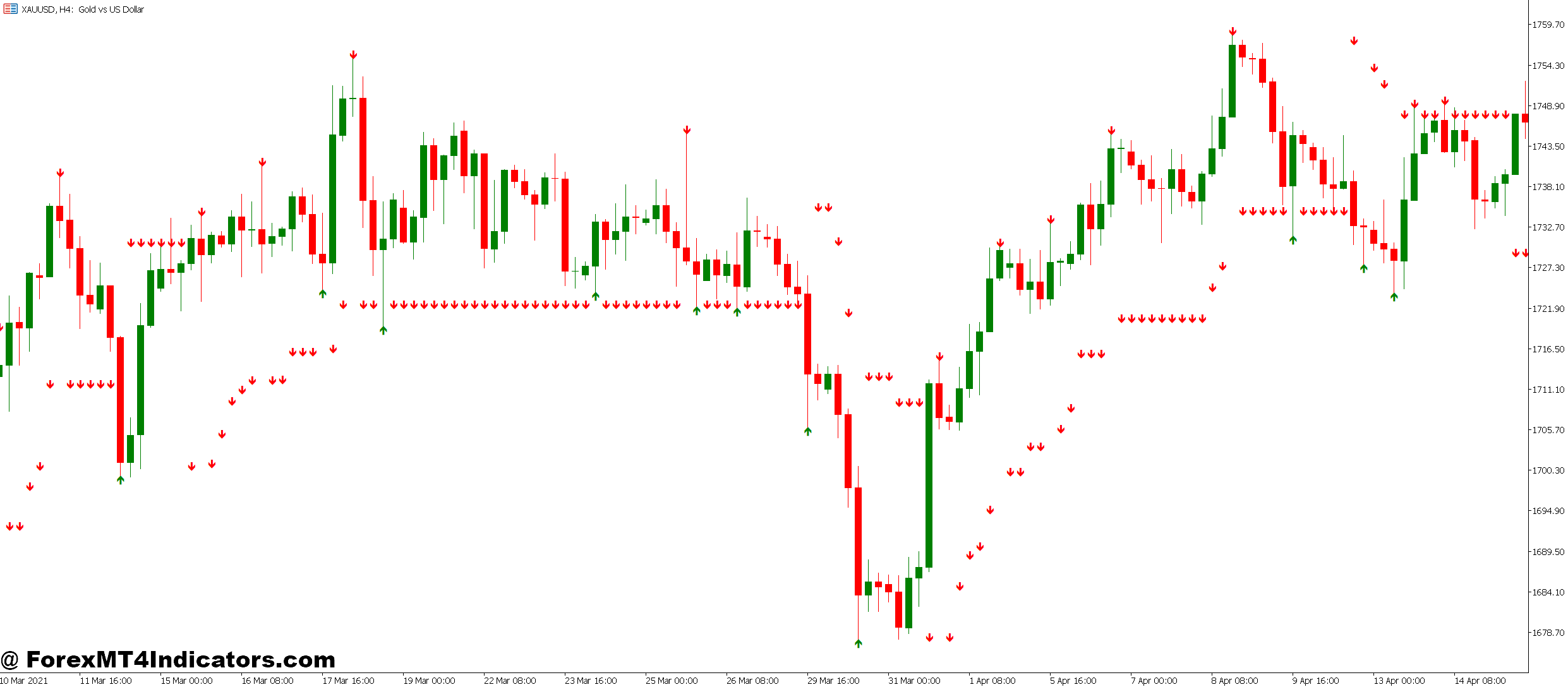

The 100 Non Repaint MT5 Indicator addresses this core issue. Once it plots a signal, that signal stays put. What you see is what you get, whether you’re analyzing the chart now or reviewing it three weeks later. This consistency lets traders backtest accurately, build confidence in their setups, and execute trades without second-guessing their tools.

What Makes Non-Repaint Indicators Different

Non-repaint indicators lock their values once a candle closes. The 100 Non Repaint MT5 Indicator falls into this category, meaning it calculates signals based on confirmed price data rather than shifting values mid-candle.

Here’s the technical distinction. Most indicators update continuously as the price moves within the current candle. That’s fine for the current bar, but problematic indicators also recalculate past bars when new data arrives. The 100 Non Repaint system prevents this backward revision. When a candle completes, and the indicator marks a signal at that point, the signal becomes permanent.

This reliability comes from how the indicator structures its calculations. It waits for candle confirmation before plotting arrows or alerts. On a 15-minute EUR/USD chart, for example, the indicator won’t display a buy signal until that 15-minute period actually closes. During the candle’s formation, traders might see preliminary calculations, but the final signal only appears after confirmation.

The name “100 Non Repaint” suggests comprehensive coverage—multiple signal types that all maintain this non-repaint property. That could include trend arrows, support and resistance levels, or momentum shifts, depending on the specific version traders download.

How Traders Apply This Indicator in Real Markets

The practical value shows up in daily trading decisions. Take a GBP/JPY scalper working the London session on a 5-minute chart. With a repainting indicator, they’d see buy signals appear and disappear throughout the session, creating confusion about which setups to take. The 100 Non Repaint MT5 Indicator eliminates this noise. When a green arrow appears after the 5-minute candle closes at 184.50, that arrow stays fixed.

Swing traders benefit differently. Someone holding USD/CAD positions for days needs reliable historical signals to identify quality support zones. If their indicator repaints, those historical reference points become meaningless. But a non-repaint tool shows exactly where signals fired in the past, helping traders identify consistent bounce zones or breakdown areas.

The indicator works across multiple scenarios:

- Trend Following: When the indicator shows a series of buy signals during an uptrend on EUR/USD’s 1-hour chart, traders can count on those signals remaining visible. This helps identify trend strength and potential continuation setups. During the September 2024 rally in gold, consistent non-repaint signals would’ve helped traders stay positioned instead of getting shaken out by temporary indicator fluctuations.

- Reversal Spots: At potential turning points, traders need confidence. If the indicator flashes a sell signal at a major resistance level on AUD/USD, knowing that signal won’t disappear helps traders commit to the reversal trade rather than waiting for additional confirmation that might come too late.

- Exit Timing: Non-repaint signals also help manage exits. When a trader is in a long position on the Dow Jones E-mini futures and the indicator finally shows a sell signal after a steady climb, that’s reliable information for taking profits. No wondering whether the signal will vanish.

Settings and Timeframe Optimization

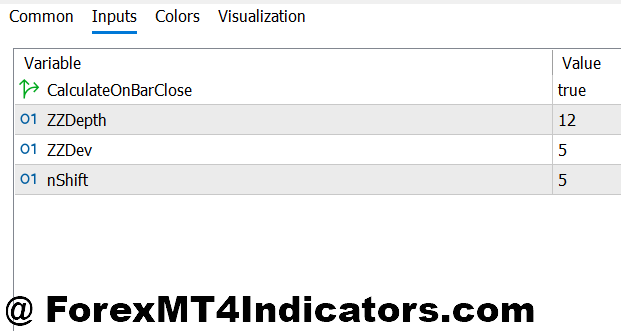

The indicator’s parameters typically include period settings, sensitivity adjustments, and alert configurations. Shorter periods (like a 10-period setting) generate more frequent signals, useful for scalpers on 1-minute or 5-minute charts. Longer periods (50 or higher) filter noise better, suitable for daily or 4-hour timeframes.

On volatile pairs like GBP/JPY or crypto markets, traders often increase the sensitivity threshold to avoid false signals during choppy conditions. A scalper might use default settings on EUR/USD’s 5-minute chart during the New York session but switch to less sensitive parameters during the Asian session when volatility drops and whipsaws increase.

Currency-specific adjustments matter. The 100 Non Repaint MT5 Indicator might perform differently on slow-moving USD/CHF versus explosive GBP/NZD. Testing across different pairs reveals which settings match each market’s personality. Some traders keep three chart templates: one for major pairs, one for crosses, and one for commodities like gold or oil.

Alert settings deserve attention, too. Most versions let traders enable sound alerts, email notifications, or mobile push alerts when new signals appear. For someone trading multiple pairs simultaneously, these alerts prevent missing opportunities while monitoring several charts.

Honest Assessment: Advantages and Limitations

The main advantage is obvious—signal consistency. Backtesting becomes meaningful when historical signals don’t change. Traders can review past trades with confidence, knowing the indicator showed the same information in real-time that it displays now. This accelerates learning and strategy refinement.

Another strength is reduced emotional trading. When signals stay put, traders stop second-guessing. They either take the trade or don’t, but they’re not stuck wondering whether their tool will betray them mid-setup.

But no indicator is perfect. The 100 Non Repaint MT5 Indicator can’t predict the future. It reacts to completed price action, which means it’s inherently lagging. By the time a signal appears after the candle closes, the price might’ve already moved 10-15 pips. In fast-moving markets during major news events like NFP or interest rate decisions, lag costs money.

The non-repaint feature also means traders can’t exit bad trades early based on indicator warnings. If someone enters long on a buy signal and the price immediately reverses, they’ll need other tools or price action skills to manage the loss. The indicator won’t repaint that buy signal into a sell signal to save them.

False signals still happen. Just because a signal doesn’t disappear doesn’t mean it was correct. During ranging markets, the indicator generates whipsaw signals at both ends of the range. EUR/USD trading between 1.0800 and 1.0850 for hours can trigger multiple buy and sell signals that go nowhere. That’s not the indicator’s fault—it’s the market structure’s nature.

Comparing with Standard Indicators

Most default MT5 indicators repaint to some degree. Moving averages shift as new candles form. Stochastic oscillator values recalculate. Even RSI technically repaints during the current candle’s formation, though its historical values stay fixed.

The 100 Non Repaint MT5 Indicator compares favorably to custom indicators that promise edge but shift signals after the fact. Those tools make backtesting pointless. They show 90% win rates historically because they’ve redrawn losing signals, but they fail in forward testing.

Against pure price action trading, the indicator serves as a complementary tool rather than a replacement. Experienced traders often use non-repaint indicators to confirm what they already see in support, resistance, and candlestick patterns. The indicator adds objectivity to subjective chart reading.

Compared to paid “holy grail” systems, this indicator offers transparency. It’s not promising unrealistic returns or hiding its limitations. Trading forex carries substantial risk. No indicator guarantees profits, and this one won’t make traders rich overnight. It simply provides consistent signals that don’t change once formed—a useful trait, but not magic.

How to Trade with 100 Non Repaint MT5 Indicator

Buy Entry

- Wait for candle close confirmation – Never enter during candle formation; wait until the 5-minute, 15-minute, or 1-hour bar fully closes with the green arrow locked in place to avoid premature entries.

- Check higher timeframe alignment – If the indicator shows a buy signal on the EUR/USD 15-minute chart, verify the 1-hour chart shows upward momentum to increase the probability by 60-70%.

- Set stop loss 3-5 pips below signal candle low – Place your stop beneath the candle that triggered the buy arrow, typically 10-15 pips for GBP/USD on 5-minute charts or 30-40 pips on 4-hour timeframes.

- Target 1.5:1 minimum risk-reward ratio – If risking 20 pips, aim for at least 30 pips profit; exit half position at 1:1 and let the remainder run to 2:1 for better overall performance.

- Avoid buy signals in tight consolidation – Skip entries when EUR/USD trades in a 20-30 pip range on the 1-hour chart; wait for clear breakouts above resistance before taking indicator signals.

- Confirm with support zones nearby – Take buy signals more seriously when they appear 5-10 pips above established support levels or previous swing lows on the daily chart.

- Risk only 1-2% per trade maximum – Even with perfect indicator signals, limit exposure to $100-200 on a $10,000 account to survive inevitable losing streaks.

- Skip signals during major news events – Ignore buy arrows 15 minutes before and 30 minutes after NFP, FOMC, or central bank announcements when spreads widen, and price action becomes erratic.

Sell Entry

- Wait for the red arrow after a full candle close – Only execute sell trades once the bearish signal is confirmed and locked at the close of the 15-minute or 1-hour candle on GBP/USD or EUR/USD.

- Verify downtrend on higher timeframe – Check that the 4-hour or daily chart shows lower highs and lower lows before taking sell signals on shorter 15-minute or 1-hour timeframes.

- Place stop loss 3-5 pips above signal candle high – Protect positions by setting stops just above the red arrow candle, typically 15-20 pips for volatile pairs like GBP/JPY on 5-minute charts.

- Take partial profits at 1:1, hold for 2:1 – Close 50% of your position when profit equals your risk, then trail stop to breakeven and target double your initial risk for the remaining position.

- Reject signals at strong support levels – Don’t take sell entries when the indicator fires within 10 pips of major daily or weekly support zones where reversals frequently occur.

- Confirm with resistance rejection – Prioritize sell signals that appear immediately after price tests and fail to break resistance on the EUR/USD 1-hour or 4-hour charts.

- Never risk more than 2% account balance – Cap losses at $200 on a $10,000 account, regardless of how confident you feel about the sell signal.

- Avoid trading during the Asian session, low liquidity – Skip sell signals between 8 PM – 2 AM EST when spreads widen to 3-5 pips on major pairs and false breakouts dominate.

Conclusion

The 100 Non Repaint MT5 Indicator delivers on its core promise: signals that don’t disappear or redraw. This consistency helps traders backtest strategies accurately, build confidence in their analysis, and eliminate one major source of trading frustration. It works best when combined with solid risk management and understanding of market structure rather than used in isolation.

Traders should test it across multiple timeframes and currency pairs to find optimal settings for their style. What works for a EUR/USD scalper won’t necessarily suit a gold swing trader. The indicator performs best in trending conditions and struggles during tight ranges, just like most technical tools.

Most importantly, this indicator doesn’t replace trading skill—it enhances it. Traders still need to understand proper position sizing, risk-reward ratios, and when to stay out of the market entirely. The non-repaint feature simply ensures that the signals they’re analyzing are stable and reliable, letting traders focus on execution rather than wondering if their tools will change their mind.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.