The Pi Cycle Top Indicator is a technical analysis tool that traders use to identify possible market tops, particularly in cryptocurrency markets like Bitcoin. It got its name from the mathematical constant Pi (3.14), which plays a role in how the indicator calculates its signals. The indicator works on the MetaTrader 5 (MT5) platform, making it accessible for traders who already use this popular trading software. Unlike some complicated indicators that require a PhD to understand, this one keeps things pretty straightforward with just two moving averages doing the heavy lifting.

How the Indicator Works

The magic happens when two specific moving averages interact with each other. The first one is a 111-day moving average, and the second is a 350-day moving average that gets multiplied by two. When the shorter 111-day moving average crosses above the longer one, the indicator flashes a potential top signal. Traders watch for this crossover like hawks because historically, it’s shown up right around major price peaks. The beauty of having this on MT5 is that the platform does all the calculations automatically, so traders just need to watch for the crossover signal instead of crunching numbers themselves.

Why Traders Love This Tool

Traders appreciate the Pi Cycle Top Indicator because it takes the guesswork out of one of the hardest questions in trading: when to sell. Nobody wants to be that person who sells too early and misses out on gains, but they also don’t want to be the one holding the bag when prices crash. This indicator has built up a solid track record, especially with Bitcoin, where it’s called several major tops with impressive accuracy. It gives traders a concrete signal to work with instead of relying purely on gut feelings or trying to predict the unpredictable. Plus, since it’s based on moving averages, it filters out a lot of the day-to-day noise that can make traders second-guess themselves.

Using It in Real Trading

Of course, no indicator is perfect, and smart traders know not to rely on just one tool. The Pi Cycle Top works best when combined with other forms of analysis and risk management strategies. Some traders use it as their main exit signal, while others treat it as one piece of a bigger puzzle. The key is understanding that it shows potential tops, not guaranteed ones. Markets can stay irrational longer than anyone expects, and sometimes a signal might flash early or late. Still, having this indicator running on MT5 gives traders an extra set of eyes watching for those critical turning points that could mean the difference between a great trade and a painful lesson.

How to Trade with Pi Cycle Top MT5 Indicator

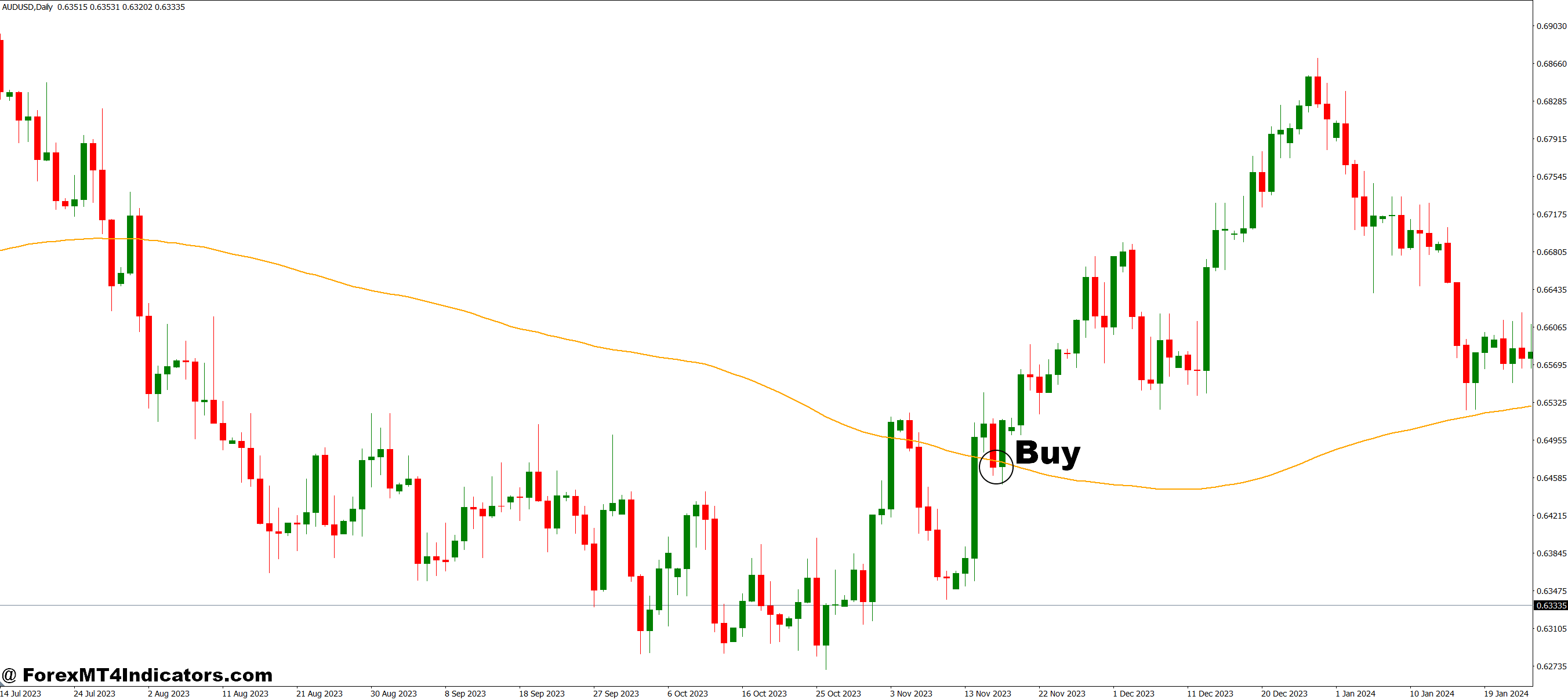

Buy Entry

- Reverse logic (use with caution) – Some traders buy when the lines are far apart and moving averages show a wide spread, indicating the market is far from a top.

- After a confirmed top – Wait for the price to drop significantly after a Pi Cycle Top signal, then use OTHER indicators to find buy entries at lower levels.

- Use different tools for entries – combine the Pi Cycle Top with bottom-finding indicators, such as RSI oversold conditions or support levels, for buy signals.

- Dollar-cost averaging – After a top signal triggers and prices decline, gradually buy back in at lower price points rather than timing one perfect entry.

- Wait for separation – Consider buying when the 111-day MA drops back below the 350-day MA × 2, showing the top signal has reset (though this isn’t a traditional buy signal).

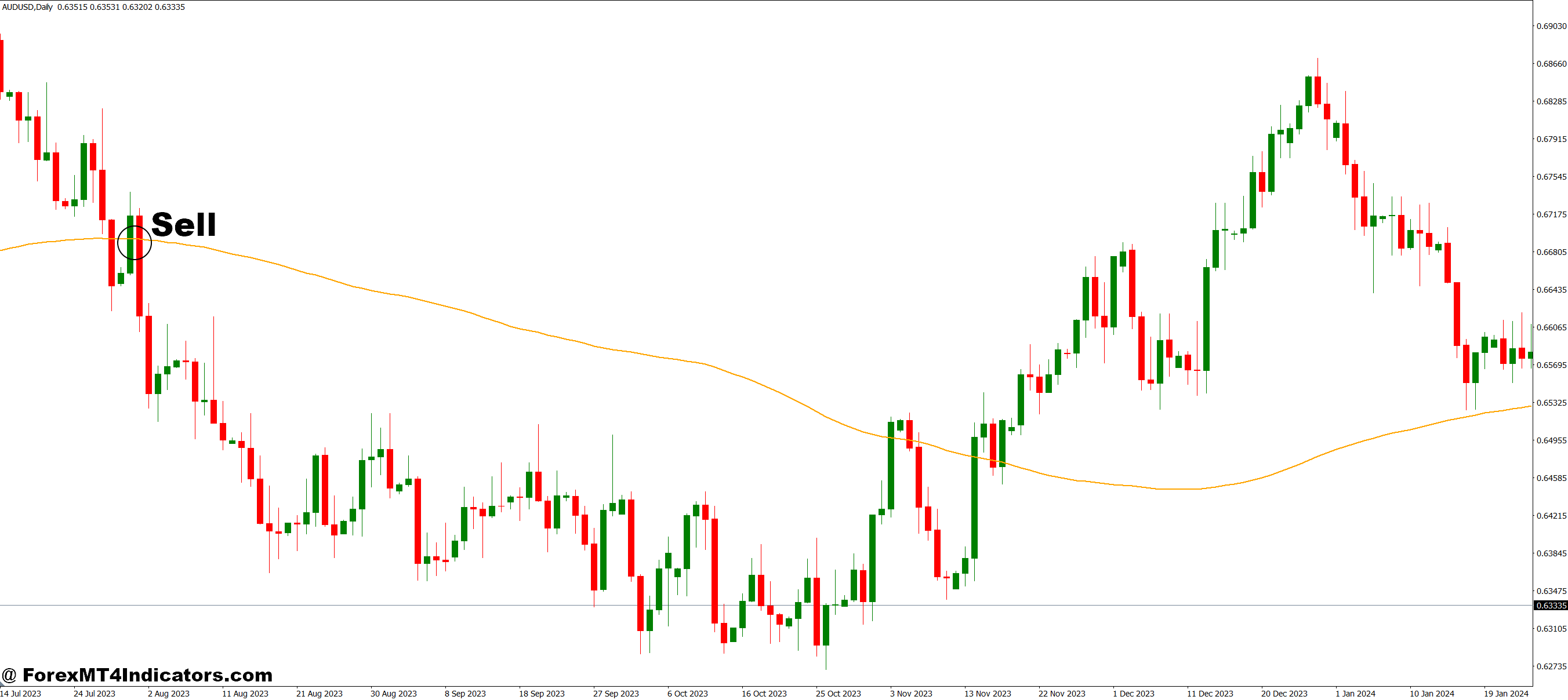

Sell Entry

- Watch for the crossover – When the 111-day moving average crosses above the 350-day moving average (multiplied by 2), it signals a potential market top.

- Don’t wait for confirmation – The indicator works best when traders act on the crossover signal rather than waiting to see if prices actually drop.

- Consider scaling out – Instead of selling everything at once, traders can sell portions of their position as the lines get closer and complete the exit on the crossover.

- Check the trend strength – The signal is stronger when it happens after a significant uptrend, not during sideways or choppy price action.

- Use stop-losses – Even with the signal, set a stop-loss above the recent high in case the market pushes higher before reversing.

- Look at volume – If the crossover happens with decreasing volume, it adds more weight to the top signal.

Conclusion

The Pi Cycle Top MT5 Indicator offers traders a practical way to spot potential market peaks without needing a crystal ball. Tracking two moving averages and watching for their crossover provides clear signals that have historically aligned with major tops. While it shouldn’t be the only tool in anyone’s trading toolkit, it’s definitely earned its place as a valuable resource for those looking to time their exits more effectively. For traders who want to avoid the all-too-common mistake of holding through a crash, this indicator brings some much-needed clarity to an otherwise murky decision.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.