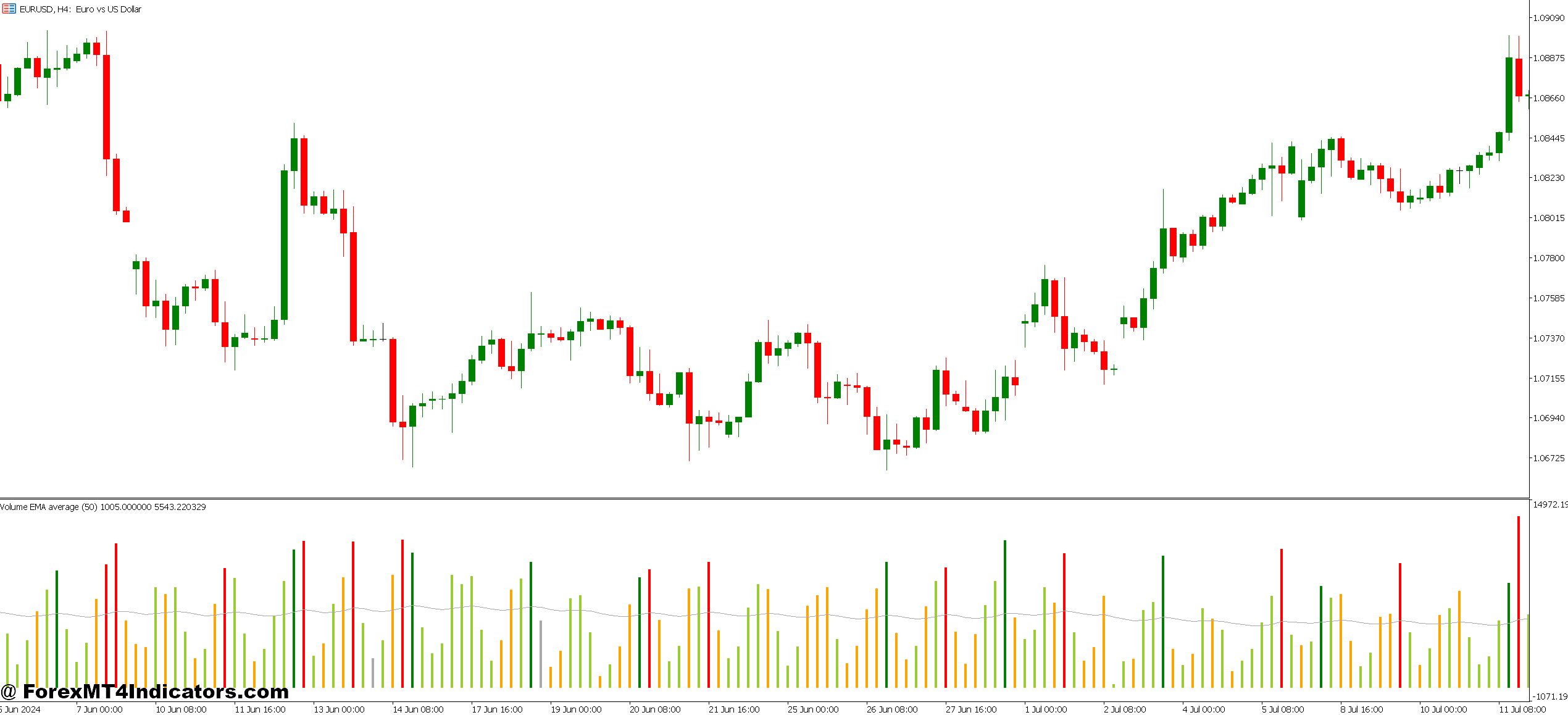

The MT5 Volume Indicator displays tick volume—the number of price changes during each period. While forex doesn’t have centralized volume like stocks, tick volume serves as a reliable proxy for actual trading activity. More ticks typically mean more trades happening.

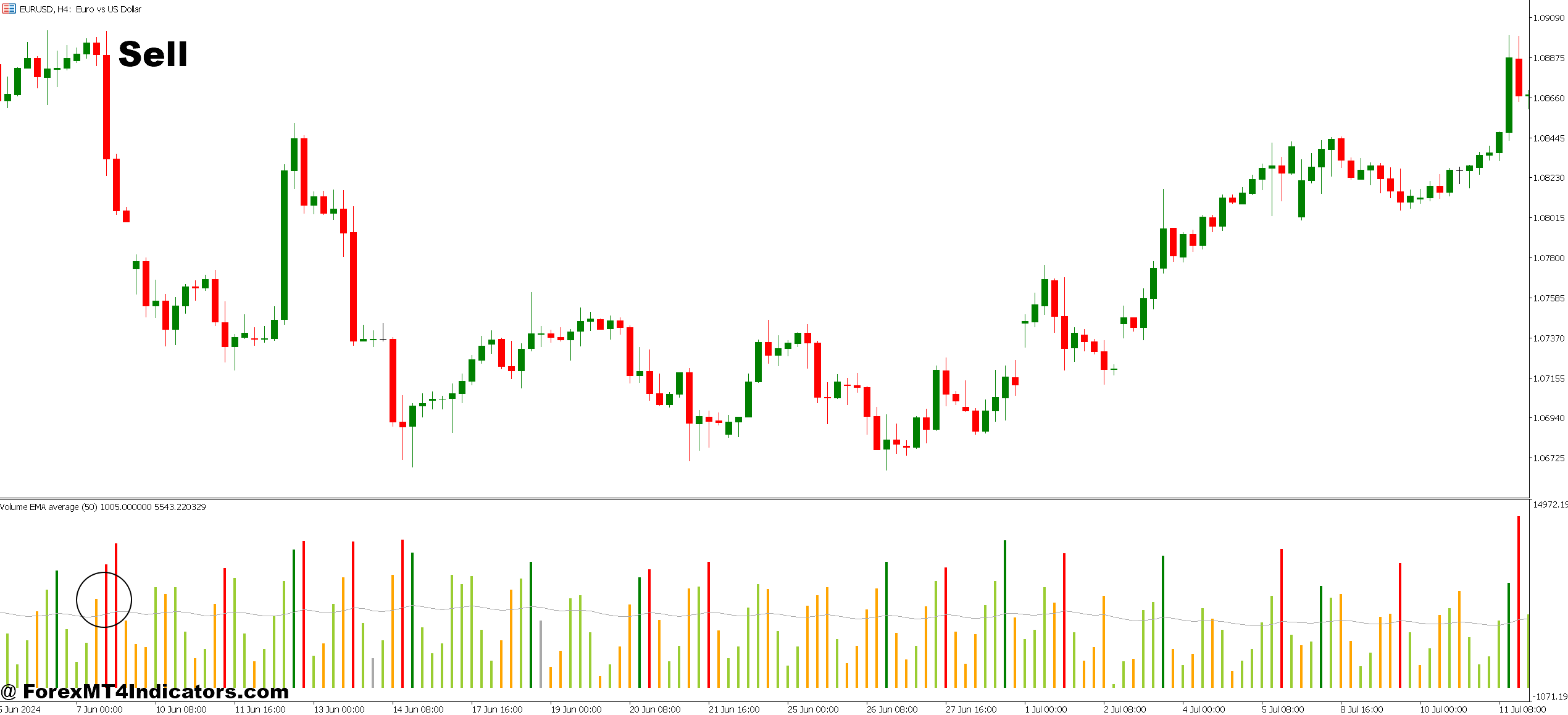

The indicator appears as a histogram below your price chart. Green bars show periods where volume increased from the previous bar. Red bars indicate decreasing volume. The height of each bar represents the intensity of trading activity during that specific candle.

This isn’t just decoration for your chart. Volume patterns reveal market psychology. High volume during uptrends suggests genuine buying interest. Low volume during rallies? That’s often a warning sign of weak moves that won’t last.

How Volume Patterns Guide Trading Decisions

Volume works best when paired with price action. A breakout above resistance means little if only 50 tick volume accompanies it. But if that same breakout shows 500 tick volume—three times the recent average—you’re likely seeing real institutional participation.

Here’s a specific example. On EUR/USD’s 15-minute chart during the London open, price broke above 1.0850 resistance. The breakout candle showed 320 tick volume while recent candles averaged 180. That volume surge confirmed strong buying pressure, and the pair continued 40 pips higher over the next two hours.

Conversely, watch for volume divergences. When price makes new highs but volume keeps declining, buyers are losing interest. Smart traders use this as an early exit signal. The 4-hour GBP/JPY chart showed this perfectly last month—price climbed to 183.50 with steadily dropping volume, then reversed 150 pips over three days.

Volume also helps during ranging markets. Low, consistent volume during sideways price action confirms you’re in consolidation. Don’t force trades there. Wait for volume to expand, signaling the market’s ready to trend again.

Customizing Your Volume Display

MT5 lets you adjust the indicator’s appearance and behavior. Right-click the volume histogram, select “Properties,” and you’ll find several useful options.

The “Volumes” dropdown offers two modes. “Tick Volume” (default) works fine for most forex trading. “Real Volume” only functions on exchanges that provide actual volume data, which excludes most forex brokers.

Color settings matter more than traders realize. Standard green/red works, but some prefer custom colors that match their chart theme. Better visibility means you’ll actually use the indicator instead of ignoring it.

Apply different volume indicators across timeframes for confirmation. A volume spike on the 1-hour chart carries more weight when the 4-hour chart shows increasing volume too. Cross-timeframe analysis filters out noise.

That said, don’t overcomplicate things. The default settings work well for most trading styles. Resist the urge to tweak every parameter—volume is straightforward by design.

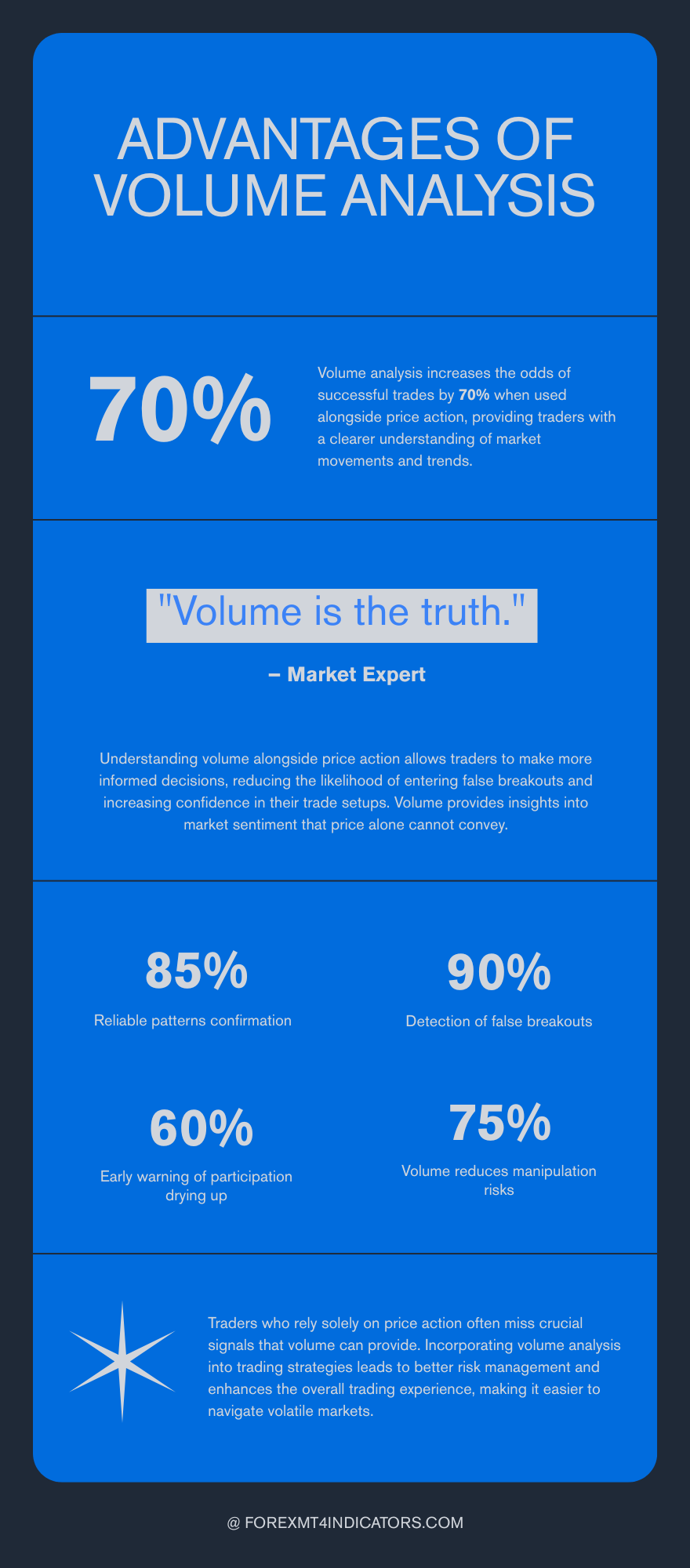

Real Advantages Over Flying Blind

The biggest edge volume provides is confirmation. Price patterns look identical whether they’ll succeed or fail—until you check volume. Ascending triangles, flags, head and shoulders patterns all become more reliable when volume confirms the expected move.

Volume catches divergences that price analysis misses. Traders watching only candlesticks often hold losing positions too long. Volume warns you earlier by showing participation is drying up before price visibly weakens.

It’s also harder to fake. While large players can push price around briefly, they can’t sustain moves without actual volume. Those quick stop-hunts and false breakouts typically show minimal tick volume. Learn to spot them, and you’ll avoid half the traps that catch retail traders.

The Limitations Worth Knowing

Trading forex carries substantial risk. No indicator guarantees profits, and volume is no exception.

Tick volume isn’t true volume. During major news events, you might see massive tick volume from rapid price fluctuations with relatively few actual trades. NFP releases and central bank announcements create this distortion regularly.

Volume doesn’t predict direction. High volume just means strong participation—it confirms moves after they start but won’t tell you which way price will break beforehand. You still need solid price action analysis and proper risk management.

Low liquidity pairs show less reliable volume patterns. EUR/USD and GBP/USD work great because they’re heavily traded. Exotic pairs like USD/TRY show erratic volume that’s harder to interpret meaningfully.

The indicator also lags. By the time volume confirms a breakout, you’ve already missed the absolute best entry. That’s acceptable—getting confirmation beats gambling on every potential breakout. But don’t expect volume to get you in at exact tops and bottoms.

How to Trade with MT5 Volume Indicator

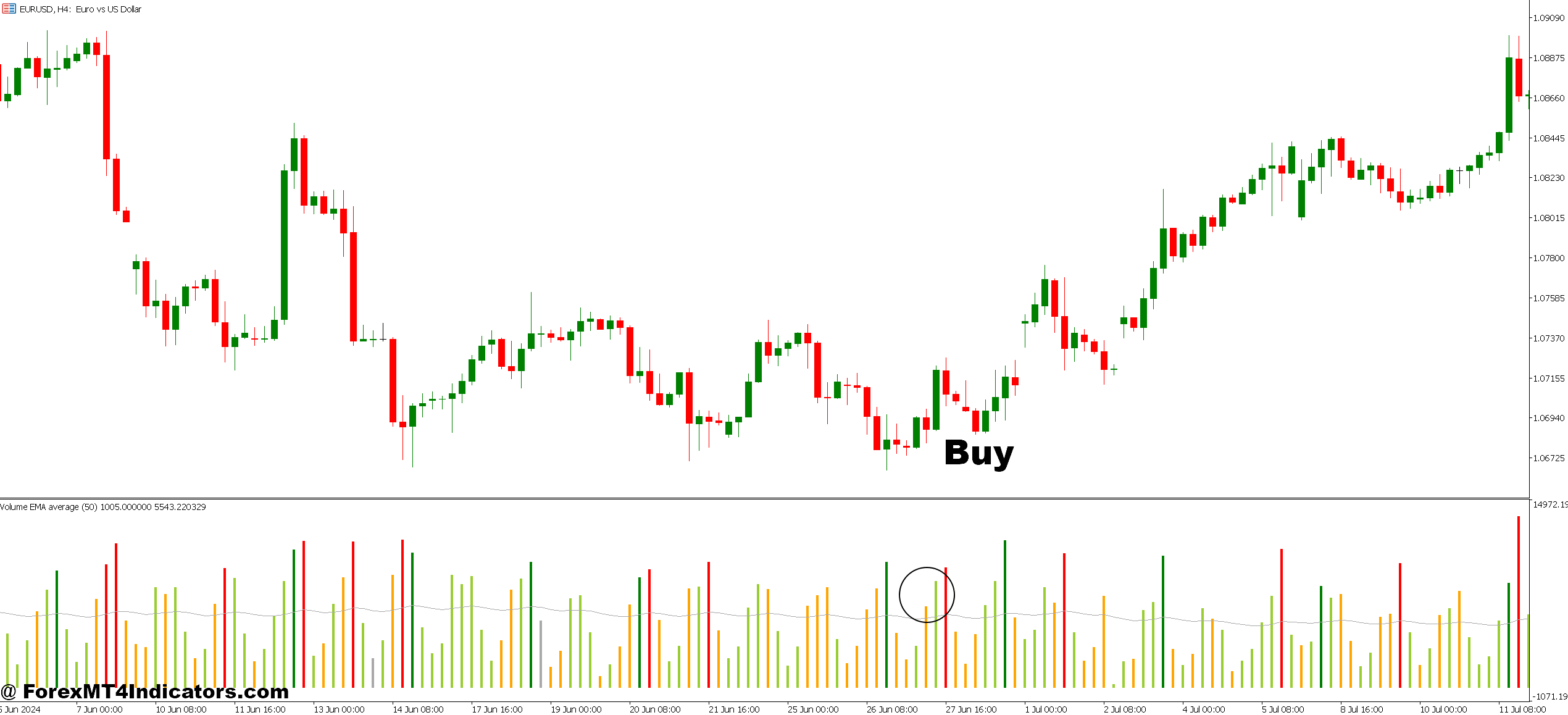

Buy Entry

- Volume surge on breakout above resistance – Enter long when price breaks a key level (like 1.0850 on EUR/USD) with volume 2x the 20-period average on the 1-hour chart or higher timeframes.

- Bullish candle with expanding volume – Take buy positions when a strong bullish engulfing or pin bar forms with at least 50% more volume than the previous 5 candles.

- Volume confirmation at support bounce – Buy when price touches major support and the bounce candle shows volume exceeding the recent average by 30% or more.

- Declining volume during pullbacks – Enter on pullbacks that show decreasing volume (indicating weak selling pressure) when the main uptrend has strong volume, especially on GBP/USD 4-hour charts.

- Volume divergence recovery – Buy when price makes a higher low with increasing volume after a period of bearish divergence (falling volume during uptrend), signaling renewed buyer interest.

- Risk 1-2% maximum per trade – Never enter a buy signal, regardless of volume confirmation, if you can’t place a stop loss that risks only 1-2% of your account balance.

- Avoid low-volume breakouts during Asia session – Skip buy signals on EUR/USD or GBP/USD between 10 PM-3 AM EST when volume typically drops below 60% of London session averages.

- Wait for volume follow-through – Don’t buy immediately on volume spikes during news events; wait 15-30 minutes for follow-through volume to confirm the move isn’t just initial volatility.

Sell Entry

- Volume spike on resistance rejection – Enter short when price fails at resistance with volume 2x higher than the 20-candle average, indicating strong selling pressure on 1-hour or 4-hour timeframes.

- Bearish pattern with high volume confirmation – Sell when bearish engulfing, evening star, or shooting star patterns form with volume at least 40% above recent averages.

- Breakdown through support with expansion – Take short positions when price breaks support levels with volume exceeding the 50-period moving average by 60% or more.

- Declining volume during rally attempts – Short when price tries to rally within a downtrend but volume keeps dropping 20-30% with each bounce, showing weak buying conviction.

- Volume divergence at new highs – Sell when price makes higher highs but volume decreases for 3+ consecutive peaks, especially on GBP/JPY or EUR/USD daily charts.

- Place stops 20-30 pips above structure – Set stop losses above the most recent swing high plus spread; skip the trade if this exceeds your 2% risk limit per position.

- Skip sells during Friday afternoon – Avoid short entries after 12 PM EST on Fridays when volume drops significantly and weekend gaps can trigger stops unexpectedly.

- Ignore volume spikes in thin markets – Don’t short exotic pairs or during major holidays when volume readings become unreliable due to low liquidity and erratic tick patterns.

How This Fits Your Trading Strategy

Volume works as a filter, not a standalone system. Use it to confirm what your primary analysis already suggests. Spot a bullish engulfing pattern? Check if volume increased. See a trendline break? Look for expanding volume. Notice a double top formation? Declining volume adds conviction.

Combine volume with support and resistance levels for high-probability setups. When price approaches a major level with increasing volume, expect a significant reaction—either a strong bounce or a clean break.

The 200-period moving average on the volume indicator itself provides context. Volume above its own average suggests heightened activity worth paying attention to. Volume below average during breakouts screams “fake-out.”

Start simple. Watch for volume expansion during your normal trade entries. If your method works better with volume confirmation, keep using it. If you notice little difference after testing 30-50 trades, you might not need it. The goal is finding what improves your specific approach, not copying someone else’s setup.

Volume won’t transform a struggling trader overnight. But it adds one more layer of confirmation that keeps you out of marginal trades. Over time, avoiding those extra losses compounds into real money saved—and that’s often the difference between profitable months and breakeven ones.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.