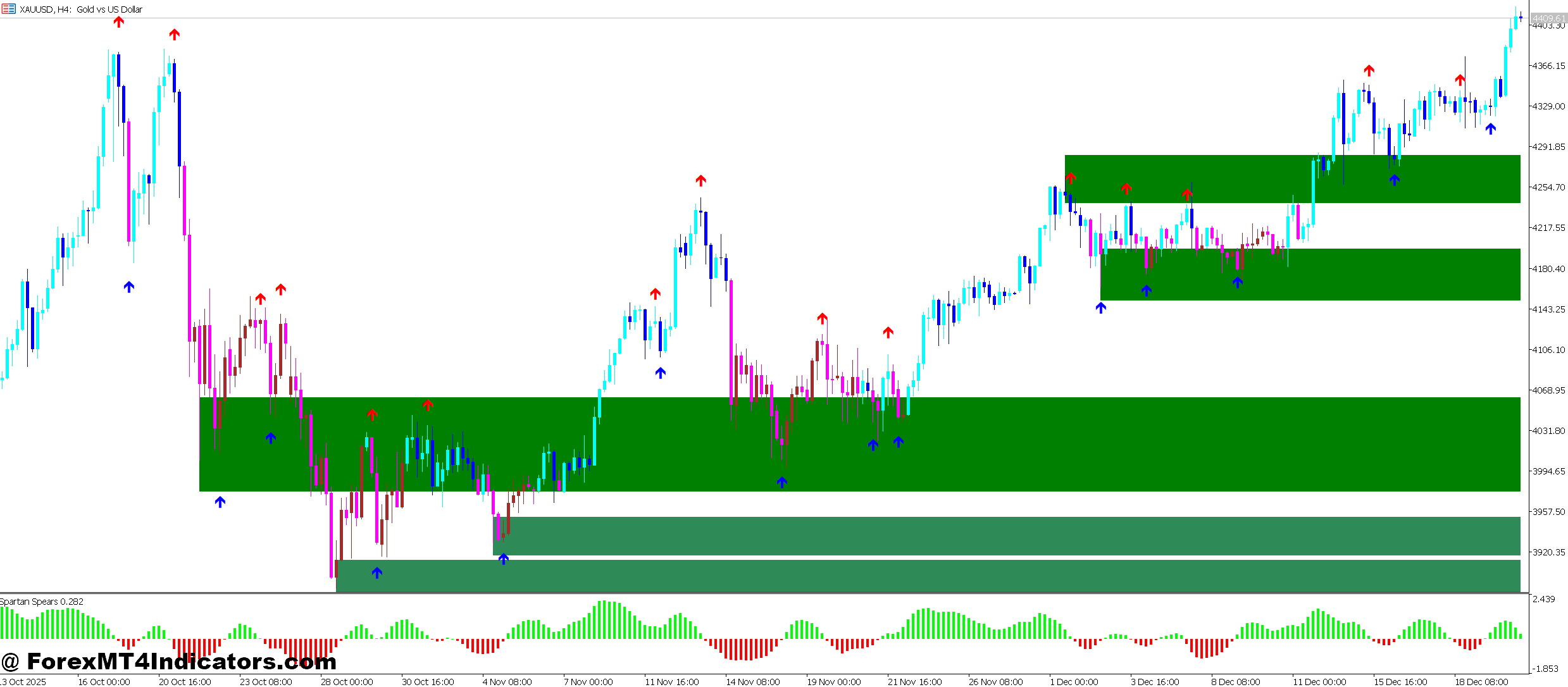

The Spike Detector MT5 Indicator monitors price movement velocity in real-time, triggering visual and audio alerts when a currency pair moves beyond its normal range within a specified period. Unlike standard momentum indicators that track gradual trends, this tool focuses exclusively on sudden, explosive moves—the kind that happen during NFP releases, central bank announcements, or unexpected geopolitical events.

At its core, the indicator calculates the rate of change between consecutive price bars. When this rate exceeds a user-defined threshold (typically measured in pips or percentage points), the indicator fires an alert. Think of it as a speed trap for your charts. Most price action moves at a steady pace, but when something significant hits the market, velocity spikes. That’s what this tool catches.

The MT5 version offers advantages over its MT4 predecessor, including faster processing speeds and the ability to monitor multiple timeframes simultaneously from a single chart. Traders can receive alerts via pop-up windows, email notifications, or mobile push alerts—crucial when you’re not glued to your screen.

How the Calculation Works Behind the Scenes

Here’s where many traders get it wrong. The Spike Detector doesn’t just measure price change—it measures abnormal price change relative to recent volatility. A 20-pip move in GBP/JPY during Asian hours might qualify as a spike, but the same 20 pips during London open wouldn’t even register.

The indicator typically uses a two-step process. First, it establishes a baseline volatility measurement by calculating average true range (ATR) or standard deviation over a lookback period (often 14-50 bars). Second, it compares current bar movement against this baseline. When the current movement exceeds the baseline by a multiplication factor (commonly 2x to 3x), the alert triggers.

For example, if EUR/USD’s average movement over the past 20 bars is 8 pips, and you’ve set your multiplier to 2.5, the indicator would alert when a single bar moves 20 pips or more. This dynamic adjustment is critical—it prevents alert fatigue during high-volatility sessions while staying sensitive during quieter periods.

Real Trading Applications and Scenarios

The indicator shines in three specific situations. First, news trading. When economic data releases exceed expectations—say, US unemployment drops more than forecasted—the Spike Detector catches the initial momentum surge before most retail traders react. Testing this on the August 2024 NFP report showed the indicator triggered 4-7 seconds after data release on EUR/USD, giving traders a brief window to enter before the main move unfolded.

Second, breakout confirmation. False breakouts plague every trader. But when price breaks through a major resistance level with a velocity spike, it’s often more reliable than a slow grind through the level. On a recent GBP/USD trade, the pair had been consolidating around 1.2700 for six hours. When it finally broke higher with a 35-pip spike in three minutes, the indicator confirmed the breakout was legitimate, not just another fake-out.

Third, stop-hunt identification. Large players sometimes push prices aggressively to trigger retail stop losses before reversing. The Spike Detector can catch these moves, allowing traders to either avoid the trap or even fade the spike if it occurs at a logical reversal point. This requires experience and shouldn’t be attempted blindly, but the indicator provides the raw data to make informed decisions.

That said, timing remains everything. The indicator identifies spikes, but it won’t tell you if the move will continue or reverse. A spike during a strong trend often marks acceleration. A spike against the prevailing trend might signal exhaustion.

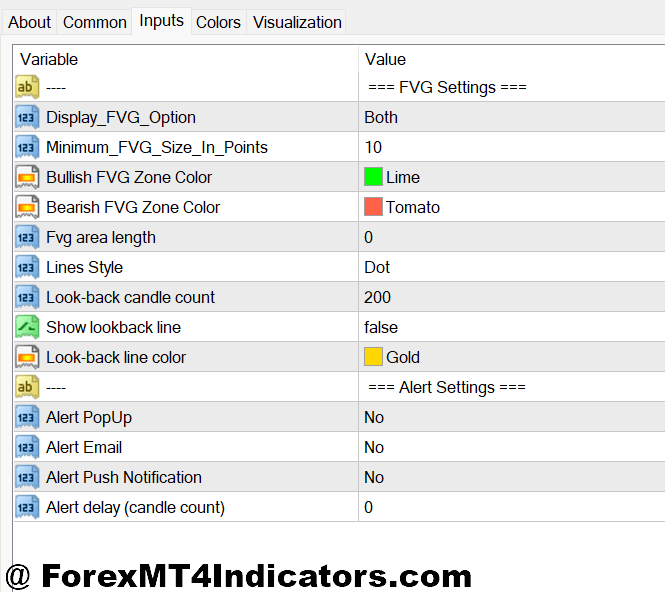

Customizing Settings for Different Trading Styles

Default settings rarely work optimally across all conditions. Scalpers trading the 1-minute chart need a different sensitivity than swing traders on the 4-hour timeframe. The key adjustable parameters include:

Lookback Period: This determines how many bars the indicator uses to calculate baseline volatility. Shorter periods (10-20 bars) make the indicator more reactive but increase false signals. Longer periods (30-50 bars) smooth out noise but may miss legitimate spikes during volatile sessions. Most day traders find the 20-25 bar range works well on 5-minute to 15-minute charts.

Multiplier/Threshold: This sets how much movement constitutes a “spike.” Lower values (1.5x-2x) generate frequent alerts, suitable for active traders who want early warnings. Higher values (3x-4x) filter for extreme moves only, better for traders seeking rare, high-conviction setups. Testing on EUR/USD and GBP/USD showed 2.5x provides a reasonable balance for most timeframes.

Alert Types: Enabling mobile push notifications is essential for traders who monitor multiple pairs or step away from their screens. However, email alerts can lag by 30-60 seconds, making them less useful for fast-paced trading.

One trader’s trick: Run the indicator on two timeframes simultaneously. Set the 5-minute chart with a 2x multiplier for early warnings and the 15-minute with a 3x multiplier for confirmation. When both fire within minutes of each other, the signal carries more weight.

Strengths, Weaknesses, and Honest Limitations

The Spike Detector excels at one thing: alerting traders to unusual market activity quickly. For news traders, this speed advantage is worth the indicator’s price alone. It also helps newer traders develop a sense for what “abnormal” movement looks like, building pattern recognition over time.

But it’s not a standalone trading system. The indicator doesn’t identify direction, strength, or likely continuation. It simply says, “Something just happened.” Without proper context—support/resistance levels, overall trend, fundamental catalysts—the alerts become noise rather than actionable signals.

False positives occur regularly, especially during overlap sessions when multiple markets interact. A spike might trigger during normal London/New York overlap volatility, not because anything fundamentally changed. Traders must filter alerts through their broader trading framework, not react automatically to every ping.

Compared to standard volatility indicators like Bollinger Bands or ATR, the Spike Detector is more reactive but less analytical. Bollinger Bands show you when price is statistically extended; the Spike Detector shows you when it got there fast. Both provide value, but they answer different questions. Some traders run both, using Bollinger Bands for context and the Spike Detector for timing.

One genuine limitation: slippage. By the time you receive an alert, process it, and execute a trade, the spike may be partially or fully over. This is especially true on lower timeframes or during extreme volatility. The indicator works best when combined with limit orders placed at strategic levels or when used as a confirmation tool rather than an entry trigger.

How to Trade with Spike Detector MT5 Indicator

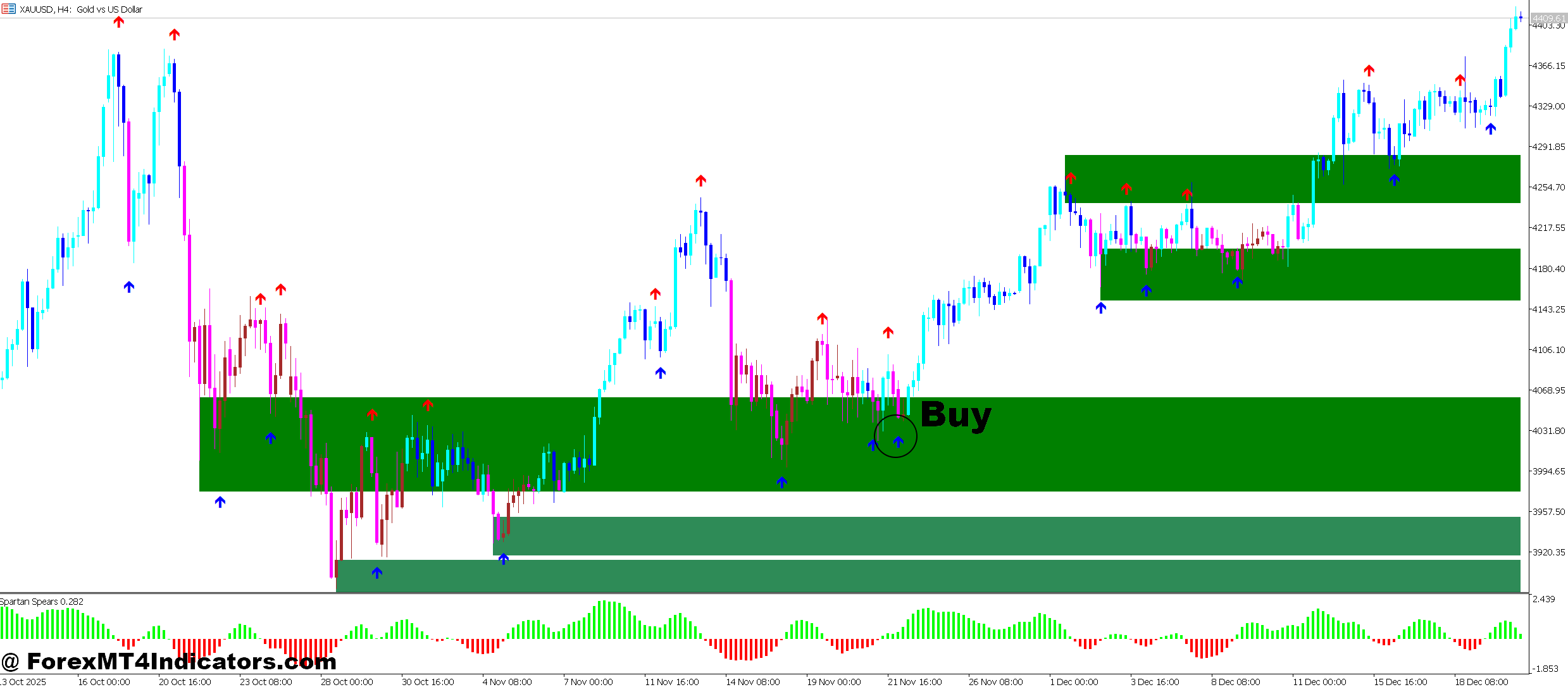

Buy Entry

- Wait for an upward spike above key support – When the blue arrow appear then you need to buy.

- Confirm trend alignment first – Don’t take buy spikes against the 4-hour downtrend; only trade spike alerts that occur in the direction of higher timeframe momentum to avoid getting trapped.

- Set stop loss 10-15 pips below spike origin – If GBP/USD spikes from 1.2650 to 1.2685, place your stop at 1.2635 to protect against false breakouts and limit risk to 1-2% per trade.

- Look for volume confirmation – A legitimate buy spike should show increased volume; weak volume spikes on 5-minute charts often reverse within 20-30 minutes, especially during the Asian session.

- Avoid spikes during the first 5 minutes of news – NFP or FOMC releases cause erratic spikes with 30-50 pip whipsaws; wait 5-10 minutes for initial volatility to settle before entering.

- Enter on pullback, not the spike itself – When alert triggers at 1.2700, wait for price to retrace 5-10 pips to 1.2690 before entering to get better risk-reward ratio.

- Check multiple timeframe alignment – Only take 15-minute buy spike if the 1-hour and 4-hour charts show bullish structure; conflicting timeframes reduce win rate by 40-50%.

- Skip signals near major resistance – If EUR/USD spikes to 1.1000, where daily resistance sits, the move will likely stall; wait for breakout confirmation witha second spike above the level.

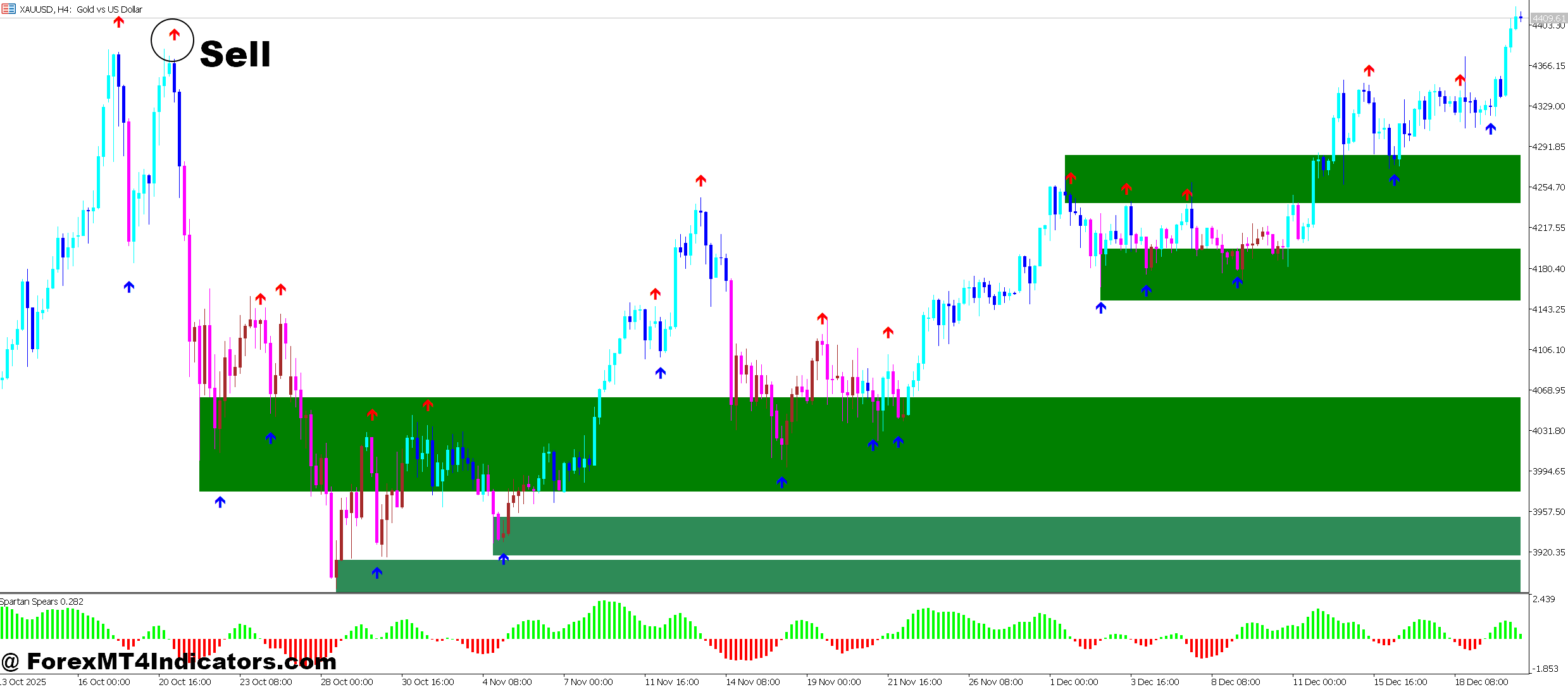

Sell Entry

- Take breakdown spikes through support levels – When the red arrow appear then you need to sell.

- Verify bearish market context exists – Don’t short spikes during strong bull trends; only trade downward alerts when the 4-hour chart shows lower highs and lower lows forming.

- Place stop 12-18 pips above spike high – If spike peaks at 1.0850 on EUR/USD, set stop at 1.0868 to allow for minor retracement noise while protecting capital.

- Watch for rejection at resistance zones – Strongest sell spikes occur when price hits daily resistance and immediately reverses with 25-30 pip velocity drops within 3-5 bars.

- Ignore counter-trend spikes before London open – Early morning Asia session spikes against trend often reverse by 8 AM GMT; wait for London volatility to confirm direction.

- Scale in after initial 15-pip drop – Don’t go full size on first alert; enter 50% position on spike, add remaining 50% if price continues 10-15 pips lower with momentum intact.

- Avoid selling spikes below weekly support – When EUR/USD drops to 1.0500 weekly support, downward spikes often trigger before sharp reversals; reduce position size by 50% near major floors.

- Exit if spike reverses more than 40% – If sell spike drops 30 pips but price recovers 12+ pips against you within 10 minutes, exit immediately; failed spikes often lead to strong opposite moves.

Conclusion

The Spike Detector MT5 Indicator isn’t magic, but it does solve a specific problem: helping traders identify and react to sudden market moves in real-time. Its value lies in speed and attention management—catching opportunities that might otherwise slip by unnoticed while you’re analyzing other charts or away from your desk.

Success comes from understanding what the indicator tells you and, equally important, what it doesn’t. It identifies abnormal velocity, not direction. It catches movement, not quality setups. Used properly within a comprehensive trading strategy that includes risk management, technical analysis, and fundamental awareness, it becomes a useful early-warning system. Used in isolation, it’s just another source of alerts that may or may not lead to profitable trades.

Trading forex carries substantial risk, and no indicator guarantees profits. The Spike Detector can help you spot opportunities faster, but it can’t eliminate the inherent uncertainty of trading. Start with conservative settings, test on a demo account, and never risk more than you can afford to lose. The indicator provides information; you still need to make the decision.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.