The 100 Non Repaint MT4 Indicator promises something different: signals that stick. Once it marks an entry, that mark stays put, whether the trade wins or loses. No more phantom signals disappearing from your chart history. No more wondering if you actually saw what you thought you saw. This indicator gives traders the reliability they need to backtest properly, execute with confidence, and actually learn from their trading history instead of chasing ghosts.

But does it deliver? Let’s break down what makes this tool work and where it fits in your trading arsenal.

What the 100 Non Repaint Indicator Actually Is

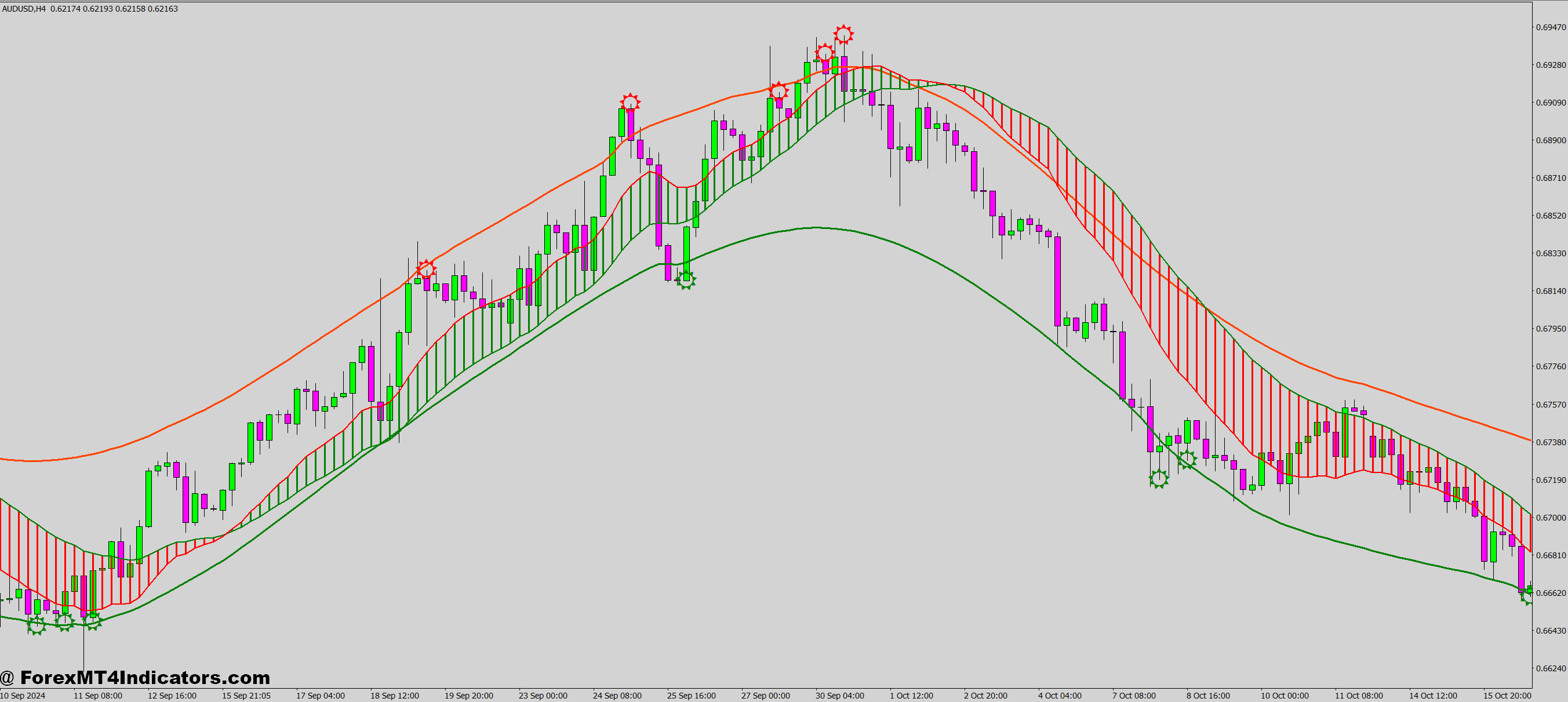

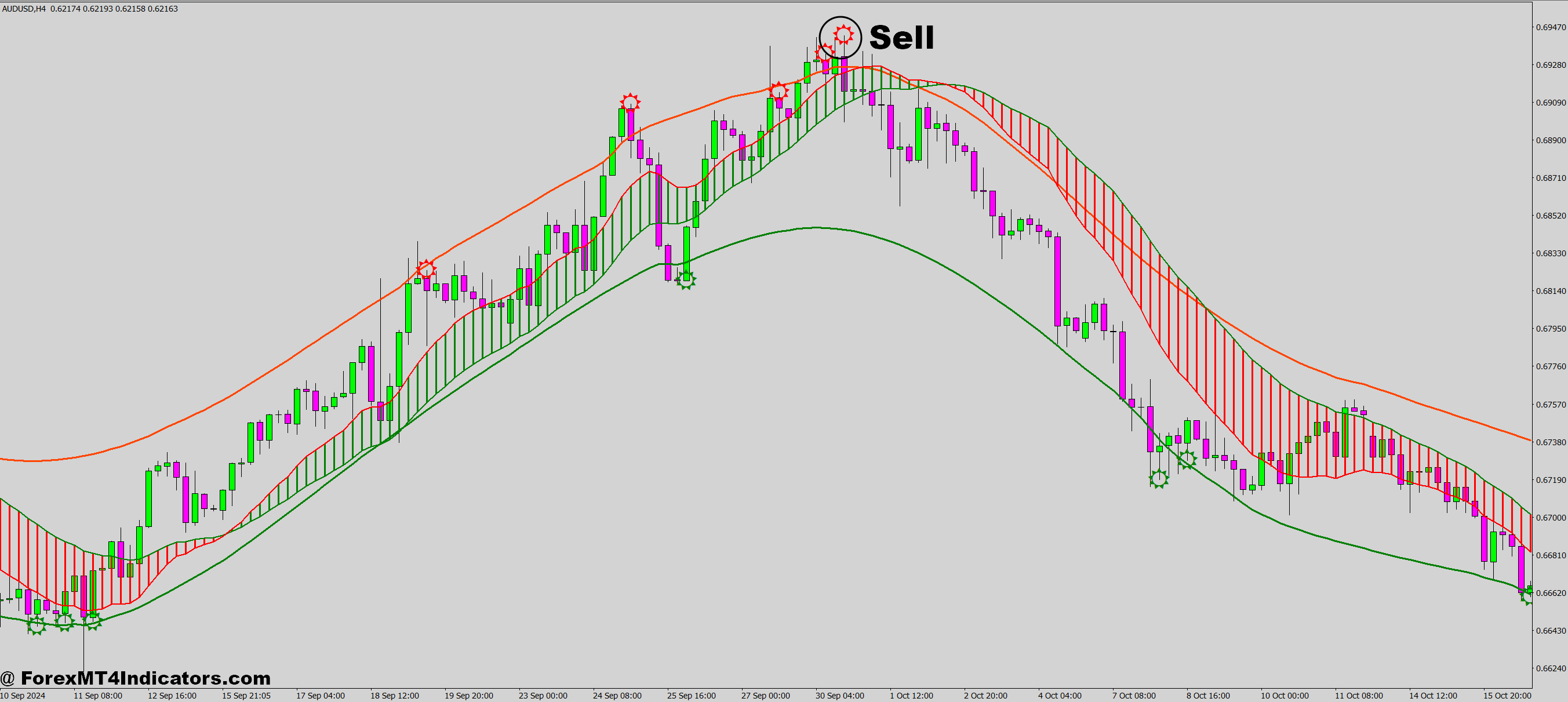

The 100 Non Repaint MT4 Indicator is a technical analysis tool designed to generate buy and sell signals without redrawing past signals when new price data arrives. Most indicators recalculate with each new candle, which can make historical signals look perfect while real-time performance falls apart. This one locks in its decision at candle close.

The “100” in its name refers to its comprehensive approach—it typically combines multiple confirmation factors before triggering a signal. We’re talking trend filters, momentum checks, and volatility assessments, working together. It’s not just a simple moving average crossover that’ll get you chopped up in ranging markets.

Here’s what makes it different: When you see an arrow on your chart pointing up or down, that arrow won’t disappear or shift positions later. Your chart becomes an honest record of what the indicator actually called in real-time, not a prettified version of hindsight.

The Logic Behind the Signals

The indicator works by analyzing completed price action rather than forming opinions about incomplete candles. It waits for the candle to close before plotting anything. This prevents the common issue where an indicator shows a bullish signal mid-candle, only to flip bearish by candle close.

Most versions use a combination of trend detection (often through moving average relationships) and momentum confirmation (like RSI or MACD components). The calculation runs on closed candles only—that’s the secret sauce. When EUR/USD closes a 4-hour candle above key resistance with strong momentum, the indicator marks it. That mark stays.

The filtering system typically requires multiple conditions to align. A simple price cross above a moving average won’t trigger it. You’d need that cross plus momentum confirmation plus perhaps a volatility filter to avoid false signals during choppy London open sessions. This multi-factor approach cuts down on signal frequency but increases reliability.

Putting It to Work: Real Trading Scenarios

Let’s talk practical application. Say you’re trading USD/CAD on the daily chart, waiting for trend continuation setups. The 100 Non Repaint Indicator flashes a sell signal as oil prices rally and the pair breaks support. You enter short at 1.3420, place your stop above the last swing high at 1.3480, and target the next support zone at 1.3200.

The trade moves against you initially—price bounces back to 1.3450. Your indicator’s arrow stays right where it was, confirming this was a legitimate signal, not some repainted fantasy. You either trust your setup or you don’t. No ambiguity. The trade eventually works out, dropping to your target over five days.

Contrast that with repainting indicators. When testing this on volatile NFP days, I’ve seen indicators that looked brilliant in backtest produce completely different signals live. You think you’re following a 70% win rate system, but you’re actually trading a 45% system with fake historical performance.

For scalpers on the 5-minute chart, the non-repaint feature matters even more. When you’re in and out of GBP/USD within 20 minutes, you need to know that signal at 8:35 AM was actually there at 8:35 AM, not something your indicator dreamed up later.

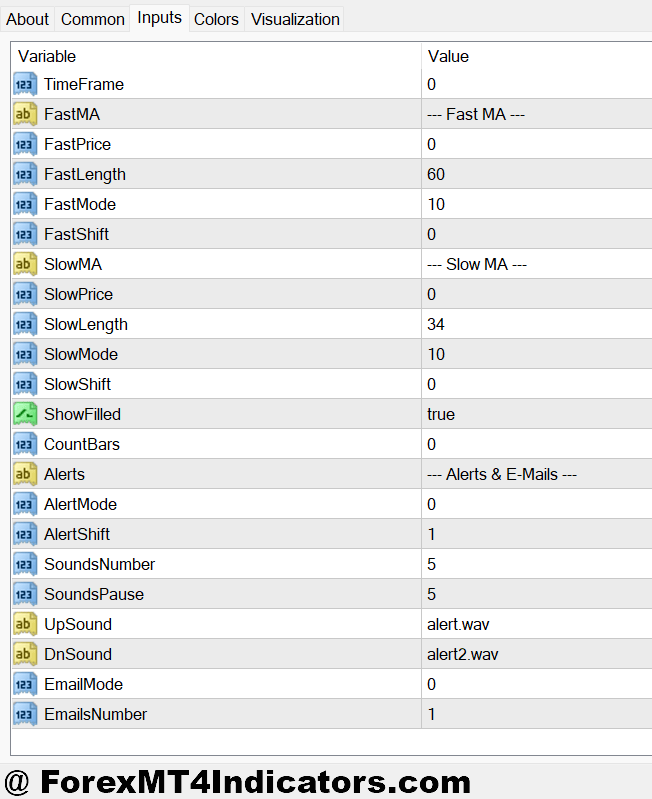

Settings and Customization for Different Markets

The standard settings work for trending pairs like EUR/USD and GBP/JPY on 1-hour to daily timeframes. But you’ll want to adjust for different conditions.

For ranging pairs like EUR/CHF, increase the signal threshold. Tighten your filters to avoid getting chopped up. Many versions let you adjust the lookback period—bump it from 14 to 21 periods in sideways markets to reduce signal frequency.

On the flip side, trending pairs during strong directional moves (think USD/JPY during BOJ intervention rumors) can handle more sensitive settings. Drop your confirmation requirements slightly to catch earlier entries, though this increases false signals.

The volatility filter is your friend during Asian session trading. When you’re dealing with 20-pip ranges on EUR/USD at 2 AM EST, you want that filter tight. Otherwise, you’re trading noise. During the London-New York overlap? Loosen it up to catch the momentum moves.

Different timeframes need different approaches. The 5-minute chart might use a 50-period moving average baseline, while the daily chart works better with 200 periods. Test thoroughly on demo before risking real money—that’s non-negotiable.

The Good, the Bad, and the Realistic

Here’s the thing: No indicator solves all your trading problems. The 100 Non Repaint MT4 Indicator’s biggest advantage is trust. You can backtest it honestly, journal your trades accurately, and build real trading statistics. That’s massive for developing consistent execution.

It also forces discipline. When that signal appears, you either take it or you don’t. There’s no “waiting to see if it stays” because it will stay, for better or worse. This eliminates a common form of cherry-picking where traders only count the signals that worked out.

But—and this is important—non-repaint doesn’t mean non-wrong. The signals are permanent, but they’re not magical. During the 2023 banking crisis volatility, even solid non-repaint indicators got whipsawed. Fast-moving news events don’t care about your technical signals.

The lag is real, too. By waiting for candle close confirmation, you’re entering later than indicators that jump the gun mid-candle. On a 4-hour chart, that could mean missing 50-100 pips of movement. Sometimes that saved movement catches up with you; sometimes you miss the best entry.

False signals still happen, especially in choppy markets. EUR/GBP during low-volume summer trading can produce signals that immediately fail. The indicator isn’t reading market manipulation or stop hunts—it’s just reading price and calculations.

How It Stacks Up Against the Competition

Compare this to standard MACD or RSI indicators, which recalculate constantly. Those tools are useful but require manual confirmation that what you’re seeing now was actually there then. With SuperTrend or Parabolic SAR indicators, you get non-repaint behavior too, but typically less sophistication in signal filtering.

Against Arrow indicators that repaint, there’s no contest for backtesting reliability. Those repainters look incredible in history, but fail forward testing every time. They’re basically trading hindsight, which doesn’t pay bills.

Some traders prefer fully customizable systems where they combine non-repaint components manually—like using Heiken Ashi non-repaint candles with specific moving averages. That works if you’ve got the experience to build robust logic. The 100 Non Repaint Indicator packages that logic for you.

Trading forex carries substantial risk of loss and isn’t suitable for all investors. No indicator, repaint or non-repaint, guarantees profits. Most retail forex traders lose money. This tool is an aid to analysis, not a crystal ball. Use proper risk management, never risk more than 1-2% per trade, and understand that even the best technical signals fail during fundamental shocks.

How to Trade with 100 Non Repaint MT4 Indicator

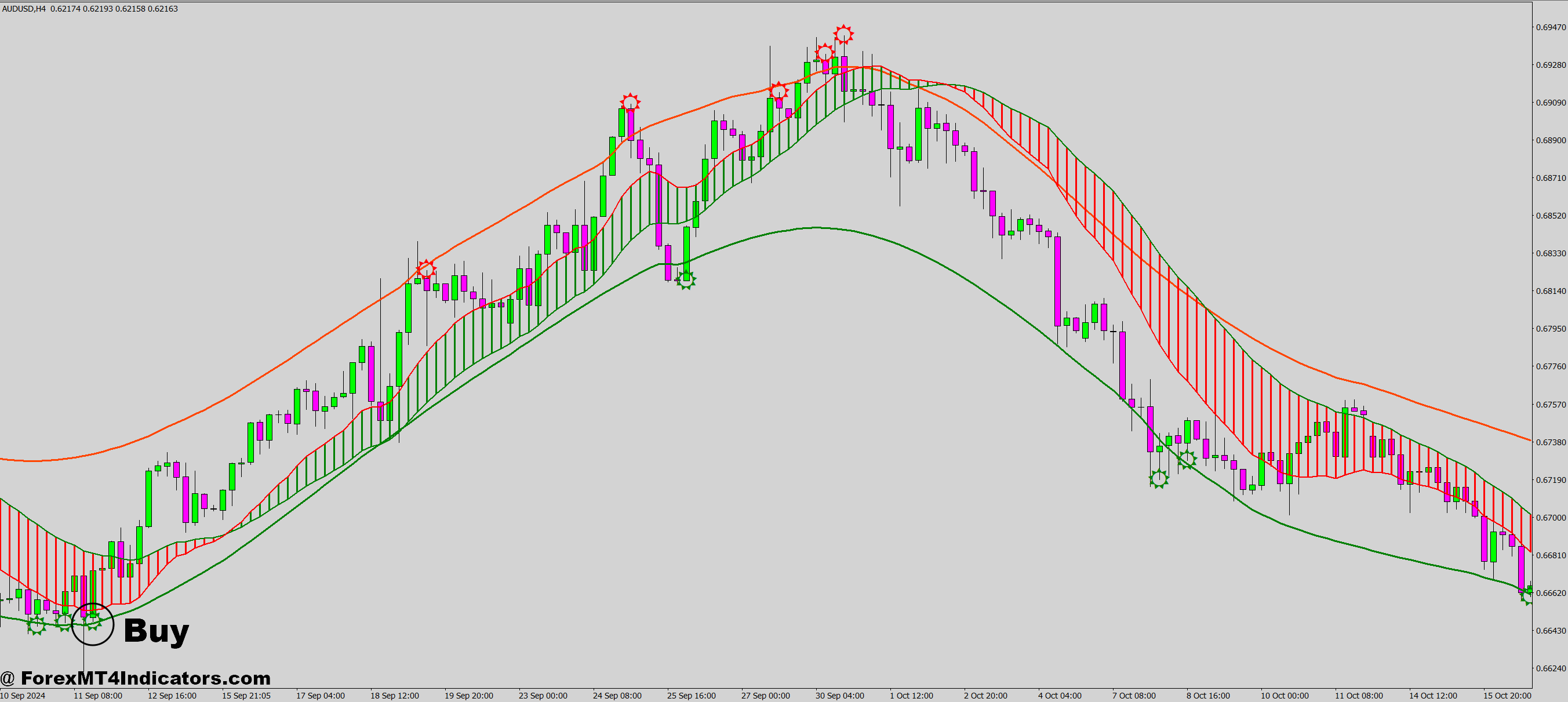

Buy Entry

- Wait for arrow confirmation – Enter only after the 1-hour or 4-hour candle closes with an upward arrow; mid-candle signals don’t count and lead to false entries.

- Check trend alignment – Ensure price is above the 200-period MA on daily charts before taking buy signals on EUR/USD or GBP/USD for higher probability setups.

- Set stop-loss 20-30 pips below signal – Place your stop beneath the most recent swing low or the signal candle’s low, whichever gives you better risk-reward on major pairs.

- Skip choppy Asian sessions – Avoid buy signals between 12 AM – 4 AM EST when EUR/USD ranges under 30 pips; wait for London open volatility instead.

- Target 2:1 risk-reward minimum – If risking 25 pips, aim for at least 50 pips profit; use previous resistance levels or round numbers (1.1000, 1.2000) as targets.

- Confirm with higher timeframe – Check that the 4-hour or daily chart shows bullish structure before taking 1-hour buy signals to avoid counter-trend traps.

- Avoid pre-NFP and FOMC signals – Don’t take entries within 2 hours of major news events; the indicator can’t predict fundamental volatility spikes.

- Risk only 1% per signal – On a $10,000 account, risk maximum $100 per buy entry regardless of how “perfect” the signal looks.

Sell Entry

- Wait for complete candle close – Only enter short when the downward arrow appears after candle close; never anticipate signals on 15-minute or 5-minute charts.

- Verify downtrend on daily chart – Confirm price trades below the 200-period MA on daily timeframe before taking sell signals on GBP/JPY or USD/CAD.

- Position stop-loss above signal high – Place stops 25-35 pips above the signal candle’s high or most recent swing high for proper protection on volatile pairs.

- Ignore signals during breakout moves – Skip sell signals when the price just broke major support with heavy volume; wait for retest confirmation instead.

- Use pending orders for precision – Set sell-stop orders 5-10 pips below signal candle low on 4-hour charts to avoid immediate whipsaw reversals.

- Check RSI below 50 – Add confluence by confirming RSI reads under 50 when sell arrow appears; above 50 suggests weakening bearish momentum.

- Avoid Friday afternoon signals – Don’t take sell entries after 12 PM EST on Fridays; weekend gaps can trigger stops on even valid technical signals.

- Scale out at resistance levels – Close 50% of the position at the first major support, move stop to breakeven, and let the remainder run toward the 3:1 target.

Conclusion

The 100 Non Repaint MT4 Indicator delivers on its core promise: honest signals that don’t disappear into the ether. That reliability helps you backtest legitimately, execute confidently, and learn from actual results rather than algorithmic revision. For traders tired of phantom signals and fake backtests, it’s a solid foundation.

That said, it won’t fix poor risk management or save you from trading against strong fundamental trends. It’s a tool, not a trading plan. Works best when you’ve already got the discipline to follow signals consistently and the wisdom to avoid trading during high-impact news. Combine it with proper support and resistance analysis, understand your pairs’ typical behavior, and keep position sizing conservative.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.