The VWMA MT5 Indicator offers a solution by weighting price movement with volume, helping traders see more reliable trend signals. By using this tool, traders can gain clarity, make smarter decisions, and improve their trading performance.

Understanding VWMA MT5

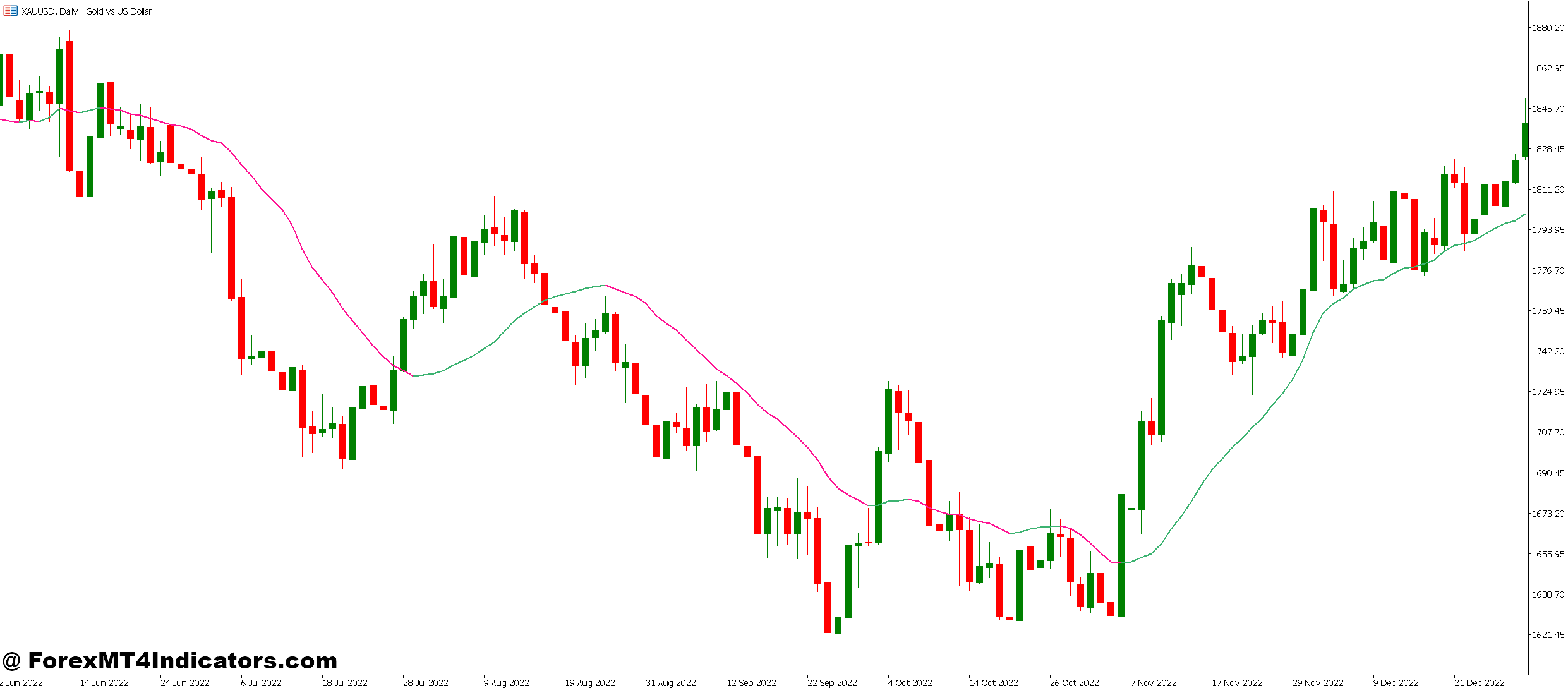

The VWMA MT5 Indicator, or Volume Weighted Moving Average, is designed for MetaTrader 5 users who want a more precise view of market trends. Unlike a regular moving average, which treats each price equally, the VWMA gives more weight to periods with higher trading volume. This makes it easier to identify trends that are supported by strong market activity rather than just price fluctuations. Traders can use it to confirm trend strength, detect reversals early, and avoid false signals that often mislead during volatile market conditions.

Why Volume Matters

Volume is a key indicator of market interest and activity. When prices rise or fall on high volume, the trend is often more reliable. The VWMA MT5 Indicator leverages this by combining price and volume, giving traders a clearer picture of real momentum. This is especially helpful for day traders or swing traders who need to make quick decisions. By understanding which moves are backed by genuine trading activity, traders can avoid fakeouts and focus on opportunities that have stronger probability for success.

How Traders Use It

Traders often pair the VWMA MT5 with other tools, like RSI or standard moving averages, to strengthen their analysis. It can be applied to any timeframe, from minutes to daily charts, making it flexible for various trading styles. Some traders use it to set entry and exit points, while others rely on it to spot potential trend reversals early. Its visual simplicity a line that responds to volume-weighted price makes it easy to integrate into existing strategies without complicated calculations.

Benefits and Practical Tips

The main benefit of the VWMA MT5 is its ability to filter noise and highlight meaningful price action. Traders can combine it with risk management techniques, like stop-loss orders, to improve overall trading outcomes. It is also highly customizable, allowing users to adjust period settings according to their strategy and market. By consistently using the VWMA MT5, traders can make decisions with more confidence, spot trends before they fully develop, and reduce the guesswork that often plagues trading in volatile markets.

How to Trade with VWMA MT5 Indicator

Buy Entry

- Price crosses above the VWMA line, indicating upward momentum.

- VWMA is sloping upward, showing trend strength supported by volume.

- Confirmation from higher volume bars during the upward move.

- Optional: Combine with RSI or MACD to ensure the market is not overbought.

- Place stop-loss below the recent swing low to manage risk.

Sell Entry

- Price crosses below the VWMA line, signaling downward momentum.

- VWMA is sloping downward, confirming a strong bearish trend.

- Confirmation from higher volume during the drop, validating the move.

- Optional: Use RSI or MACD to ensure the market is not oversold.

- Place stop-loss above the recent swing high to limit losses.

Conclusion

The VWMA MT5 Indicator is a practical tool for traders who want a clearer, volume-informed perspective on market trends. By combining price and volume, it helps filter noise, identify strong trends, and support smarter trading decisions. Whether used alone or alongside other indicators, it can give traders the edge they need to navigate fast-moving markets with confidence.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.