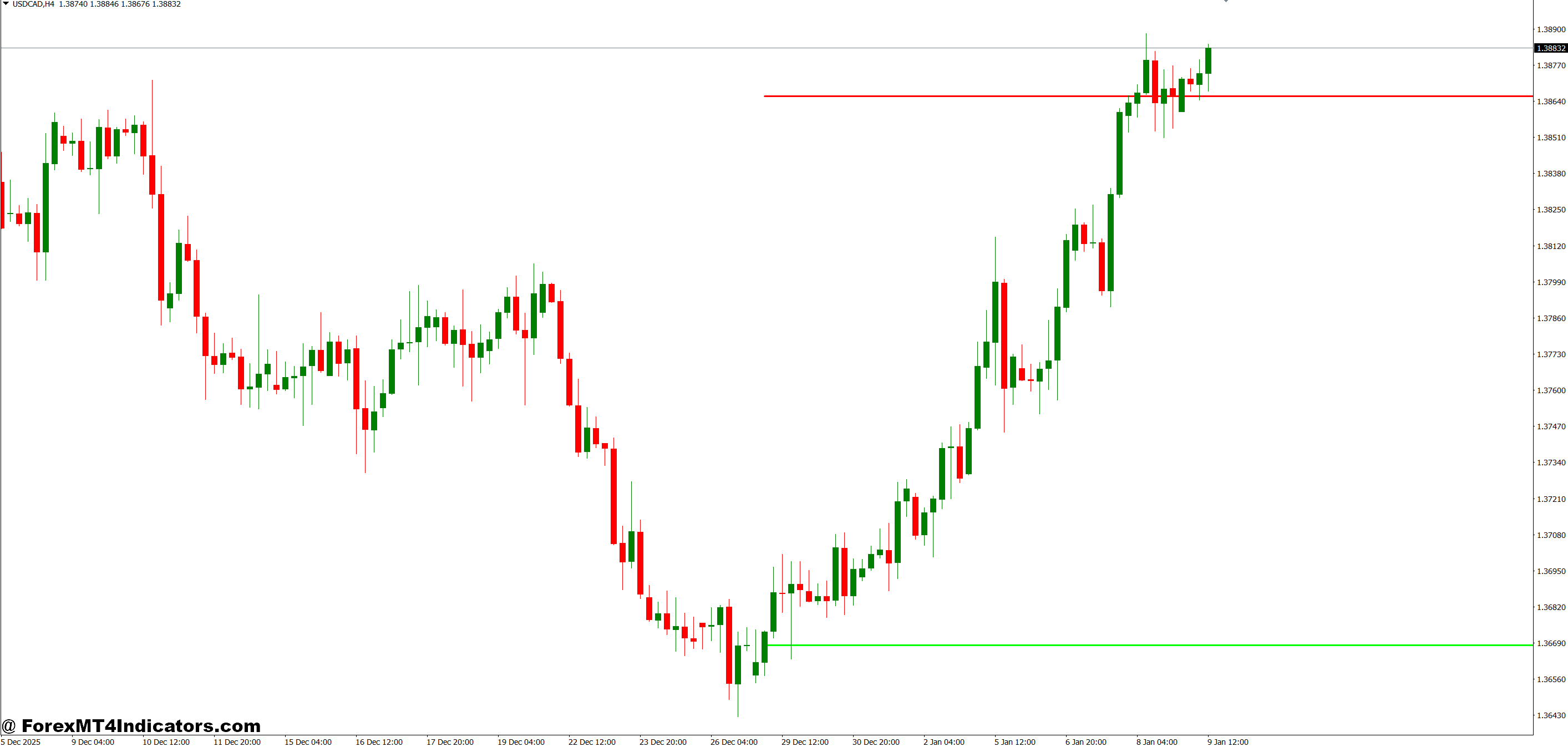

The Opening Range Breakout indicator identifies the high and low boundaries established during the opening period of a trading session typically the first 30, 60, or even 120 minutes after a major market opens. Once that range is defined, the indicator plots horizontal lines at those levels and monitors for price to break above or below them.

Traders use this because institutional players often test levels during the open before committing capital. When price finally breaks the range with conviction, it signals that one side has gained control. The indicator saves you from manually tracking these levels across multiple pairs or timeframes.

The concept isn’t new. Floor traders used opening range breakouts decades ago in futures pits. What’s changed is the automation. The MT4 version does the calculations instantly and works across forex pairs, indices, and commodities.

How the ORB Indicator Calculates Breakout Levels

Here’s what happens behind the scenes. The indicator tracks price action during your specified time period let’s say 9:30 AM to 10:30 AM EST for the New York session. During that hour, it records the highest high and lowest low. Those two prices become your breakout levels.

When the opening period ends, the indicator draws horizontal lines at those points. Some versions also plot zones or color-coded backgrounds. The calculation is straightforward: Opening Range High = Max(High prices during opening period) and Opening Range Low = Min(Low prices during opening period).

What makes this useful? The indicator continues plotting those levels throughout the trading day. If you’re trading GBP/USD on the 5-minute chart and price breaks the opening range high at 2:00 PM, you get a visual signal immediately. Many versions include alert functions that send notifications when the breakout occurs.

The best indicators also show how far price travels after the breakout. This helps with profit targets. If EUR/USD typically moves 40-50 pips after breaking the London opening range, you can set realistic expectations instead of hoping for a 200-pip runner.

Practical Trading Applications

Let’s get specific. On December 15th, a trader watching USD/JPY during Tokyo open (7:00 PM to 8:00 PM EST) sees the opening range establish between 149.20 and 149.60. The indicator plots these lines automatically. At 9:45 PM, price breaks above 149.60 with strong momentum and closes at 149.85 within 15 minutes. That’s a clean 25-pip move from the breakout level.

The indicator shines during high-volatility sessions. NFP days are perfect examples. The first 30 minutes after the 8:30 AM EST release creates a range as the market digests the data. When price breaks that range, the move often has legs because it reflects genuine directional conviction rather than initial whipsaw.

But here’s the thing false breakouts happen. Price touches 149.61, you enter long, then immediately reverses back into the range. That’s why experienced traders wait for a candle close beyond the breakout level, not just a wick. Some use a buffer zone, requiring price to break the range by 5-10 pips before entry.

The indicator works across timeframes, though 15-minute and 30-minute charts tend to provide clearer signals than 1-minute chaos. Daily opening ranges on H1 charts offer swing trading setups, while shorter ranges on M5 charts suit scalpers.

Settings and Customization Options

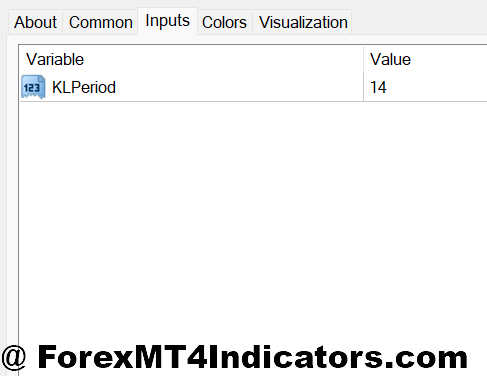

Most ORB indicators let you adjust the opening period duration. The standard settings include 30 minutes, 60 minutes, and 120 minutes. For Asian session trading, you might extend it to 240 minutes due to slower price action. US session traders often prefer 30-60 minute ranges because volatility picks up faster.

You can also customize which session to track. If you’re a London session trader, set it to calculate from 3:00 AM EST. New York traders use 9:30 AM EST. The flexibility matters because different sessions produce different range sizes.

Visual customization includes line colors, thickness, and style (solid, dashed, dotted). Some indicators add text labels showing the exact price levels. Others plot arrows or boxes when a breakout occurs. Choose whatever keeps your charts clean too many indicators create visual noise.

Alert settings are crucial. Enable push notifications to your phone so you don’t miss breakouts while away from the screen. Email alerts work too, though they’re slower. In-terminal pop-ups are fine if you’re actively monitoring.

Parameter optimization depends on your trading style. Day traders might test 30-minute vs 60-minute ranges on EUR/USD to see which produces higher win rates. That requires backtesting, not guessing. The 14-period ATR can help here if the opening range size is smaller than recent ATR, breakouts might lack follow-through.

Advantages and Limitations

The biggest advantage? Automation. You’re not eyeballing charts trying to remember where the high and low were. The indicator does it instantly across every pair you monitor. This speeds up decision-making during fast-moving markets.

Opening ranges also provide objective levels. Unlike subjective support and resistance zones, the ORB high and low are mathematically defined. There’s no debate about whether the level is 1.0850 or 1.0855 the indicator tells you exactly.

The strategy aligns with institutional behavior. Large players often probe levels during the open before committing. When they finally push through, retail traders piling in late creates additional momentum. You’re essentially trading with the smart money flow.

That said, the limitations are real. Choppy, range-bound days produce multiple false breakouts. You might get stopped out twice before a genuine move occurs. The indicator doesn’t predict market conditions it simply plots levels. On low-volatility days, breakouts fizzle quickly.

Time zone issues matter too. If you’re based in Asia but trading the London range, you’re awake at odd hours. The indicator works, but the lifestyle demands can be tough. And during major news events, the opening range might expand so much that breakouts offer minimal profit potential relative to risk.

Compared to support and resistance indicators, the ORB is more time-specific. S&R levels persist across sessions; opening ranges reset daily. Versus moving averages, the ORB provides clearer entry triggers but no trend information. You’ll want complementary tools RSI for momentum confirmation, for instance.

How to Trade with Opening Range Breakout MT4 Indicator

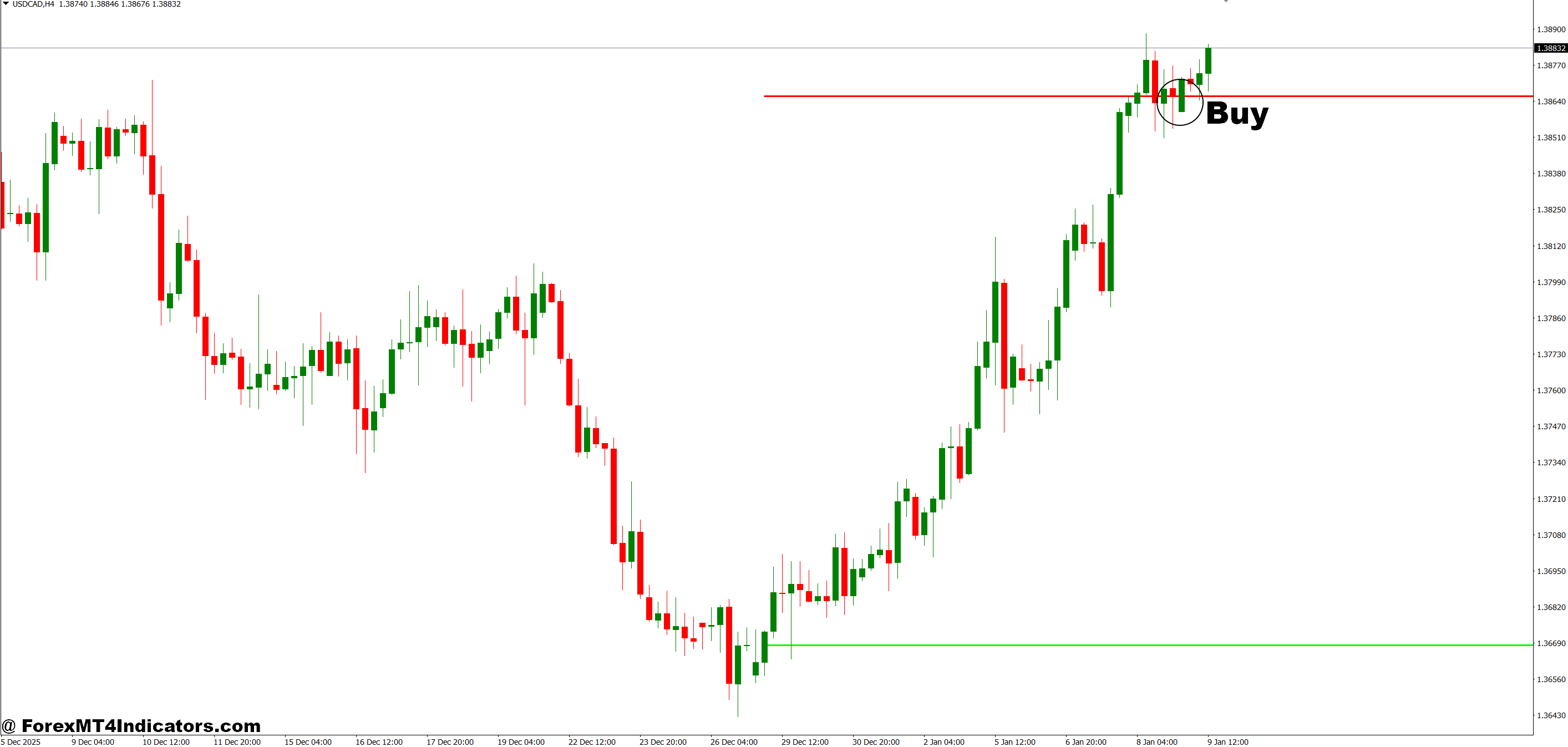

Buy Entry

- Wait for candle close above range high – Don’t enter on wicks alone; wait for a 15-minute or 30-minute candle to close at least 5-10 pips above the opening range high to confirm genuine breakout momentum.

- Check volume during breakout – Look for increased volume when price breaks the range high; weak volume breakouts on EUR/USD often reverse back into the range within 15-20 minutes.

- Set stop loss 10-15 pips below range high – Place your stop just below the breakout level to protect against false breaks; avoid tight 3-5 pip stops that get triggered by normal spread fluctuation.

- Enter during London or New York sessions – Take BUY signals between 3:00-6:00 AM EST (London) or 9:30 AM-12:00 PM EST (New York) when liquidity is strongest; skip Asian session breakouts on GBP/USD due to low volume.

- Confirm with 1-hour trend direction – Only take BUY breakouts when the 1-hour chart shows an uptrend or consolidation; avoid buying against a strong downtrend even if range breaks.

- Target 1.5x to 2x the range size – If the opening range is 30 pips wide, aim for 45-60 pip profit targets; this gives realistic expectations based on typical breakout extension.

- Skip breakouts during major news – Avoid BUY entries 15 minutes before and after NFP, FOMC, or CPI releases; these create erratic spikes that invalidate normal ORB patterns.

- Use smaller position size on second breakout attempt – If price broke the range high earlier and failed, cut your position size by 50% on the second attempt; false breakout probability increases significantly.

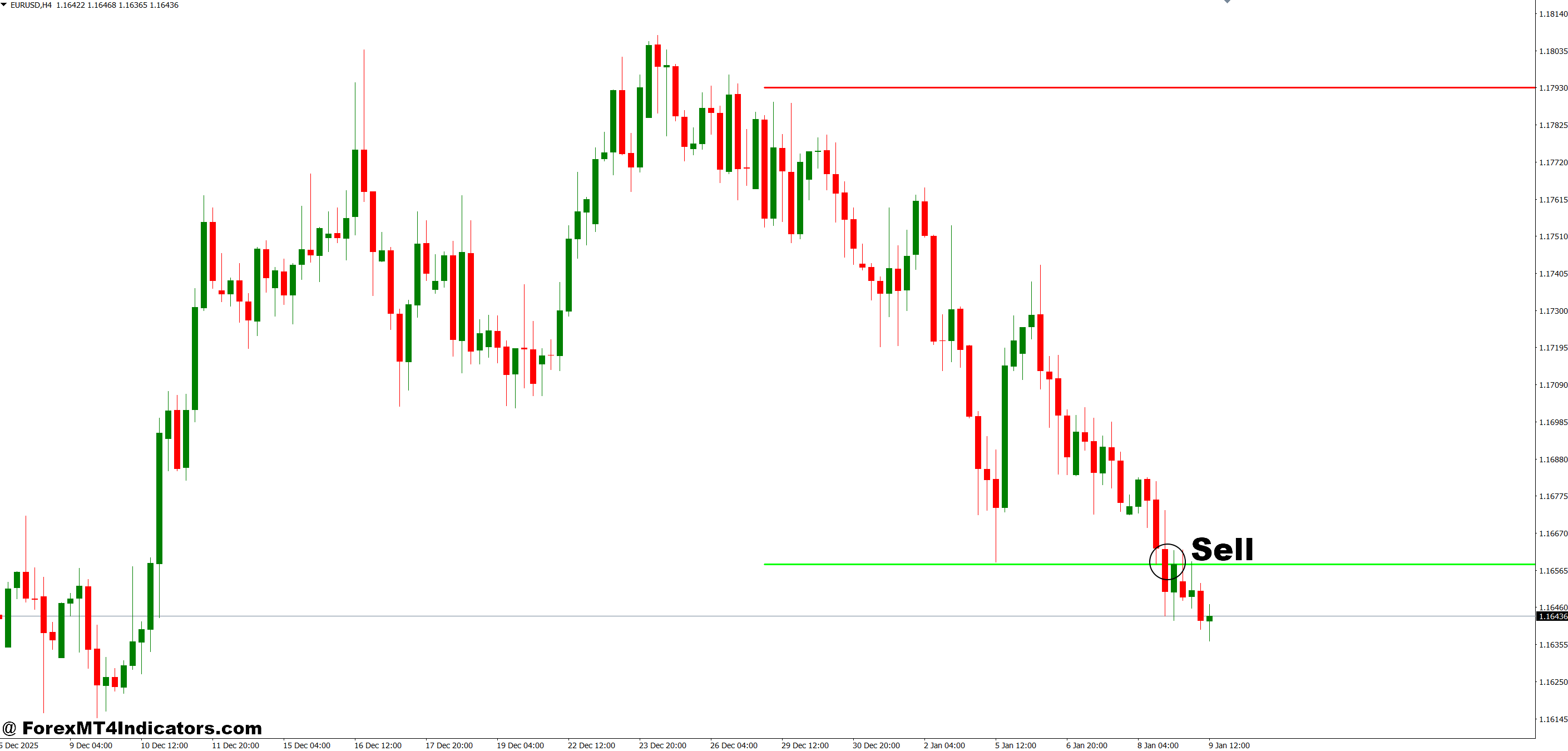

Sell Entry

- Wait for candle close below range low – Require a complete 15-minute or 30-minute candle close 5-10 pips under the opening range low before entering short positions.

- Set stop loss 10-15 pips above range low – Position your stop just above the breakout level; this protects capital if the breakdown fails and price reverses higher.

- Verify bearish momentum with RSI – Look for RSI below 50 when selling the range breakdown on EUR/USD 1-hour charts; RSI above 60 suggests weak selling pressure.

- Target support levels or previous session lows – Don’t just set arbitrary profit targets; identify visible support 40-60 pips below and trail stops as price approaches those levels.

- Avoid SELL signals in strong uptrends – Skip bearish breakouts when the 4-hour or daily chart shows price above the 200-period moving average; you’re fighting the bigger trend.

- Enter during high-volatility currency pairs – Prioritize SELL setups on GBP/USD or GBP/JPY over slow pairs like EUR/CHF; volatile pairs follow through better after range breakdowns.

- Check for liquidity zones below – Don’t sell if there’s major support within 20 pips below the range low; price often bounces at these levels, stopping you out immediately.

- Exit if price re-enters range within 30 minutes – If your SELL trade sees price climb back above the range low within 30 minutes, close the position; the breakdown likely failed and reversal risk is high.

Key Takeaways for Traders

The Opening Range Breakout MT4 indicator automates range identification during crucial market opens, saving time and reducing human error. It works best during volatile sessions like London and New York opens, particularly on pairs with tight spreads and good liquidity. The tool isn’t magic false breakouts happen, and you’ll need proper risk management. Wait for candle closes beyond the range rather than jumping on wicks. Use it alongside other confirmation methods like volume analysis or price action patterns. Trading forex carries substantial risk, and no indicator guarantees profits. But for traders who understand session dynamics and breakout behavior, the ORB indicator offers a systematic approach to capturing momentum moves. Test it on a demo account first, dial in your preferred settings, and see if it fits your trading personality.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.