A Fair Value Gap represents an imbalance in the market where buying or selling pressure was so aggressive that the price skipped over certain levels, leaving behind minimal trading activity. In technical terms, it’s a three-candle pattern where the wick of the first candle doesn’t overlap with the wick of the third candle, creating a visible gap.

Think of it like this: when a large institution executes a massive order, they need liquidity. They don’t wait around—they blow through price levels, leaving behind areas with few limit orders filled. The market has a tendency to return to these zones, similar to how price often retests breakout levels.

The MT4 indicator automates the detection of these patterns. Instead of manually scanning charts for the specific three-candle formation, the tool identifies and marks these zones with colored boxes. Bullish FVGs (formed during upward price movements) typically appear in one color, while bearish FVGs show up in another.

How the Indicator Calculates Fair Value Gaps

The logic behind the calculation is straightforward. The indicator scans for instances where:

- Candle 1 shows directional movement (up or down)

- Candle 2 makes an aggressive move in the same direction

- Candle 3 continues the move, but leaves a gap between Candle 1’s high and Candle 3’s low (for bullish FVGs) or between Candle 1’s low and Candle 3’s high (for bearish FVGs)

The indicator measures the vertical distance of this gap and draws a rectangle marking the zone. Some versions include filters to ignore gaps smaller than a certain pip value—useful for eliminating noise on higher timeframes like the 4-hour or daily charts.

What separates quality FVG indicators from basic ones is their ability to track whether gaps get filled. Advanced versions will change the box color or add markers once price revisits the zone, helping traders distinguish between fresh opportunities and already-filled imbalances.

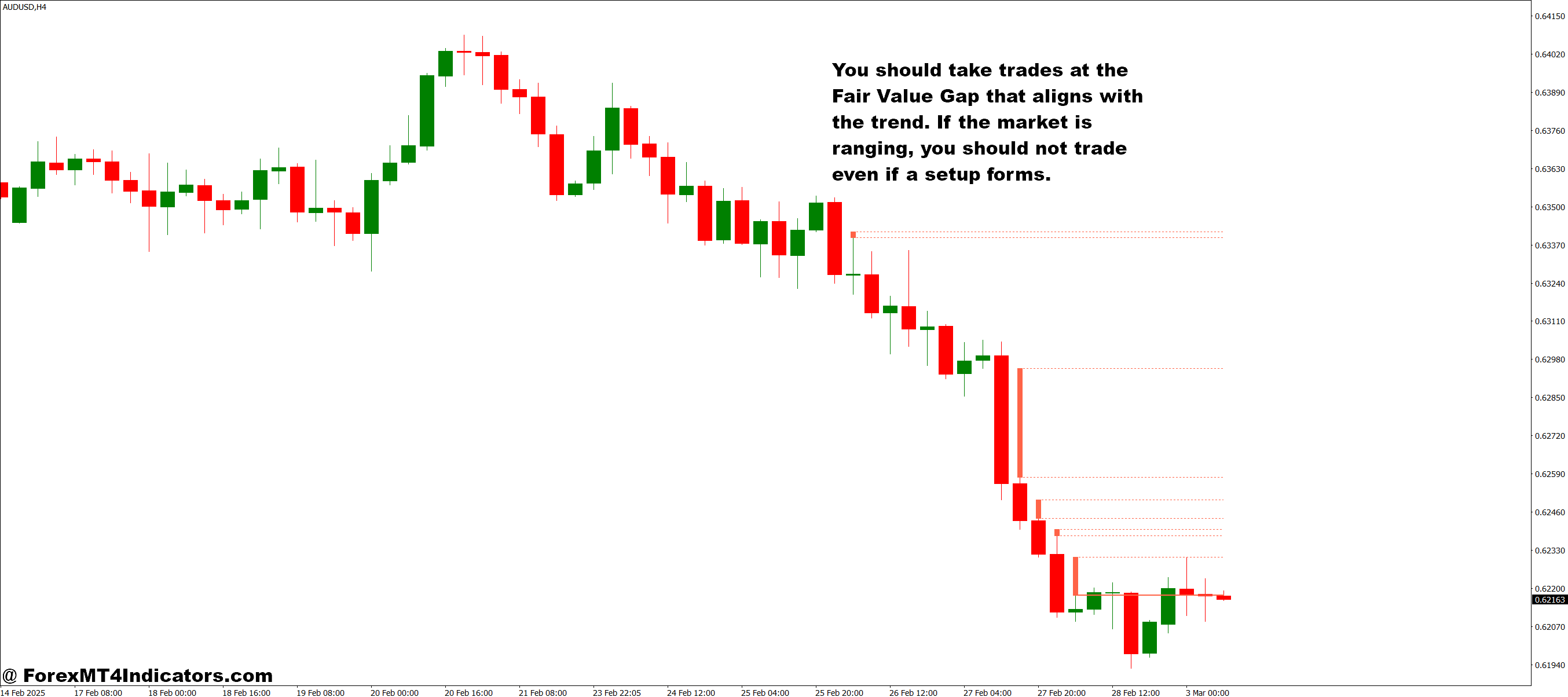

Trading Fair Value Gaps in Real Market Conditions

On a GBP/JPY 15-minute chart during the Asian session, a trader might spot a bearish FVG formed around the 185.50 level. Price quickly dropped 60 pips, leaving a gap between 185.45 and 185.65. The indicator marked this zone automatically.

Here’s where it gets practical. Many traders wait for price to retrace into this zone during the London session overlap. When price climbed back to 185.50, they entered short positions with stops just above the gap at 185.70—a tight 20-pip risk. The reward? Price often continues in the original direction (down in this case), potentially offering 80-100 pip moves toward the Asian lows.

But not every gap fills immediately. Sometimes price ignores an FVG and keeps running. That’s why combining this indicator with other confirmation helps. If an FVG aligns with a key Fibonacci retracement level or a previous support-turned-resistance zone, the probability increases significantly.

For swing traders using daily charts on USD/CAD, FVGs might represent zones spanning 100-150 pips. These larger gaps don’t fill in hours—they might take days or weeks. The patient trader marks these zones and waits, understanding that institutional orders often sit at these levels.

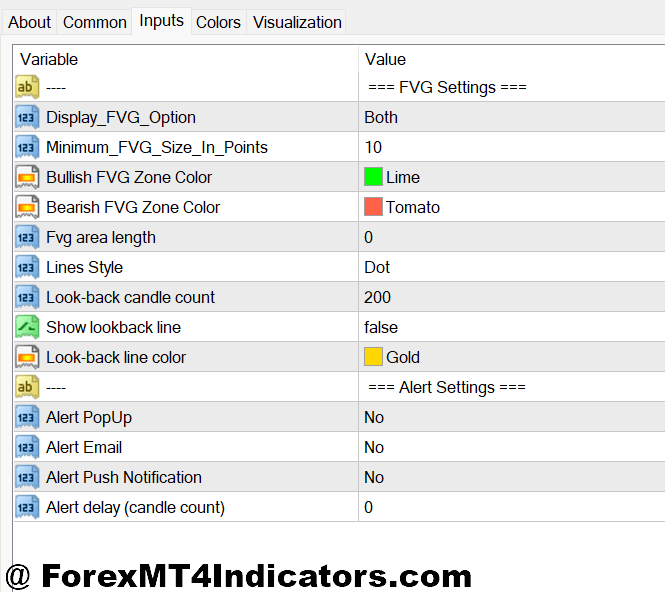

Customizing Settings for Different Trading Styles

Most Fair Value Gap indicators offer adjustable parameters. The minimum gap size setting proves crucial for filtering out insignificant imbalances. On a 1-minute chart, a 2-pip gap means nothing—noise from the spread. Setting the minimum to 10-15 pips eliminates false signals.

The lookback period determines how many candles the indicator scans backward. Scalpers might set this to 100-200 bars to keep charts clean, focusing only on recent gaps. Position traders analyzing weekly charts could extend this to 500+ bars to track major historical imbalances.

Color customization matters more than it sounds. When using multiple indicators, having FVGs in distinct colors prevents visual clutter. Some traders prefer semi-transparent boxes so they can still see candlestick patterns within the gap zones.

An often-overlooked setting is the gap deletion option. Should the indicator remove filled gaps from the chart, or keep them visible? Beginners benefit from seeing filled gaps—it reinforces the concept and builds pattern recognition. Experienced traders usually enable auto-deletion to maintain clean charts.

Strengths and Realistic Limitations

The Fair Value Gap approach excels at identifying potential reversal or continuation zones with defined risk parameters. Unlike lagging indicators such as moving averages, FVGs are forward-looking—they mark where price might go, not where it’s been.

The visual clarity helps traders avoid emotional decisions. Instead of guessing where to place entries, the indicator literally draws the zones. This objective approach reduces the “should I enter here?” paralysis that kills many trading accounts.

That said, FVGs aren’t magical. During ranging markets with low volume, gaps form constantly but rarely lead to clean setups. The EUR/USD during quiet summer trading sessions can create a dozen small gaps that price chops through without respect. Filtering by market session and volatility becomes essential.

Whipsaw risk exists. Price might enter an FVG zone by 5 pips, trigger stops, then reverse without truly filling the gap. This happens frequently on choppy 5-minute charts during low-impact news releases. Traders need confluence—waiting for additional signals like candlestick patterns or volume spikes within the gap.

Another reality: not all FVGs are created equal. A gap formed during a parabolic move after a major economic surprise holds more weight than one created during overnight thin liquidity. Context matters, and the indicator can’t distinguish between them automatically.

How This Differs from Traditional Support and Resistance

Standard support and resistance levels mark where price previously reversed. Fair Value Gaps identify where price should reverse based on market inefficiency rather than historical price action alone. It’s a subtle but powerful distinction.

Supply and demand zones share some similarities with FVGs—both highlight imbalance areas. But supply/demand zones typically require more complex identification involving base formations and departure candles. FVGs offer a simpler, more mechanical approach that’s easier to backtest.

Compared to pivot points or Fibonacci retracements, FVGs adapt to current price action rather than mathematical calculations. A Fibonacci level doesn’t care about market structure—it’s just math. An FVG represents actual trading activity (or lack thereof), making it dynamic and price-behavior-focused.

Trading forex carries substantial risk of capital loss. Fair Value Gaps, like any technical analysis method, don’t guarantee profitable trades. Markets can remain irrational, and gaps may never fill or fill far later than expected. Proper risk management and position sizing are non-negotiable.

How to Trade with Fair Value Gap MT4 Indicator

Buy Entry

- Bullish FVG forms during uptrend – Wait for price to create a gap above the 50-period EMA on EUR/USD 1-hour chart, then enter when price pulls back into the gap zone with a 15-20 pip stop below the gap.

- Price taps FVG lower boundary – Enter long when the first candle closes inside the bullish gap on GBP/USD 4-hour chart, placing stops 5 pips below the gap’s bottom edge for tight risk management.

- Volume spike confirmation – Only take the buy if volume increases by 30%+ as price enters the FVG zone on the 15-minute chart, indicating institutional interest in filling the imbalance.

- Align with higher timeframe trend – Skip the setup if daily chart shows bearish structure; only trade bullish FVGs when the 4-hour and daily charts both trend upward to avoid counter-trend traps.

- Gap size minimum of 20 pips – Ignore FVGs smaller than 20 pips on EUR/USD 1-hour charts as they often represent noise rather than true institutional imbalances worth trading.

- Wait for candlestick confirmation – Don’t enter immediately; watch for a bullish engulfing or hammer pattern to form within the FVG zone before going long with a 2:1 reward-to-risk ratio.

- Avoid trading during high-impact news – Skip FVG entries 30 minutes before and after NFP, FOMC, or central bank decisions as volatility creates fake fills and unpredictable price action.

- Combine with support levels – Double your conviction when a bullish FVG aligns with a previous daily support zone on GBP/JPY, creating confluence for a higher-probability long entry.

Sell Entry

- Bearish FVG forms during downtrend – Enter short when price retraces into the gap on USD/CAD 4-hour chart, setting stops 20 pips above the gap’s upper boundary to limit risk.

- Price rejects FVG upper boundary – Go short when price touches the top of a bearish gap on the EUR/USD 1-hour chart and forms a bearish pin bar, targeting the next support level 60-80 pips away.

- Gap created during London open – Prioritize bearish FVGs formed between 8:00-10:00 GMT on GBP/USD, as these often carry institutional sell orders that drive price lower throughout the session.

- Check RSI below 50 – Only take sell entries when the 14-period RSI stays below 50 on the 1-hour chart, confirming bearish momentum supports the FVG setup.

- Minimum 30-pip gap on 4-hour chart – Filter out weak signals by requiring bearish FVGs to span at least 30 pips on higher timeframes like the 4-hour GBP/USD chart.

- Avoid ranging markets – Skip sell setups when ATR (14-period) drops below 50 pips on the daily EUR/USD chart, indicating low volatility conditions where gaps frequently fail to produce clean moves.

- Wait for 50% gap fill – Enter short positions only after price retraces to the middle or upper portion of the bearish FVG, not at the first touch, to improve entry quality.

- No entries during Asian session – Avoid taking bearish FVG signals between 23:00-6:00 GMT on thin liquidity pairs like EUR/GBP, as low volume creates unreliable gap behavior and excessive slippage.

Conclusion

The Fair Value Gap MT4 indicator brings Smart Money Concepts into an accessible format for retail traders. It automates pattern recognition that would otherwise require constant manual chart monitoring, freeing up mental bandwidth for trade management and strategy refinement.

Three things make it work: combining FVG zones with confirmation signals like trendline breaks or momentum shifts, adjusting settings to match your trading timeframe and pair characteristics, and accepting that some gaps never fill—patience and selectivity beat forcing every setup.

The real edge isn’t just marking gaps on a chart. It’s understanding why institutions leave these imbalances and how market dynamics push prices back to fill them. That knowledge transforms a visual indicator into a genuine trading tool.

Start by marking historical FVGs on your favorite pairs. Track how often they fill, how long it takes, and what market conditions surrounded the best setups. That hands-on experience beats any theoretical understanding.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.