The Quasimodo Pattern MT4 Indicator solves this specific problem by automatically identifying one of the most reliable reversal formations in price action trading. This pattern, affectionately nicknamed after the hunchback character due to its distinctive shape, flags potential turning points where institutional traders often pile in. Let’s break down exactly how this indicator works and why traders who understand it gain a genuine edge.

What Makes the Quasimodo Pattern Different

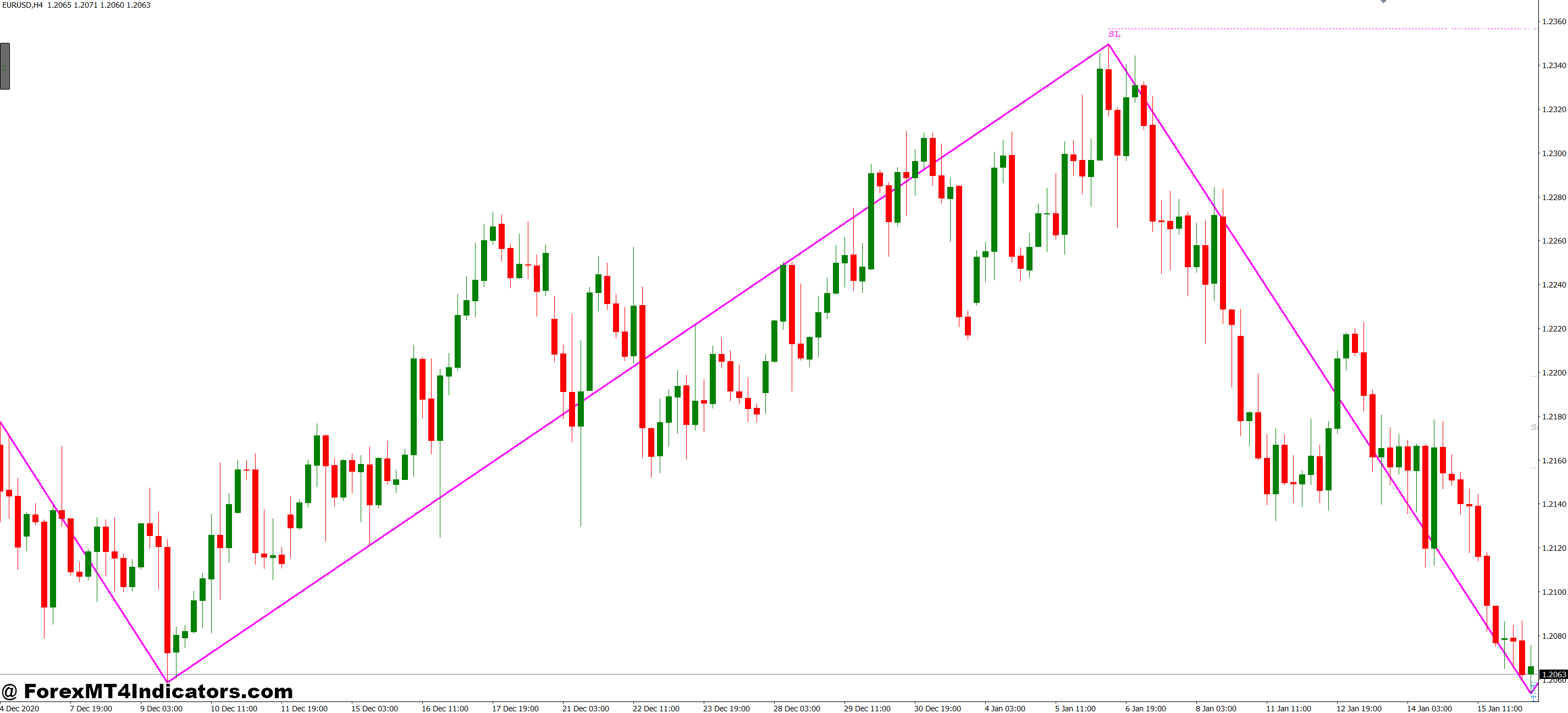

The Quasimodo pattern isn’t your typical indicator that plots lines or oscillates in a separate window. It identifies a specific price structure that signals trapped traders and potential reversals. Here’s what it looks like: price creates a swing high (or low), pulls back, breaks that level with conviction, then reverses sharply when weak hands get squeezed out.

The pattern consists of three key elements. First, an initial swing point establishes a temporary high or low. Second, price breaks through this level, which triggers stop losses and lures breakout traders into positions. Third, the false breakout fails and price aggressively reverses, creating that characteristic “hunchback” formation on the chart.

What separates Quasimodo from head and shoulders patterns? The neckline break. While head and shoulders requires a break of the neckline for confirmation, Quasimodo triggers when price fails to hold beyond the initial swing point. That subtle difference means earlier entries and often better risk-to-reward ratios.

How the Indicator Identifies Valid Setups

The MT4 version automates pattern recognition by scanning for specific structural requirements. The algorithm tracks swing highs and lows across your selected timeframe, then monitors for violations of these levels. When price breaks a swing point but fails to maintain momentum, the indicator flags the potential reversal zone.

Most versions plot arrows or boxes around the pattern, with the critical entry zone marked at the point where the false breakout occurred. Traders who tested this on GBP/JPY during the 2023 Bank of England announcements noticed the indicator caught multiple 80-100 pip reversals that manual chart reading might’ve missed in real-time volatility.

The calculation logic centers on measuring the distance between the initial swing, the false breakout depth, and the reversal point. Better indicators allow customization of the minimum swing size and breakout distance to filter out noise on smaller timeframes. A typical setting might require a 20-pip minimum swing on the 1-hour chart, while day traders using 15-minute charts might drop this to 8-10 pips.

Real-World Application Across Market Conditions

The pattern shines brightest during ranging markets transitioning to trends. When AUD/USD consolidated between 0.6450 and 0.6520 for two weeks in late 2024, the Quasimodo indicator marked three clean reversal setups at the range extremes. Each one offered at least a 2:1 risk-reward to the opposite range boundary.

But here’s the thing—not every Quasimodo signal deserves your attention. Context matters. The highest-probability setups occur when the pattern forms at significant support or resistance levels, previous swing points, or round psychological numbers. A Quasimodo forming at 1.1000 on EUR/USD carries more weight than one appearing at a random mid-range level like 1.0847.

Timeframe selection drastically impacts results. The 4-hour and daily charts produce fewer but higher-quality signals. Scalpers working 5-minute charts will see Quasimodo patterns constantly, but many turn into whipsaws within choppy price action. That said, during major news events like NFP releases, even 15-minute Quasimodo reversals can deliver explosive moves if you catch them right.

Entry timing requires discretion. Conservative traders wait for a close back above (or below) the original swing point. Aggressive traders enter on the first rejection candle, which improves the reward ratio but increases the risk of getting caught in continued false breakout volatility. Stop losses typically sit 5-10 pips beyond the false breakout extreme, while profit targets aim for previous swing points or use trailing stops to capture extended moves.

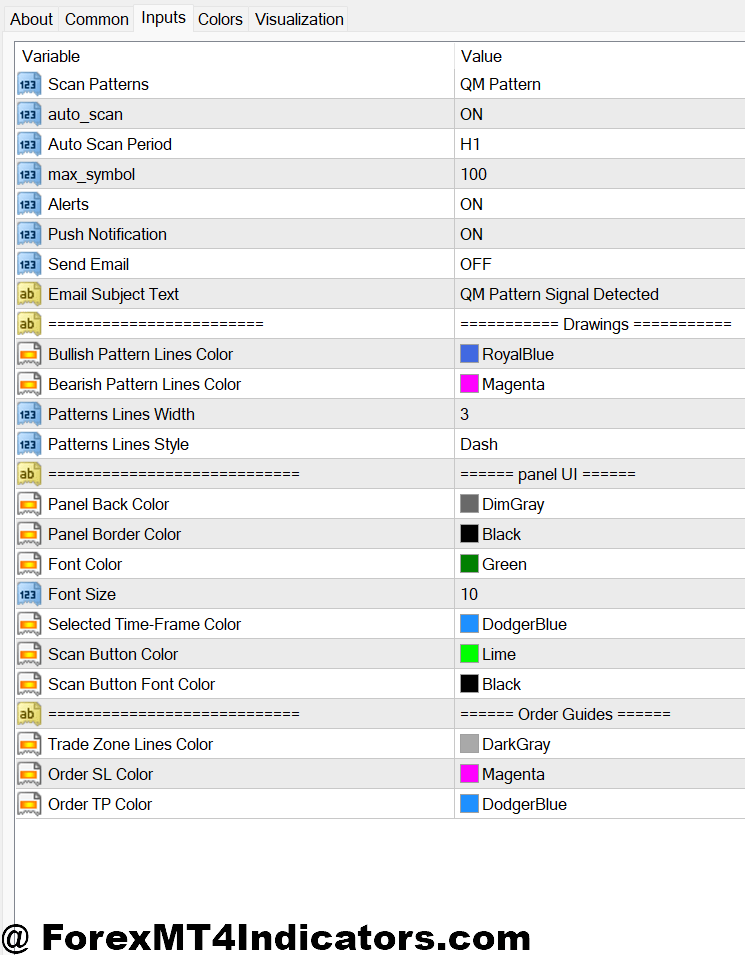

Customization and Parameter Optimization

Default settings rarely work optimally across all pairs and timeframes. The swing period parameter controls how far back the indicator looks to identify significant highs and lows. Setting this too low generates excessive signals with minimal follow-through. Too high, and you’ll miss responsive reversals in fast-moving markets.

For major pairs like EUR/USD and GBP/USD on 1-hour charts, a swing period of 15-20 bars balances signal frequency with quality. Exotic pairs with erratic movement might need 25-30 bars to filter out random noise spikes. The breakout confirmation parameter determines how many pips price must violate the swing point before the indicator considers it a valid break—typically 5-15 pips depending on the pair’s average true range.

Alert customization becomes crucial for traders monitoring multiple pairs. Most quality versions let you set email, mobile, or sound alerts when patterns form. This beats staring at charts for hours waiting for setups that might appear once or twice per week on any given pair.

Honest Assessment: Strengths and Limitations

The Quasimodo indicator excels at catching reversals where retail traders get trapped. When it works, the entries feel almost magical—you’re positioned right as the herd realizes they’re wrong. The pattern’s structure naturally provides clear stop-loss placement and favorable risk-to-reward scenarios.

That said, no indicator guarantees profits. Trading forex carries substantial risk, and the Quasimodo pattern fails plenty. Trending markets produce the most brutal losing streaks when every reversal attempt gets steamrolled by continuation. During the USD rally of late 2024, traders who blindly followed Quasimodo short signals on USD pairs got repeatedly stopped out as trends extended far beyond expectations.

False signals cluster during low-liquidity sessions. Asian session chop creates pattern-like formations that lack the institutional participation needed for genuine reversals. Some indicators lack filtering mechanisms to distinguish high-probability setups from random noise, which means traders must apply discretion rather than mechanically taking every signal.

The pattern also suffers during extremely volatile markets where price gaps through levels. Cryptocurrency crosses, especially during weekend trading, often invalidate Quasimodo setups with sudden spikes that ignore traditional support and resistance logic.

Combining Quasimodo with Confirmation Tools

Smart traders stack confluence factors before pulling the trigger. Pairing the Quasimodo indicator with RSI or stochastic oscillators helps confirm reversal momentum. When a Quasimodo pattern forms while RSI shows divergence at oversold levels, the probability of a successful reversal increases substantially.

Volume analysis adds another layer. Legitimate reversals typically show increased volume at the turning point as institutional money enters. Indicators displaying volume spikes can validate whether the Quasimodo pattern has real teeth or just represents thin retail positioning.

Previous price action remains the ultimate filter. A Quasimodo forming at a level where price previously rejected multiple times over the past month carries significantly more weight than a pattern at an untested level. This is where experience separates profitable traders from those who struggle—recognizing which patterns matter and which to ignore.

How to Trade with Quasimodo Pattern MT4 Indicator

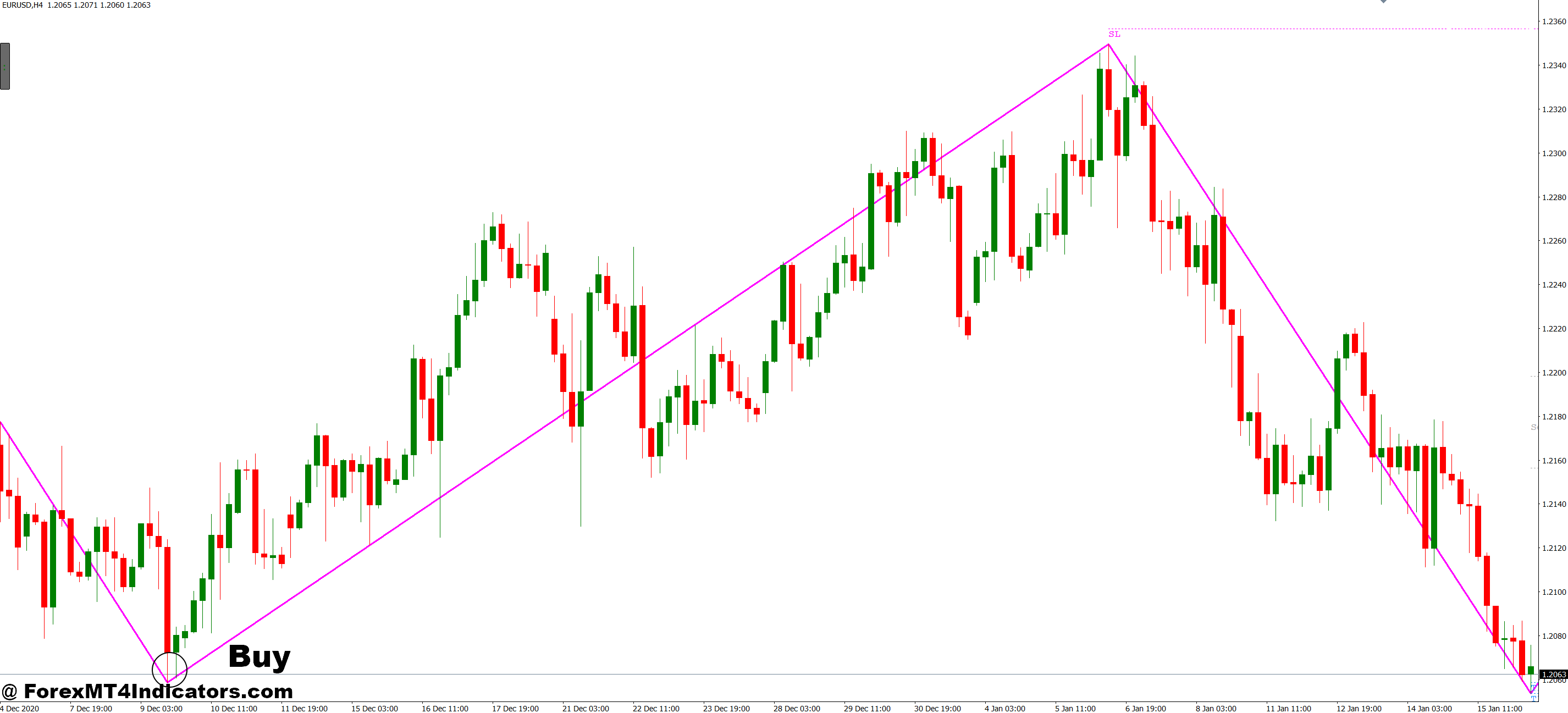

Buy Entry

- Identify the failed breakdown – Wait for price to break below a swing low by at least 5-10 pips on EUR/USD 1-hour chart, then reverse sharply back above it

- Confirm bullish rejection candle – Enter when a strong bullish candle closes above the violated swing low with a wick showing clear rejection of lower prices

- Check higher timeframe alignment – Only take the BUY signal if the 4-hour or daily chart shows overall bullish structure or you’re at major support

- Set stop loss 10-15 pips below the false breakdown low – Place your stop just beneath the lowest point of the failed break to minimize risk exposure

- Target previous swing high – Aim for the most recent resistance level which typically offers 30-60 pip potential on GBP/USD

- Avoid during strong downtrends – Skip BUY signals when price is making consistent lower lows and lower highs on the 4-hour timeframe

- Look for volume spike confirmation – The reversal candle should show increased volume compared to the previous 5-10 bars, indicating real buying pressure

- Consider RSI oversold conditions – Strongest BUY setups occur when the Quasimodo pattern forms while RSI is below 30 on the same timeframe

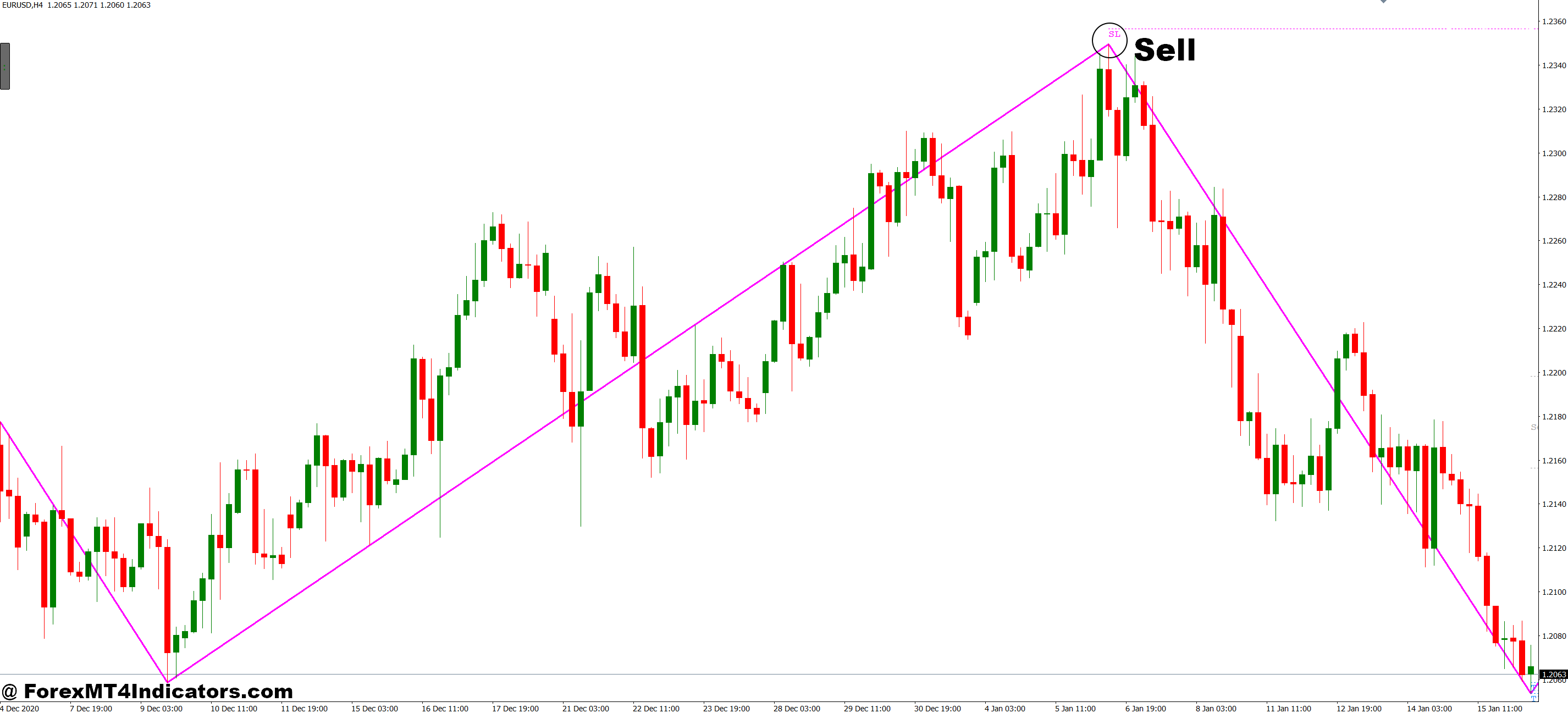

Sell Entry

- Spot the false breakout above resistance – Price must break a swing high by 5-10 pips minimum then fail to hold, reversing lower

- Wait for bearish engulfing confirmation – Enter when a strong red candle closes below the initial swing high, engulfing the false breakout

- Verify lower timeframe momentum shift – Check 15-minute chart shows lower highs forming after the failed breakout on your primary 1-hour chart

- Place stop loss 10-15 pips above the fake-out high – Protect yourself just beyond the highest point where bulls got trapped

- Target 2:1 or 3:1 reward-to-risk minimum – If risking 20 pips, aim for at least 40-60 pips toward the next support level on EUR/USD

- Skip signals during major news events – Avoid taking SELL entries 30 minutes before or after high-impact news like NFP or Fed decisions

- Check for bearish divergence – Best SELL signals happen when RSI makes lower highs while price makes higher highs at the Quasimodo pattern

- Ignore patterns in thin Asian session – Wait for London or New York session when institutional volume validates the reversal on major pairs

Final Thoughts

The Quasimodo Pattern MT4 Indicator offers traders a systematic approach to identifying high-probability reversal zones where breakout traders get trapped and institutional money often enters. When combined with proper market context, timeframe selection, and confluence factors, it can highlight opportunities with favorable risk-reward profiles. The pattern works best at significant support and resistance levels during markets transitioning from ranges to trends, though it struggles during strong trending conditions and low-liquidity sessions.

Success with this tool demands more than installing the indicator and taking every signal. Traders need to filter setups based on location, confirm reversals with price action or momentum indicators, and manage risk appropriately. The pattern won’t eliminate losing trades—nothing does—but it provides a structured framework for spotting reversals that might otherwise go unnoticed until after the fact.

Start by testing the indicator on major pairs with demo accounts, focusing on 1-hour or 4-hour timeframes where patterns develop with more reliability. Pay attention to which market conditions produce winning trades versus which generate false signals. That hands-on experience will teach you more than any article ever could about whether the Quasimodo pattern fits your trading style.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.