The STC MT4 indicator was designed to solve exactly this problem. Short for Schaff Trend Cycle, this tool combines the trend-following nature of MACD with cycle analysis to produce faster, smoother signals. Unlike indicators that wait for trends to fully develop, the STC aims to catch moves earlier while filtering out the noise that plagues oscillators. For traders tired of entering trends too late or getting stopped out on false breakouts, this indicator deserves a closer look.

What the Schaff Trend Cycle Actually Is

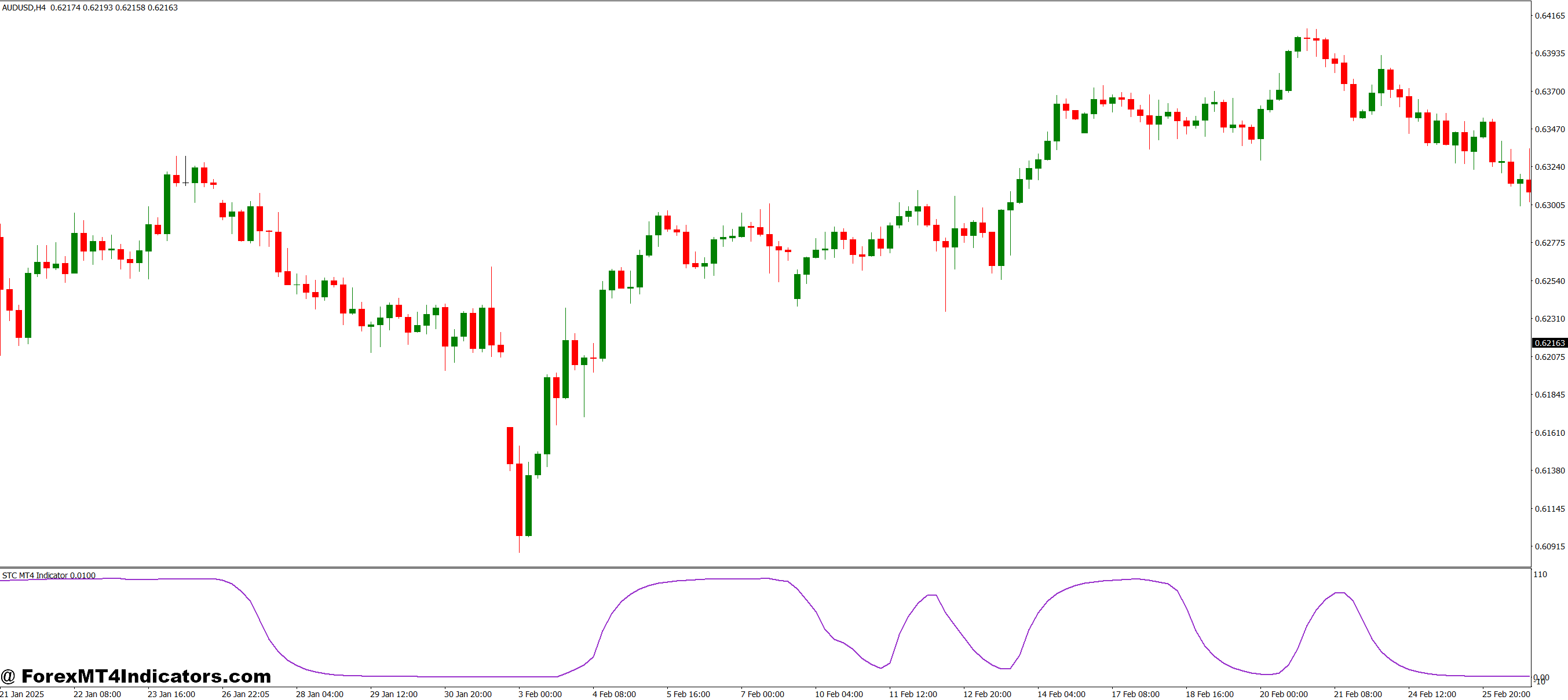

The STC indicator is a forward-looking oscillator that measures both trend direction and momentum cycles. Created by Doug Schaff in the 1990s, it builds on MACD’s foundation but adds a layer of cycle analysis borrowed from stochastic calculations. The result? An indicator that oscillates between 0 and 100, giving traders clearer entry and exit points.

Here’s what sets it apart: while MACD can trend indefinitely and produce unclear signals during ranging markets, the STC stays bounded. When the line crosses above 25, that’s typically a buy signal. Below 75 suggests it’s time to consider exits or shorts. The bounded nature makes it easier to spot overbought and oversold conditions at a glance.

Most traders display the STC as a single line with horizontal reference levels at 25 and 75. Some versions include a signal line, but the standard setup keeps things clean and straightforward.

How the STC Calculates Faster Signals

The math behind the STC involves a two-step stochastic calculation applied to MACD values. Don’t worry—understanding the exact formula isn’t necessary to use it effectively. But knowing the logic helps.

First, the indicator calculates a MACD value using exponential moving averages (typically 23 and 50 periods). Then it applies a stochastic calculation to that MACD, smoothing it with a cycle period (usually 10). A second stochastic calculation follows, creating the final STC line. This double-smoothing process filters out the false signals that plague raw MACD while maintaining responsiveness.

The cycle component is what makes this work. By incorporating price cycles into the calculation, the STC adapts to market rhythm rather than just following price mechanically. When tested on GBP/JPY during the London session, this becomes obvious—the indicator picks up momentum shifts faster than standard MACD, often by 2-4 bars on a 15-minute chart.

Putting the STC to Work: Real Trading Scenarios

Theory means nothing without practical application. Here’s how traders actually use this thing.

- Trend Following with Confirmation: On a 4-hour USD/JPY chart, wait for the STC to cross above 25 after a pullback in an uptrend. That’s the entry trigger. The key is context—this works best when price is respecting a rising 50 EMA. One trader noted catching a 90-pip move in October 2024 using this exact setup when the pair bounced off support at 149.50.

- Early Exit Signals: When the STC crosses below 75 during a profitable long trade, it’s a warning that momentum is fading. This doesn’t always mean reverse the position, but it’s time to tighten stops. EUR/USD traders found this particularly useful during NFP releases, where the initial spike often reverses within 30 minutes. The STC frequently topped out around 85-90 right before those reversals hit.

- Range Trading: In choppy conditions on pairs like AUD/NZD, the STC becomes an overbought/oversold indicator. Crosses above 75 signal short opportunities near range highs, while crosses below 25 suggest longs near support. The 1-hour chart works well for this, especially during Asian session consolidation.

That said, ranging markets require tight risk management. The STC can give multiple signals that don’t pan out if the range is too narrow. Stop losses matter even more here.

Adjusting Settings for Different Markets

The standard settings are 23, 50, and 10 (MACD fast, MACD slow, and cycle period). But these aren’t carved in stone.

For scalpers working 1-minute or 5-minute charts, shortening the MACD periods to 12 and 26 (standard MACD settings) with a cycle of 5 produces more signals. The tradeoff? More noise. It works on highly liquid pairs like EUR/USD during peak hours, but the false signals multiply during slow Asian sessions.

Swing traders often extend everything—try 34, 89, and 15 for daily charts. This smooths out intraday volatility and focuses on significant trend changes. When backtesting this on GBP/USD daily charts, the signals decreased from 40-50 per year to about 12-15, but the win rate improved noticeably.

Currency-specific adjustments help too. Volatile pairs like GBP/JPY benefit from slightly longer cycle periods (12-15) to avoid getting chopped up. Stable pairs like EUR/CHF can handle shorter settings without generating too much noise.

The Good, The Bad, and The Realistic

- Advantages: The STC reacts faster than MACD while staying smoother than a raw stochastic. It works across multiple timeframes and suits both trend and range trading. The bounded scale makes interpretation straightforward—no guessing whether a reading is “high enough” like with unbounded oscillators. Plus, it combines reasonably well with price action concepts like support and resistance.

- Limitations: No indicator is perfect, and the STC has its share of flaws. During violent breakouts, it can stay pegged near 100 or 0 for extended periods, making entries impossible to time. The lag, while reduced compared to MACD, still exists—this isn’t a crystal ball. Whipsaws happen, especially on lower timeframes or during major news events.

The bigger issue? Over-reliance. Some traders treat any cross above 25 as an automatic buy signal without considering trend context, nearby resistance, or risk-reward ratios. That’s a recipe for frustration and losses.

Trading forex carries substantial risk. No indicator guarantees profits, and the STC is no exception. It’s a tool, not a system. Without proper risk management, stop losses, and position sizing, even the best signals lead nowhere good.

How It Compares to MACD and Stochastic

Traders often wonder: why not just stick with MACD or stochastic individually?

MACD’s strength is trend identification, but it lags significantly and gives unclear signals in ranges. The STC addresses both issues by adding cycle analysis and bounding the output. In side-by-side tests on EUR/GBP 1-hour charts, the STC generated entry signals an average of 3-5 bars earlier than MACD crossovers.

Stochastic oscillators react quickly but produce too many false signals in trending markets. They’ll show overbought conditions for weeks during strong trends, leaving traders on the sidelines or worse, fighting the trend. The STC’s trend-following component helps filter these out. When gold rallied in late 2024, standard stochastics stayed overbought for days while the STC continued generating valid long signals.

The STC sits in the sweet spot between these two indicators—faster than MACD, more trend-aware than stochastics. But it’s not necessarily “better” in absolute terms. Some market conditions favor pure MACD or stochastics. Knowing when to use which tool separates experienced traders from beginners.

How to Trade with STC MT4 Indicator

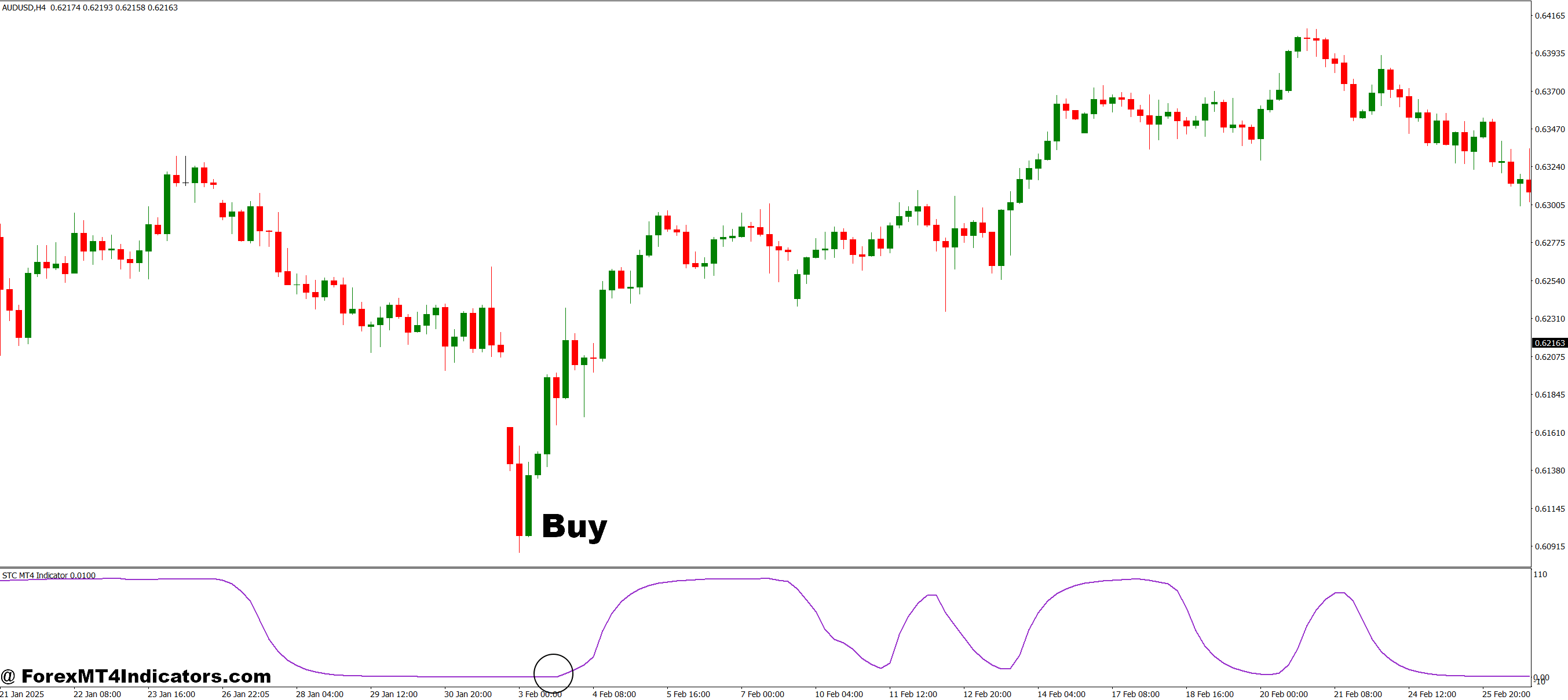

Buy Entry

- STC crosses above 25 – Enter long when the STC line crosses above 25 on EUR/USD 1-hour charts, but only if price is above the 50 EMA and not within 10 pips of major resistance.

- Bullish divergence at oversold levels – When price makes lower lows, but STC makes higher lows below 25, enter long on the next candle close with a 20-30 pip stop below recent swing low.

- Re-entry on pullbacks – If STC drops to the 40-50 zone during an uptrend onthe GBP/USD 4-hour chart, enter long when it bounces back above 50, confirming trend continuation.

- Confirmation with support – Take buy signals only when STC crosses 25 while price bounces off a tested support level—wait for a bullish candle close to confirm.

- Avoid news events – Don’t enter long positions 15 minutes before or after high-impact news releases, even if STC shows perfect buy signals—whipsaws will stop you out.

- Multiple timeframe alignment – Confirm 1-hour STC buy signals with the daily chart showing STC above 50, increasing the probability of sustained moves of 50+ pips.

- Set proper risk-reward – Only take STC buy signals where resistance is at least 2x further than your stop loss distance; if resistance is 30 pips away, stop should be 15 pips maximum.

- Skip choppy Asian sessions – Ignore STC crossovers during low-volume Asian hours (typically 2-6 AM GMT) on pairs like EUR/USD—false signals increase by 40-50% during these times.

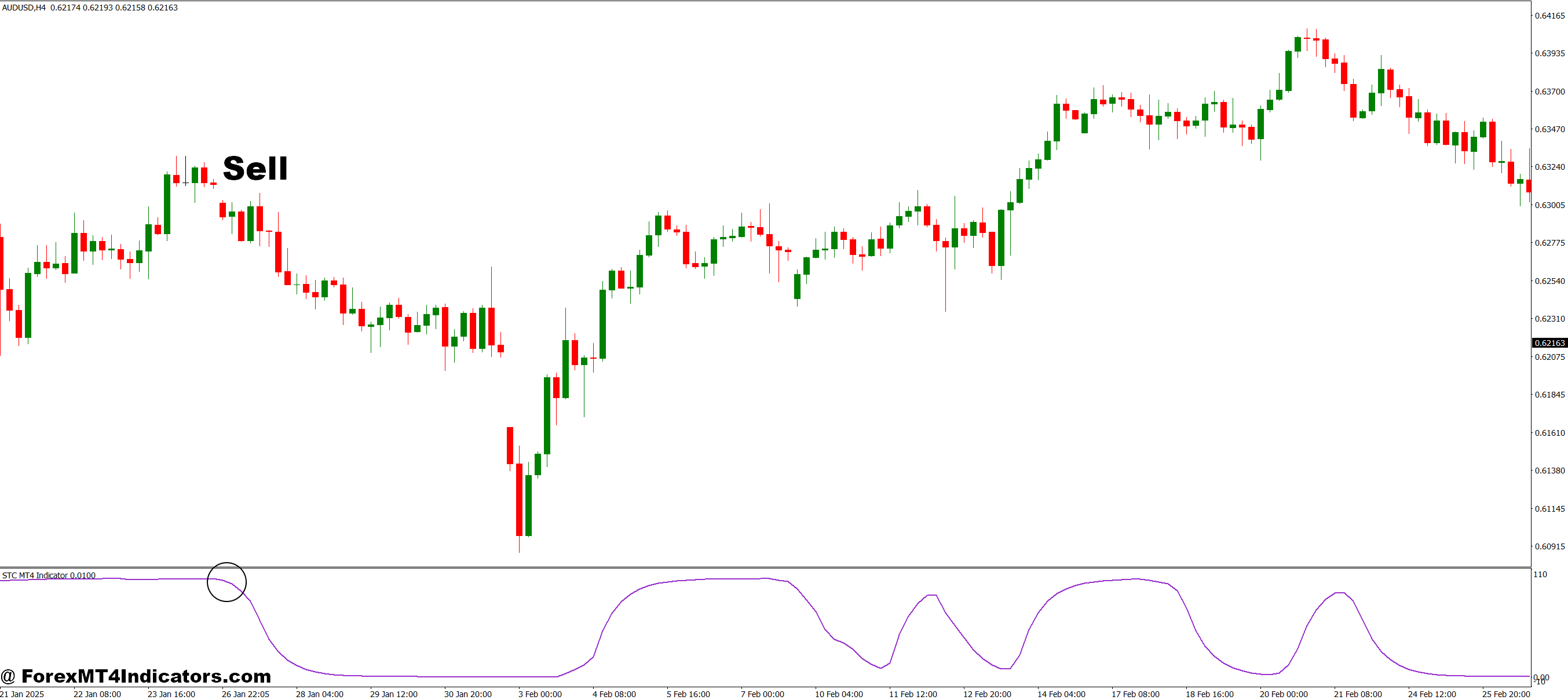

Sell Entry

- STC crosses below 75 – Enter short when STC drops below 75 on EUR/USD 1-hour charts, but only if price is trading below the 50 EMA and at least 15 pips away from major support.

- Bearish divergence at overbought – When price makes higher highs but STC makes lower highs above 75, enter short with stops 25-30 pips above the recent swing high.

- Failed breakout reversal – If price breaks resistance but STC stays below 75 or immediately reverses below it, enter short targeting a 40-60 pip move back to breakout level.

- Rejection from resistance – Take sell signals when STC crosses below 75 while price forms a bearish rejection candle at known resistance—skip if rejection wick is less than 5 pips.

- Trend alignment on GBP/USD – Only take 4-hour STC sell signals when the daily chart STC is also below 50, filtering out counter-trend trades that rarely work.

- Don’t fight strong trends – Skip sell signals if price is in a strong uptrend, making consistent higher highs—wait for STC to drop below 25 first, indicating potential trend exhaustion.

- Tighten stops in volatile pairs – On GBP/JPY, use 30-40 pip stops maximum for STC sell signals instead of the standard 50 pips due to increased intraday volatility.

- Avoid range-bound conditions – Don’t take STC sell signals when ATR (14-period) on the daily chart is below 50 pips for EUR/USD—low volatility produces unreliable signals and minimal profit potential.

Conclusion

The Schaff Trend Cycle indicator offers traders a refined approach to catching trends earlier and filtering false signals. Its combination of MACD logic with cycle analysis creates a responsive yet relatively smooth tool that works across timeframes. Real traders have used it successfully for everything from 5-minute scalping to daily swing trades.

But here’s the thing—this isn’t a magic solution. The STC still requires confirmation from price action, proper risk management, and realistic expectations. It works best when traders understand its strengths (early trend detection, clear signals) and limitations (lag during breakouts, false signals in chop). The traders who profit consistently with this indicator are the ones who view it as one piece of a larger strategy, not a standalone answer.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.