This indicator isn’t your standard moving average crossover or RSI clone. It analyzes the mathematical probability of a price breakout succeeding by evaluating three core components:

- Historical breakout success rate at similar price levels over the past 100-500 bars (configurable). If EUR/JPY has broken above a certain resistance zone 12 times in the past six months and sustained the move only 4 times, the indicator factors that 33% success rate into its calculation.

- Current volatility versus average volatility. Breakouts during high volatility periods (ATR reading 20% above the 20-period average, for instance) tend to show different success rates than breakouts during consolidation. The indicator compares real-time ATR against historical norms.

- Volume confirmation metrics. While MT5 forex charts show tick volume rather than actual transaction volume, significant increases in tick volume (above 150% of the 50-bar average) can indicate institutional participation. The algorithm weighs this factor into probability calculations.

The output appears as a percentage displayed near the price level. A reading of “72%” means historical conditions similar to the current setup have resulted in successful breakouts roughly 72% of the time. That’s not a guarantee—it’s a statistical edge.

How Traders Apply This in Real Market Conditions

Let’s get practical. During the London session open on GBP/USD, price approaches the 1.2850 resistance level that’s rejected twice over the past week. Here’s how the indicator changes the decision-making process:

- Scenario 1: Price touches 1.2850, the indicator shows 38% probability. Most experienced traders would wait. That sub-40% reading suggests conditions don’t favor a sustained break—volatility might be too low, or the level has proven too strong historically.

- Scenario 2: Two hours later, the price returns to 1.2850, but now the indicator reads 68%. Volatility has picked up (visible on ATR), volume is elevated, and the technical picture has shifted. The trader enters long with a tighter stop-loss, knowing odds favor the trade but nothing’s certain.

Here’s what separates this from blind breakout trading: position sizing adapts to probability. A 45% reading might warrant a half-position with a wider stop. A 75% reading could justify a standard position size with normal risk parameters. The indicator doesn’t make the decision—it informs risk management.

Customization Settings That Actually Matter

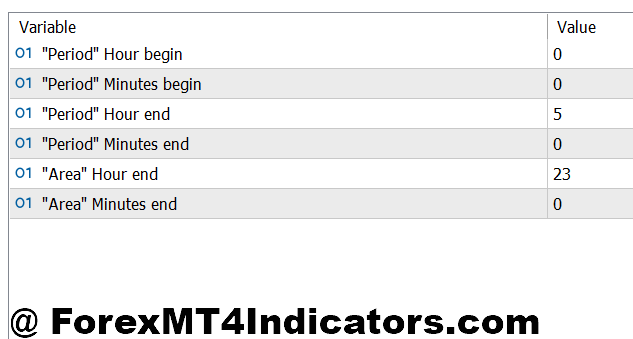

The default parameters work for 4-hour and daily timeframes, but scalpers and swing traders need different configurations. Three settings control the indicator’s behavior:

Lookback Period (default: 200 bars). This determines how much historical data the algorithm analyzes. Day traders on 15-minute charts often reduce this to 100 bars to keep the dataset relevant to recent price action. Swing traders might extend it to 500 bars for more statistical significance. But here’s the catch: longer periods smooth out the probability readings, which can lag during rapidly changing market conditions.

Volatility Multiplier (default: 1.5). This adjusts how heavily ATR factors into calculations. Setting it to 2.0 makes the indicator more conservative, requiring higher volatility before upgrading breakout probability. Aggressive traders drop it to 1.2, but that increases false signals during choppy markets.

Volume Threshold (default: 150%). This sets the tick volume increase required for confirmation. Pairs like USD/JPY during Tokyo hours might need only 130% due to natural liquidity, while exotic pairs might require 200% to filter out noise.

One trader running this on AUD/NZD—a notoriously range-bound pair—found success by increasing the lookback period to 400 bars and raising the volume threshold to 175%. The more restrictive settings reduced signal frequency but improved win rate from 52% to 64% over a three-month sample.

The Honest Assessment: Advantages and Limitations

What works: The indicator excels at filtering out low-probability setups. In sideways markets where breakout attempts fail repeatedly, it keeps traders on the sidelines. That preservation of capital matters more than most realize. One month of avoided losses can outweigh two months of modest gains.

The probability-based framework also removes emotion from entries. When the indicator shows 70%+ and your technical analysis aligns, pulling the trigger becomes easier. Conversely, a 35% reading provides rational justification to pass on a setup, even if FOMO screams otherwise.

What doesn’t work: This tool struggles during unprecedented market events. Brexit, COVID crash, Swiss franc depeg—these black swan moments invalidate historical probability. The indicator shows moderate readings because nothing in the historical dataset matches current conditions. Traders need discretion to override the tool during obvious macro disruptions.

It also lags during the first test of new support or resistance levels. If GBP/USD breaks above 1.3000 for the first time in two years, the indicator has limited historical data at that specific level. Readings become less reliable until the level is tested multiple times.

And here’s the uncomfortable truth: even 80% probability means 1 in 5 trades fails. Traders who expect certainty will be disappointed. This indicator improves odds; it doesn’t eliminate risk.

How It Compares to Standard Breakout Tools

Traditional breakout indicators—Donchian Channels, Bollinger Bands, or simple support/resistance breaks—signal when price exceeds a level. They’re binary: breakout detected, take the trade. The Breakout Probability Indicator adds context.

Donchian Channels on a 4-hour EUR/USD chart might trigger 8 breakout signals in a week. The probability indicator might classify 3 of those as high-probability (65%+), 3 as moderate (45-55%), and 2 as low (below 40%). That filtering reduces overtrading and improves the quality of entries.

Compared to volume-based breakout tools like the Volume Breakout Indicator, this tool is more comprehensive. Volume indicators confirm breakouts after they occur, while probability calculations can anticipate which breakouts have better statistical backing before price fully commits.

That said, it shouldn’t replace price action analysis. Traders still need to identify consolidation zones, understand market structure, and recognize candlestick patterns. The indicator is a decision-support tool, not a standalone system.

How to Trade with Breakout Probability MT5 Indicator

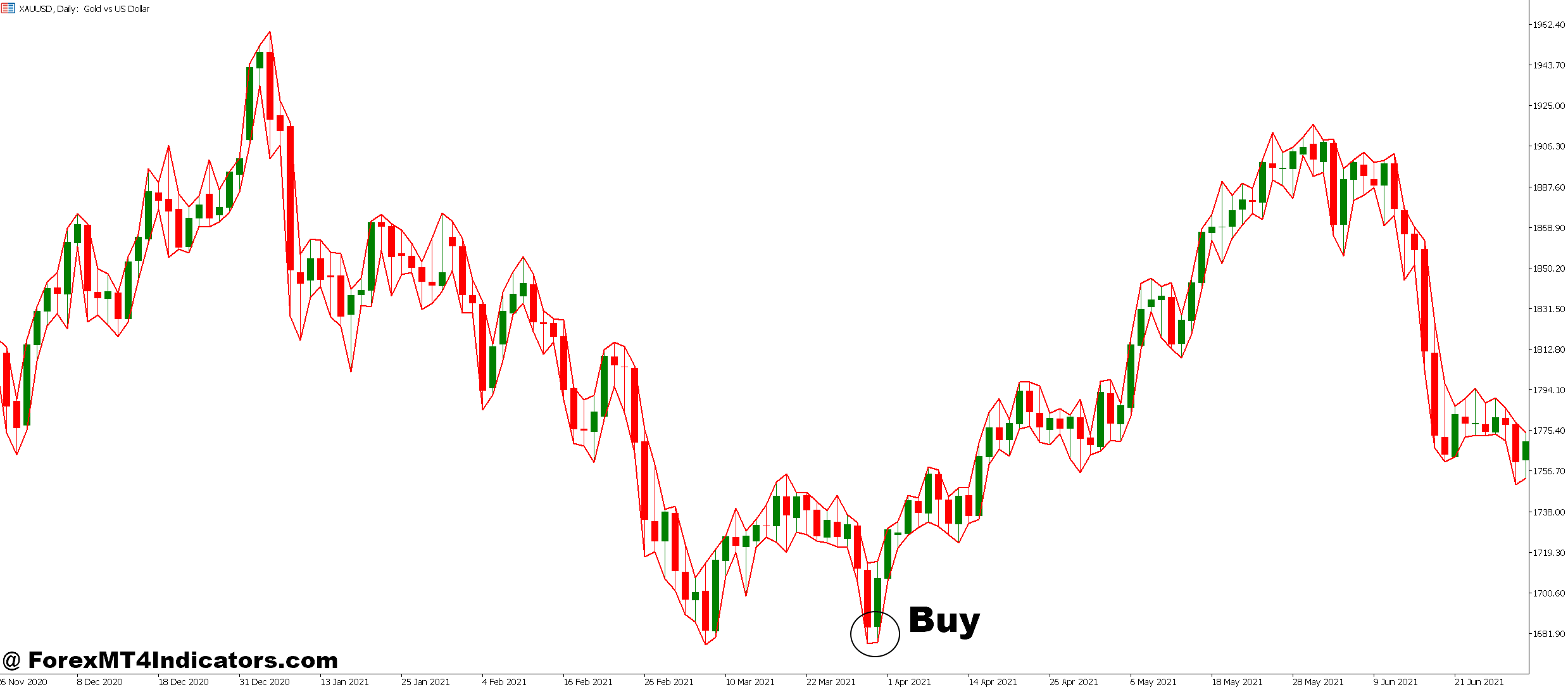

Buy Entry

- Wait for 65%+ probability reading – Only enter long positions when the indicator shows a minimum 65% breakout probability at resistance levels on EUR/USD or GBP/USD 4-hour charts to filter out weak setups.

- Confirm with volume spike – Enter when tick volume exceeds 150% of the 50-bar average alongside a high probability reading, signaling institutional participation rather than retail noise.

- Enter on candle close above resistance – Don’t jump the gun; wait for the 1-hour or 4-hour candle to fully close 5-10 pips above the resistance level before executing the buy order.

- Set stop-loss below the breakout level – Place stops 15-20 pips below the broken resistance (now support) on EUR/USD, or 25-30 pips on GBP/USD to account for higher volatility.

- Avoid entries below 50% probability – Skip the trade entirely if the indicator shows less than 50%, even if price action looks bullish; historical data suggests these fail more than they succeed.

- Scale position size with probability – Risk 1% of account on 65-70% readings, increase to 1.5% on 75%+ readings, but never exceed 2% regardless of indicator confidence.

- Check ATR before entry – Only take the signal if the current ATR is at least 20% above the 20-period average, indicating sufficient volatility to sustain the breakout move.

- Avoid trading during low liquidity – Skip breakout signals during the Asian session on EUR pairs or 30 minutes before major news releases when fake-outs are most common.

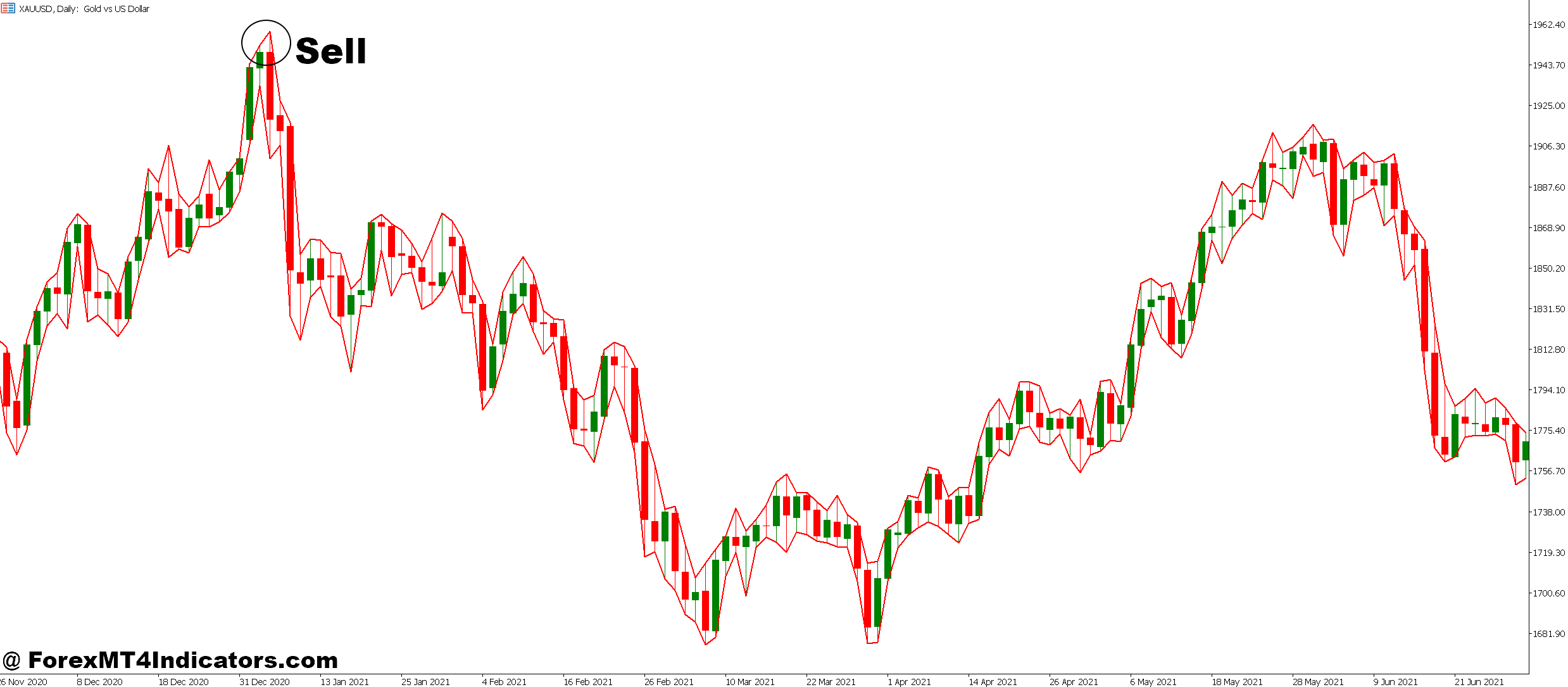

Sell Entry

- Enter at 65%+ probability on support breaks – Take short positions only when the indicator confirms a minimum 65% probability that the support breakdown will hold on daily or 4-hour timeframes.

- Wait for candle close below support – Don’t sell prematurely; confirm the 4-hour candle closes 5-10 pips below support level with the probability reading staying elevated throughout the candle formation.

- Verify with declining volume on retests – Enter shorts when price retests the broken support as new resistance but fails to attract strong volume (below 120% of average), showing weak buying interest.

- Place stop-loss above breakdown point – Set stops 20-25 pips above the broken support level on EUR/USD, or 30-35 pips on GBP/USD to survive normal retest volatility.

- Skip entries during uptrends – Ignore even 70%+ probability sell signals when price is above the 200-period moving average on the daily chart; counter-trend breakdowns fail frequently.

- Reduce position size on marginal readings – Risk only 0.5-0.75% of account when probability shows 60-65%, and avoid selling entirely below 60% regardless of how bearish the price looks.

- Confirm with RSI below 50 – Add confluence by checking that 14-period RSI has crossed below 50 before entering, filtering out breakdowns that occur during temporary pullbacks in uptrends.

- Avoid shorting into support clusters – Don’t take sell signals when another major support level sits 30-50 pips below the current breakdown point; the next level often absorbs selling pressure quickly.

Conclusion

The Breakout Probability MT5 Indicator shifts breakout trading from guesswork to calculated risk. It won’t make bad trades good, and it won’t catch every winning move. What it does is help traders avoid the majority of low-quality breakout attempts that drain accounts slowly over time.

Successful implementation requires backtesting on your preferred pairs and timeframes. What works for EUR/USD may not work for GBP/JPY. What succeeds on daily charts might fail on 5-minute charts. The indicator provides data; traders provide strategy, discipline, and risk management.

Trading forex carries substantial risk. No indicator guarantees profits, and past performance doesn’t ensure future results. This tool increases the probability of success, but probability isn’t certainty. Use appropriate position sizing, maintain strict stop-losses, and never risk capital you can’t afford to lose.

For traders serious about breakout trading, this indicator deserves consideration, not as a holy grail, but as one more edge in a market where every advantage counts.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.