The SSL Hybrid MT5 Indicator tackles this exact problem. It cuts through market noise by showing traders which direction actually has momentum behind it. Instead of reacting to every price swing, traders get a visual framework that separates genuine trend moves from choppy, range-bound action. This article breaks down how the indicator functions, where it shines, and—just as importantly—where it falls short.

Trading forex carries substantial risk. No indicator guarantees profits, and past performance doesn’t predict future results. What follows is a technical analysis of one tool among many that traders use to inform their decisions.

What the SSL Hybrid Indicator Actually Does

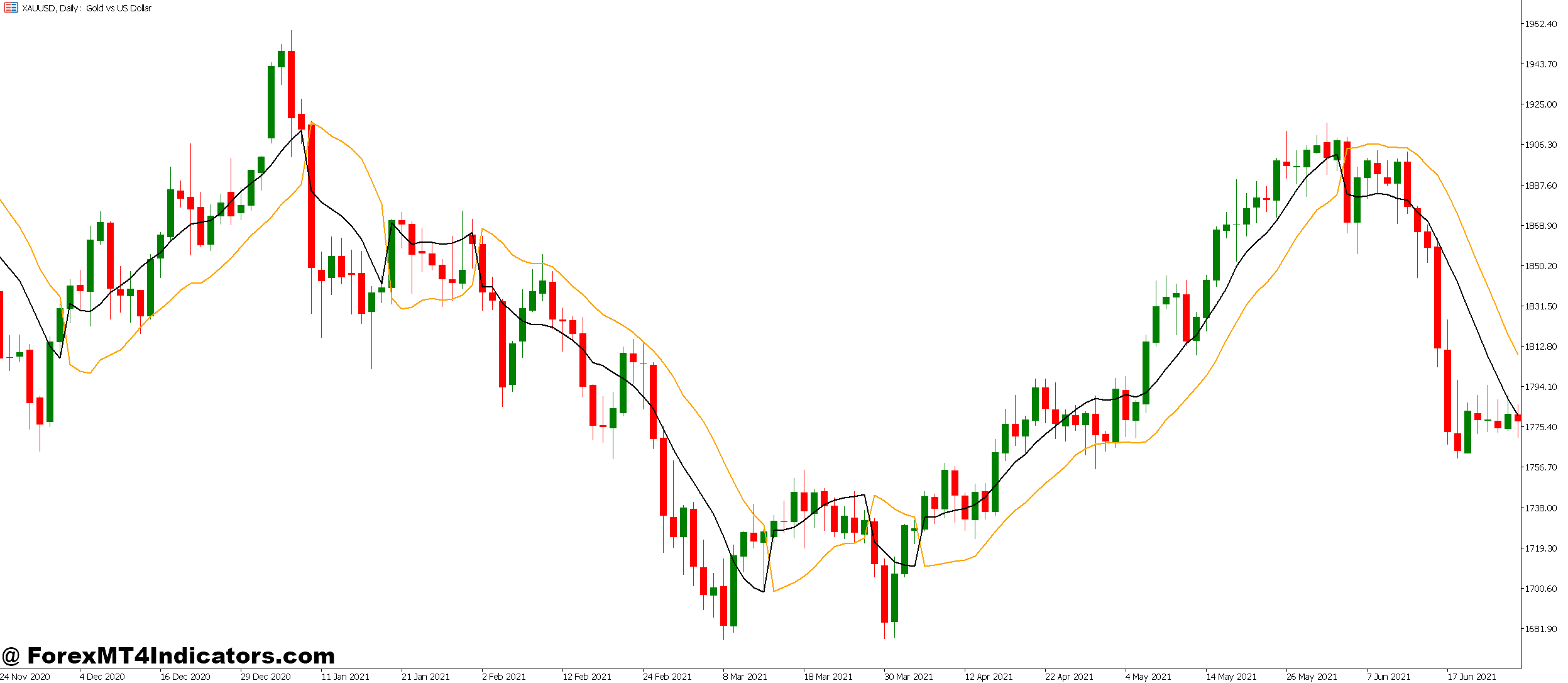

The SSL Hybrid combines two separate channel systems into one visual tool. Think of it as having both a fast-reacting sensor and a slower, more stable filter working together. The indicator plots colored lines above and below the price—when the trend shifts from bullish to bearish (or vice versa), these lines flip position and change color.

Unlike single-line moving averages, SSL Hybrid creates a channel zone. This zone expands during volatile periods and contracts when the price consolidates. Traders use it primarily for trend direction and entry timing, not as a standalone system.

The “hybrid” name comes from its dual-baseline approach. It doesn’t just track one moving average period; it monitors both a quick-moving line for sensitivity and a slower line for confirmation. When both agree on direction, traders get a higher-confidence signal.

The Technical Mechanics Behind the Signals

Here’s where things get specific. The SSL Hybrid uses exponential moving averages (EMAs) applied to the high and low of each candle. The default settings typically use a 10-period EMA for the fast line and a 20-period EMA for the baseline.

When price trades above the channel, the indicator plots a green zone—signaling bullish conditions. Drop below, and it switches to red for bearish. But there’s a twist: the indicator doesn’t flip immediately on one candle crossing. It waits for the EMA channels to fully cross each other, which filters out minor retracements.

The calculation looks at whether the fast EMA of the highs crosses above or below the slow EMA of the lows. That crossover point becomes the trigger for color changes. This lag—usually 1-3 bars depending on volatility—keeps traders from jumping into every fake-out.

In practice, this means GBP/JPY might show bullish colors while the price briefly dips below the channel. The indicator holds its signal because the underlying EMAs haven’t fully crossed. That patience prevents premature exits during normal pullbacks.

Real Trading Applications and Entry Logic

Where traders actually use this: trend confirmation on higher timeframes and entry refinement on lower ones. A common approach puts SSL Hybrid on the 4-hour chart to identify the dominant trend, then drops to 15-minute charts for specific entries.

Let’s say the 4-hour EUR/USD chart shows green SSL channels on Tuesday morning. Price is above both lines, and momentum looks clean. A trader watching this wouldn’t take shorts against that structure. Instead, they’d wait for the price to retrace to the green channel line, then look for bullish patterns—pin bars, engulfing candles, whatever their system uses.

The 15-minute chart adds precision. If the bigger trend is up, but the 15-minute SSL flips red temporarily, that’s not a reversal signal. It’s a pullback opportunity. Smart money waits for the 15-minute to flip back to green, confirming the lower timeframe aligns with the higher one.

During the London session on USD/JPY, this setup caught a 60-pip move last month when the 4-hour stayed bullish while the 1-hour made a brief dip into red territory. The re-entry as a 1-hour flip back to green gave a clean entry with defined risk below the channel.

Customizing Settings for Different Market Conditions

Default settings work fine for major pairs on standard timeframes. But exotic pairs or news-heavy sessions need adjustments. The fast EMA period (typically 10) and baseline period (typically 20) are the two variables that matter most.

For choppy pairs like GBP/NZD, bumping the fast period to 15 and baseline to 30 reduces false signals. The trade-off? Slower reaction to genuine trend changes. It’s always a balance between sensitivity and reliability.

Scalpers on 1-minute charts might lower settings to 5 and 10 to catch quicker moves. That said, whipsaw risk jumps significantly. The indicator wasn’t designed for ultra-fast timeframes where spreads and slippage eat most profits anyway.

Currency pairs with smooth trends—like AUD/NZD or EUR/GBP—handle default settings well. Volatile movers (GBP/JPY during Tokyo open) benefit from wider settings. Some traders run two versions simultaneously: one for signals, one for filters with different periods.

Color schemes matter less than most think, but visibility during different chart backgrounds helps. Green/red is standard, but blue/orange works better for colorblind traders or those using dark themes.

The Strengths and Honest Limitations

SSL Hybrid excels at keeping traders on the right side of established trends. It prevents the classic mistake of buying every dip in a downtrend or selling every rally in an uptrend. The visual clarity—seeing price relative to colored zones—makes trend direction immediately obvious.

It also filters out minor noise effectively. Single-candle spikes don’t flip the indicator, so traders avoid panic reactions to momentary volatility. The channel zone provides dynamic support and resistance levels that adjust automatically as trends develop.

Now the reality check: SSL Hybrid lags during trend transitions. By design, it needs confirmation before switching colors, which means the initial reversal move happens without warning. Traders entering on color flips typically miss the first 20-40% of a new trend.

Range-bound markets murder this indicator’s effectiveness. When EUR/USD spends three days bouncing between 1.0850 and 1.0900, SSL will flip colors every few hours, generating losing signal after losing signal. No trend-following tool handles consolidation well.

False breakouts occur, especially around major news events. The indicator might flip green just as NFP data drops and price reverses violently. It can’t predict fundamentals, only react to price structure. Traders combining SSL with volume analysis or order flow tools get better results.

Compared to MACD or RSI, SSL Hybrid doesn’t measure momentum strength—just direction. It won’t show overbought or oversold conditions. Paired with an oscillator, though, it becomes significantly more useful. The indicator works best as one component in a broader system, not as a solo decision-maker.

How to Trade with SSL Hybrid MT5 Indicator

Buy Entry

- Wait for green channel confirmation – Enter only after both SSL lines turn green and price closes above the channel; avoid entries during color transitions to prevent false breakouts.

- Enter on pullback to the green line – On 4-hour EUR/USD, wait for price to retrace and touch the lower green channel line, then enter when next candle shows bullish momentum with 15-20 pip stop below the channel.

- Confirm with higher timeframe alignment – Check daily chart shows green SSL before taking 1-hour buy signals; this multi-timeframe confirmation increases win rate by filtering counter-trend trades.

- Avoid buying when the channel is too wide – If the green channel spans more than 80 pips on the GBP/USD 1-hour chart, volatility is excessive, and whipsaw risk increases—wait for consolidation.

- Use the fast line as a trailing stop – Once in profit by 30+ pips, move the stop loss to just below the lower green line; exit immediately if SSL flips to red before the target.

- Don’t chase price far above channel – If EUR/USD trades 40+ pips above the upper green line on 15-minute chart, signal is overextended—wait for pullback rather than buying at extremes.

- Skip signals during major news events – Avoid entries 30 minutes before and after NFP, interest rate decisions, or CPI releases; SSL can’t predict fundamental-driven volatility spikes.

- Require at least 3 green candles – After SSL flips from red to green, wait for 3 consecutive bullish candles on the 1-hour chart to confirm trend strength before entering.

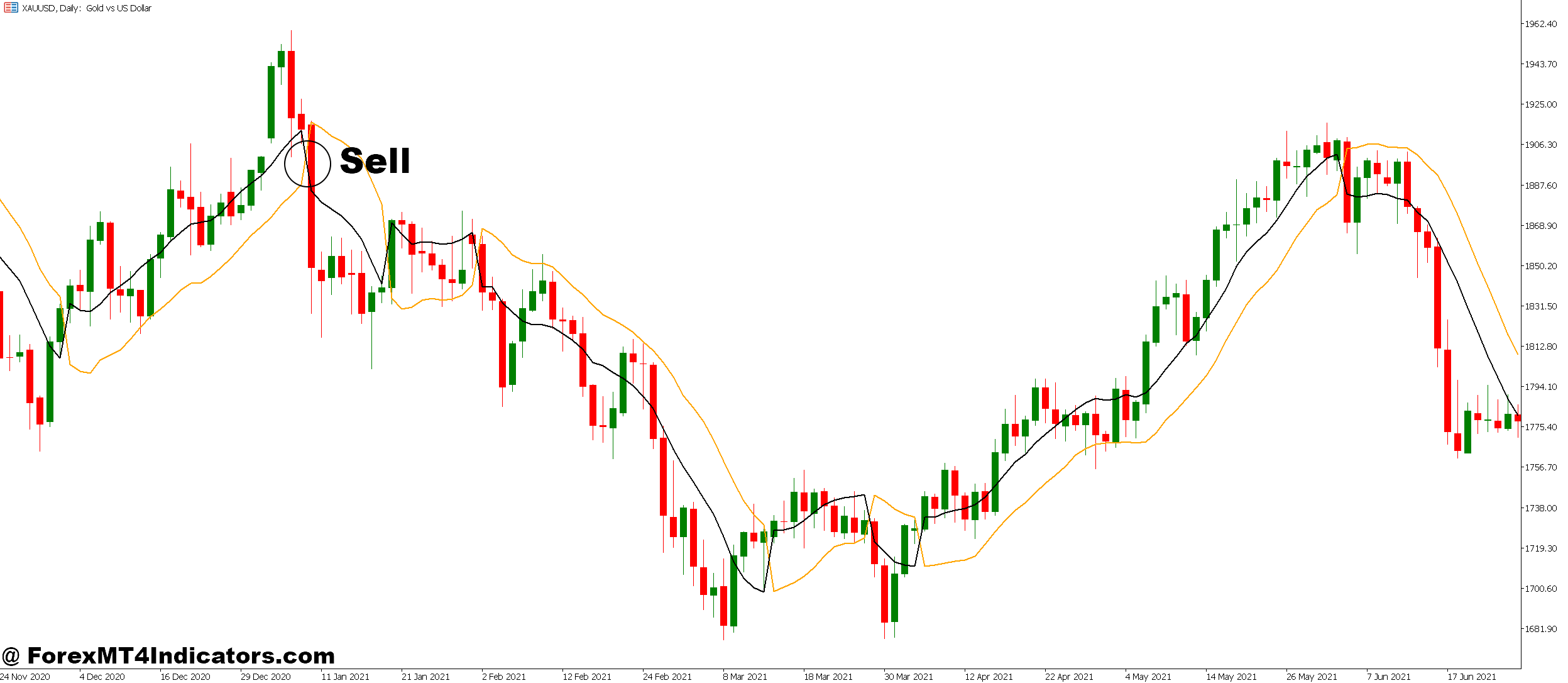

Sell Entry

- Enter when SSL flips completely red – Take sell positions only after both channel lines turn red and price closes below; premature entries during the flip cause unnecessary losses.

- Sell on rallies to the red line – On 4-hour GBP/USD, wait for price to bounce up to touch the upper red channel line, then enter short when rejection candle appears with 20-25 pip stop above.

- Check daily trend supports your sell – Never sell on 1-hour red SSL if daily chart shows green; trading against higher timeframe SSL color reduces success rate below 40%.

- Avoid tight ranges – If EUR/USD on 4-hour bounces between red and green every 6-8 hours, the market is ranging, not trending—skip all SSL signals until clear directional movement emerges.

- Trail stops using the upper red line – After gaining 25+ pips, adjust stop to just above the upper red channel; exit full position if SSL switches to green.

- Don’t sell when price drops too far below – If GBP/JPY trades 60+ pips below the lower red line on 1-hour, selling is late—either wait for bounce back to channel or skip the signal.

- Ignore signals during thin liquidity hours – Skip SSL flips during Asian session on USD pairs, or Sunday opens; low volume causes erratic price action that triggers false red signals.

- Confirm with momentum – Before selling red SSL on the 15-minute chart, verify price made a lower high and lower low—pattern confirmation prevents selling into temporary dips within uptrends.

Conclusion

SSL Hybrid MT5 Indicator delivers trend clarity without overwhelming charts with data. Traders get directional bias from color zones, dynamic support/resistance from the channels, and false-signal filtering from its dual-EMA structure. It handles major forex pairs during trending conditions effectively, giving both swing traders and position holders a reliable visual guide.

The tool demands realistic expectations. It won’t catch every reversal early, won’t handle ranges profitably, and won’t work without proper risk management behind it. What it does do is keep traders aligned with momentum and out of counter-trend disasters.

Risk management still trumps indicators every time. Position sizing, stop placement, and capital preservation matter more than any technical tool. Use SSL Hybrid as directional confirmation, combine it with price action or other indicators, and test thoroughly on demo accounts before risking real capital. The best indicator setup means nothing without disciplined execution backing it up.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.