The Bollinger Band Squeeze Forex Swing Trading System

The Bollinger band squeeze swing trading strategy is simple and easy to comprehend. It is called the Bollinger band squeeze because the Bollinger band becomes more narrow as price volatility decreases, this happens due to price moving sideways and in a tight range. When this situation occurs, the market may be due for a breakout to the upside or the downside. The Bollinger band indicator will tell you that the market is being squeezed into a tight trading range and there should be a breakout.

Trading Rules:

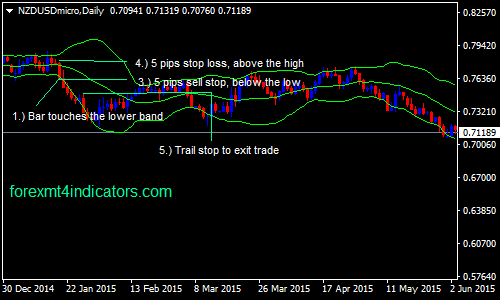

- Look at the candlestick breakout of the either the upper and lower band as the Bollinger band squeezes.

- After the candlestick breaks and closes either above or below the band, place a buy stop order 5 pips above the high of the breakout candlestick if it breaks out of the upper band.

- If it is in the lower band, place a sell stop order 5 pips below the low of that candlestick only after it closes.

- Place stop loss 5 pips above the high (if you use a sell stop order) or 5 pips below the low of the breakout candlestick if you use a buy stop order.

- Take profit at a 1:3 risk and reward ration, at the previous swing high or low, or trailing the stop and lock in the profits as the price continue to move in your favor.

ADVANTAGES:

- The Bollinger band squeeze indicates to you in advance that a price breakout may be happening sooner.

- This is applicable to all timeframes.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: