The Golden Line MT4 Indicator plots dynamic price levels derived from Fibonacci ratios and moving average calculations. At its core, it identifies the golden ratio (1.618 and its inverse 0.618) applied to recent price swings, then smooths these levels using a weighted moving average. The result? Support and resistance zones that shift as market conditions change.

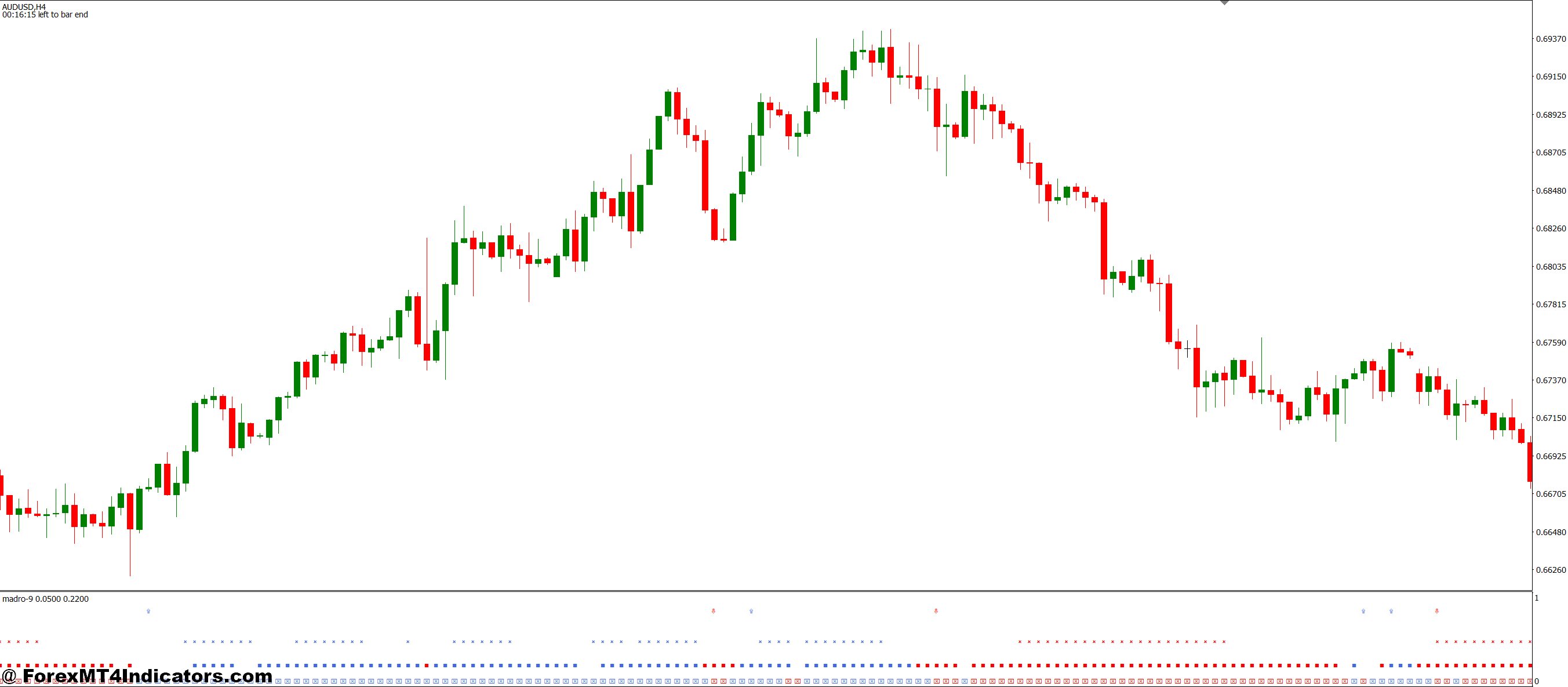

The indicator displays two primary lines on your chart—an upper golden line and a lower golden line. When price trades between these boundaries, the market is considered range-bound. Breaks above or below these lines signal potential trend continuation or reversal, depending on additional confirmation factors.

What separates this from standard Fibonacci retracement tools is the automatic recalculation period. Instead of manually drawing Fib levels after every swing, the Golden Line does this continuously using the last 50 bars (adjustable parameter). This means your support and resistance levels stay relevant even during choppy or trending markets.

How It Calculates These Levels

The math behind the Golden Line isn’t rocket science, but it’s precise. The indicator first identifies the highest high and lowest low within your specified lookback period—typically 50 bars. It then calculates the range between these extremes and multiplies it by 0.618 (the inverse golden ratio).

For the upper line: High – (Range × 0.618) For the lower line: Low + (Range × 0.618)

These initial values get smoothed using an exponential moving average with a period of 8 (default setting). This smoothing prevents the lines from jumping erratically on every single bar, giving traders cleaner levels to work with. Some versions also incorporate ATR (Average True Range) adjustments to account for volatility expansion or contraction.

The beauty of this calculation method lies in its balance. It’s responsive enough to adapt to changing market conditions but stable enough to avoid the noise that plagues many real-time indicators. When testing this on GBP/JPY during the London session, the lines adjusted smoothly through volatility spikes without generating false breaks.

Practical Trading Applications

So how do actual traders use this tool? The most straightforward strategy involves treating the golden lines as dynamic support and resistance. When price pulls back to the lower golden line in an uptrend, that’s a potential long entry. If price retraces to the upper line during a downtrend, traders look for short opportunities.

Take USD/JPY on the 1-hour chart during a typical trending day. Price broke above the upper golden line at 149.20 in the Asian session. For the next six hours, price repeatedly tested this line from above—each touch provided a low-risk entry for trend continuation trades. The line acted as support four times before price eventually broke back below it.

But here’s the thing: the indicator works best with confirmation. Smart traders don’t just buy at the lower line or sell at the upper line blindly. They wait for candlestick patterns (pin bars, engulfing candles), RSI divergence, or volume signals to confirm the bounce. Trading the Golden Line in isolation leads to whipsaw trades, especially during choppy ranges.

Another practical application involves using the space between the lines as a filter. When the upper and lower lines are far apart, volatility is high, and traders might use wider stops or smaller position sizes. When the lines converge, the market is compressing—often preceding a breakout. EUR/GBP showed this perfectly in March 2024 when the lines squeezed to within 30 pips before the pair shot up 150 pips over three days.

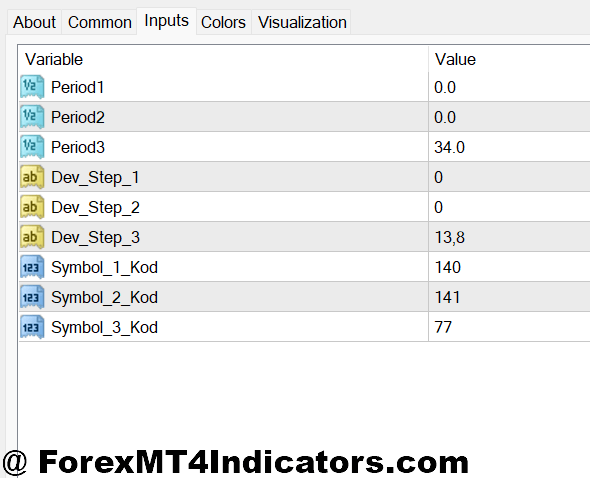

Customization and Settings

The Golden Line indicator offers several adjustable parameters, though the defaults work surprisingly well. The lookback period (typically 50) determines how many bars the indicator analyzes to find its high-low range. Shorter periods like 20-30 make the lines more responsive but increase fake-outs. Longer periods like 80-100 create smoother, more reliable levels, but lag during rapid market shifts.

The smoothing period (usually 8) controls how much the EMA dampens line movement. Traders dealing with higher timeframes—4-hour or daily charts—often increase this to 13 or 21 for stability. Scalpers on 5-minute charts sometimes drop it to 5 for faster reaction.

Some versions let you adjust the Fibonacci ratio itself. While 0.618 is standard, certain traders experiment with 0.382 or 0.786 to create tighter or wider zones. Testing this on AUD/USD showed that 0.382 worked better during ranging markets, while 0.618 performed better during trends.

Color and line thickness are cosmetic but matter for chart clarity. When running multiple indicators, making the Golden Lines bold and distinct prevents confusion. Many traders set the upper line to red andthe lower to green for intuitive recognition.

Strengths and Honest Limitations

The Golden Line excels at adapting to market conditions without trader intervention. Unlike manually drawn support and resistance, it updates automatically, saving time and removing bias. It also provides objective levels—there’s no subjective interpretation of where to place your lines.

The indicator shines particularly well in trending markets. During sustained USD/CHF downtrends in late 2024, the upper golden line acted as resistance with remarkable consistency. Traders who shorted at these touches captured multiple profitable swings. It also handles volatility shifts better than fixed indicators, expanding and contracting its levels as market conditions dictate.

That said, no indicator is perfect. The Golden Line struggles during extreme whipsaws and unexpected news events. When the Swiss National Bank made their surprise rate announcement, price gapped through both lines, rendering them useless for several sessions. The indicator also generates occasional false signals in ranging markets where price bounces between lines without clear direction.

Another limitation: it’s a lagging indicator by design. Because it calculates based on historical price data, it can’t predict sudden market reversals. Traders expecting the Golden Line to forecast turning points will be disappointed. It identifies where price has been reacting, not where it will react next.

And let’s be clear—trading forex carries substantial risk. No indicator guarantees profits, and the Golden Line won’t turn a losing strategy into a winner. It’s a tool that needs to be part of a broader trading plan with proper risk management.

How It Compares to Similar Indicators

Traders often wonder how the Golden Line stacks up against Bollinger Bands, Donchian Channels, or standard Fibonacci retracements. Bollinger Bands use standard deviation to plot levels, making them more sensitive to volatility but less grounded in price structure. The Golden Line’s Fibonacci basis gives it a mathematical edge that traders find more reliable.

Donchian Channels simply plot the highest high and lowest low—they don’t incorporate the golden ratio smoothing. This makes them more prone to sudden shifts. The Golden Line’s EMA smoothing provides stability that Donchian Channels lack.

Compared to manual Fibonacci retracements, the Golden Line wins on convenience and objectivity. Manual Fibs require traders to identify swing points and draw levels repeatedly. The Golden Line automates this process while maintaining mathematical accuracy. However, experienced traders note that manual Fibs allow for more discretion in choosing relevant swing points, which can be an advantage in complex market structures.

How to Trade with Golden Line MT4 Indicator

Buy Entry

- Price touches lower golden line – Enter long when price tests the lower line with a bullish pin bar or engulfing candle on the EUR/USD 1-hour chart, confirming support is holding.

- Break above the upper line with volume – Buy the breakout when price closes 10-15 pips above the upper golden line on the GBP/USD 4-hour chart, placing stop 20 pips below the line.

- Double bottom at lower line – Take long position when price forms two clear lows at the lower golden line within 24 hours, risking 1-2% account balance per trade.

- RSI divergence at lower support – Enter buy when RSI shows bullish divergence while price hits the lower golden line on daily charts, targeting the upper line for 2:1 reward-risk.

- Golden line acts as new support – Go long when price retests the broken upper line from above on the USD/JPY 4-hour chart, confirming the breakout wasn’t false.

- Lines converging before breakout – Buy when upper and lower lines squeeze within 30 pips on the EUR/GBP 1-hour chart, then price breaks above resistance with momentum.

- Avoid chop zones – Don’t enter longs when price whipsaws between lines more than 4 times in 3 hours, or during major news releases like NFP.

- Confirm with moving averages – Only take buy signals when 50 EMA slopes upward and the price trades above it, filtering out counter-trend traps on all timeframes.

Sell Entry

- Price rejects upper golden line – Enter short when price hits the upper line and forms a bearish engulfing or shooting star on GBP/JPY 1-hour chart, placing stop 15-20 pips above.

- Break below the lower line confirmed – Sell the breakdown when price closes 10 pips below the lower golden line on the EUR/USD 4-hour chart with increased selling volume.

- Double top at upper resistance – Take a short position when price creates two clear highs at the upper golden line within 12-24 hours, targeting the lower line for profit.

- Bearish divergence at upper line – Enter sell when RSI shows lower highs while price makes higher highs at the upper golden line on the daily USD/CHF chart.

- Failed breakout above upper line – Go short when price breaks above upper line but closes back below within 1-2 candles on AUD/USD 1-hour chart, stop above the wick high.

- Downtrend retest from below – Sell when price breaks below the lower line, then retests it from underneath on the 4-hour GBP/USD chart, confirming support turned resistance.

- Skip sideways grind – Don’t short when both golden lines are flat and parallel for 8+ hours, indicating range-bound chop that produces false signals.

- Risk only 1% per trade – Never risk more than 1% account equity on golden line signals during volatile sessions like London open or major central bank announcements.

Final Thoughts

The Golden Line MT4 Indicator offers traders dynamic support and resistance levels grounded in Fibonacci mathematics and responsive to market conditions. It works best for trend traders looking for pullback entries and breakout traders monitoring compression zones. The automatic calculation removes guesswork and saves time, while the customizable parameters let traders adapt it to their specific style and timeframe.

Don’t expect miracles—this indicator won’t eliminate losing trades or replace sound risk management. What it does provide is objective, adaptive levels that improve decision-making when combined with proper trade confirmation. Traders using the Golden Line as part of a complete strategy report better entry timing and clearer market structure understanding. Test it on a demo account first, adjust the settings to match your trading style, and remember that even golden lines can break when the market decides to move. The key isn’t finding a perfect indicator—it’s learning to use imperfect tools skillfully.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.