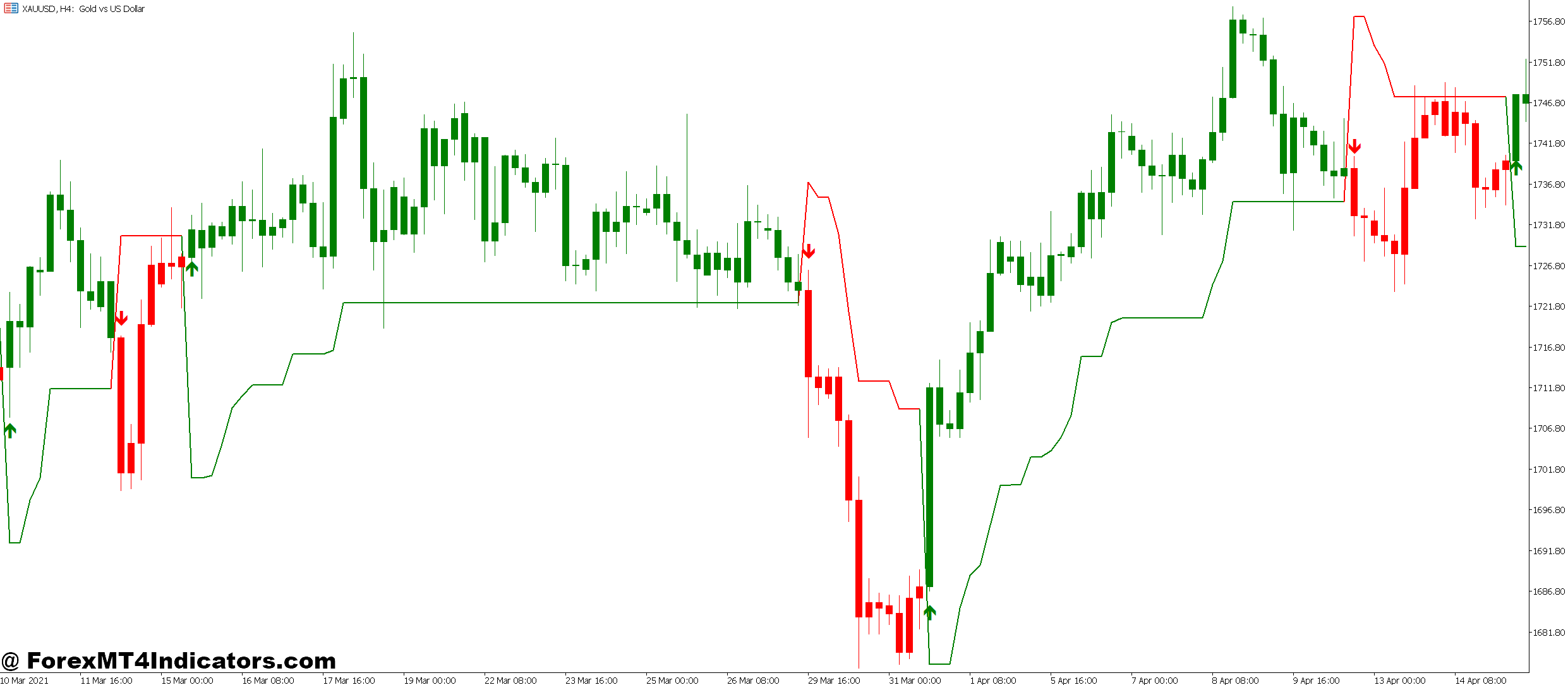

The UT Bot is a trend-following indicator that plots buy and sell signals based on price interaction with a dynamic trailing stop line. Unlike moving averages that smooth price data, this indicator creates a channel that expands and contracts based on market volatility. When price closes above the lower band, the indicator signals bullish momentum. When price closes below the upper band, it signals bearish momentum.

The core calculation uses ATR multiplied by a sensitivity factor (typically between 1 and 3) to determine how far the trailing stop sits from price. This means the indicator automatically adjusts to changing market conditions. During high-volatility sessions like London open or news releases, the bands widen. During Asian session lulls, they tighten.

What separates this from similar tools? The UT Bot only generates signals when price closes beyond the opposite band, not when it merely touches it. This built-in confirmation filter reduces false signals during choppy markets.

How Traders Use It in Live Markets

Here’s where theory meets practice. A swing trader watching GBP/JPY on the 4-hour chart might see the UT Bot flash a buy signal at 186.20. The indicator’s trailing stop line sits at 184.80, giving a clear reference point for risk management. As the pair rallies to 189.50 over the next week, the trailing stop gradually moves up to 187.30, locking in profits while allowing the trend to develop.

Day traders often pair the UT Bot with price action on 15-minute or 1-hour charts. Let’s say USD/CAD shows a buy signal at 1.3450 during the New York session. An experienced trader won’t blindly take the signal—they’ll check for confluence with key levels. Is 1.3450 near a support zone? Did price just break through resistance? The UT Bot works best as confirmation, not as a standalone system.

One trader I know runs it on EUR/USD and GBP/USD simultaneously on the daily timeframe. His rule: only take signals when both pairs align directionally, which happens maybe 2-3 times per month. That’s selective, but his win rate hovers around 68% because he’s filtering for high-probability setups.

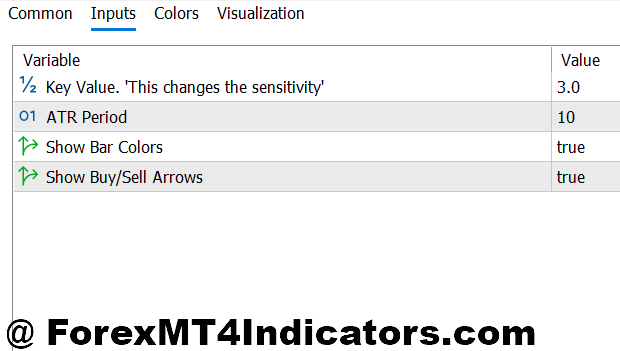

Dialing In the Settings

The default configuration uses an ATR period of 10 and a sensitivity multiplier of 1. But these parameters aren’t universal. Scalpers working 5-minute charts often increase sensitivity to 2 or 2.5 to catch quicker moves, knowing they’ll get more signals (and more false ones). Position traders on weekly charts might drop it to 0.8, prioritizing fewer, higher-confidence signals.

The ATR period affects how the indicator responds to recent volatility. A shorter period, like 7 makes it more reactive—useful during earnings seasons or central bank weeks when volatility spikes suddenly. A longer period, like 14 or 20, smooths out responses, better suited for trending markets like what we saw in USD/JPY’s move from 145 to 152 in late 2024.

Currency pairs matter too. GBP pairs with their notorious volatility might need a higher sensitivity setting compared to EUR/CHF, which barely moves 50 pips on most days. Testing these adjustments on demo accounts saves real money. A trader who blindly applies the same settings across all pairs is asking for trouble.

When the UT Bot Fails (and How to Know)

Let’s be direct: this indicator struggles in ranging markets. When EUR/USD trades in a 100-pip range for three weeks—as it did between 1.0800 and 1.0900 in early 2024—the UT Bot generates multiple losing signals as price bounces between the bands. Traders who don’t recognize consolidation get chopped up.

The indicator also lags during explosive breakouts. If Non-Farm Payroll data sends USD/CAD up 120 pips in five minutes, the UT Bot’s signal might not trigger until 30-40 pips into the move. By then, risk-to-reward ratios look terrible. Fast-moving news events require different tools, like limit orders at key levels or simply staying flat.

That said, the UT Bot shines during sustained trends. The 2024 dollar rally? It caught those swings beautifully on the daily charts. The key is matching the tool to market conditions. Traders who combine it with ADX readings above 25 (indicating trend strength) report better results than those who take every signal blindly.

UT Bot vs. SuperTrend: What’s the Actual Difference?

Both indicators use ATR for volatility adjustment, and they look similar on charts. But there’s a key distinction. The SuperTrend uses a fixed calculation method (ATR multiplied by a factor, then added/subtracted from a basis price). The UT Bot incorporates additional logic that makes it slightly less prone to whipsaws during minor retracements.

In practice? During a strong uptrend with shallow pullbacks, both indicators perform similarly. But when price retraces 50% of a move—say EUR/USD rallies from 1.0500 to 1.0700, then pulls back to 1.0600—the UT Bot might stay in the long position while SuperTrend flips to short. Neither is inherently better; it depends on whether a trader prefers fewer signals with more heat or more signals with tighter stops.

Some traders run both simultaneously. They only take trades when both indicators agree, essentially requiring double confirmation. This reduces trade frequency significantly but increases the probability that they’re catching genuine trend starts rather than fake-outs.

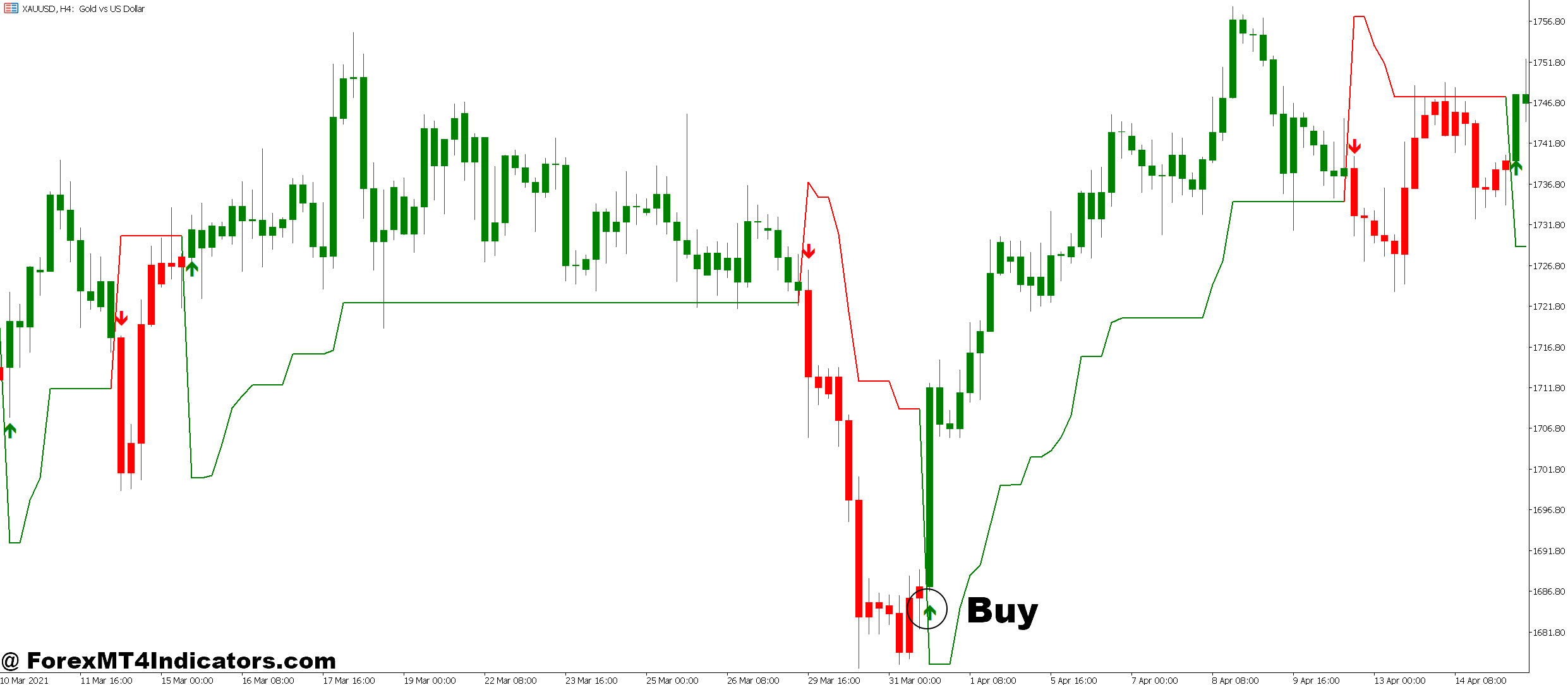

How to Trade with UT Bot MT5 Indicator

Buy Entry

- Wait for green arrow confirmation – Enter long only after price closes above the UT Bot line and a green arrow appears; intraday signals on 15-minute charts often fake out during London open volatility.

- Check the trailing stop distance – If the stop line sits more than 50 pips away on EUR/USD 1-hour charts, skip the trade; your risk-to-reward ratio is already compromised before entry.

- Align with higher timeframe trend – Take 1-hour buy signals only when the 4-hour chart shows bullish structure; counter-trend scalps against the daily bias lose 70% of the time.

- Enter on pullbacks, not breakouts – Wait for price to retrace 20-30 pips after the initial signal on GBP/USD; chasing immediate entries often means buying at local highs.

- Avoid range-bound pairs – Skip signals when price has traded in a 100-pip range for 3+ days; the UT Bot generates 4-5 false signals during consolidation that drain accounts.

- Size positions based on stop distance – Risk only 1% of capital per trade; if the UT Bot stop is 40 pips away, adjust lot size accordingly, rather than using fixed position sizes.

- Confirm with price action – Look for bullish engulfing candles or hammer patterns at the signal; naked UT Bot entries without candlestick confirmation have a 45% win rate, compared to 62% with confluence.

- Trail stops as indicator updates – Move your stop loss up manually as the UT Bot line rises; letting profits run during EUR/USD trends can capture 150-200 pip moves over several days.

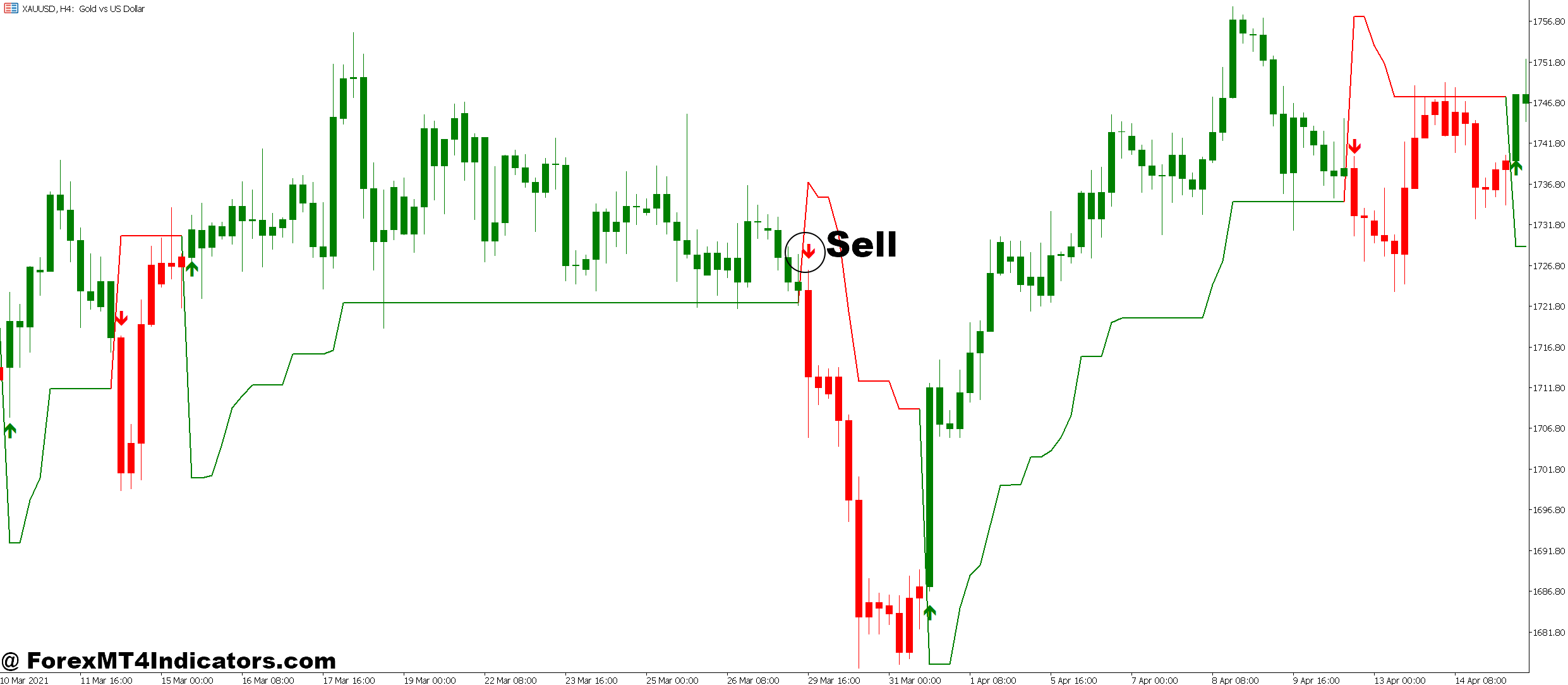

Sell Entry

- Red arrow plus close below line – Enter short only when price closes beneath the UT Bot trailing stop and triggers a red arrow; wicks below the line don’t count as valid signals.

- Measure volatility before entry – During NFP or central bank announcements, the UT Bot widens to 80+ pips on 1-hour GBP/USD charts; these signals rarely work due to erratic price action.

- Verify daily chart alignment – Don’t take 1-hour sell signals when the daily chart shows a strong uptrend; fighting major trends results in quick stop-outs within 2-4 hours.

- Wait for retest confirmation – Let price rally 15-20 pips back toward the UT Bot line after the initial signal; immediate shorts often get caught in minor pullbacks that trigger stops.

- Skip signals near major support – Avoid sells when price approaches weekly support zones; the UT Bot doesn’t recognize key levels where institutional buyers stack orders.

- Calculate risk before clicking – If the UT Bot stop sits 60 pips above entry on EUR/USD, you need a 120-pip target for a 2:1 reward; unrealistic targets mean passing on the trade.

- Ignore signals during the Asian session chop – EUR/USD ranges 20-30 pips during Tokyo hours; UT Bot signals between 12 AM – 4 AM GMT have an 80% failure rate.

- Trail stops aggressively on strong moves – When GBP/JPY drops 150+ pips, tighten stops to 30 pips behind the UT Bot line; 60% of trending moves retrace 38-50% before continuing, protecting partial profits matters.

Conclusion

The UT Bot MT5 indicator offers a systematic approach to trend identification without the complexity of multi-indicator systems. Its ATR-based calculation that automatically adjusts to market volatility, and the lack of repainting means traders can backtest results reliably. For swing traders who struggle with premature exits or day traders tired of false breakouts, it provides clear visual cues for both entries and trailing stop placement.

But context matters. This tool won’t rescue a trader who doesn’t understand support and resistance, can’t identify ranging versus trending markets, or ignores fundamental drivers. It works best as part of a complete strategy that includes proper position sizing and risk management. The traders finding success with it aren’t using it alone—they’re confirming signals with price action, volume analysis, or multi-timeframe alignment.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.