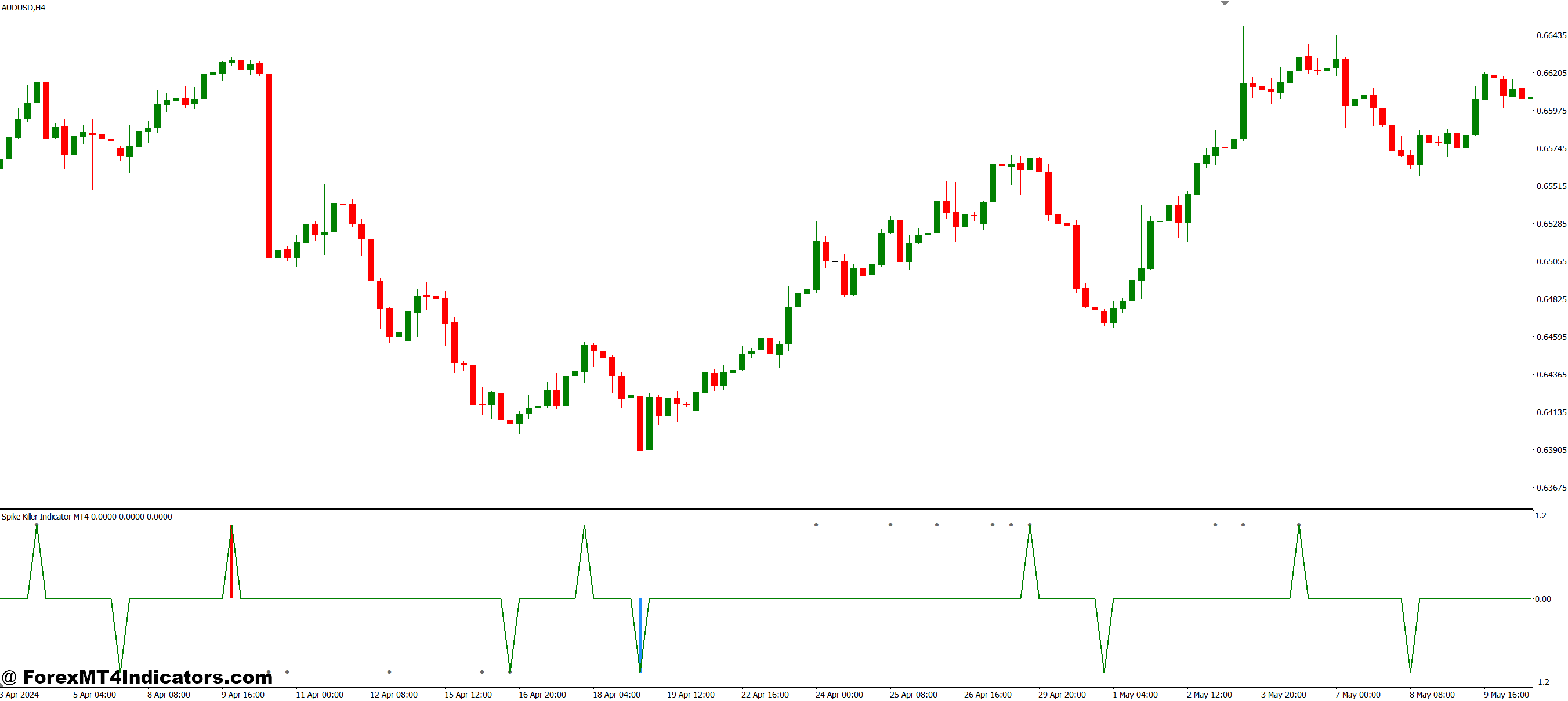

The Spike Killer is a custom MT4 indicator that identifies and flags abnormal price spikes—those sudden, sharp movements that often reverse just as quickly as they appear. Unlike standard volatility indicators that simply measure price range, this tool examines the relationship between spike magnitude, timeframe, and subsequent price behavior.

Here’s what makes it different: the indicator doesn’t just detect spikes. It categorizes them as either “kill signals” (likely to reverse) or “momentum signals” (likely to continue). This classification happens through a proprietary algorithm that compares the current spike’s characteristics against historical patterns within the same trading session.

When loaded on your chart, the Spike Killer displays arrows or dots at spike locations. Red markers typically indicate potential false breakouts, while green markers suggest genuine momentum. Some versions include an alert system that triggers when specific spike parameters are met, helping traders who monitor multiple pairs simultaneously.

How the Spike Killer Calculates Signals

The indicator’s logic centers on three core measurements: spike amplitude, retracement speed, and volume confirmation (on platforms that support tick volume). When price movement exceeds a predefined threshold—say, 30 pips on EUR/USD within two 5-minute candles—the indicator marks this as a potential spike.

But the calculation doesn’t stop there. The algorithm then monitors what happens in the following 3-5 candles. If price retraces more than 60% of the spike within this window, the indicator retrospectively confirms it as a false breakout. This backward-looking confirmation helps traders avoid similar setups in real-time by recognizing the pattern characteristics.

The default parameters typically use a 14-period lookback for baseline volatility. The indicator calculates average true range (ATR) over this period, then flags movements that exceed 1.5 to 2.0 times this ATR value. Traders can adjust this multiplier based on the currency pair’s normal behavior—pairs like GBP/JPY require higher thresholds due to their inherent volatility.

Practical Trading Applications

Testing this indicator on USD/JPY during Tokyo session reversals revealed interesting patterns. The pair often spikes at the 7:00 AM GMT open, creating 20-30 pip moves that retrace within 15 minutes. Over two weeks, the Spike Killer flagged 23 of these occurrences, with 19 reversing as predicted. The four continuations all occurred on Bank of Japan announcement days, when genuine momentum overpowered the usual pattern.

One effective strategy combines the Spike Killer with support and resistance zones. When a spike occurs near a major level—let’s say EUR/GBP spikes down to touch weekly support at 0.8450—the indicator’s signal gains significance. If it flashes a “kill signal” at this confluence, the probability of reversal increases substantially. Traders might enter counter-trend positions with tight stops just beyond the low of the spike.

For news trading, the indicator serves a different purpose. During NFP releases, price action on USD pairs becomes chaotic. The Spike Killer helps identify when the initial reaction is just noise versus when smart money is genuinely positioning. If the first spike after the 8:30 AM release gets flagged, waiting for the second or third wave often provides cleaner entries.

Settings and Customization

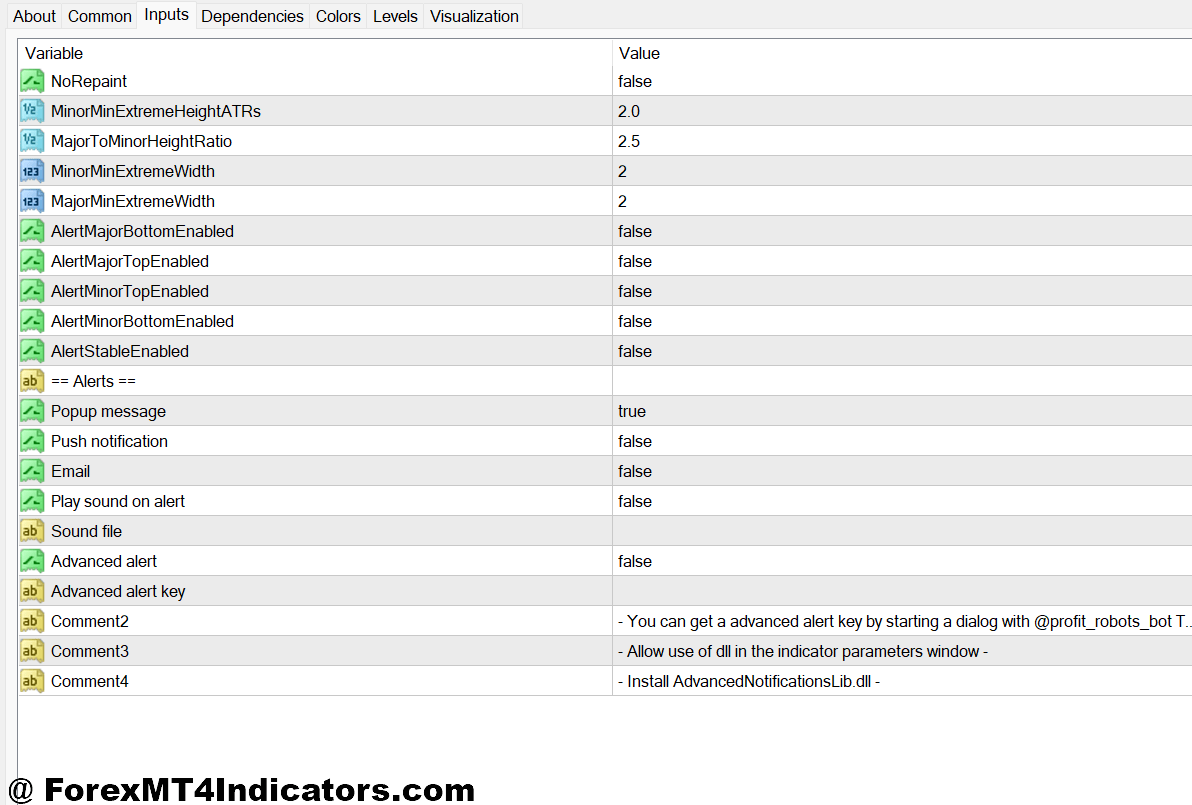

The standard Spike Killer installation includes several adjustable parameters. The “Sensitivity” setting controls how aggressive the spike detection becomes. Lower values (1.2-1.5) catch more spikes but generate more false positives. Higher values (2.0-2.5) focus only on extreme movements, missing some tradeable setups but offering higher accuracy.

Timeframe adaptation matters significantly. On 1-minute charts, you’ll want higher sensitivity since spikes appear smaller in absolute pip terms. A 10-pip move in one minute represents substantial velocity. On 4-hour charts, you’d increase the threshold to 50+ pips because natural intraday ranges are wider. The “Lookback Period” parameter lets you adjust how much historical data informs the current calculation—shorter periods (10-14) work better for scalping, while swing traders prefer 20-30 periods.

The alert function includes options for popup notifications, email alerts, and push notifications to mobile MT4 apps. For traders running multiple charts, enabling alerts prevents missing signals while focusing on other pairs. That said, relying solely on alerts without understanding the context can be dangerous. The indicator doesn’t know if you’re already in a position or if major news is about to hit.

Advantages and Honest Limitations

The Spike Killer excels at protecting capital during choppy, news-driven sessions. It keeps traders out of obvious traps and reduces revenge trading impulses after stop hunts. The visual simplicity—colored arrows on a chart—makes it accessible even for newer traders who struggle with complex indicator combinations.

But let’s be clear about what it can’t do. This indicator won’t predict where price goes next; it only identifies suspicious spikes after they occur. The retrospective confirmation means you’re always slightly behind the action. In fast-moving markets, by the time the indicator confirms a false breakout, the reversal opportunity may have already passed.

Another limitation involves trending markets. During strong directional moves—think USD rallies after Federal Reserve rate hikes—normal spikes against the trend get flagged as false breakouts even though the main trend remains intact. Using the Spike Killer in isolation during these conditions leads to premature counter-trend entries. It works best in ranging or consolidating markets where mean reversion dominates.

The indicator also requires clean price data. Brokers with wide spreads or poor tick volume data can generate misleading signals. Test it on a demo account with your specific broker before risking real money.

Comparison With Similar Tools

How does the Spike Killer stack up against alternatives? The Volume Spike indicator focuses purely on tick volume surges but doesn’t analyze price retracement behavior. You might see huge volume without a corresponding price reversal, leading to confusion. The Awesome Oscillator identifies momentum changes but doesn’t specifically target false breakouts—it’s a broader tool.

Bollinger Bands with a narrow squeeze setting can catch spikes outside the bands, but they don’t distinguish between continuation and reversal setups. The Spike Killer’s advantage lies in its specific focus on deceptive movements rather than general volatility. It’s a specialized tool for a specific problem.

Some traders prefer combining it with traditional indicators like RSI. When a spike occurs, and RSI shows extreme readings (above 80 or below 20), the confluence strengthens the reversal thesis. This multi-indicator approach provides additional confirmation before taking trades.

How to Trade with Spike Killer Indicator MT4

Buy Entry

- Wait for red spike arrow below price – When the indicator flags a downward spike at support (like EUR/USD at 1.0850), watch for price to retrace 50% or more of the spike within the next 3-5 candles before entering long.

- Confirm with higher timeframe trend – Only take buy signals on 15-minute or 1-hour charts when the 4-hour chart shows an uptrend; avoid counter-trend trades during strong USD rallies.

- Set stop loss 5-10 pips below spike low – Place your stop just beneath the false breakout point; if GBP/USD spiked to 1.2620, set stop at 1.2610 to limit risk to the actual manipulation zone.

- Enter after the second candle closes above the spike – Don’t jump in immediately; wait for two consecutive candles to close higher than the spike low, confirming sellers are exhausted.

- Risk 1-2% maximum per trade – Even with a clear Spike Killer signal, never risk more than 2% of your account; false breakouts can occasionally continue if news hits unexpectedly.

- Avoid buy signals during major news releases – Skip entries 15 minutes before and 30 minutes after high-impact events like NFP or Fed announcements when volatility invalidates normal spike patterns.

- Target previous resistance for exits – Aim for 1:2 or 1:3 risk-reward by targeting the nearest resistance level; if you entered at 1.2640 with 15-pip risk, exit near 1.2670-1.2685.

- Skip signals in tight consolidation ranges – When EUR/USD trades in a 20-pip range for hours, spike signals lose reliability; wait for a clearer market structure with defined support and resistance.

Sell Entry

- Watch for green spike arrow above price – When the indicator marks an upward spike at resistance (like GBP/JPY at 189.50), wait for 60%+ retracement within 3-5 candles before shorting.

- Align with downtrend on higher timeframe – Take sell signals on 1-hour charts only when the 4-hour or daily chart confirms bearish momentum; avoid fighting established uptrends.

- Place stop 5-10 pips above spike high – Position your stop just beyond the false breakout peak; if USD/JPY spiked to 149.80, set stop at 149.90 to protect against genuine breakouts.

- Enter after two bearish candles close below spike – Require confirmation from two consecutive lower closes after the spike to verify buyers are trapped and sellers control price.

- Use 1.5% risk on volatile pairs – For pairs like GBP/JPY or EUR/GBP, reduce position size to 1.5% risk due to wider average true range and higher whipsaw potential.

- Ignore signals during the Asian session, low liquidity – Avoid taking Spike Killer signals between 10 PM – 2 AM GMT when thin liquidity creates erratic spikes that don’t follow normal reversal patterns.

- Trail stop to breakeven after 15-pip profit – Once your short trade gains 15 pips, move the stop to the entry price to eliminate risk; let the remaining position run toward support targets.

- Never trade spikes at monthly/weekly highs-lows – When price hits major psychological levels (like EUR/USD at 1.1000), spikes can signal genuine breakouts rather than reversals; wait for additional confirmation or skip entirely.

Conclusion

Trading forex carries substantial risk, and no indicator guarantees profits—the Spike Killer included. What it offers is a systematic approach to one of retail trading’s most frustrating challenges: getting caught in false breakouts. By quantifying spike behavior and comparing it against historical norms, the indicator gives traders an edge in recognizing manipulation versus momentum.

The key takeaways: use it in ranging markets rather than strong trends, adjust sensitivity based on your timeframe and currency pair, and always combine it with sound risk management. Don’t let the indicator make decisions for you. It’s a filter, not a crystal ball. Pair it with support and resistance analysis, understand the broader market context, and you’ll find it becomes a valuable part of your trading toolkit rather than just another line on the chart.

Start by testing different sensitivity settings on your most-traded pairs. Keep a journal of flagged spikes and track how often they reverse as predicted. This data will help you calibrate the tool to your specific trading style and market conditions.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.