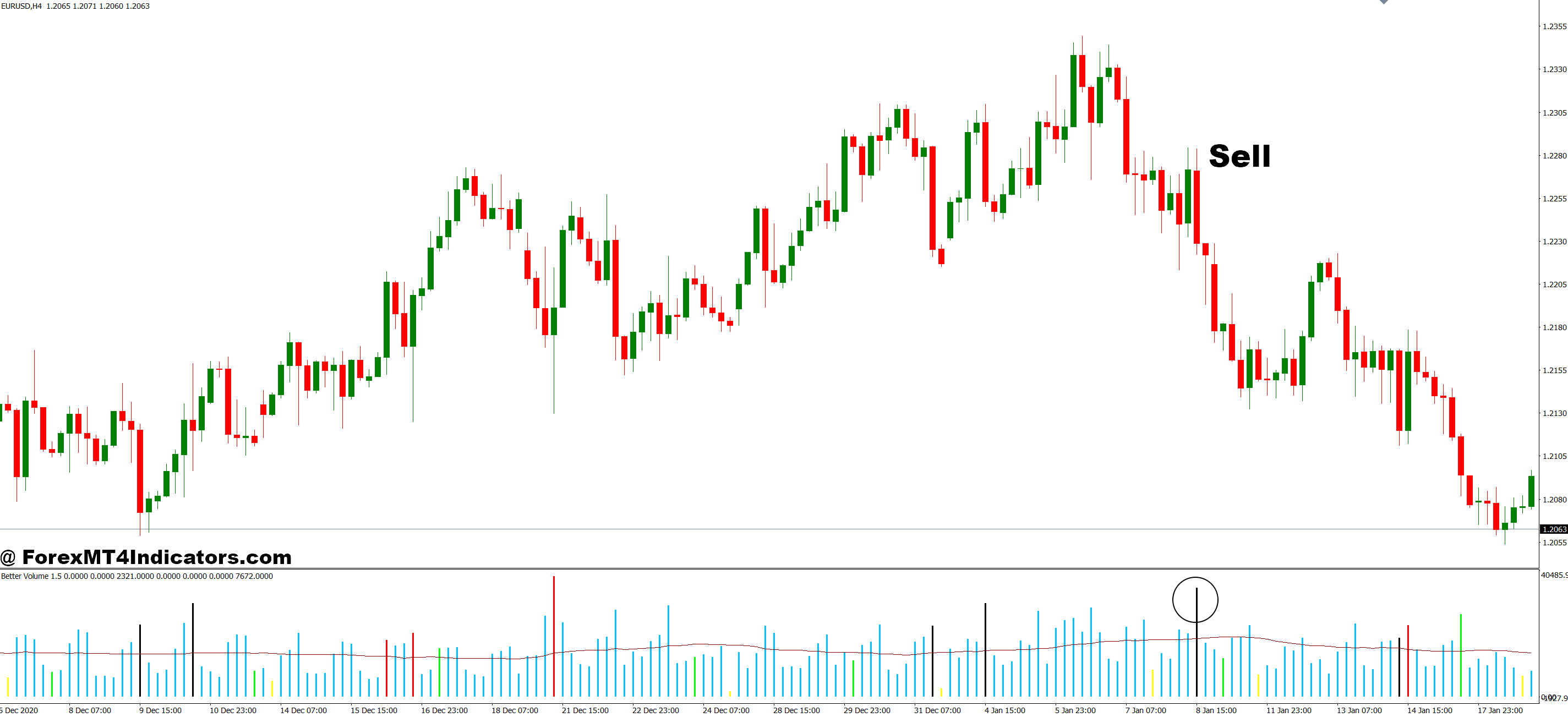

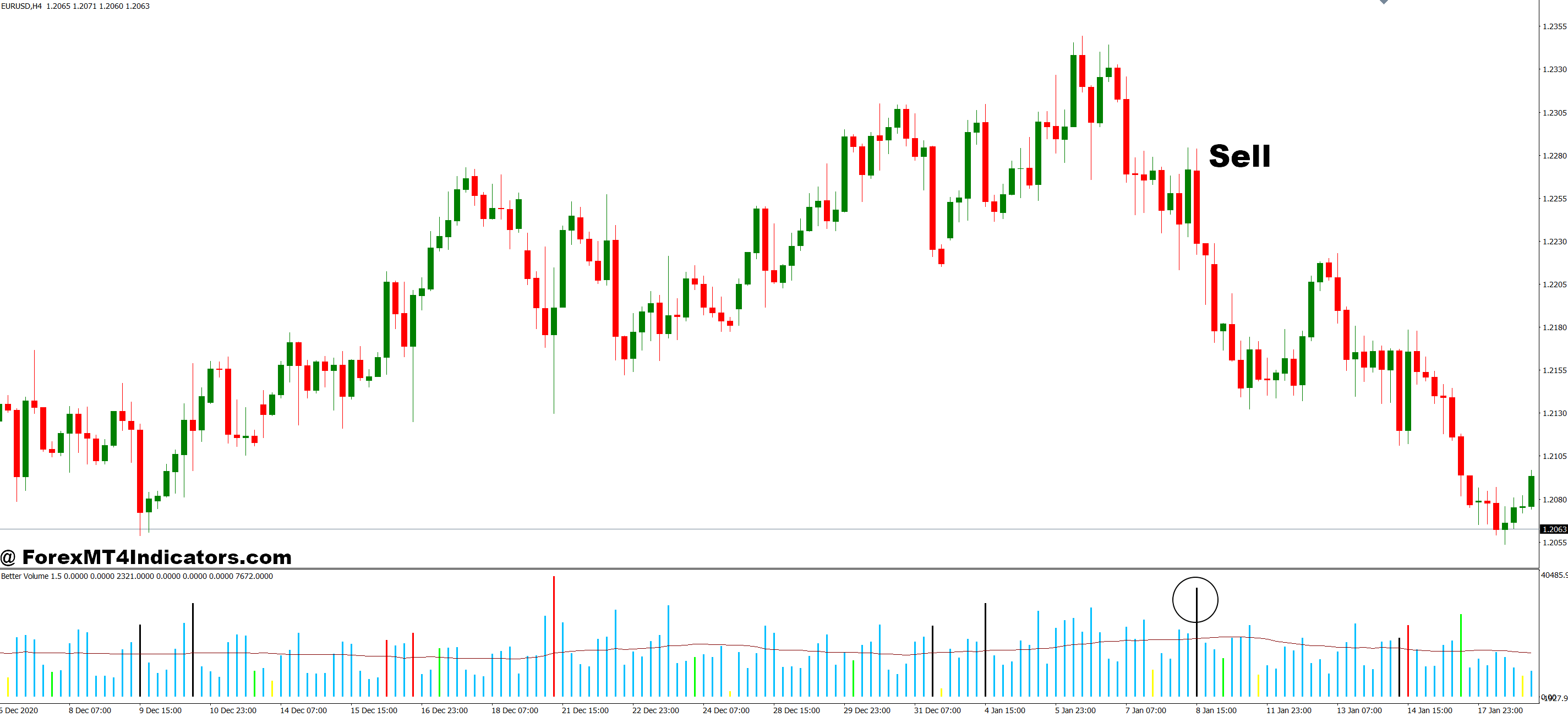

Sell Entry

- Volume climax at resistance – Short when price hits resistance (like GBP/USD at 1.2700) with volume 3x the average, indicating exhaustion and probable reversal within 2-4 candles.

- Breakdown with expanding volume – Sell when price breaks daily support with volume bars 50-100 pips larger than consolidation average, confirming sellers are in control.

- Bearish divergence pattern – Enter shorts when EUR/USD makes higher highs but volume steadily declines over 6+ candles on the 4-hour chart, showing weakening buying pressure.

- Volume spike rejection – Go short when price pushes to new highs, volume explodes, then the candle closes in the lower 30% of its range, indicating trapped buyers.

- Declining volume uptrend – Fade rallies when each higher high shows progressively smaller volume bars over 8+ hours, signaling the move is running out of fuel.

- Post-news fade with volume drop – Short 15-30 minutes after news spikes if the follow-through candles show 60% less volume than the initial reaction candle.

- Avoid low-volume Asian breakdowns – Skip sells during 22:00-6:00 GMT when volume is thin; breakdowns often reverse when London opens with real liquidity.

- Use 2:1 minimum reward-risk – Only take volume-confirmed sells targeting at least 40 pips when risking 20 pips; exit immediately if volume spikes against your position within 3 candles.

Making Volume Part of Your Trading System

Volume works best as a confirmation filter, not a standalone signal generator. Build your setups around price action, support and resistance, or your preferred indicators. Then use volume to confirm whether the setup deserves a trade.

Here’s a practical workflow: Spot a setup (double bottom, trendline break, whatever you trade). Before entering, glance at the volume bars. Does the confirming candle show above-average volume? If yes, take the trade. If volume’s weak or declining, pass or wait for better confirmation.

Trading forex carries substantial risk. No indicator guarantees profits, and volume can’t prevent losses from poor risk management or overtrading. But used correctly, the MT4 volume indicator helps you avoid low-conviction trades and increases your confidence in high-probability setups. That’s worth the two seconds it takes to check those histogram bars before clicking the buy or sell button.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.