Introduction to the FX5 Divergence V2.0 Indicator

Divergences are one of the telltale signals that the market may start to reverse. In fact, many seasoned traders use divergences as a means to confirm potential trend reversals. The FX5 Divergence V2.0 Indicator is a technical analysis tool developed to help traders identify divergence based reversal indications.

What is the FX5 Divergence V2.0 Indicator?

The FX5 Divergence V2.0 Indicator is a trend reversal signal indicator which is based on Oscillator of Moving Averages (OsMA) divergences.

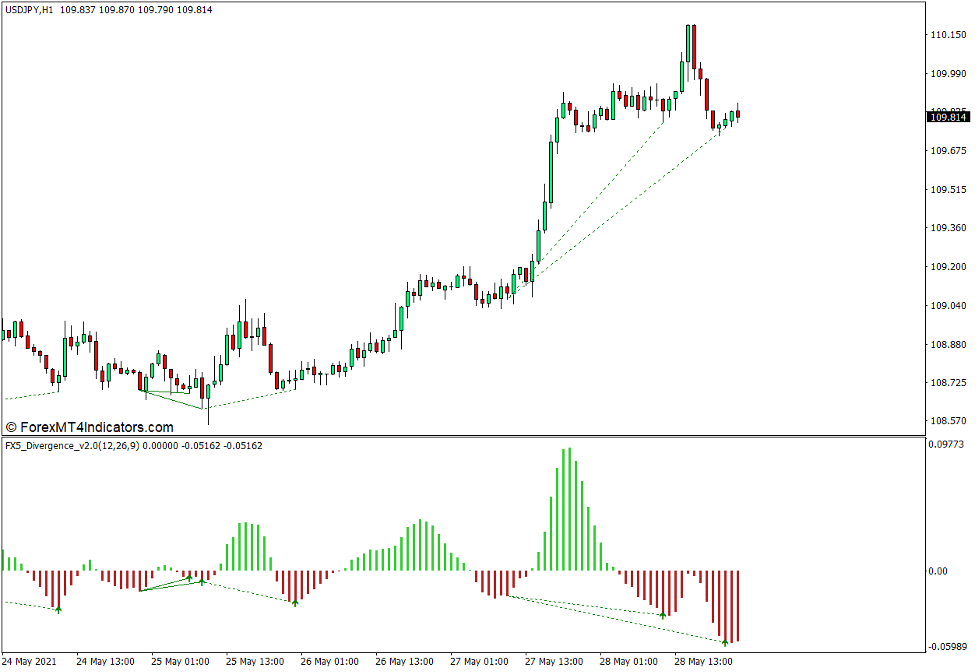

This indicator automatically identifies divergences between price action and its own oscillator. It then plots lines connecting the swing highs and swing lows on price action, as well as the peaks and dips on the oscillator values whenever it detects a divergence. This also allows users to review if the identified divergence signals are valid.

This indicator plots the lines below price action connecting the swing lows, as well as below the oscillator connecting the dips to indicate a bullish divergence. Inversely, it plots the lines above price action connecting the swing highs, as well as above the oscillator connecting the peaks to indicate a bearish divergence.

It also plots dashed lines to indicate a hidden divergence and solid lines to indicate a regular divergence.

How the FX5 Divergence V2.0 Indicator Works?

This indicator compares the values between swing highs, swing lows, peaks, and dips to identify possible divergences. It aligns the identified peaks and dips with the swing highs and swing lows. If it detects a divergence in the direction of the slope of the connected swing points, as well as the peaks and dips, it will then automatically identify that point as a divergence. It would then plot a line connecting the points and arrow pointing the direction of the reversal signal.

How to use the FX5 Divergence V2.0 Indicator for MT4

This indicator has several options within its settings which users can modify.

“fastEMA” and “slowEMA” allows users to modify the faster and slower EMA periods used on the underlying OsMA.

“signal” allows users to modify the signal line period used on the OsMA calculation.

“positiveSensitivity” and “negativeSensitivity” modifies the threshold in which the indicator would detect divergences.

“drawDivergenceLines” toggles the plotting of the connecting lines on the price chart.

“displayAlert” toggles the alert whenever the indicator detects divergences.

Buy Trade Setup

When to Enter?

Open a buy order if the FX5 Divergence V2.0 Indicator identifies a valid bullish divergence.

When to Exit?

Allow the FX5 Divergence V2.0 oscillator bars to swing to positive then close the trade if the bars drop back to negative.

Sell Trade Setup

When to Enter?

Open a sell order if the FX5 Divergence V2.0 Indicator identifies a valid bearish divergence.

When to Exit?

Allow the FX5 Divergence V2.0 oscillator bars to swing to negative then close the trade if the bars drop back to positive.

Conclusion

The FX5 Divergence V2.0 Indicator can be a very effective divergence based reversal signal indicator. However, the divergences it identifies are not always aligned with the valid price swings, peaks, and dips. It is still very important to visually verify if the divergence signals are valid. It is also best to trade these signals in confluence with other technical indications.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 90% VIP Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: VIP90

(Free MT4 Indicators Download)

Enter Your Email Address below, download link will be sent to you.