Introduction to the Daily Range Projections Indicator

The Daily Range Projections Indicator is an indicator developed based on the book “Forex from the first person – For Beginners and Professions”, which was written by A. Vedikhin, G. Petrov, and B. Shylov. It is a logical take on how to effectively project price ranges based on the previous day’s price movement.

What is the Daily Range Projections Indicator?

The Daily Range Projections Indicator is a custom technical indicator which helps traders objectively identify the potential range for the day as well as the trend or momentum bias for the day.

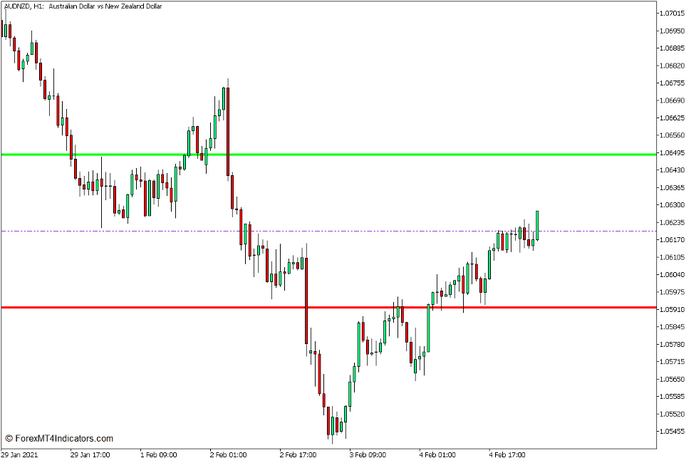

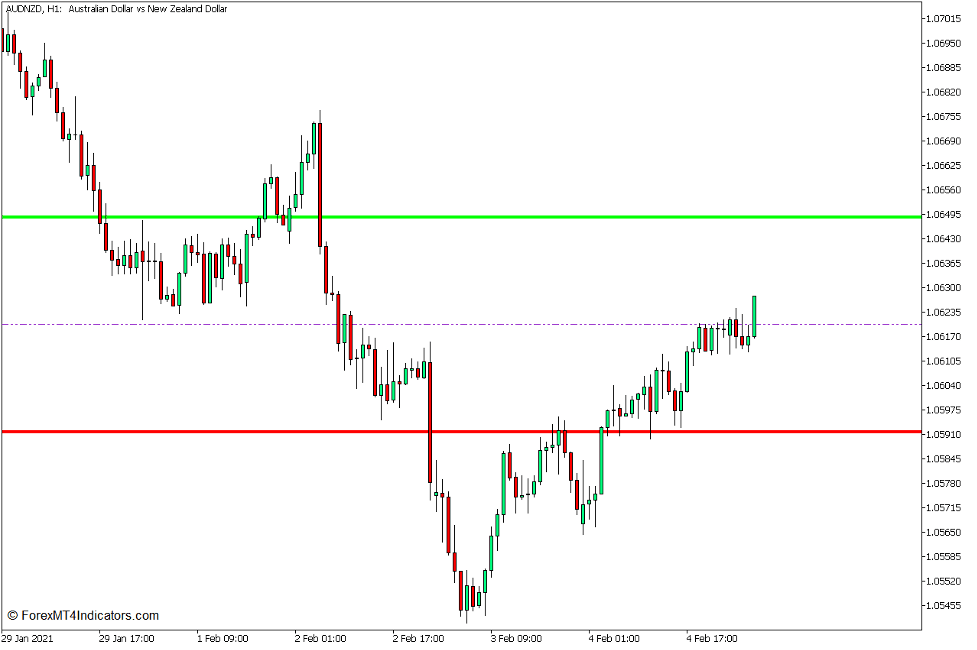

This indicator plots three lines. It plots a dot-dot-dashed line which represents the weighted average of the projected daily range. It also plots a solid lime line which represents the potential high of the day and a solid red line which represents the potential low of the day.

How the Daily Range Projections Indicator Works?

The Daily Range Projections Indicator uses a complex formula for each of the three lines it plots.

Its algorithm uses three possible formulas for the midline based on the relation of today’s close and open price. The formulas vary depending on whether the close is higher than the open or not. Below are the three possible formulas.

If Close[0] < Open[0], then X = (High[1] + Low[1] + Close [1] + Low[1]) / 2

If Close[0] > Open[0], then X = (High[1] + Low[1] + Close [1] + High[1]) / 2

If Close[0] = Open[0], then X = (High[1] + Low[1] + Close [1] + Close[1]) / 2

Where:

Open[0], High[0], Low[0], Close[0] – Current day prices

Open[1], High[1], Low[1], Close[1] – Yesterday’s prices

As for the minimum and maximum prices for the projected price range, the indicator uses the formulas below.

Anticipated low price: Min = X – High[1]

Anticipated high price: Max = Low[1] – X

How to use the Daily Range Projections Indicator?

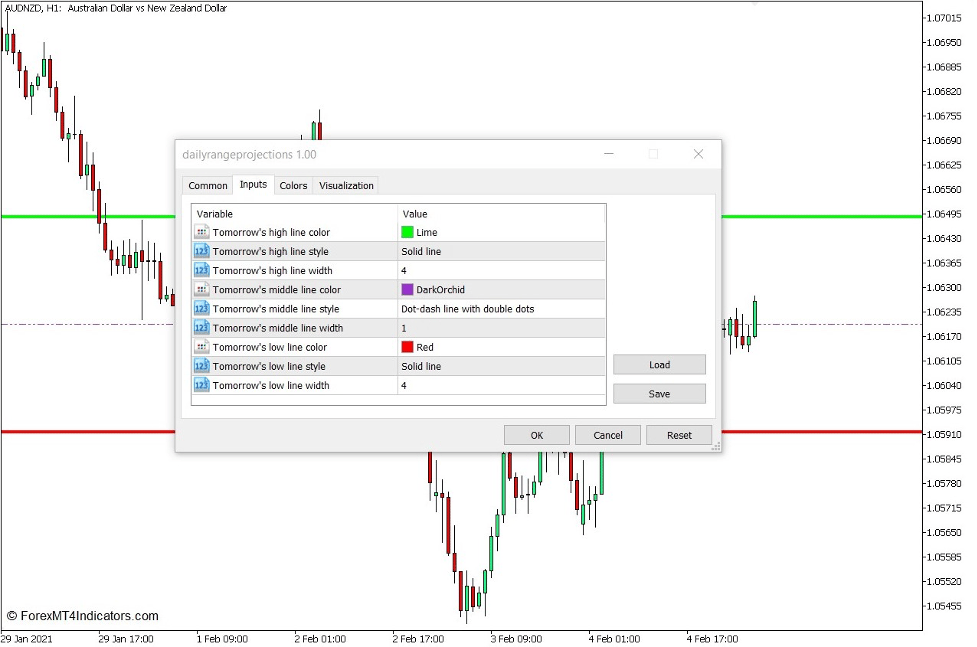

This indicator allows for several options which allow users to modify its visual presentation. It allows users to change the color of the lines, the style of the lines it plots, as well as the thickness of the lines.

There are several ways traders can interpret this price range.

Traders can opt to avoid trading against the outer lines if price is already very close to the outer lines or has breached beyond it. The logic would be that price has already consumed its price range in that direction and the market might reverse.

Based on the same thought, traders could also take mean reversal trades as price shows signs of reversal as it touches these outer lines.

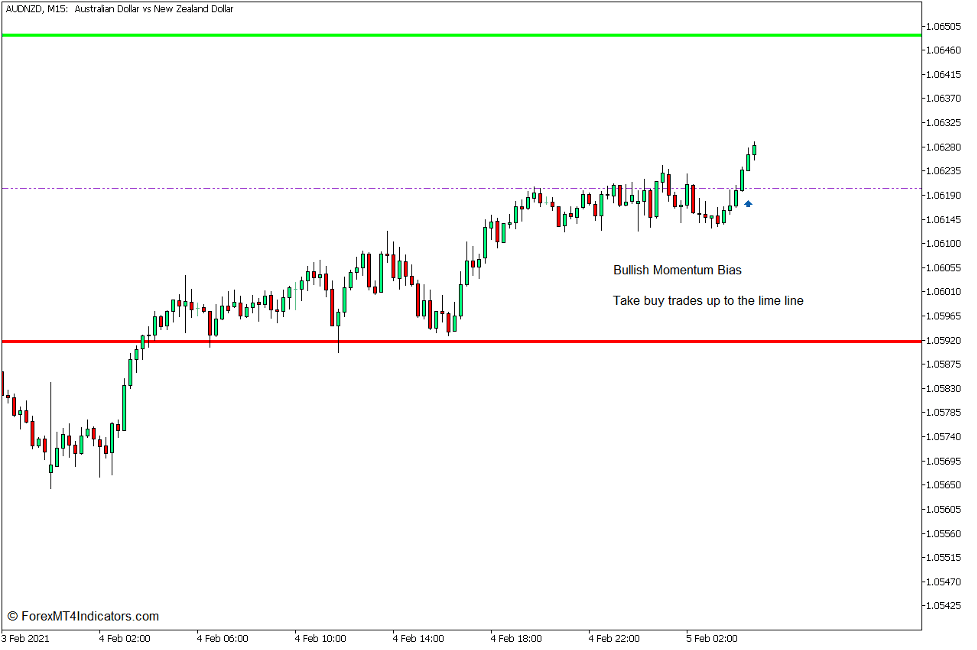

Traders can also opt to trade in the direction of the momentum based on which half of the range price is already in. The sample charts below would show this idea. Note that these are not trade signals. Traders should still identify trade setups based on other technical analysis.

Buy Trade Bias

Take buy trades on the lower timeframes if price action has breached above the middle line with strong momentum.

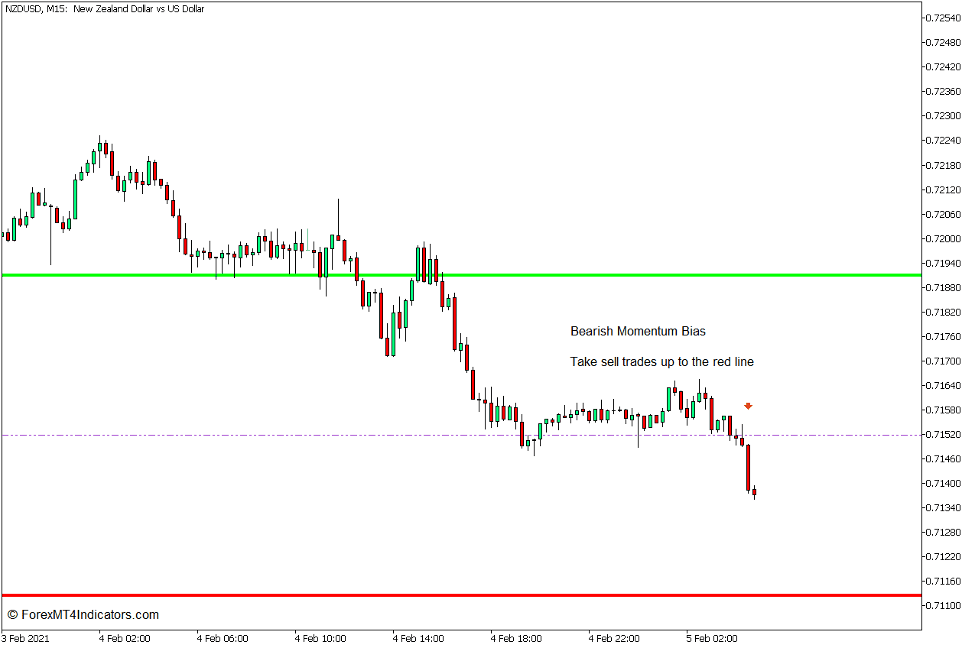

Sell Trade Bias

Take sell trades on the lower timeframes if price action has dropped below the middle line with strong momentum.

Conclusion

This technical indicator is an excellent tool. It can help traders identify which direction price is more likely to move next. This can significantly increase the win rate of a trader as they could now have a context of where price is based on its potential price range.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: